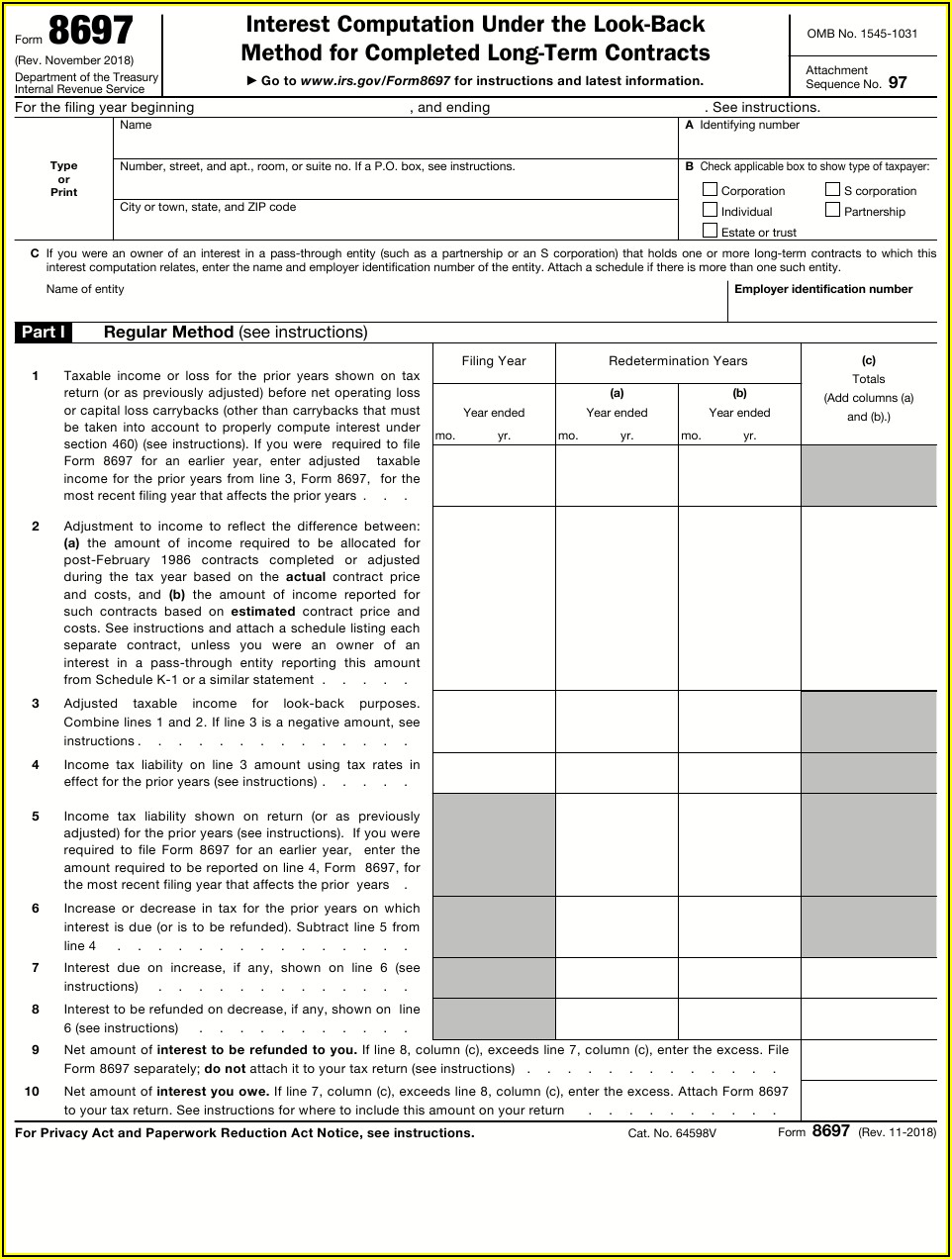

1088 Form Irs

1088 Form Irs - Gross receipts or sales (. Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Generally, you must also attach form 8283, noncash charitable contributions, if the. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Web the 1088 tax form is one of the most important forms that a business will need to file with their annual taxes. Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website:

Web there are several ways to submit form 4868. Generally, you must also attach form 8283, noncash charitable contributions, if the. The internal revenue service uses the information on this form to. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Web get federal tax return forms and file by mail. Ad fanniemae 1088 & more fillable forms, register and subscribe now! Edit, sign and save income analysis form. Sign it in a few clicks draw your signature, type it,. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

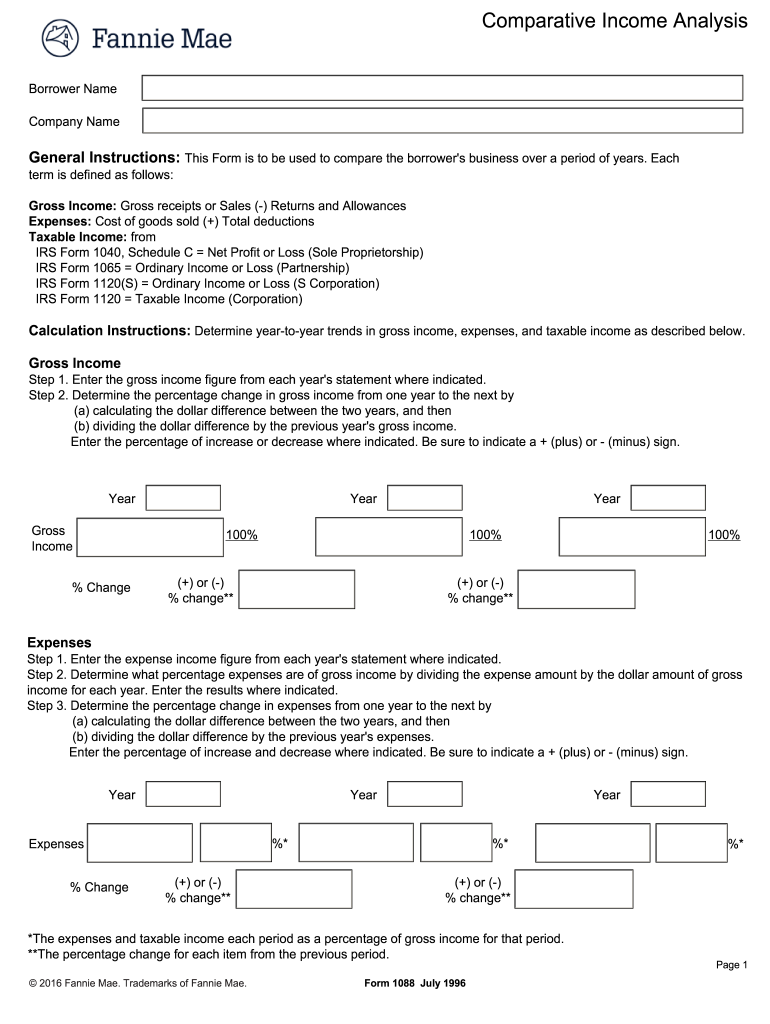

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web attach to your tax return (personal service and closely held corporations only). Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Ad fanniemae 1088 & more fillable forms, register and subscribe now! Web the 1088 tax form is one of the most important forms that a business will need to file with their annual taxes. This form is to be used to compare the borrower's business over a period of years. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Web attach to your tax return (personal service and closely held corporations.

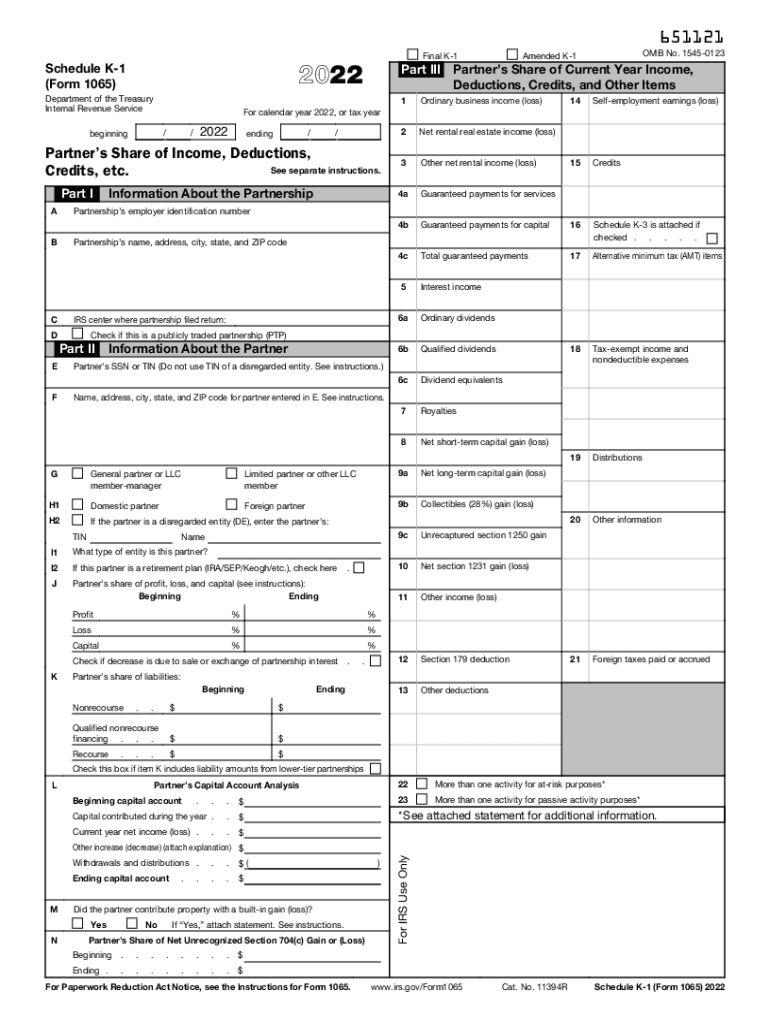

2022 Form IRS 1065 Schedule K1 Fill Online, Printable, Fillable

Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Ad fanniemae 1088 & more fillable forms, register and subscribe now! Uslegalforms allows users to edit, sign, fill.

EDGAR Filing Documents for 000130817916000303

Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Edit, sign and save income analysis form. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses.

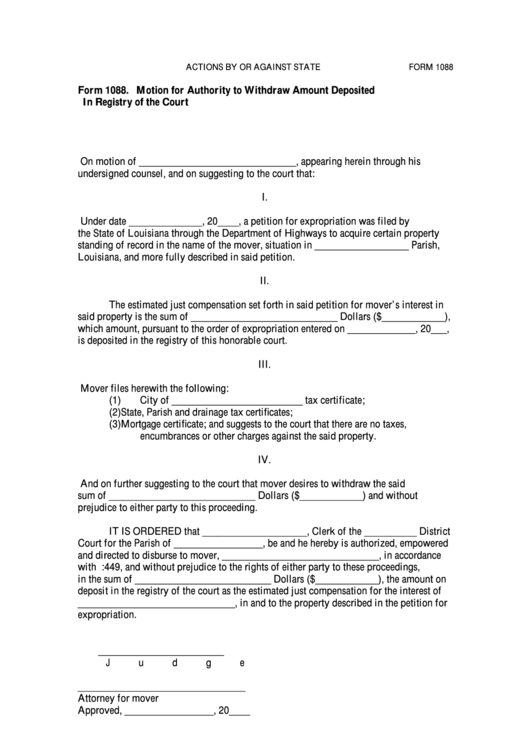

Fillable Form 1088 Motion For Authority To Withdraw Amount Deposited

Web get federal tax return forms and file by mail. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Edit, sign and save income analysis form. This form is to be used to compare the borrower's business over a period of years. Web attach to your tax return (personal service and closely held.

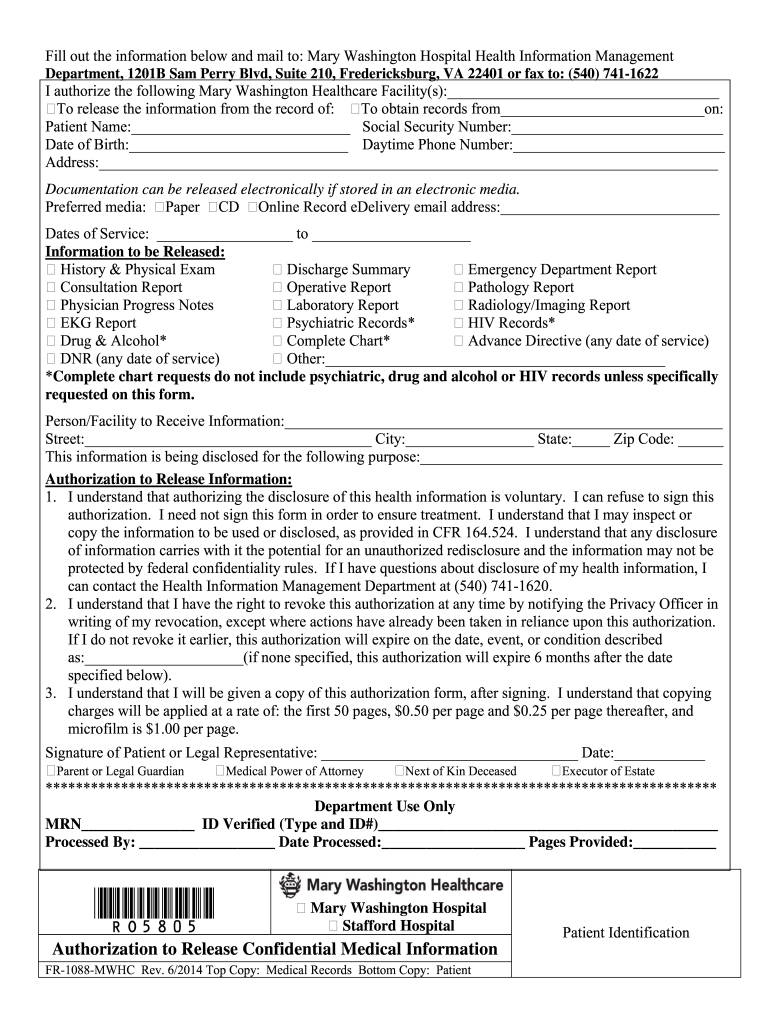

MWHC FR1088MWHC 2014 Fill and Sign Printable Template Online US

Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Gross receipts or sales (. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web there are several ways to submit form 4868. Edit, sign and save income analysis form.

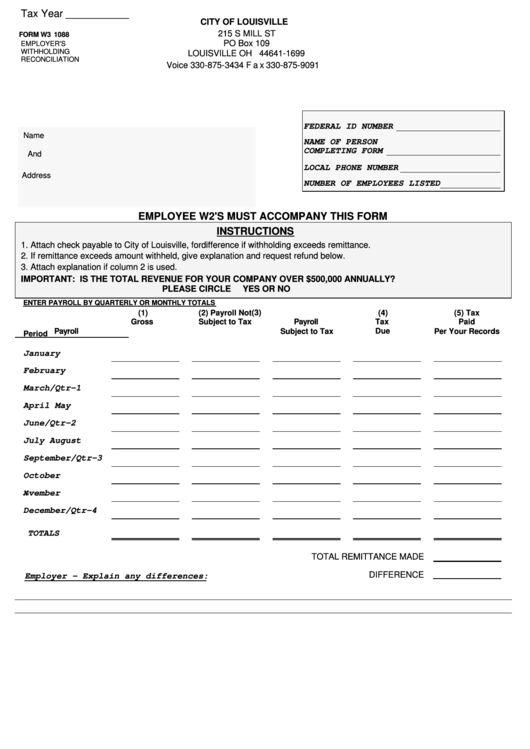

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad fanniemae 1088 & more fillable forms,.

FIA Historic Database

Web there are several ways to submit form 4868. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Uslegalforms allows users to edit, sign, fill & share all type of documents online. The internal revenue service uses the.

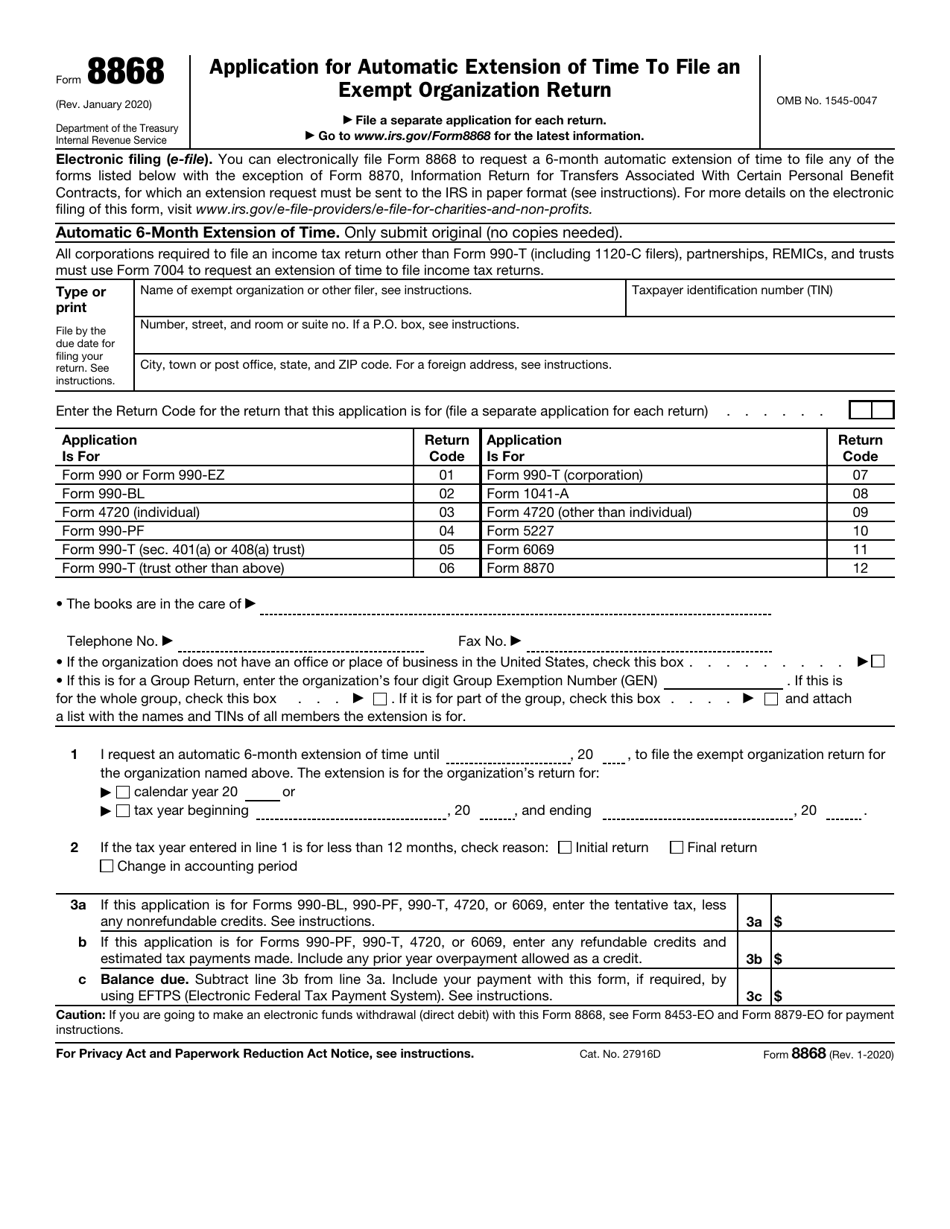

Irs Fillable Extension Form Printable Forms Free Online

Web attach to your tax return (personal service and closely held corporations only). Web there are several ways to submit form 4868. Sign it in a few clicks draw your signature, type it,. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify.

1088 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website: This form is to be used to compare the borrower's business over a period of years. Web get federal tax return forms and file by mail. The form has a number of different sections, each with slightly. Web.

Laser Tax Form 1098E Student Copy B Free Shipping

This form is to be used to compare the borrower's business over a period of years. Edit, sign and save income analysis form. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. The internal.

Edit, Sign And Save Income Analysis Form.

Each term is defined as follows: Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an.

Web Get Federal Tax Return Forms And File By Mail.

Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Generally, You Must Also Attach Form 8283, Noncash Charitable Contributions, If The.

Web attach to your tax return (personal service and closely held corporations only). This form is to be used to compare the borrower's business over a period of years. The form has a number of different sections, each with slightly. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or.

Web There Are Several Ways To Submit Form 4868.

Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website: Web the 1088 tax form is one of the most important forms that a business will need to file with their annual taxes. Gross receipts or sales (. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more.