941 Amended Form

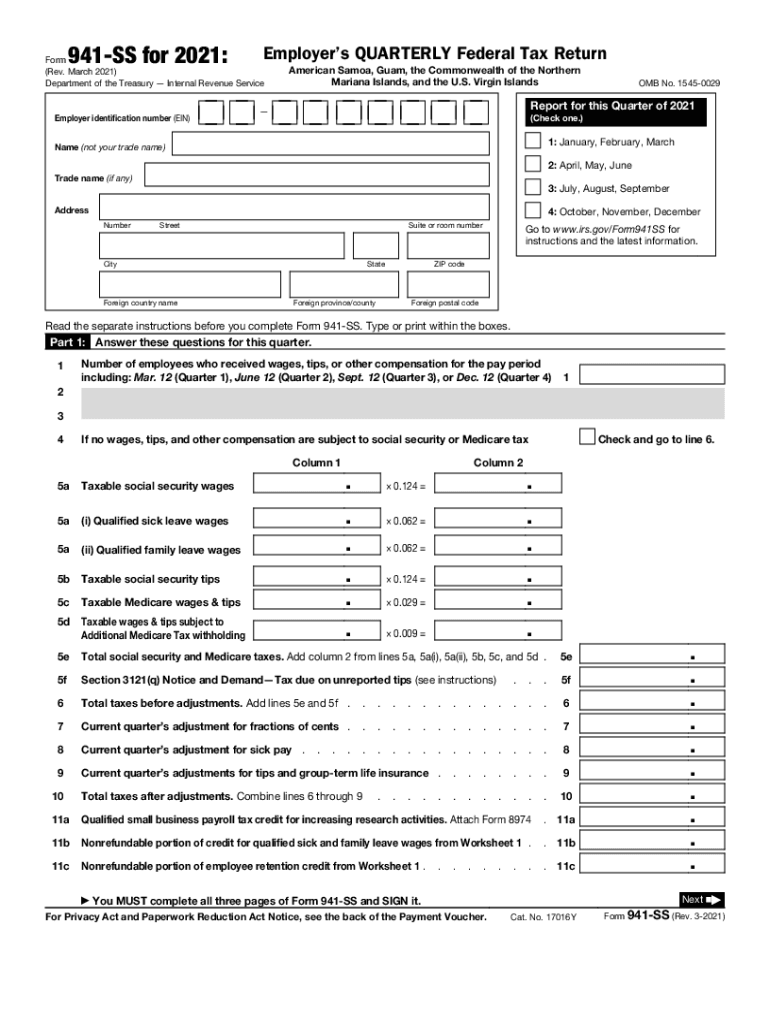

941 Amended Form - Upload, modify or create forms. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document employers must fill out and file with the government to report fica taxes. Web choose the appropriate form link. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Use the form if you encounter mistakes related to taxable medicare wages. Web since the pandemic began, the irs has experienced significant delays in processing individual and business tax returns plus a flood of amended forms 941 to. Reminders don't use an earlier revision of. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022.

In the event there's no delete option, you'll need to prepare a corrected or amended form. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Use the form if you encounter mistakes related to taxable medicare wages. Upload, modify or create forms. Select delete, then confirm its deletion. Try it for free now! Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document employers must fill out and file with the government to report fica taxes. Now that you’re allowed to have both your ppp loans and. Ad download or email form 941x & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today.

March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Now that you’re allowed to have both your ppp loans and. Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document employers must fill out and file with the government to report fica taxes. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Try it for free now! Reminders don't use an earlier revision of. Select delete, then confirm its deletion. Ad download or email form 941x & more fillable forms, register and subscribe now! Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today.

Form 941SS (Rev. March 2021) IRS Fill and Sign Printable Template

Try it for free now! Use the form if you encounter mistakes related to taxable medicare wages. Reminders don't use an earlier revision of. Ad get ready for tax season deadlines by completing any required tax forms today. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —.

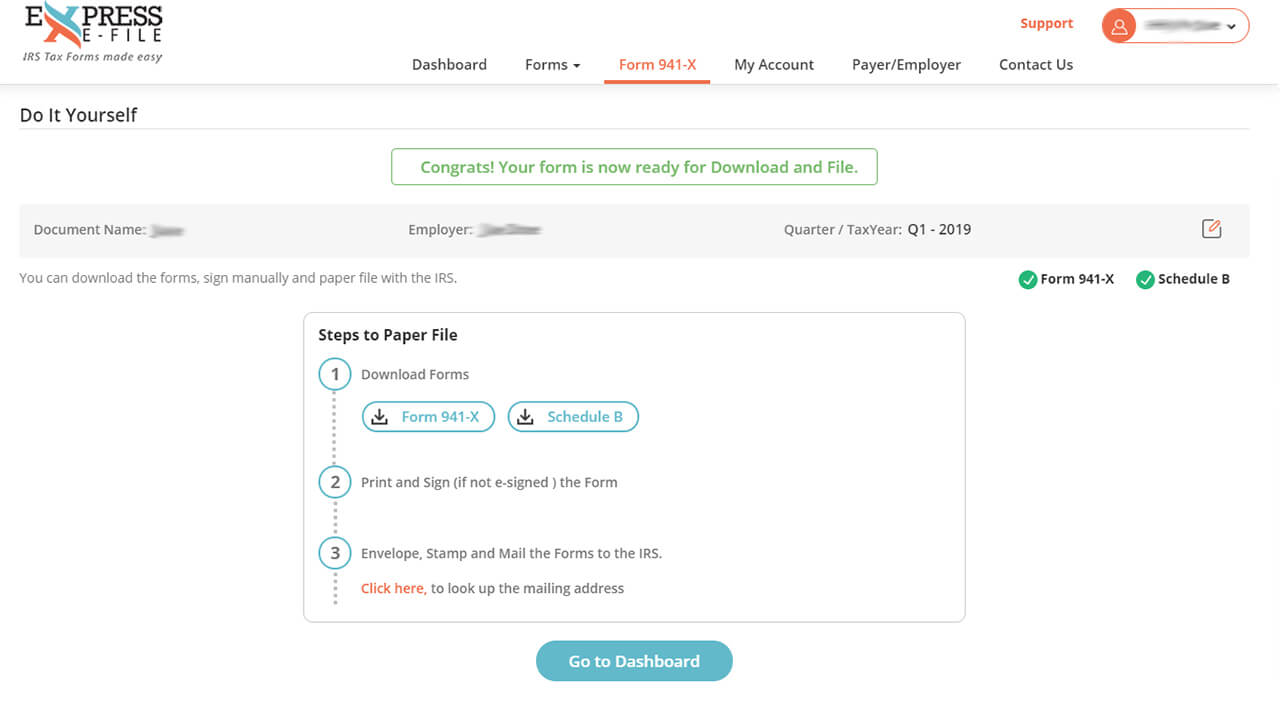

How to Complete & Download Form 941X (Amended Form 941)?

Try it for free now! Select delete, then confirm its deletion. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Web choose the.

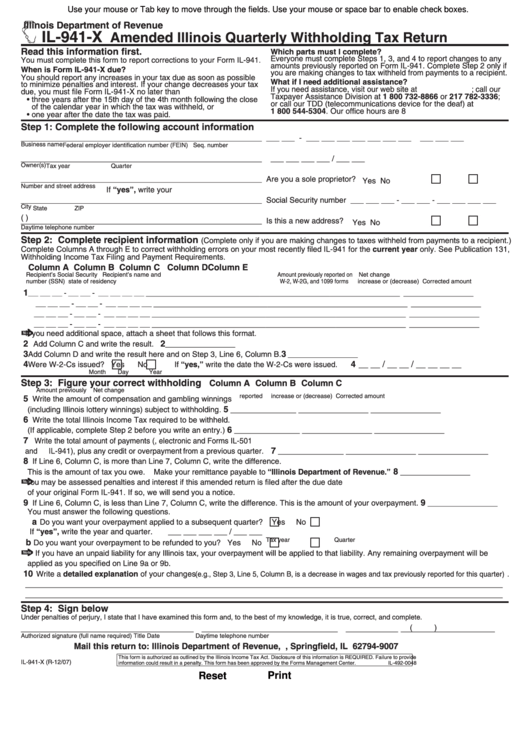

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

Web choose the appropriate form link. Upload, modify or create forms. Reminders don't use an earlier revision of. Use the form if you encounter mistakes related to taxable medicare wages. Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document employers must fill out and file with the government to report fica.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Ad download or email form 941x & more fillable forms, register and subscribe now! Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document.

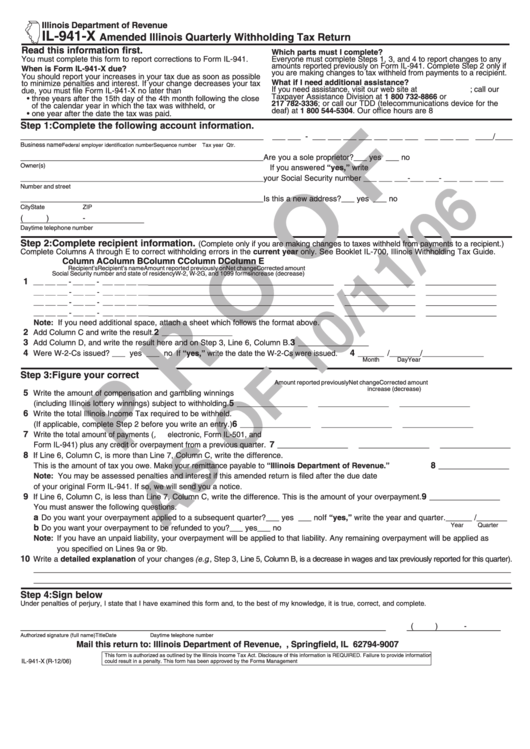

Form Il941X Amended Illinois Quarterly Withholding Tax Return

Try it for free now! Ad download or email form 941x & more fillable forms, register and subscribe now! In the event there's no delete option, you'll need to prepare a corrected or amended form. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31,.

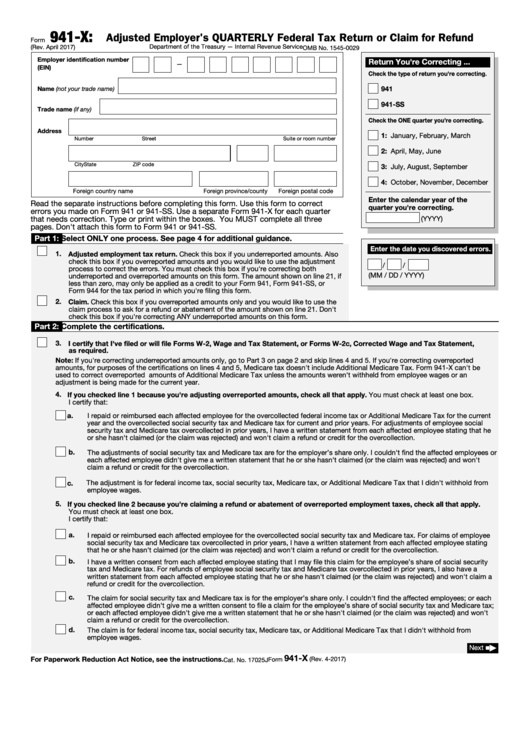

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Make sure to enter the necessary liability adjustments before. Reminders don't use an earlier revision of. Web since the pandemic began, the irs has experienced significant delays in processing individual and business tax returns plus a flood of amended forms 941 to. In the event there's no delete option, you'll need to prepare a corrected or amended form. Web the.

Irs.gov Form 941 Amended Form Resume Examples MW9pPdM9AJ

Try it for free now! Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Web since the pandemic began, the irs has experienced significant delays in processing individual and business tax returns plus a flood of amended forms 941 to. Ad get ready.

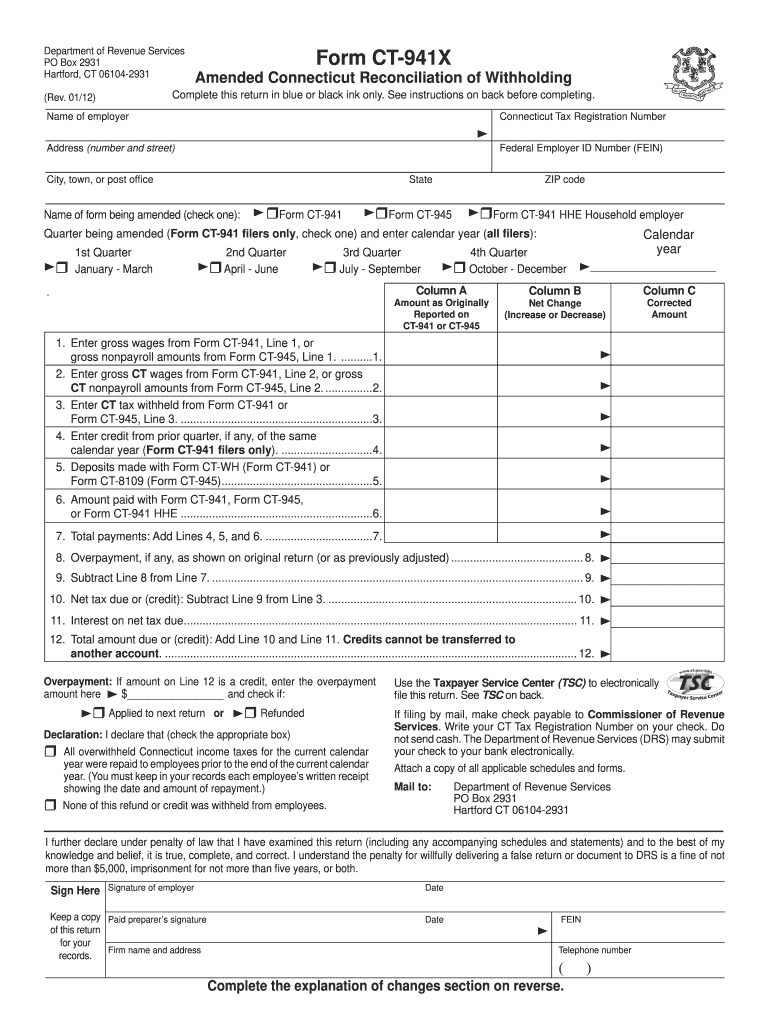

2012 Form CT DRS CT941X Fill Online, Printable, Fillable, Blank

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Select delete, then confirm its deletion. Upload, modify or create forms. In.

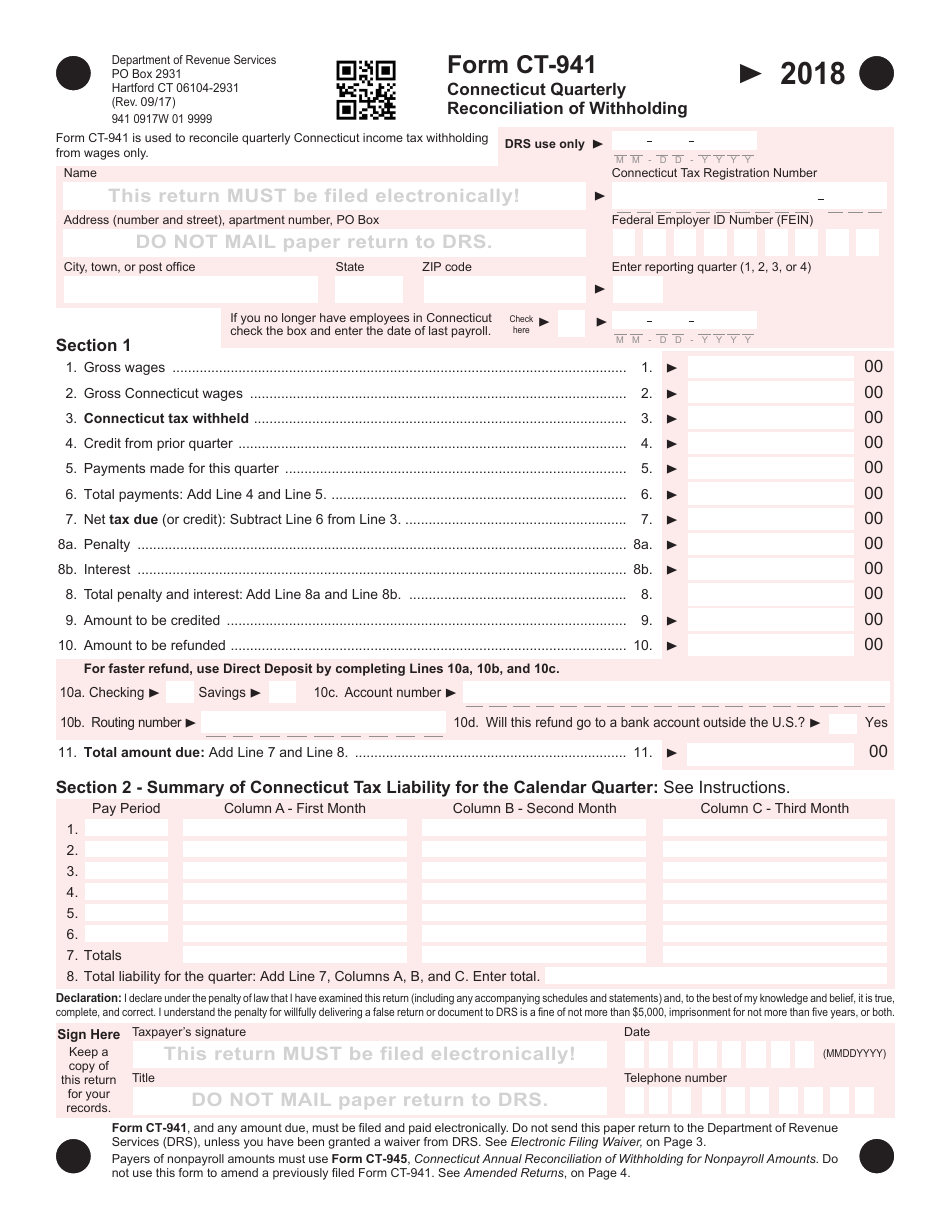

Form CT941 Download Printable PDF or Fill Online Connecticut Quarterly

In the event there's no delete option, you'll need to prepare a corrected or amended form. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. Now that you’re allowed to have both your ppp loans and. Reminders don't use an earlier revision of.

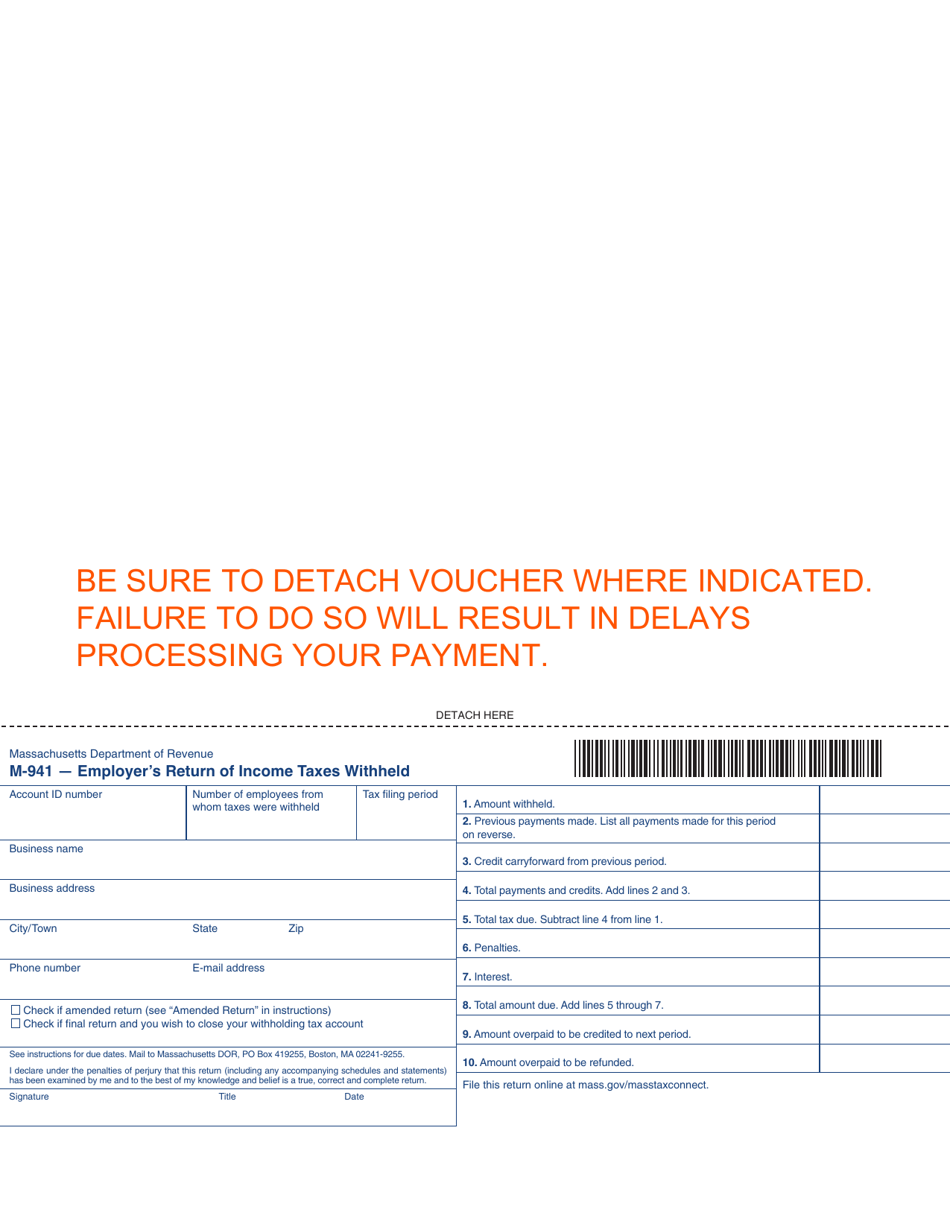

Form M941 Download Printable PDF or Fill Online Employer's Return of

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Ad download or email form 941x & more fillable forms, register and subscribe now! Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of.

Use The Form If You Encounter Mistakes Related To Taxable Medicare Wages.

Ad download or email form 941x & more fillable forms, register and subscribe now! Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Try it for free now! Make sure to enter the necessary liability adjustments before.

In The Event There's No Delete Option, You'll Need To Prepare A Corrected Or Amended Form.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Reminders don't use an earlier revision of. Now that you’re allowed to have both your ppp loans and.

Web The Advance Payment On Form 941, Part 1, Line 13H, For The Fourth Quarter Of 2021 And Paying Any Balance Due By January 31, 2022.

Select delete, then confirm its deletion. Web choose the appropriate form link. Web since the pandemic began, the irs has experienced significant delays in processing individual and business tax returns plus a flood of amended forms 941 to. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web in short, irs form 941, or the employer’s quarterly federal tax return, is a quarterly tax document employers must fill out and file with the government to report fica taxes. Upload, modify or create forms.