3 Day Appraisal Waiver Form

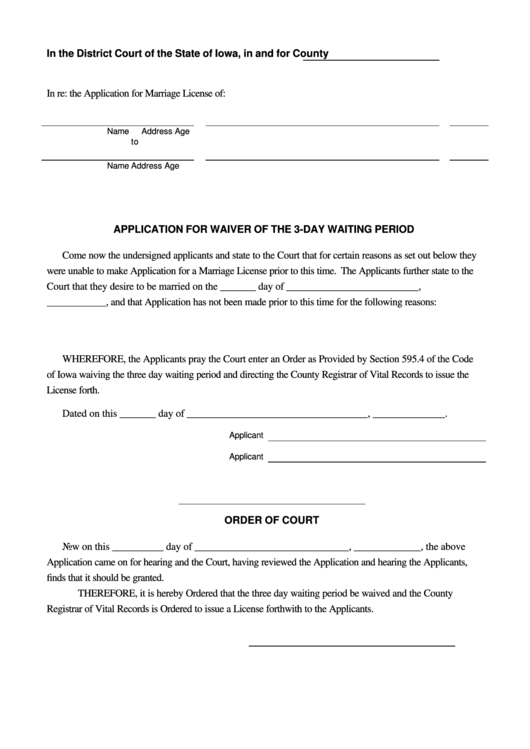

3 Day Appraisal Waiver Form - So that means you need to have the appraisal for three days prior to closing. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a. The “promptly upon completion” standard is. Ago you're choosing one of two options: They say it's an insurance policy so that we wouldn't have to postpone closing. Web appraisal 3 day waiver | for bankers. Mega capital funding, inc borrower names(s): Web unless you waive the right, if the appraisal comes in late, we have to delay closing to give you 3 days to review the appraisal. We have some originators that want to add a waiver to the initial disclosure package that would waive the 3 day appraisal delivery requirement. Web an appraisal waiver is an agreement between you and your lender that allows a real estate transaction to go forward without an official appraisal.

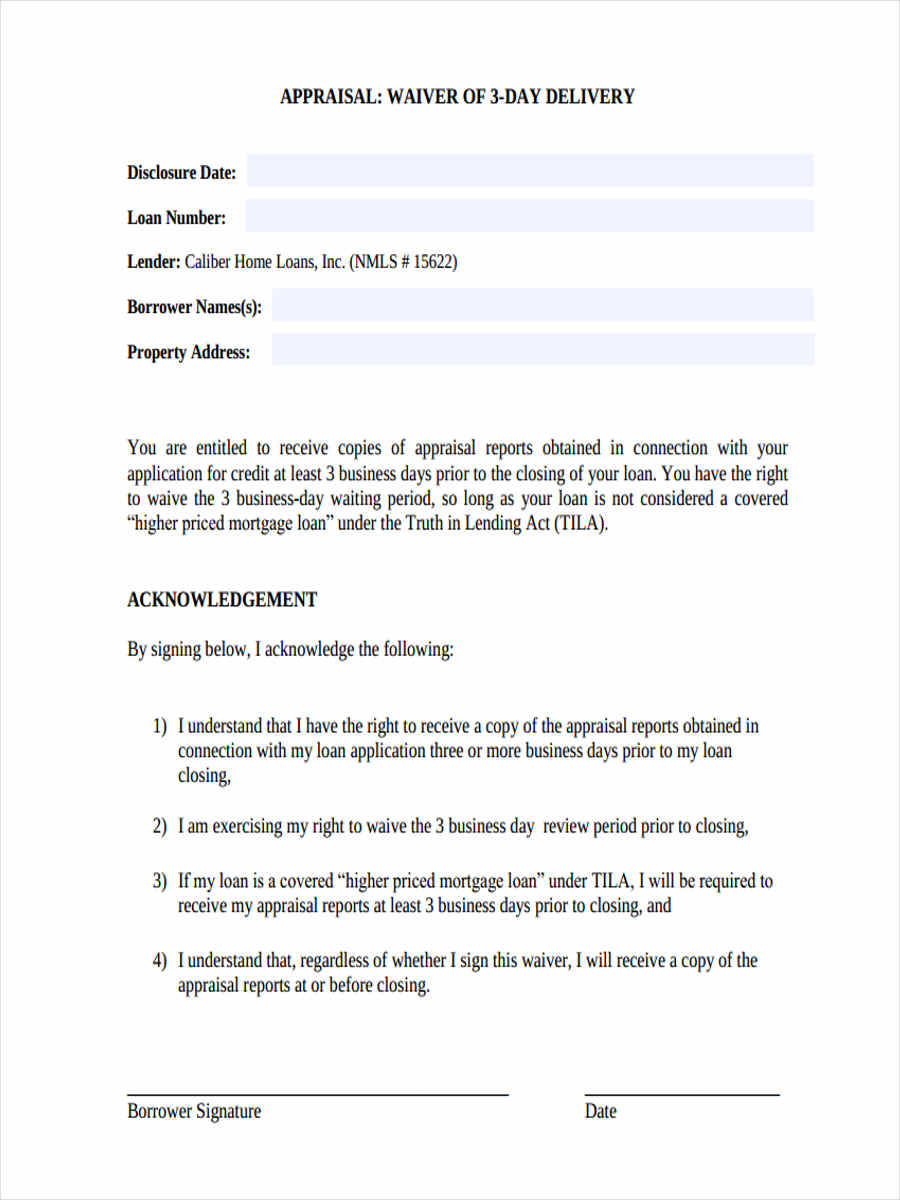

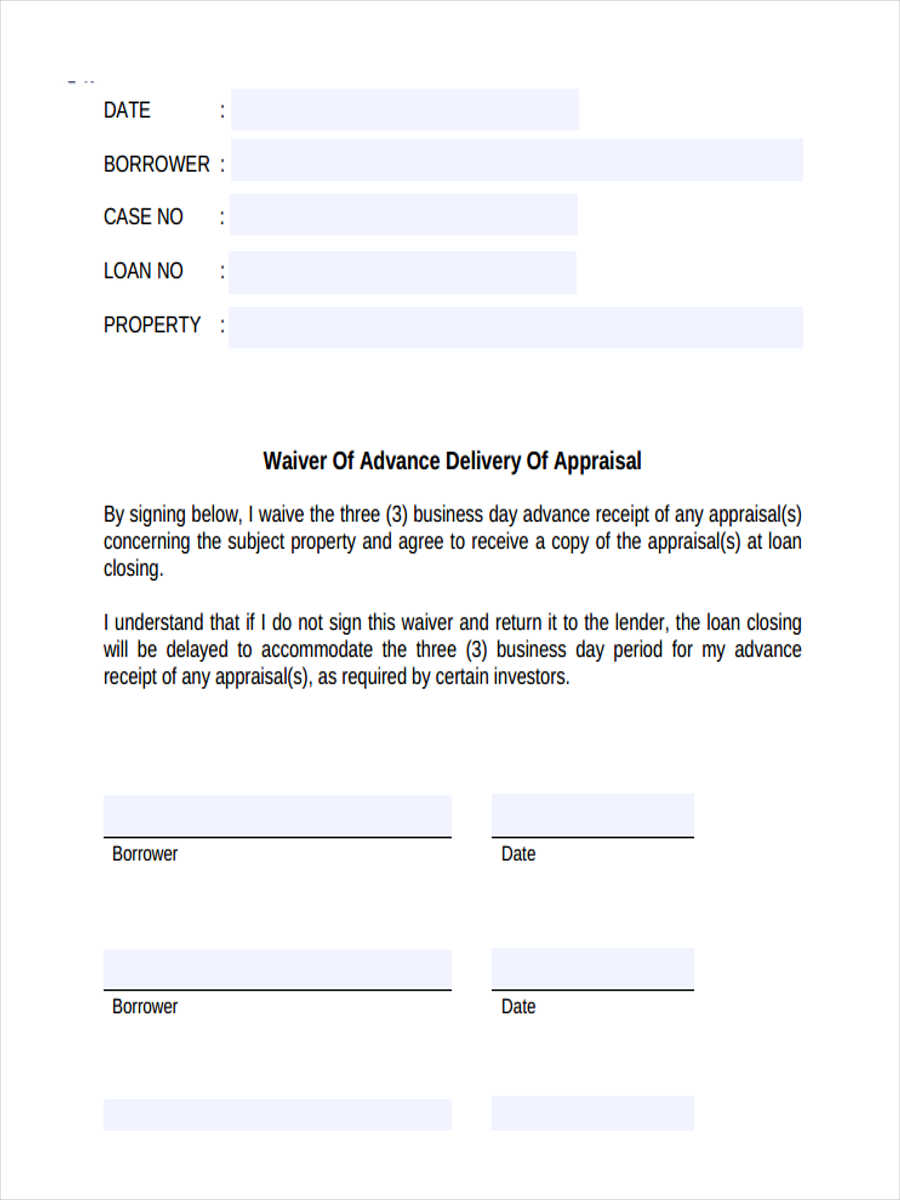

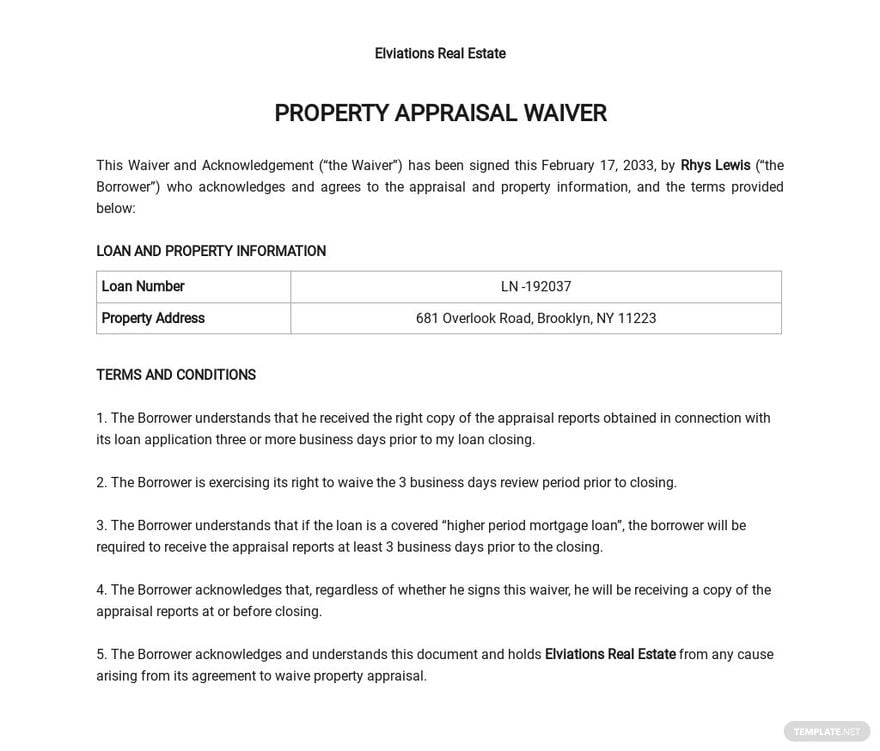

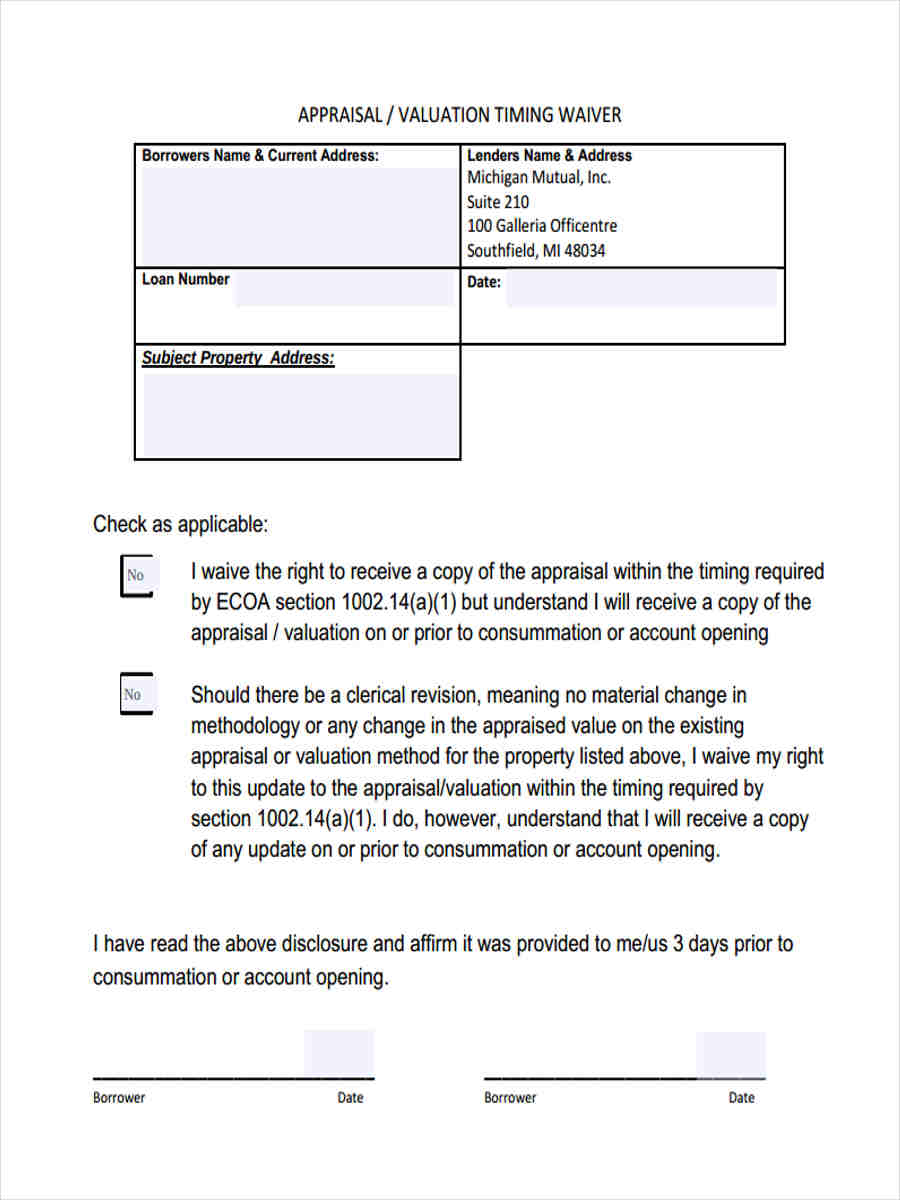

You are entitled to receive a copy of the appraisal report(s) obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. Web value acceptance (appraisal waivers) frequently asked questions. So that means you need to have the appraisal for three days prior to closing. Web unless you waive the right, if the appraisal comes in late, we have to delay closing to give you 3 days to review the appraisal. Find out how much you can. If the value acceptance (appraisal waiver) offer is not exercised, an appraisal is required for this transaction and the loan Mega capital funding, inc borrower names(s): Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a. Web appraisal 3 day waiver | for bankers. You are entitled to receive copies of appraisal reports and other written valuations obtained in connection with your application for credit at least 3 business days prior to the closing of your loan.

Mega capital funding, inc borrower names(s): Instead, lenders use data generated by an automated underwriting system to determine the value of the home based on the information it has collected from other recent home sales in the area. Web value acceptance (appraisal waivers) frequently asked questions. You are entitled to receive a copy of the appraisal report(s) obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. Web (appraisal waiver) offer with representation and warranty relief on the value, condition, and marketability of the subject property, the loan delivery file must include the casefile id and special feature code 801. Find out how much you can. The “promptly upon completion” standard is. Web unless you waive the right, if the appraisal comes in late, we have to delay closing to give you 3 days to review the appraisal. They say it's an insurance policy so that we wouldn't have to postpone closing. Web appraisal 3 day waiver | for bankers.

What is an Appraisal Waiver? NFM Lending

Instead, lenders use data generated by an automated underwriting system to determine the value of the home based on the information it has collected from other recent home sales in the area. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this.

Appraisal Forms in Word Templates, Designs, Docs, Free Downloads

Web appraisal 3 day waiver | for bankers. How does an appraisal waiver work? Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other.

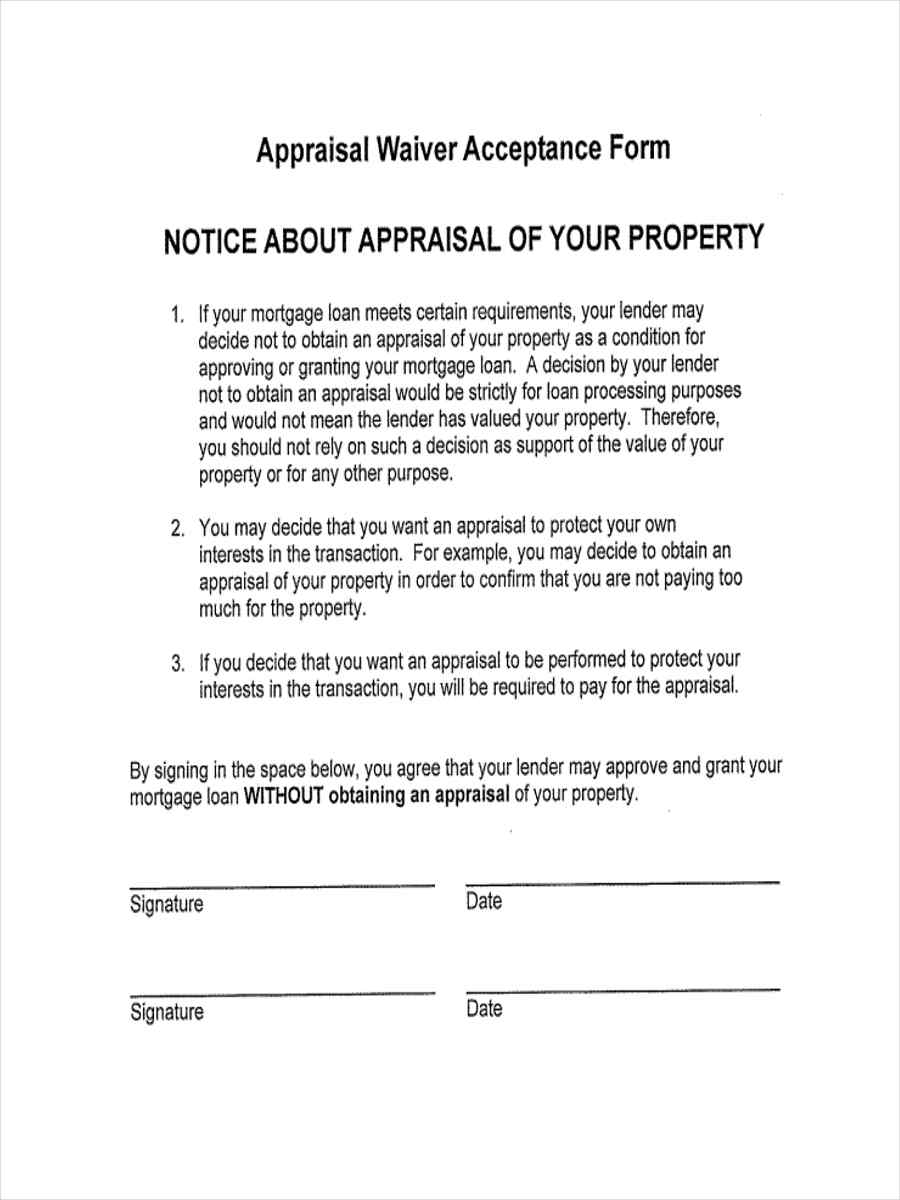

FREE 6+ Appraisal Waiver Forms in PDF Ms Word

Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a. If the value acceptance (appraisal.

Fillable Application For Waiver Of The 3Day Waiting Period printable

Web three business days after mailing or delivering copies of the valuation to the last known address of the applicant, or when evidence indicates actual receipt of copies of the appraisal by the applicant. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement.

What Is An Appraisal Waiver Or Property Inspection Waiver? CC

Ago you're choosing one of two options: You are entitled to receive copies of appraisal reports and other written valuations obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. How does an appraisal waiver work? So that means you need to have the appraisal for three days prior to.

What Is an Appraisal Waiver and Should I Get One? Ownerly

Web appraisal 3 day waiver | for bankers. Mega capital funding, inc borrower names(s): Web (appraisal waiver) offer with representation and warranty relief on the value, condition, and marketability of the subject property, the loan delivery file must include the casefile id and special feature code 801. Web unless you waive the right, if the appraisal comes in late, we.

FREE 6+ Appraisal Waiver Forms in PDF Ms Word

Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a. So that means you need.

FREE 6+ Appraisal Waiver Forms in PDF Ms Word

Instead, lenders use data generated by an automated underwriting system to determine the value of the home based on the information it has collected from other recent home sales in the area. You want to see the appraisal prior to closing. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral.

IDCC 2700 Fixation des garanties annuelles de rémunération dans la CC…

Web an appraisal waiver is an agreement between you and your lender that allows a real estate transaction to go forward without an official appraisal. How does an appraisal waiver work? Web value acceptance (appraisal waivers) frequently asked questions. You want to see the appraisal prior to closing. Instead, lenders use data generated by an automated underwriting system to determine.

FREE 6+ Appraisal Waiver Forms in PDF Ms Word

Web three business days after mailing or delivering copies of the valuation to the last known address of the applicant, or when evidence indicates actual receipt of copies of the appraisal by the applicant. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement.

Instead, Lenders Use Data Generated By An Automated Underwriting System To Determine The Value Of The Home Based On The Information It Has Collected From Other Recent Home Sales In The Area.

So that means you need to have the appraisal for three days prior to closing. You want to see the appraisal prior to closing. Web an appraisal waiver is an agreement between you and your lender that allows a real estate transaction to go forward without an official appraisal. Web (appraisal waiver) offer with representation and warranty relief on the value, condition, and marketability of the subject property, the loan delivery file must include the casefile id and special feature code 801.

Web Unless You Waive The Right, If The Appraisal Comes In Late, We Have To Delay Closing To Give You 3 Days To Review The Appraisal.

How does an appraisal waiver work? Web value acceptance (appraisal waivers) frequently asked questions. Ago you're choosing one of two options: Mega capital funding, inc borrower names(s):

We Have Some Originators That Want To Add A Waiver To The Initial Disclosure Package That Would Waive The 3 Day Appraisal Delivery Requirement.

Web appraisal 3 day waiver | for bankers. If the value acceptance (appraisal waiver) offer is not exercised, an appraisal is required for this transaction and the loan The “promptly upon completion” standard is. You are entitled to receive a copy of the appraisal report(s) obtained in connection with your application for credit at least 3 business days prior to the closing of your loan.

Find Out How Much You Can.

You are entitled to receive copies of appraisal reports and other written valuations obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. Web three business days after mailing or delivering copies of the valuation to the last known address of the applicant, or when evidence indicates actual receipt of copies of the appraisal by the applicant. They say it's an insurance policy so that we wouldn't have to postpone closing. Web if, within three business days of consummation or account opening, the applicant provides the creditor an affirmative oral or written statement waiving the timing requirement under this rule and the waiver pertains solely to the applicant's receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a.

/filters:quality(60)/2020-09-02-What-Is-An-Appraisal-Waiver-CDN.jpg)