941 Form For 2020

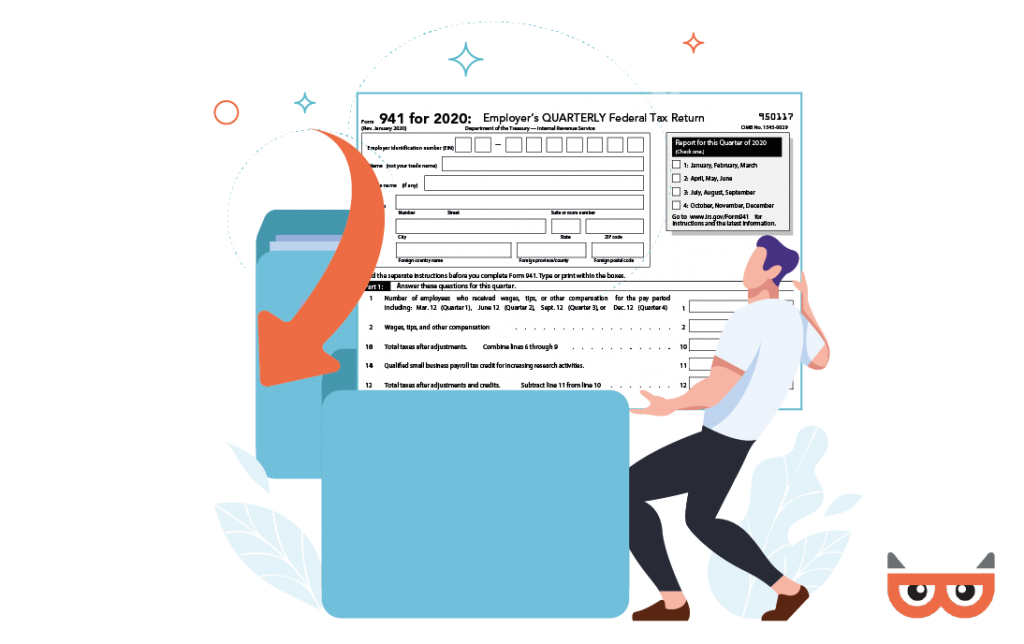

941 Form For 2020 - Web form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web employer's quarterly federal tax return for 2021. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Type or print within the boxes. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web changes to form 941 (rev.

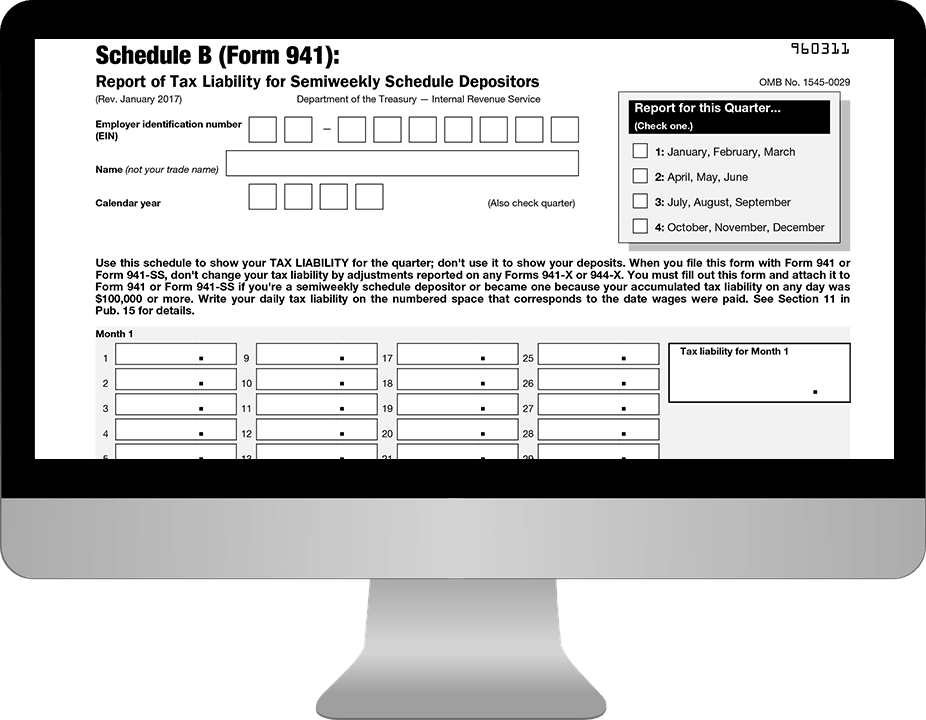

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Filing deadlines are in april, july, october and january. Web employer's quarterly federal tax return for 2021. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Web form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; Pay the employer's portion of social security or medicare tax.

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Instructions for form 941 (2021) pdf. Web about form 941, employer's quarterly federal tax return. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web changes to form 941 (rev. Web employer's quarterly federal tax return for 2021. Pay the employer's portion of social security or medicare tax. Web form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021;

941 Form 2021

Web changes to form 941 (rev. Instructions for form 941 (2021) pdf. April, may, june read the separate instructions before completing this form. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Form 941 instructions 2020 revisions pdf for additional information related to.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

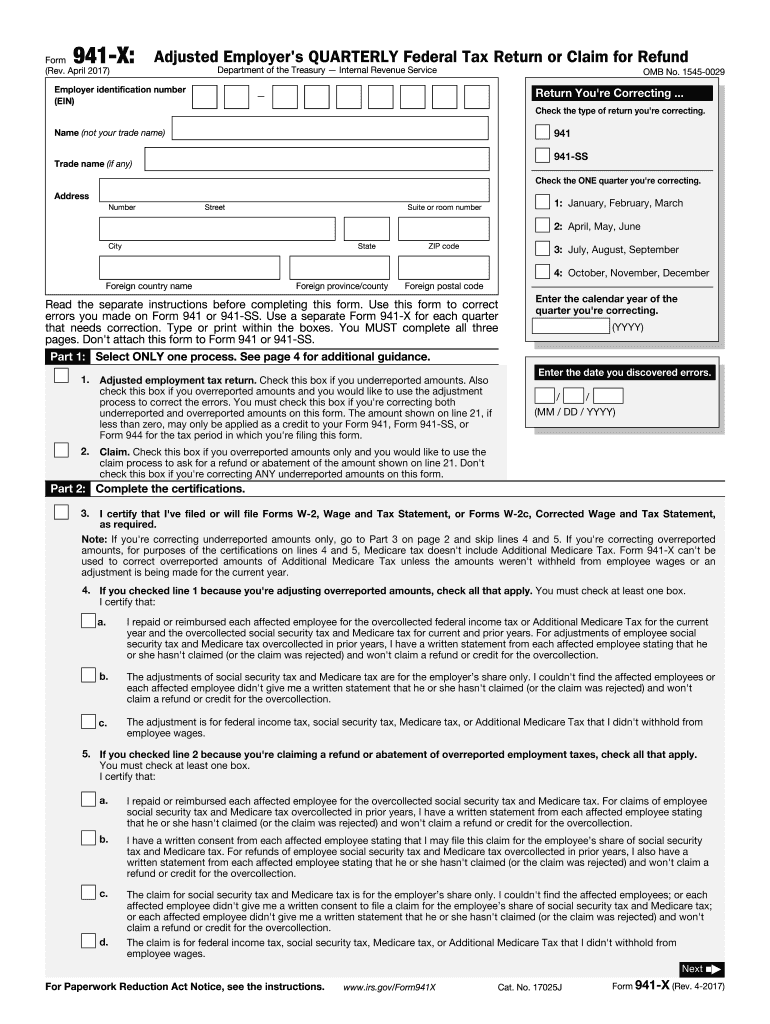

Web form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; Web employer's quarterly federal tax return for 2021. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on The july 2020 revision of form 941.

941 Form Fill Out and Sign Printable PDF Template signNow

The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web changes to form 941 (rev. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Pay the employer's portion of social security.

20152020 Form MO MO941 Fill Online, Printable, Fillable, Blank

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Type or print within the boxes. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Pay the employer's portion of social security or medicare tax. Form 941 instructions 2020.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Type or print within the boxes. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Pay the employer's portion of social.

Update Form 941 Changes Regulatory Compliance

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web changes to form 941 (rev. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Form 941.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Filing deadlines are in april, july, october and january. Web about form 941, employer's quarterly federal tax return. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Instructions for form 941 (2021) pdf. Web changes to form 941 (rev. Filing deadlines are in april, july, october and january. The july 2020 revision of form 941 will be used to report employment.

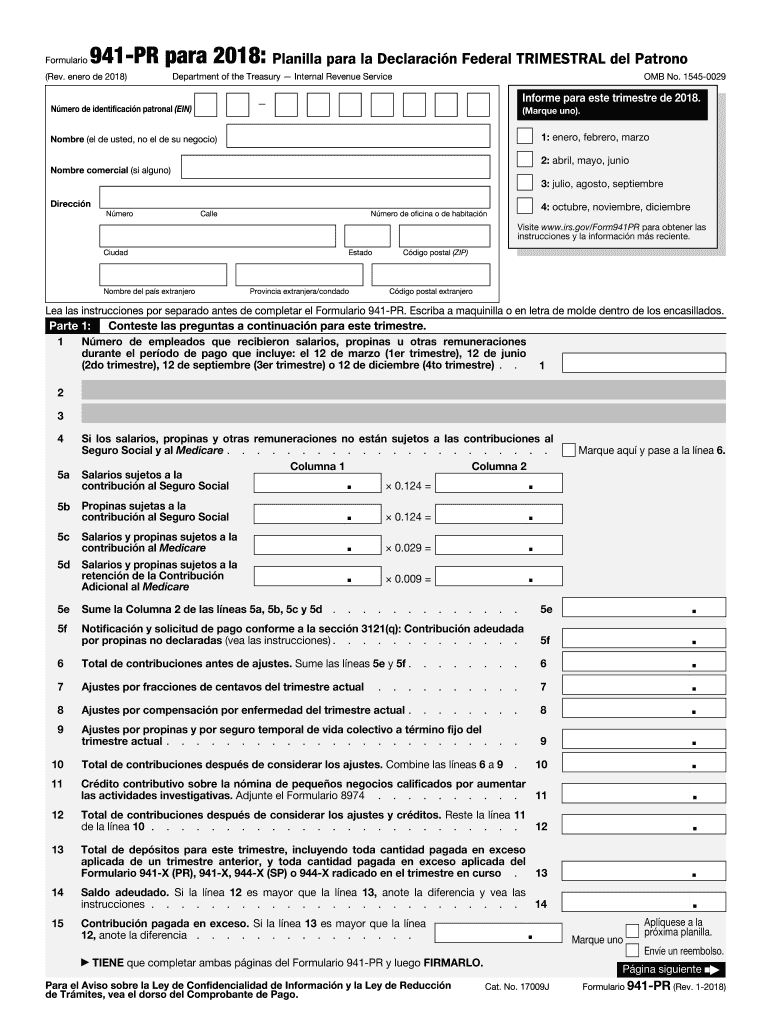

941 Pr 2019 Fill Out and Sign Printable PDF Template signNow

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web changes to form 941 (rev. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Pay the employer's portion of social security or medicare tax. Instructions for form 941 (2021) pdf.

941 Form 2020 941 Forms

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Instructions for form 941 (2021) pdf. January 2020) employer’s quarterly federal tax return department of the.

April, May, June Read The Separate Instructions Before Completing This Form.

Filing deadlines are in april, july, october and january. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Pay the employer's portion of social security or medicare tax.

Form 941 Has Been Revised To Allow Employers That Defer The Withholding And Payment Of The Employee Share Of Social Security Tax On Wages Paid On

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Type or print within the boxes. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web about form 941, employer's quarterly federal tax return.

Web Form 941 Instructions, December 2021 Revision Pdf For Additional Information Related To The Erc For Quarters In 2021;

Web employer's quarterly federal tax return for 2021. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; Instructions for form 941 (2021) pdf. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020.

Web Irs Form 941 Is A Form Businesses File Quarterly To Report Taxes They Withheld From Employee Paychecks.

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web changes to form 941 (rev.