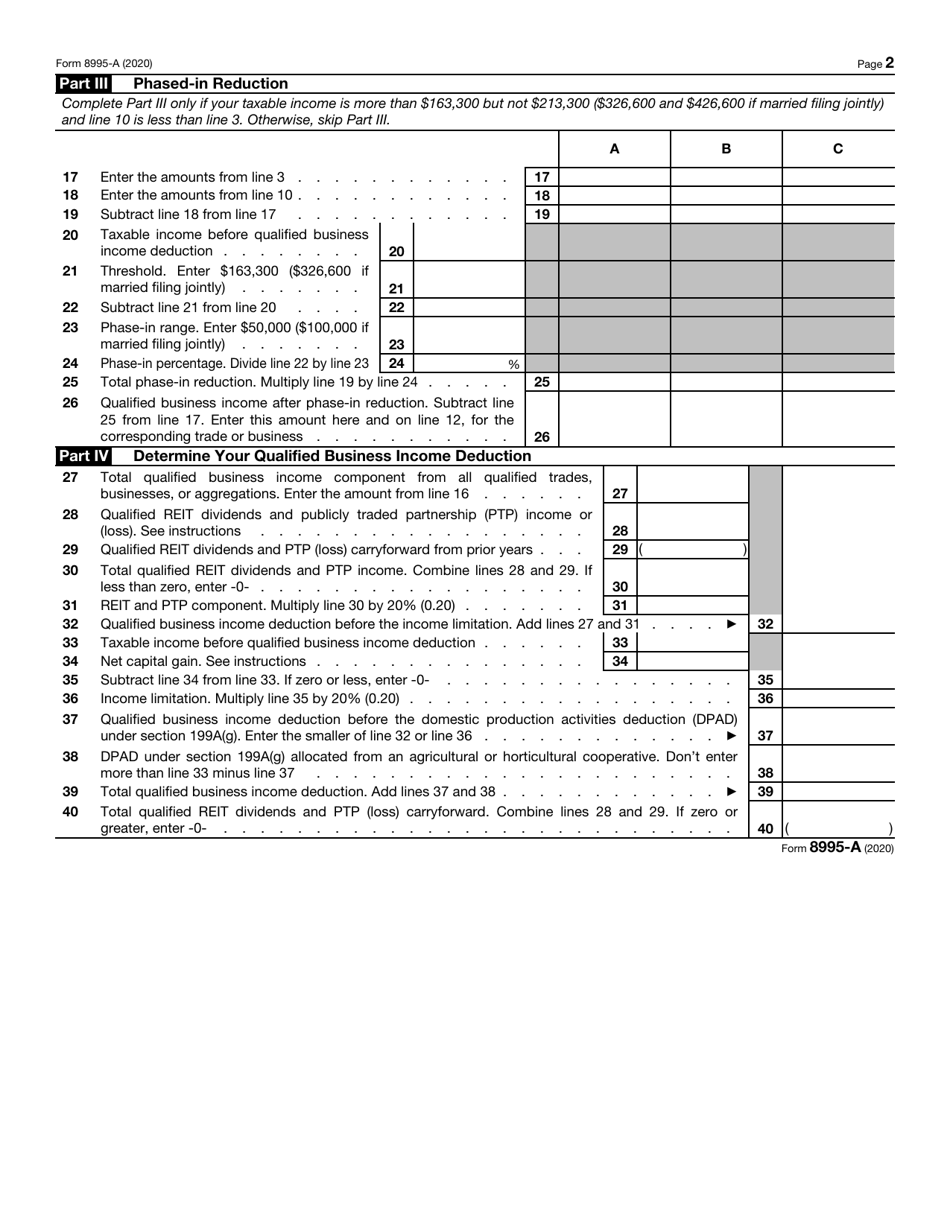

8995-A Form

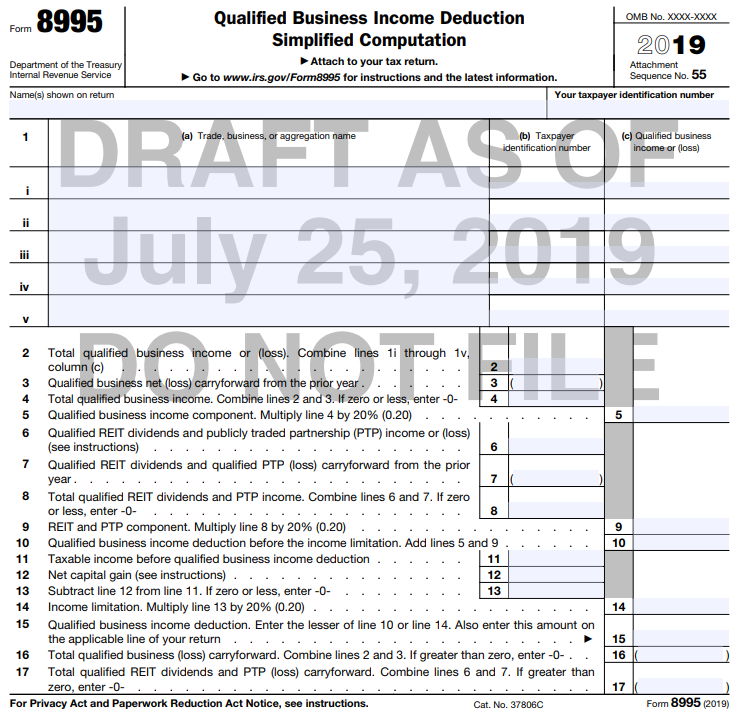

8995-A Form - Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web passed through from an agricultural or horticultural cooperative. Include the following schedules (their specific instructions are shown later), as. Form 8995 is a simplified. The individual has qualified business income. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 and form 8995a. Form 8995 is the simplified form and is used if all of the following are true: Use this form if your taxable income, before your qualified business income deduction, is above.

Web passed through from an agricultural or horticultural cooperative. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. And your 2019 taxable income. Use this form if your taxable income, before your qualified business income deduction, is above. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 and form 8995a. Include the following schedules (their specific instructions are shown later), as. The individual has qualified business income. You have qbi, qualified reit dividends, or qualified ptp income or loss; Form 8995 is a simplified.

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Include the following schedules (their specific instructions are shown later), as. The individual has qualified business income. Use this form if your taxable income, before your qualified business income deduction, is above. Form 8995 and form 8995a. Form 8995 is a simplified. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. And your 2019 taxable income. Form 8995 is the simplified form and is used if all of the following are true:

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Include the following schedules (their specific instructions are shown later), as. You have qbi, qualified reit dividends, or qualified ptp income or loss; Form 8995 is a simplified. And your 2019 taxable income. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

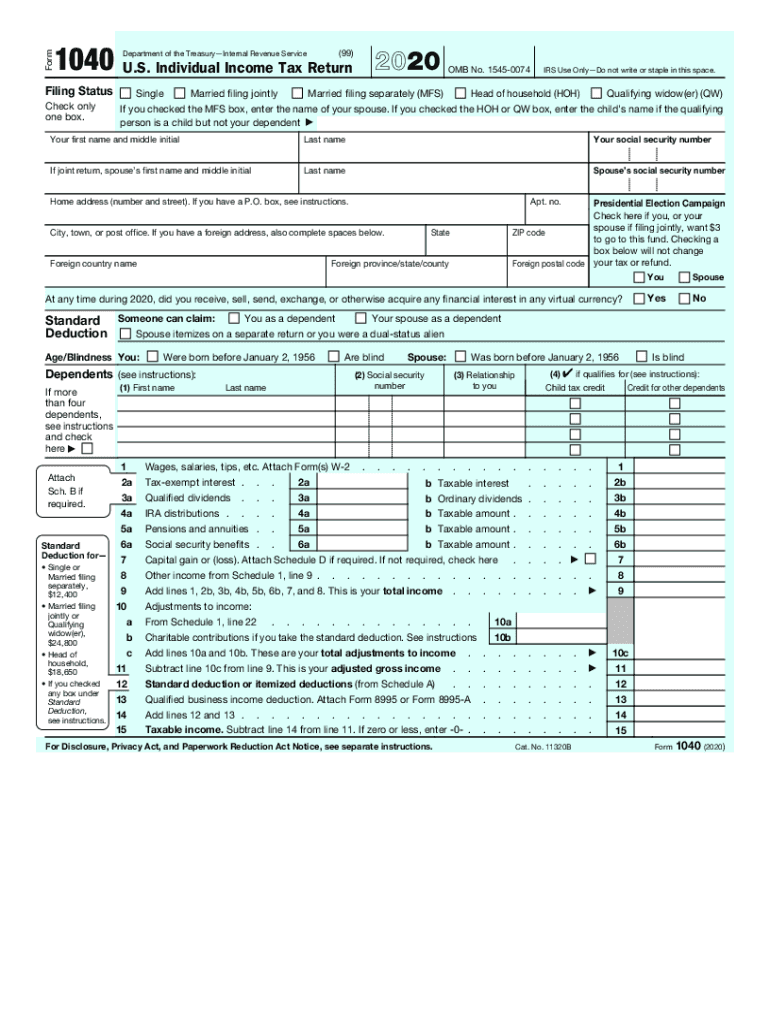

IRS 1040 20202022 Fill out Tax Template Online US Legal Forms

Include the following schedules (their specific instructions are shown later), as. Form 8995 is a simplified. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. And your 2019 taxable income. You have qbi, qualified reit dividends, or qualified ptp income or loss;

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Form 8995 and form 8995a. Form 8995 is the simplified form and is used if all of the following are true: Web passed through from an agricultural or horticultural cooperative. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. And your 2019 taxable income.

Mason + Rich Blog NH’s CPA Blog

You have qbi, qualified reit dividends, or qualified ptp income or loss; Form 8995 and form 8995a. Form 8995 is the simplified form and is used if all of the following are true: The individual has qualified business income. Form 8995 is a simplified.

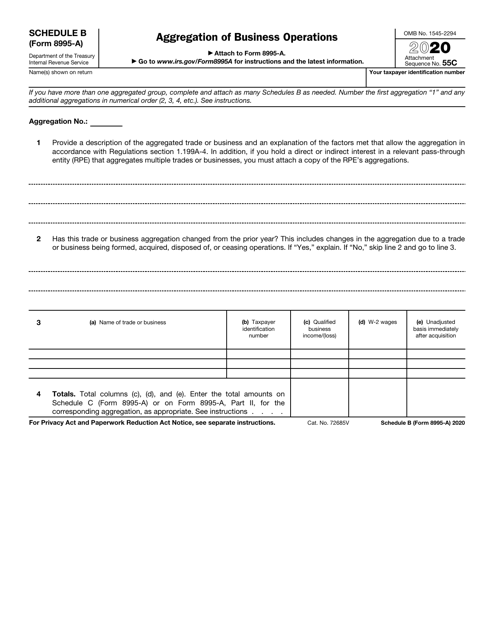

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Form 8995 is the simplified form and is used if all of the following are true: Web passed through from an agricultural or horticultural cooperative. Form 8995 is a simplified. Use this form if your taxable income, before your qualified business income deduction, is above. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified.

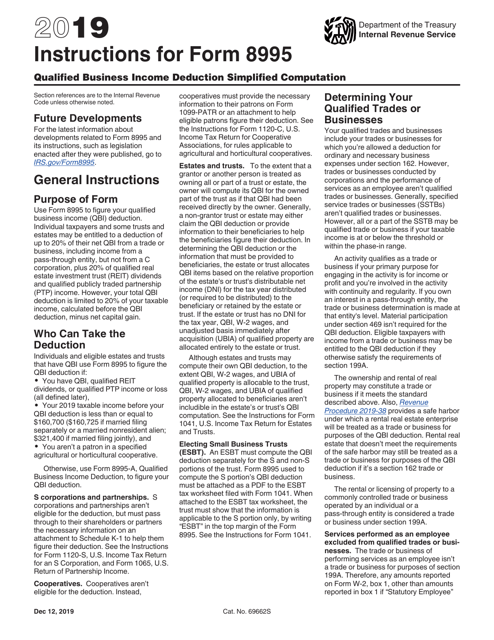

Download Instructions for IRS Form 8995 Qualified Business

The individual has qualified business income. And your 2019 taxable income. Include the following schedules (their specific instructions are shown later), as. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

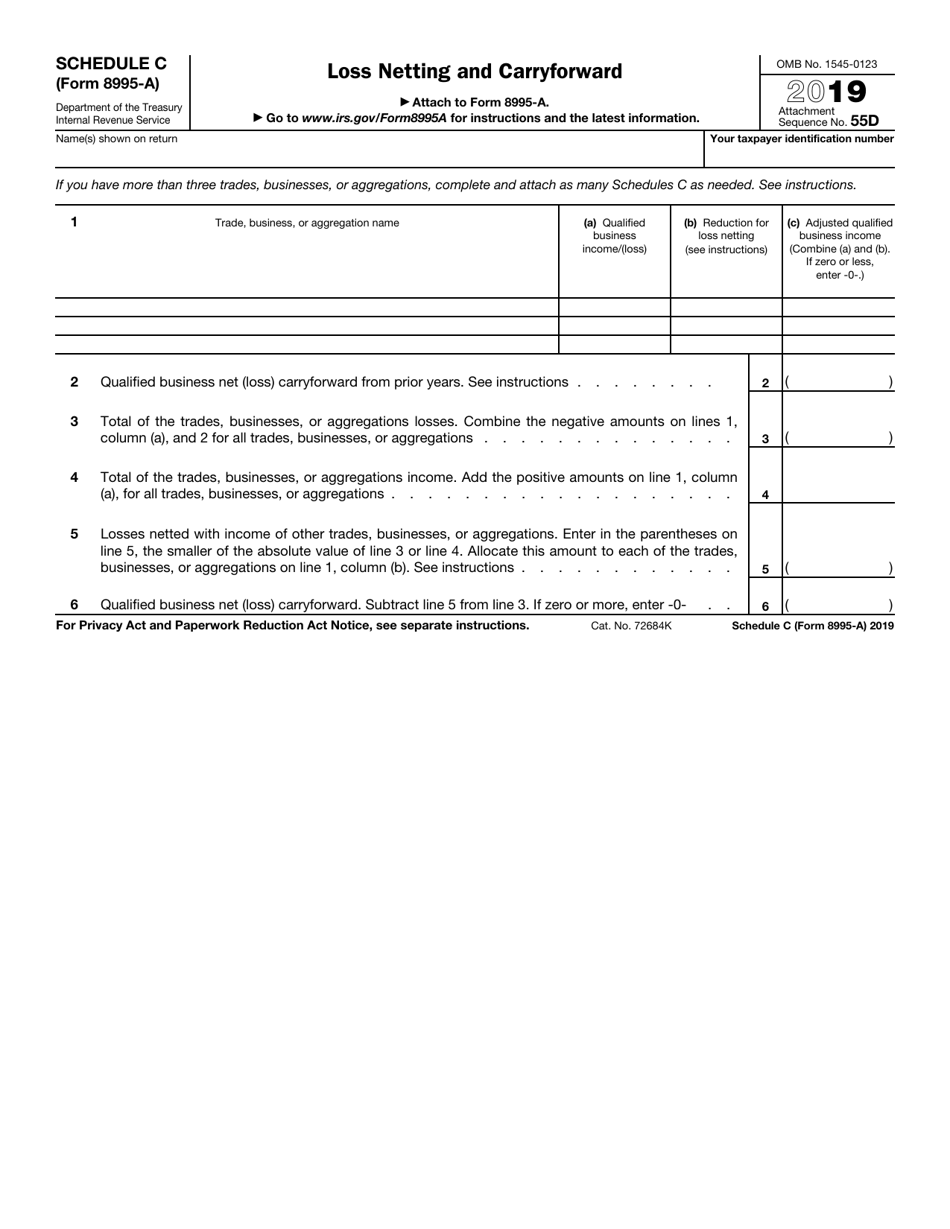

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

And your 2019 taxable income. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 and form 8995a. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach.

Fill Free fillable F8995a 2019 Form 8995A PDF form

Form 8995 is the simplified form and is used if all of the following are true: And your 2019 taxable income. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Use this form if your taxable income, before your qualified business income deduction, is above. Form 8995 is.

Form 8995A Draft WFFA CPAs

Form 8995 is the simplified form and is used if all of the following are true: Form 8995 and form 8995a. Include the following schedules (their specific instructions are shown later), as. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web passed through from an agricultural or.

Instructions for Form 8995A (2022) Internal Revenue Service

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. You have qbi, qualified reit dividends, or qualified ptp income or loss; Form 8995 and form 8995a. And your 2019 taxable income. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach.

And Your 2019 Taxable Income.

Use this form if your taxable income, before your qualified business income deduction, is above. The individual has qualified business income. Form 8995 and form 8995a. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

Include The Following Schedules (Their Specific Instructions Are Shown Later), As.

Form 8995 is a simplified. Form 8995 is the simplified form and is used if all of the following are true: Web passed through from an agricultural or horticultural cooperative. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.