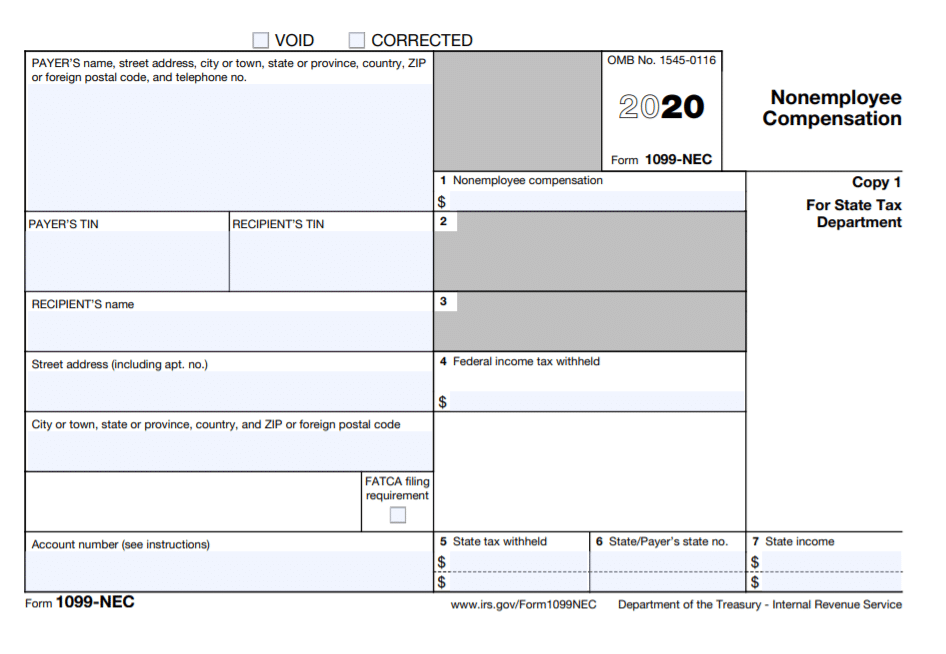

1099 Nec Form 2020

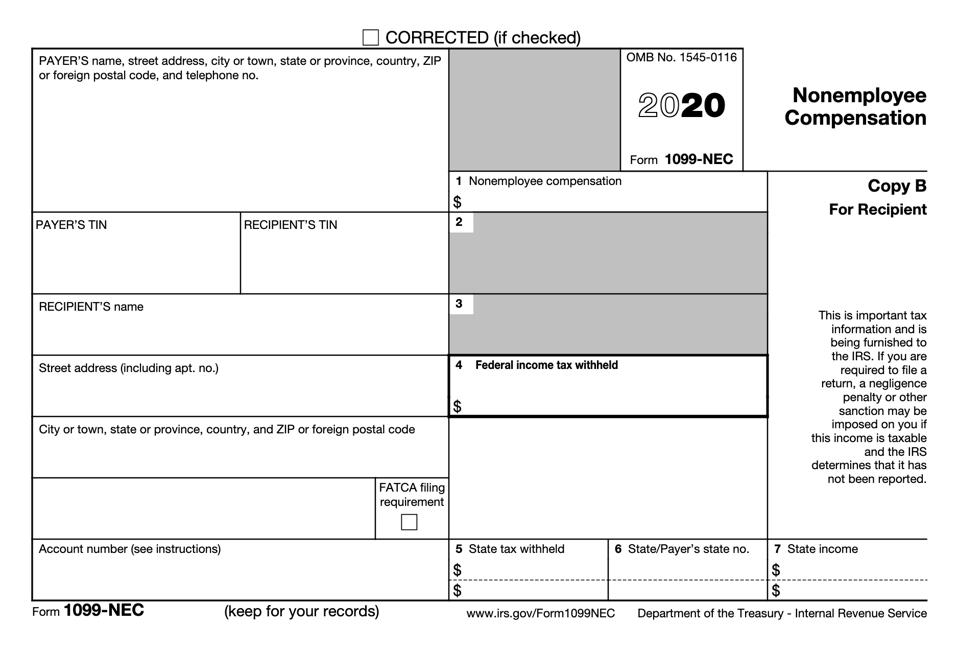

1099 Nec Form 2020 - Previously, businesses reported this income information on 1099 misc box 7. 03 export or print immediately. If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. 01 fill and edit template. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. Current general instructions for certain information returns. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Web the social security administration shares the information with the internal revenue service. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Web reporting nec with new 1099 form 2020:

Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. For internal revenue service center. Current general instructions for certain information returns. Web the social security administration shares the information with the internal revenue service. Web reporting nec with new 1099 form 2020: 03 export or print immediately. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Previously, businesses reported this income information on 1099 misc box 7. 01 fill and edit template.

If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). Current general instructions for certain information returns. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Previously, businesses reported this income information on 1099 misc box 7. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without the more steps and delays. For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

For internal revenue service center. Web the social security administration shares the information with the internal revenue service. Current general instructions for certain information returns. Web reporting nec with new 1099 form 2020: Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc).

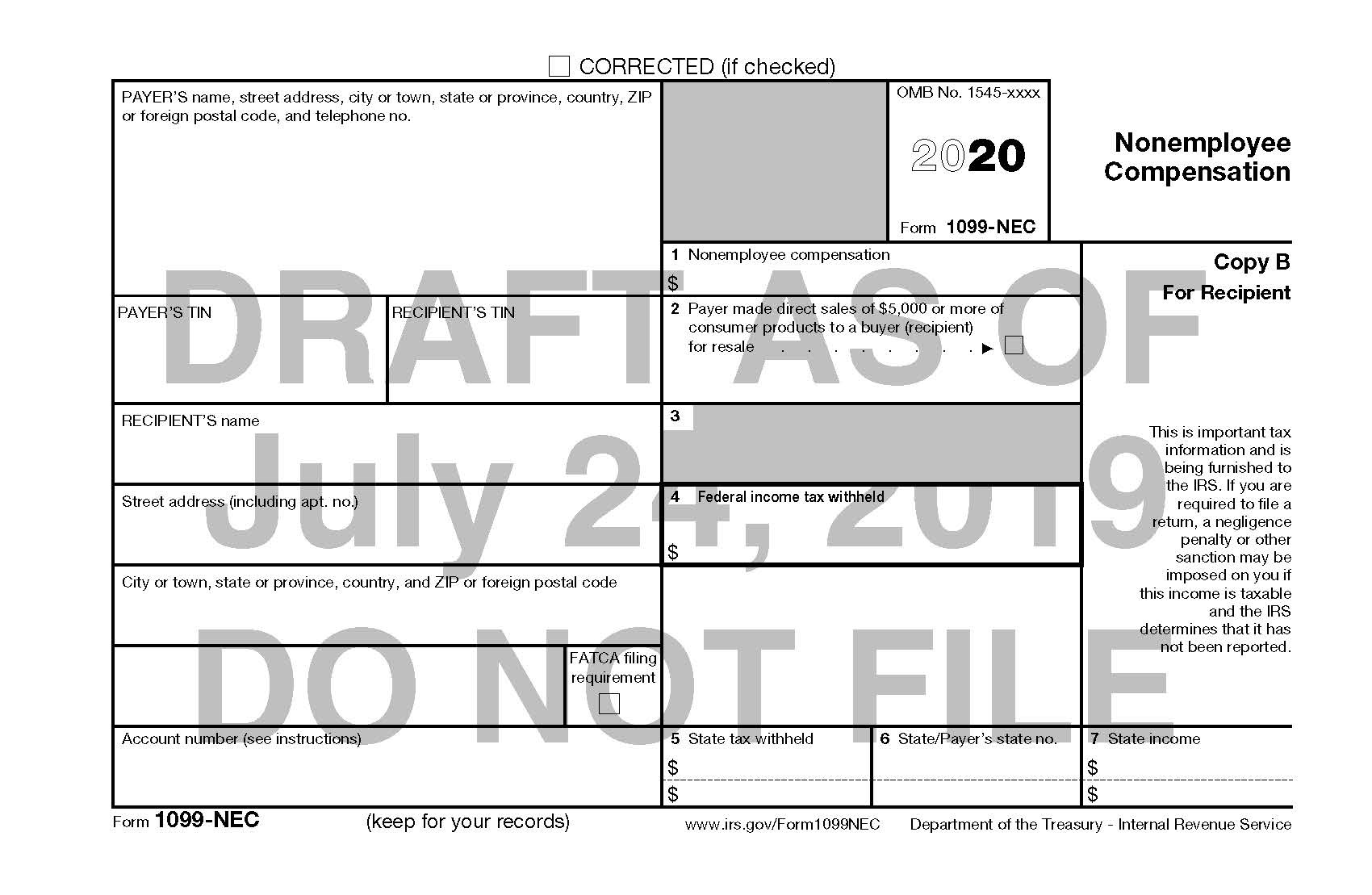

There’s A New Tax Form With Some Changes For Freelancers & Gig

Web the social security administration shares the information with the internal revenue service. Previously, businesses reported this income information on 1099 misc box 7. 01 fill and edit template. 03 export or print immediately. If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features.

IRS 1099NEC 20202022 Fill and Sign Printable Template Online US

03 export or print immediately. Current general instructions for certain information returns. Web reporting nec with new 1099 form 2020: Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Report payments made of at least $600 in the course of a trade or business to a person who's.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. For internal revenue service center. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent.

1099 Nec Form 2020 Printable Customize and Print

For internal revenue service center. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. 01 fill and edit template. 03 export or print immediately. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc).

1099 Nec Form 2020 Printable Customize and Print

03 export or print immediately. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Shows.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without the more steps and delays. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. Web reporting.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. 01 fill and edit template. Current general instructions for certain information returns. For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees,.

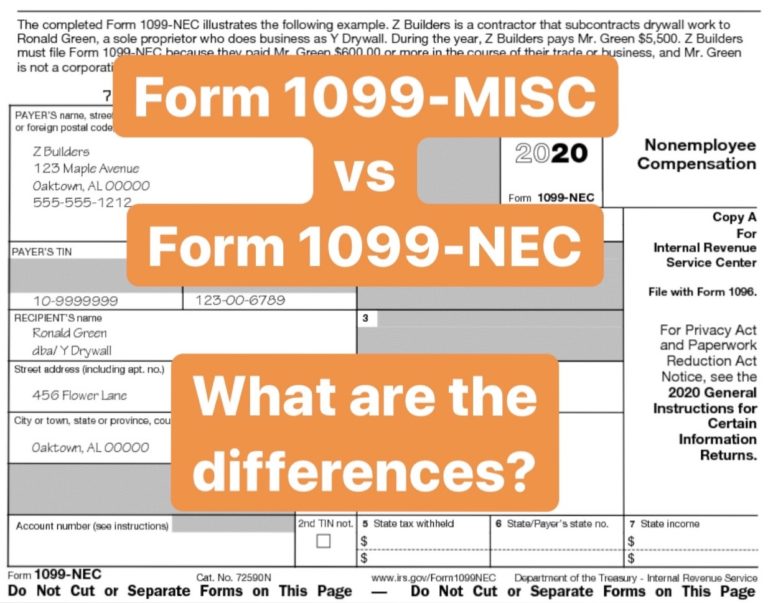

Form 1099MISC vs Form 1099NEC How are they Different?

Web reporting nec with new 1099 form 2020: 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Web the social security administration shares the information with the internal revenue service. Web 1 wide open broaden a fillable file by simply hitting the.

Web 1 Wide Open Broaden A Fillable File By Simply Hitting The Get Form Button And Begin To Prepare 1099 Form Using Built In Features Without The More Steps And Delays.

2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). Web the social security administration shares the information with the internal revenue service. 01 fill and edit template.

Current General Instructions For Certain Information Returns.

03 export or print immediately. If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

Report Payments Made Of At Least $600 In The Course Of A Trade Or Business To A Person Who's Not An Employee For Services, Payments To An.

Web reporting nec with new 1099 form 2020: For internal revenue service center. Previously, businesses reported this income information on 1099 misc box 7.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)