Arizona 1099 Form

Arizona 1099 Form - Federal tax return was itemized arizona income tax payments for the tax. How must forms 1099 be filed with arizona? Filers can download and print. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. If you file 250 or more 1099 forms with arizona you. The total amount of the member’s pension for the previous. Web remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Web the state of arizona requires form 1099, which is an information return that is used to report various other types of amounts paid to the individuals other than employees. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Find them all in one convenient place.

Find them all in one convenient place. Web 26 rows form number title; If you have elected to receive your 1099 digitally, you will receive an email notification prior to january 31 that. Filers can download and print. You can file the 1099 on paper or electronically. If you file 250 or more 1099 forms with arizona you. Web this is the quickest way to receive your tax forms. File the state copy of form 1099 with the arizona taxation agency by february 28, 2021. From the latest tech to workspace faves, find just what you need at office depot®! Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

From the latest tech to workspace faves, find just what you need at office depot®! How must forms 1099 be filed with arizona? Taxpayers can begin filing individual income tax returns through. Web remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. If you file 250 or more 1099 forms with arizona you. Web if you live in arizona. If you elect this option, you will receive an email notification in january when your tax documents are available online. Filers can download and print. 5 need to know facts. Web the arizona department of revenue mandates the filing of the 1099 form only if there is state tax withholding.

Where To Send Arizona 1099 Forms Form Resume Examples VX5Jm3lDjv

Web the state of arizona requires form 1099, which is an information return that is used to report various other types of amounts paid to the individuals other than employees. Taxpayers can begin filing individual income tax returns through. Ad success starts with the right supplies. If you elect this option, you will receive an email notification in january when.

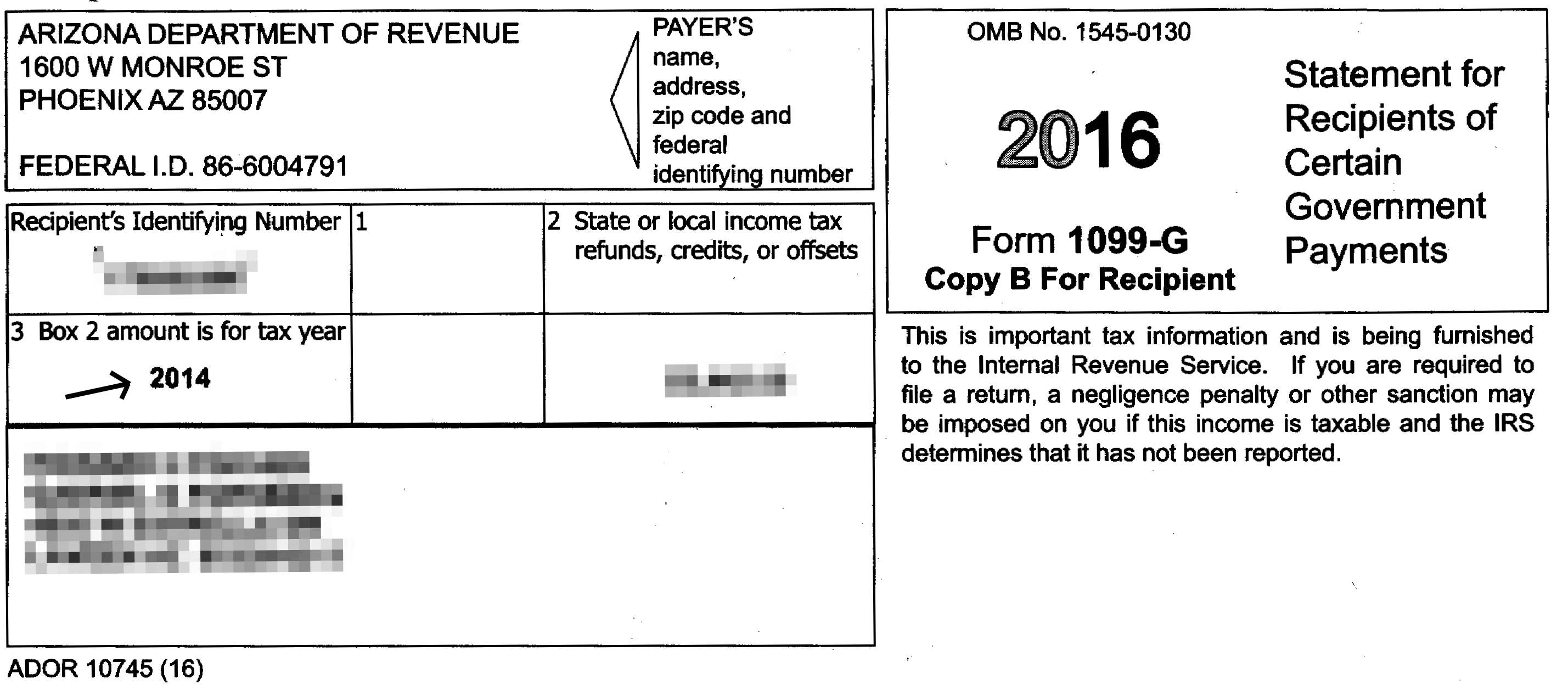

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

Web yes, arizona requires any forms 1099 with state tax withholding to be filed with the state. If you have elected to receive your 1099 digitally, you will receive an email notification prior to january 31 that. Web what do i need to report for unemployment benefits when i file my 2022 taxes? If you elect this option, you will.

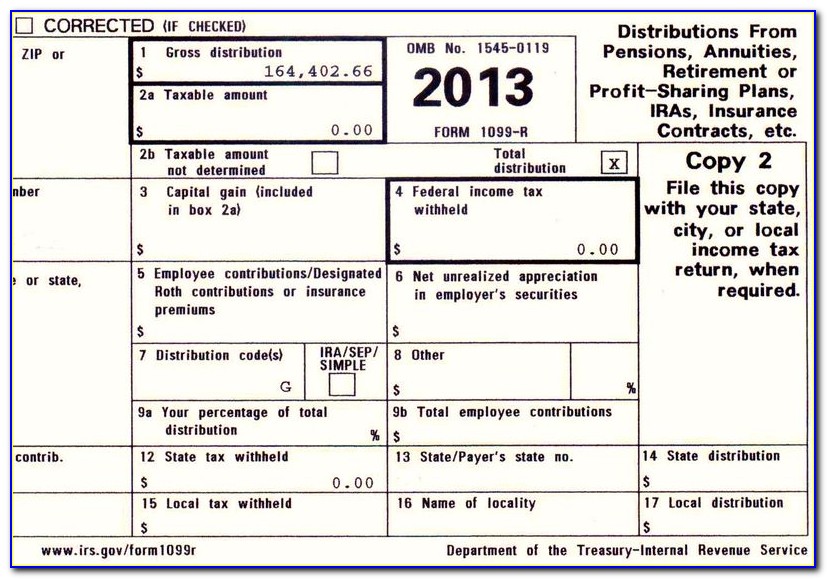

1099 Form Az Form Resume Examples v19xoxb27E

And you are filing a form. Web this is the quickest way to receive your tax forms. If you have elected to receive your 1099 digitally, you will receive an email notification prior to january 31 that. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. File the state copy of form.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web the arizona department of revenue mandates the filing of the 1099 form only if there is state tax withholding. Web file the following forms with the state of arizona: Federal tax return was itemized arizona income tax payments for the tax. Find them all in one convenient place. Web department of emergency and military affairs (dema):

5 Form Arizona Five Ingenious Ways You Can Do With 5 Form Arizona AH

Web the arizona department of revenue mandates the filing of the 1099 form only if there is state tax withholding. Web 26 rows form number title; Web department of emergency and military affairs (dema): If you file 250 or more 1099 forms with arizona you. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and.

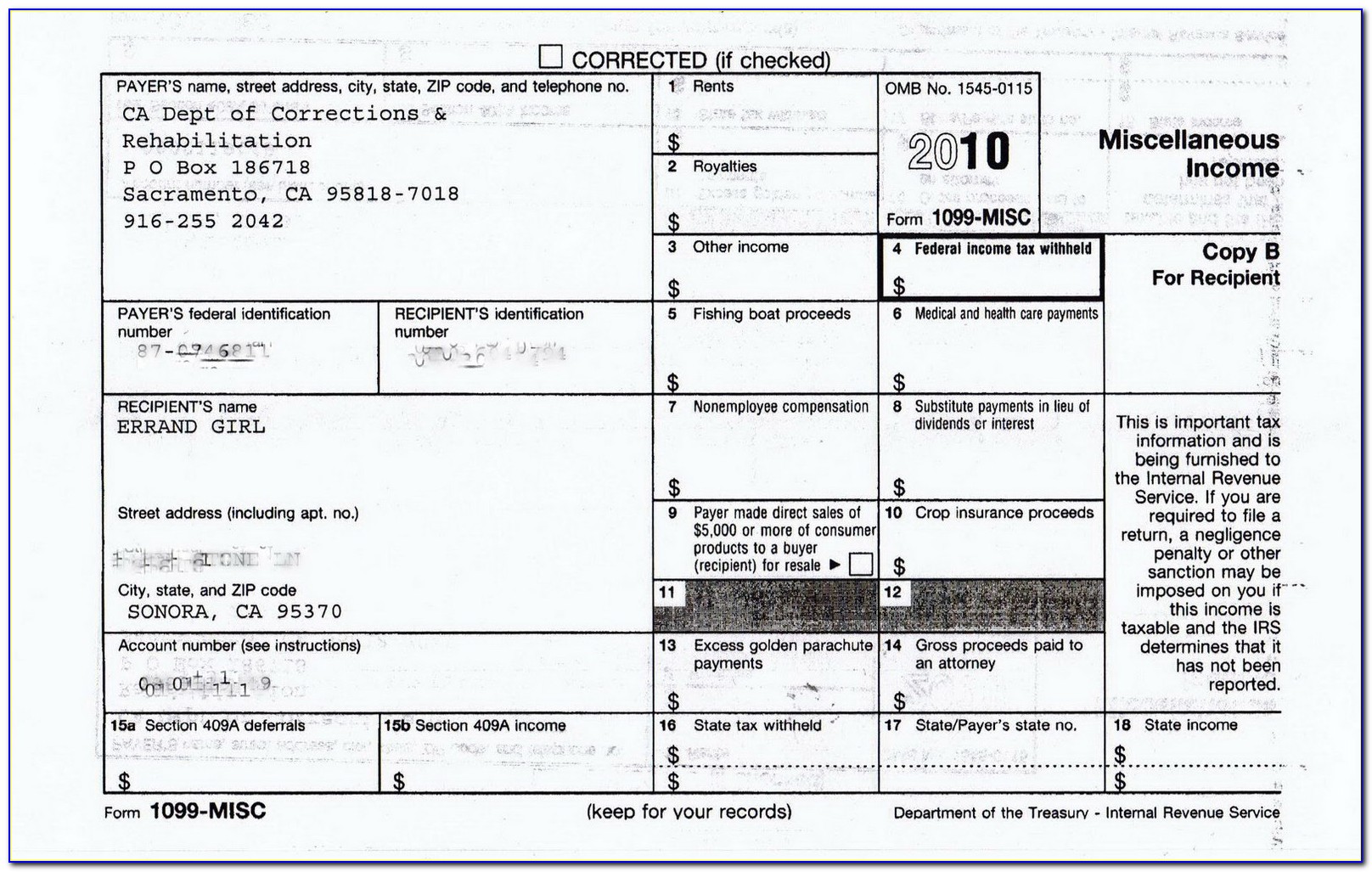

1099MISC Form Sample

Taxpayers can begin filing individual income tax returns through. How must forms 1099 be filed with arizona? File the state copy of form 1099 with the arizona taxation agency by february 28, 2021. Find them all in one convenient place. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes.

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

If you file 250 or more 1099 forms with arizona you. If you have elected to receive your 1099 digitally, you will receive an email notification prior to january 31 that. Labor, equipment, materials, and others (lemo) forms dema's lemo forms are to be used to record p. Web file the following forms with the state of arizona: Web department.

Hold up on doing your taxes; Arizona tax form 1099G is flawed The

Web yes, arizona requires any forms 1099 with state tax withholding to be filed with the state. If you elect this option, you will receive an email notification in january when your tax documents are available online. How must forms 1099 be filed with arizona? And you are not enclosing a payment, then use this address. If you have elected.

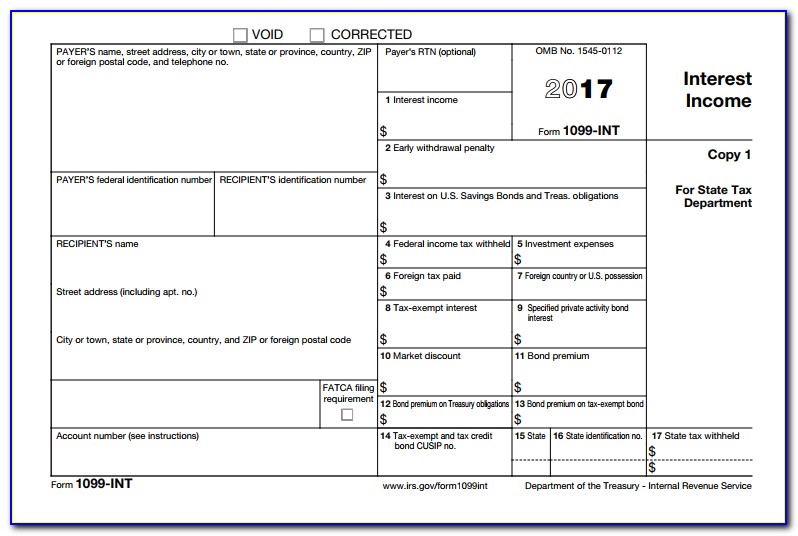

1099 Int Tax Form Printable Universal Network

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Application for bingo license packet: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web what do i need to report for unemployment benefits when i file my 2022 taxes? Web the arizona department of revenue.

Affidavit Of Death Of Trustee Form Arizona Form Resume Examples

How must forms 1099 be filed with arizona? 5 need to know facts. Federal tax return was itemized arizona income tax payments for the tax. Application for bingo license packet: Web yes, arizona requires any forms 1099 with state tax withholding to be filed with the state.

If You File 250 Or More 1099 Forms With Arizona You.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 26 rows form number title; Application for bingo license packet: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

Web What Do I Need To Report For Unemployment Benefits When I File My 2022 Taxes?

File the state copy of form 1099 with the arizona taxation agency by february 28, 2021. If you have elected to receive your 1099 digitally, you will receive an email notification prior to january 31 that. You can file the 1099 on paper or electronically. Web the state of arizona requires form 1099, which is an information return that is used to report various other types of amounts paid to the individuals other than employees.

Web File The Following Forms With The State Of Arizona:

Web yes, arizona requires any forms 1099 with state tax withholding to be filed with the state. Web remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. The total amount of the member’s pension for the previous. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes.

Web If You Live In Arizona.

Web department of emergency and military affairs (dema): Web this is the quickest way to receive your tax forms. If you elect this option, you will receive an email notification in january when your tax documents are available online. Filers can download and print.