2022 Form 3922

2022 Form 3922 - Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web forms 3921 and 3922, see the form instructions; Web instructions for forms 3921 and 3922. Web the irs instructions to form 3921 and 3922 may be obtained here. Complete, edit or print tax forms instantly. Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price. Web form 3922 provides the following information to the irs and an employee or former employee for whom the corporation records in 2021 the first transfer of legal title. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully.

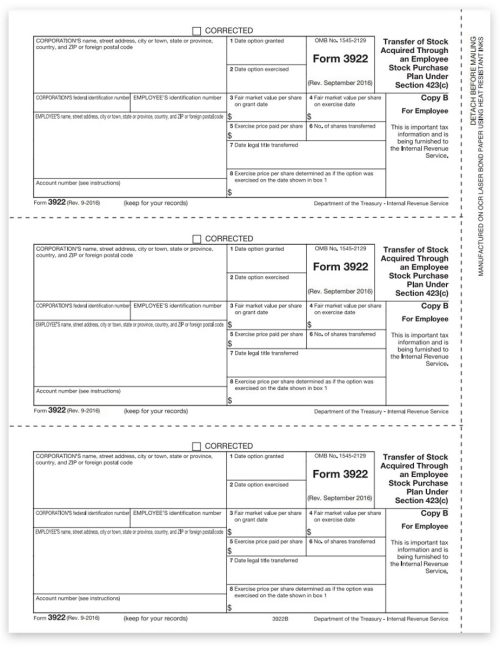

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. On the other hand, under copy a, 28th february. Irs form 3922 is used by the companies to report. Web form 3922 is available on the irs website. Web instructions for forms 3921 and 3922. Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. When you need to file form 3922 you are required to. Persons with a hearing or speech disability with access to. Form 3922 is used when the employee.

On the other hand, under copy a, 28th february. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web form 3922 is available on the irs website. Web the irs instructions to form 3921 and 3922 may be obtained here. Form 3922 is used when the employee.

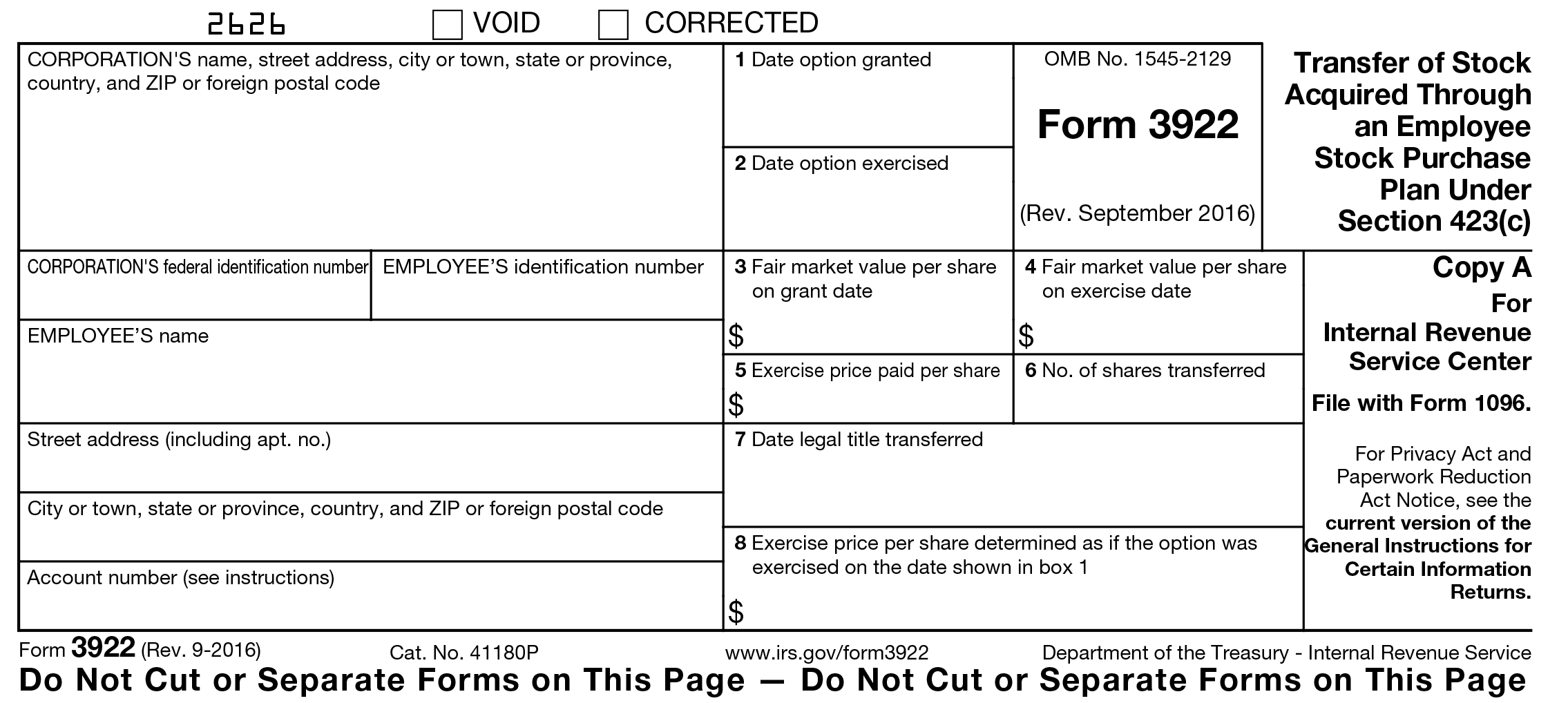

IRS Form 3922

Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Web forms 3921 and 3922, see the form instructions; Web irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase plan. Web in the case of copy b, isos or espps exercised.

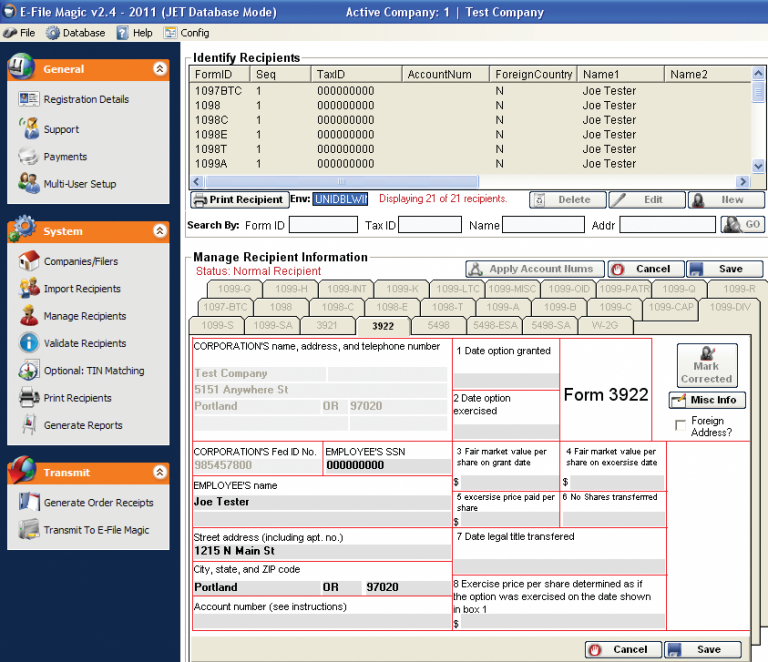

Form 3922 Software Transfer of Stock Acquired Through an Employee

Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. Complete, edit or print tax forms instantly. Web the irs instructions to form 3921 and 3922 may be obtained here. Web we last updated the transfer of stock acquired through an employee stock purchase.

What Is IRS Form 3922?

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. You can also obtain the latest developments for each of the. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14,.

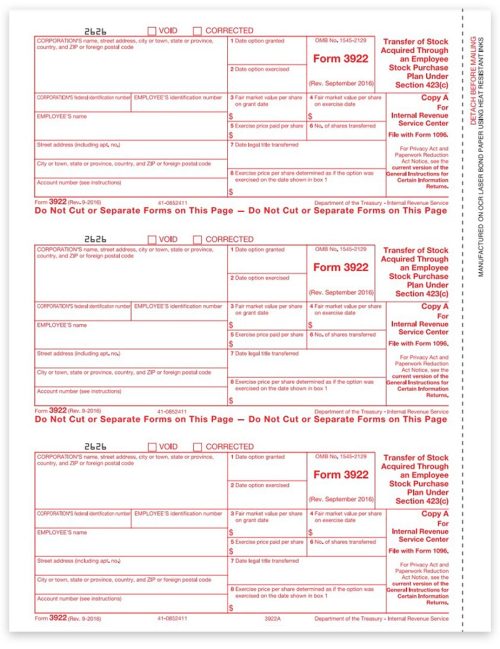

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. Web forms 3921 and 3922, see the form instructions; On the other hand, under copy a, 28th february. Web form 3922 is available on the irs website. Web form 4419 must be submitted to.

Form 1099K Notices & Penalties For 2022 Tax1099 Blog

Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully. Web.

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Web the irs instructions to form 3921 and 3922 may be obtained here. Persons with a hearing or speech disability with access to. Web guide for filing form 3922 for 2022 tax year. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. You can also obtain the latest developments for each.

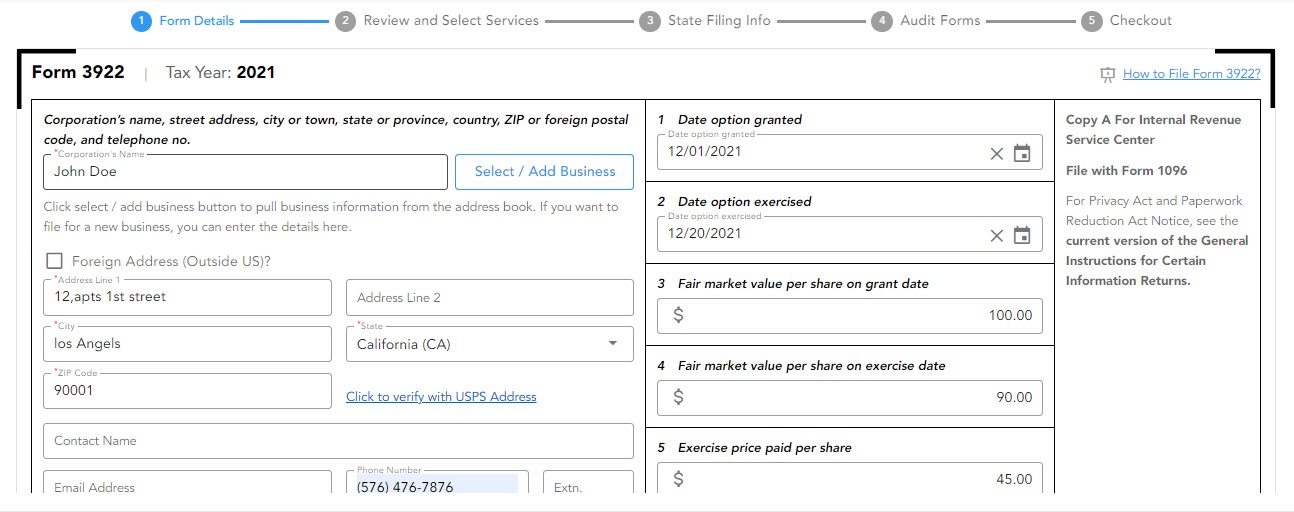

File IRS Form 3922 Online EFile Form 3922 for 2022

Irs form 3922 is used by the companies to report. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Complete, edit or print tax forms instantly. Web a form a corporation files with the irs upon an employee's exercise of a.

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. Irs form 3922 is used by the companies to report. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 •.

3922 2020 Public Documents 1099 Pro Wiki

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. Persons with.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

On the other hand, under copy a, 28th february. Form 3922 is used when the employee. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Persons with a hearing or speech disability with access to. Web in the case of copy.

Form 3922 Is Used When The Employee.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Complete, edit or print tax forms instantly. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022.

Complete, Edit Or Print Tax Forms Instantly.

On the other hand, under copy a, 28th february. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. You can also obtain the latest developments for each of the.

Web The Irs Instructions To Form 3921 And 3922 May Be Obtained Here.

Web guide for filing form 3922 for 2022 tax year. Get ready for tax season deadlines by completing any required tax forms today. Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price. Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Irs form 3922 is used by the companies to report. Web form 3922 provides the following information to the irs and an employee or former employee for whom the corporation records in 2021 the first transfer of legal title. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by.