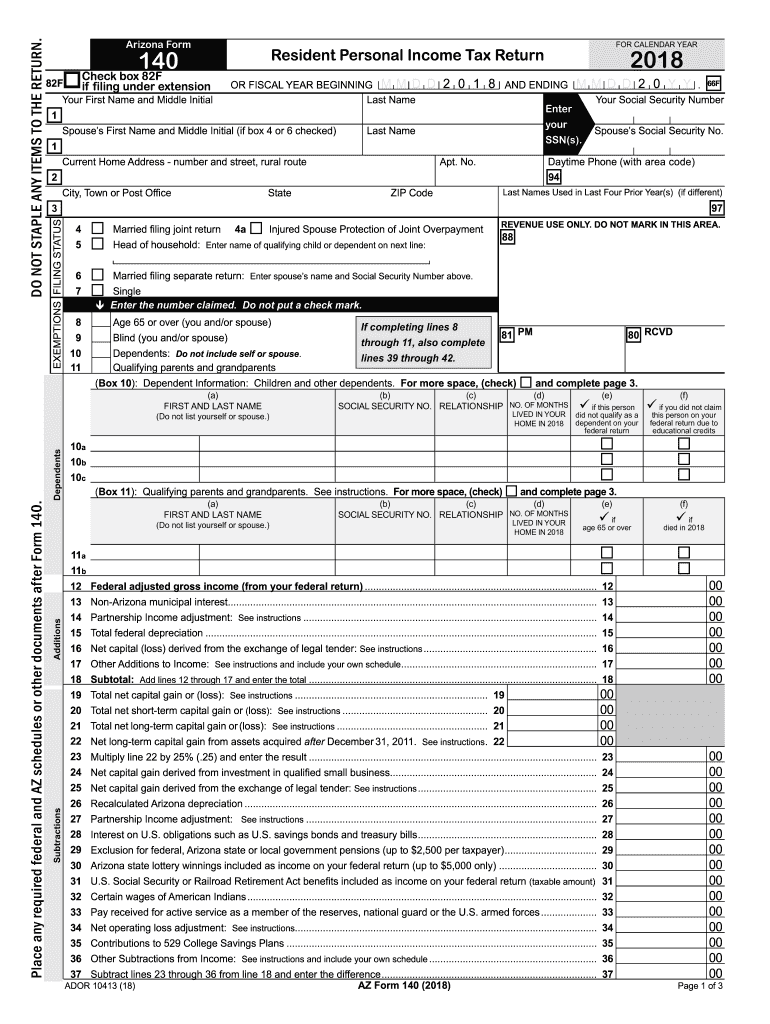

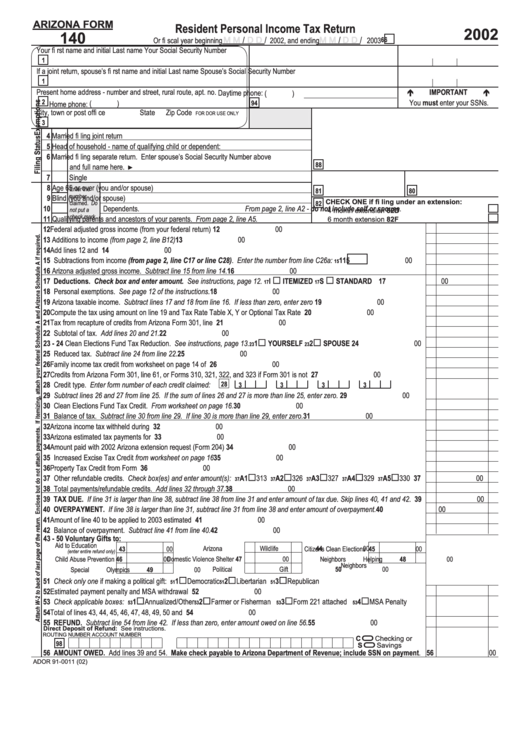

Arizona Tax Form 140

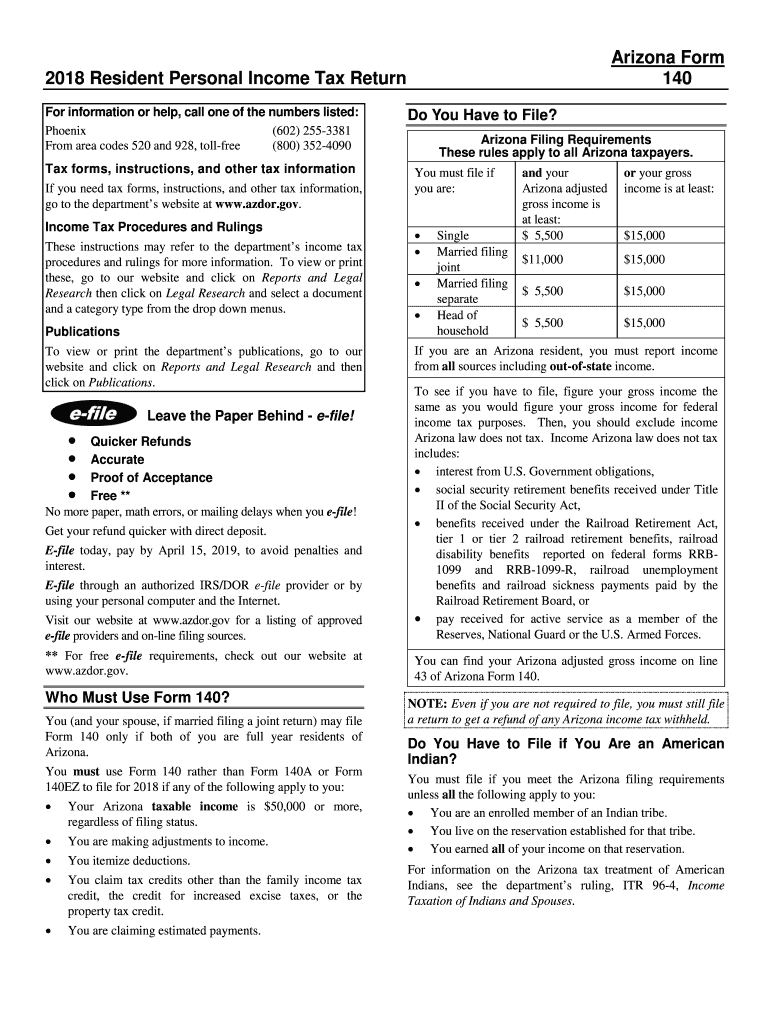

Arizona Tax Form 140 - Web form 140ptc is an arizona individual income tax form. Make an individual or small business income payment. This form is for income earned in tax year 2022, with tax returns due in. Select the document you want to sign and click upload. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents. Web the most common arizona income tax form is the arizona form 140. Web we last updated the individual amended return in february 2023, so this is the latest version of form 140x, fully updated for tax year 2022. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web individual income tax forms.

Save or instantly send your ready documents. Arizona usually releases forms for the current tax year between january and april. Individual payment type options include: We last updated arizona form 140 instructions from the department of. This form is used by residents who file an individual income tax return. Web form 140 schedule a itemized deduction adjustments if you claimed a credit on your 2021 return for a contribution that you made during 2022 (see arizona forms 321, 322, 323,. Do not staple any items to the return. Complete, edit or print tax forms instantly. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue. Web individual income tax forms.

Web resident personal income tax booklet who can use arizona form 140? You can download or print current. All arizona taxpayers must file a form 140 with the arizona department of revenue. Save or instantly send your ready documents. This form should be completed after. Do not staple any items to the return. Web form 140ptc is an arizona individual income tax form. Get ready for tax season deadlines by completing any required tax forms today. Web form 140 schedule a itemized deduction adjustments if you claimed a credit on your 2021 return for a contribution that you made during 2022 (see arizona forms 321, 322, 323,. Select the document you want to sign and click upload.

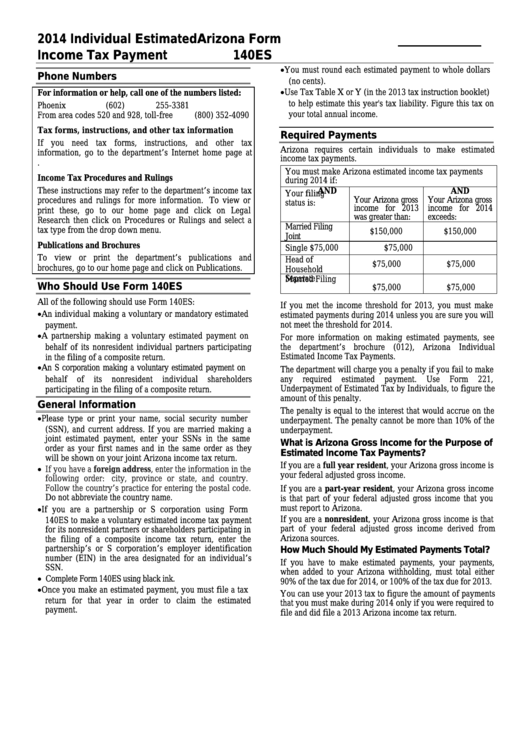

Arizona Form 140es Individual Estimated Tax Payment 2014

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents. Arizona usually releases forms for the current tax year between january and april. Select the document.

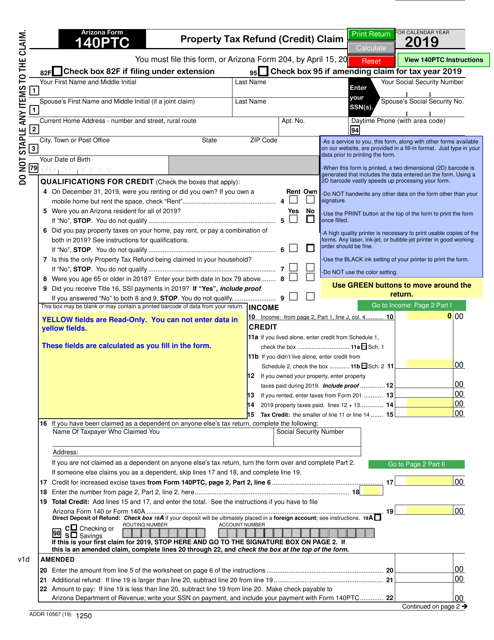

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web place any required federal and az schedules or other documents after form 140. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You can download.

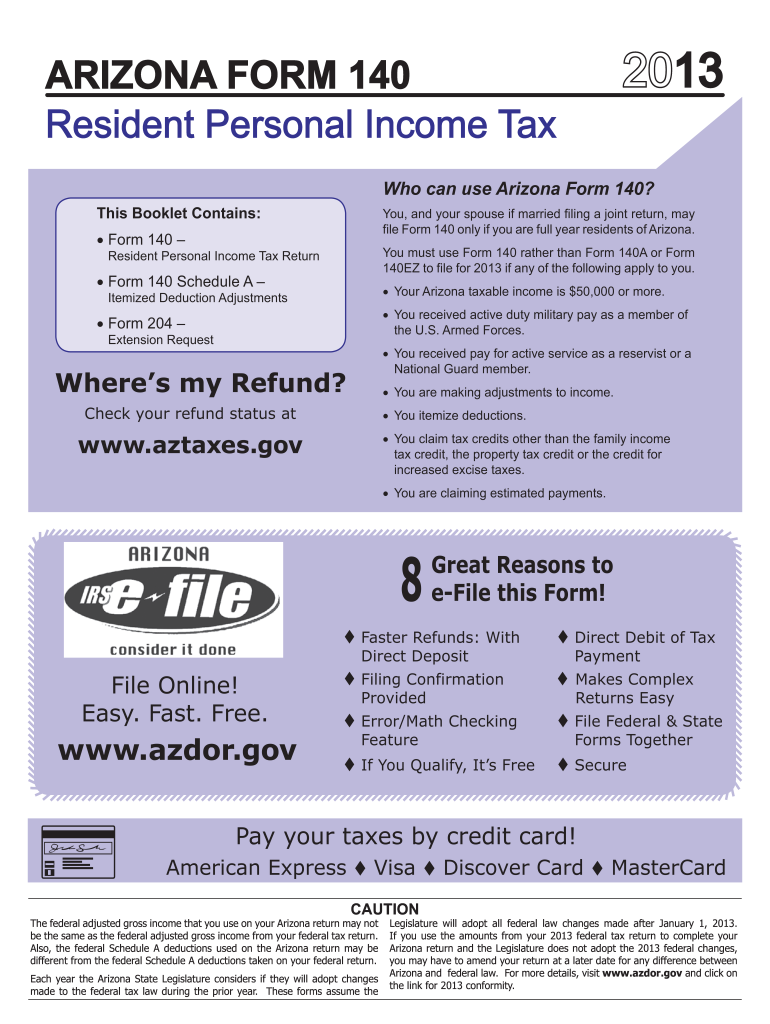

AZ DoR 140 Instructions 20202021 Fill out Tax Template Online US

Get ready for tax season deadlines by completing any required tax forms today. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue. This form is used by residents who file an individual income tax return. Select the document you want to sign and click upload. Web we last updated the individual amended return.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Select the document you want to sign and click upload. This form is used by residents who file an individual income tax return. This form is for income earned in tax year 2022, with tax returns due in. We last updated arizona form 140 instructions from the department of. Web printable 140 tax return form for arizona residents.

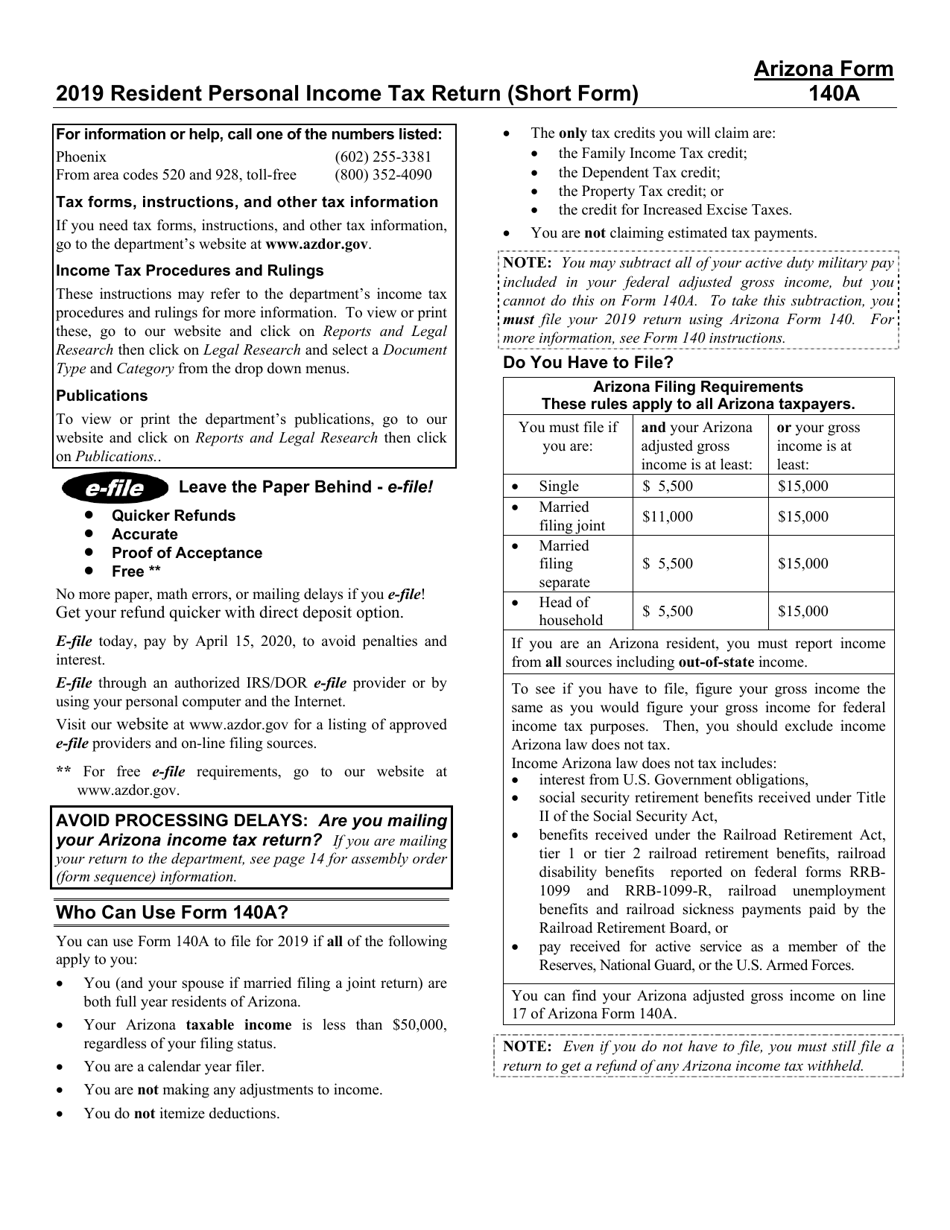

Download Instructions for Arizona Form 140A, ADOR10414 Resident

Register and subscribe now to work on your az form 140 & more fillable forms. We last updated arizona form 140 instructions from the department of. Web form 140ptc is an arizona individual income tax form. Individual payment type options include: This form should be completed after.

2018 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Select the document you want to sign and click upload. Web personal income tax return filed by resident taxpayers. Web printable 140 tax return form for arizona residents. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents. Web resident personal income tax booklet who can use arizona form.

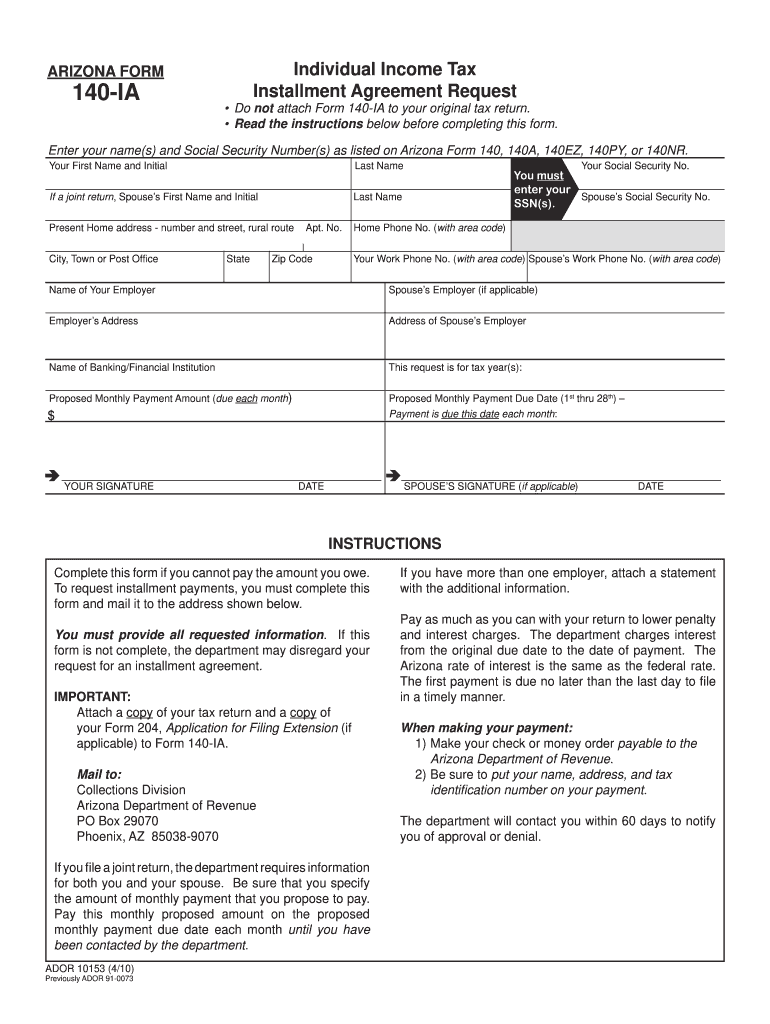

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Complete, edit or print tax forms instantly. Form 140a arizona resident personal income tax booklet. Web form 140 schedule a itemized deduction adjustments if you claimed a credit on your 2021 return for a contribution that you made during 2022 (see arizona forms 321, 322, 323,. Web the most common arizona income tax form is the arizona form 140. All.

Arizona Employment Tax Forms PLOYMENT

Arizona usually releases forms for the current tax year between january and april. All arizona taxpayers must file a form 140 with the arizona department of revenue. Make an individual or small business income payment. Web place any required federal and az schedules or other documents after form 140. Web we last updated the individual amended return in february 2023,.

AZ DoR 140 Instructions 2018 Fill out Tax Template Online US Legal

Web personal income tax return filed by resident taxpayers. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: Web form 140et is an arizona individual income tax form. Web form 140ptc is an arizona individual income tax form. Web form 140 schedule a itemized deduction adjustments if you claimed.

Fillable Arizona Form 140 Resident Personal Tax Return 2002

You can download or print current. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Select the document you want to sign and click upload. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents..

Web Form 140 Schedule A Itemized Deduction Adjustments If You Claimed A Credit On Your 2021 Return For A Contribution That You Made During 2022 (See Arizona Forms 321, 322, 323,.

Get ready for tax season deadlines by completing any required tax forms today. Arizona usually releases forms for the current tax year between january and april. This form should be completed after. Web form 140ptc is an arizona individual income tax form.

Form 140A Arizona Resident Personal Income Tax Booklet.

Individual payment type options include: All arizona taxpayers must file a form 140 with the arizona department of revenue. Web we last updated the individual amended return in february 2023, so this is the latest version of form 140x, fully updated for tax year 2022. We last updated arizona form 140 instructions from the department of.

Web Individual Income Tax Forms.

All arizona taxpayers must file a form 140 with the arizona department of revenue. Web resident personal income tax booklet who can use arizona form 140? You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In.

Select the document you want to sign and click upload. Web form is used by a individual who electronically files an income tax return (form 140) and is separately mailing payment for taxes not remitted with the tax form, when filed. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.