Arkansas W4 Form 2022

Arkansas W4 Form 2022 - Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Ar1100esct corporation estimated tax vouchers. Web 42 rows arkansas efile; File this form with your employer. Web the arkansas department of finance and administration (dfa) has published updated 2022 withholding tax tables, effective october 1, 2022. The top individual tax rate is now. According to its website , here are. Enter the amount paid for this monthly reporting period only. Ssc 425 little rock, ar.

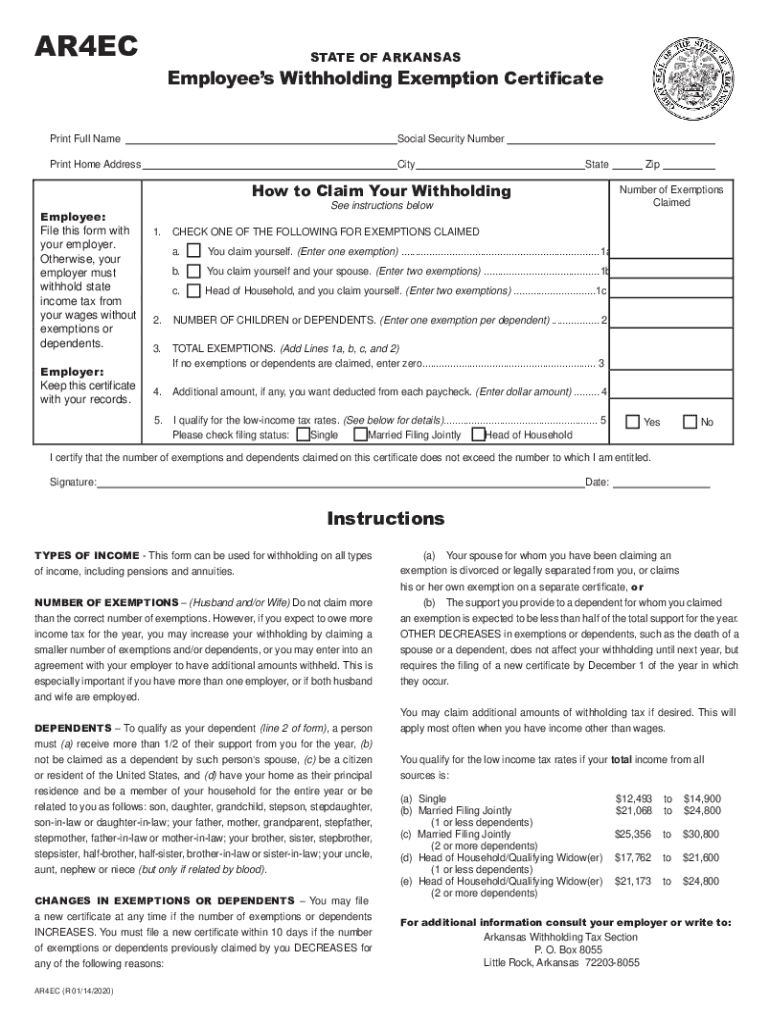

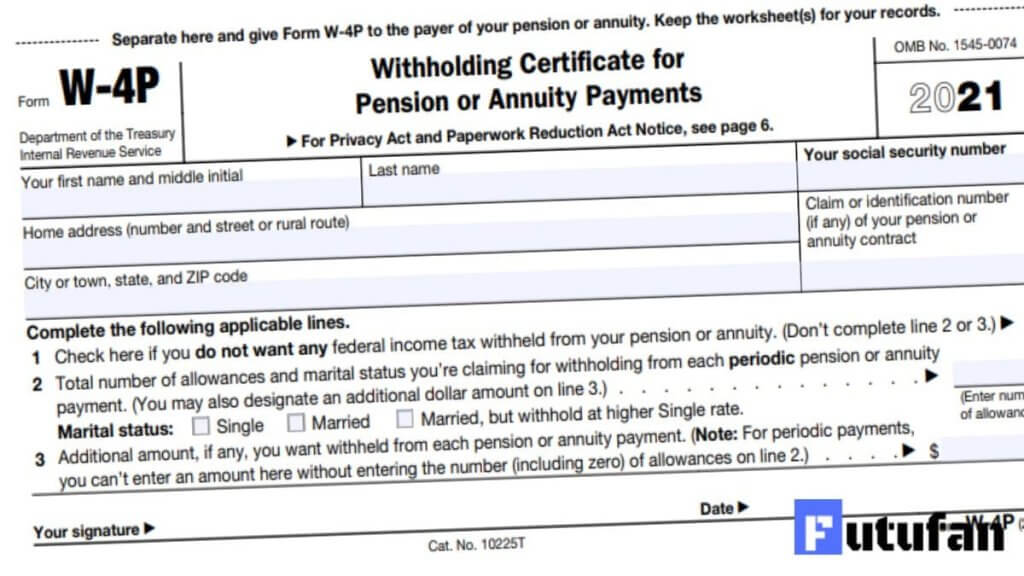

Enter the amount paid for this monthly reporting period only. If too little is withheld, you will generally owe tax when you file your tax return. File this form with your employer. Web how to claim your withholding state zip number of exemptions employee: Web 42 rows arkansas efile; Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the. Ssc 425 little rock, ar. The top individual tax rate is now. Ar1023ct application for income tax exempt status. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer.

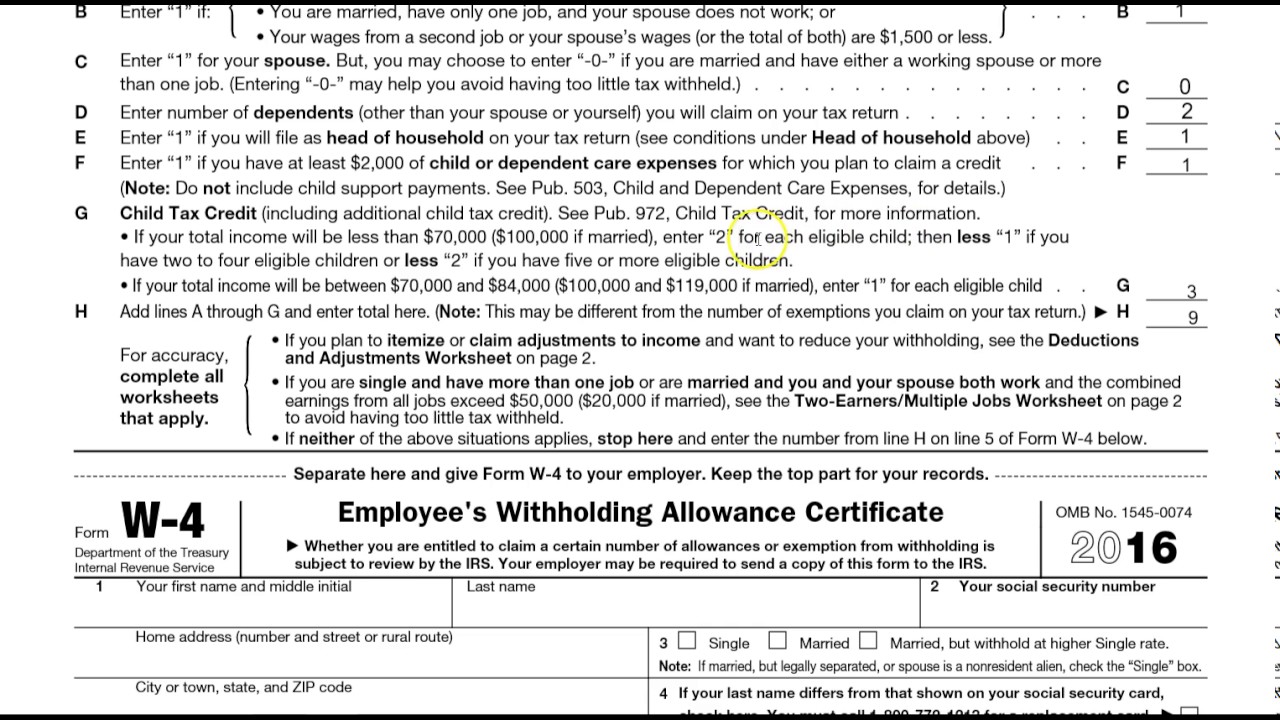

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If too little is withheld, you will generally owe tax when you file your tax return. Enter the amount paid for this monthly reporting period only. Web how to claim your withholding state zip number of exemptions employee: File this form with your employer. Web $2.04 billion, powerball, nov. What are the top 10 largest mega millions jackpots ever? Otherwise, your employer must withhold state income tax from your. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Single married filing jointly $13,055 to $15,700 $22,016 to $26,100 or less.

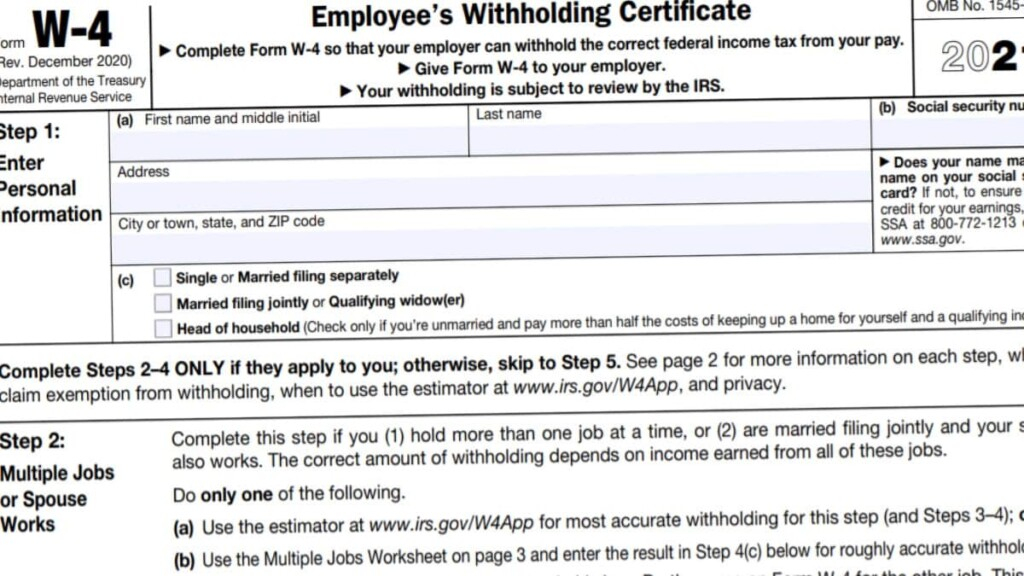

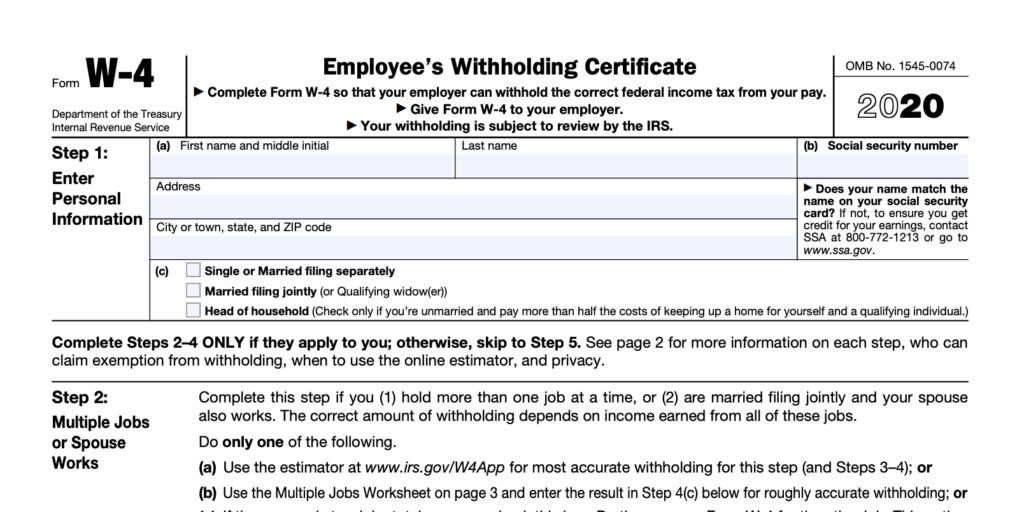

W4 Tax Form 2022 W4 Form 2022 Printable

Fiduciary and estate income tax forms; Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Ssc 425 little rock, ar. Otherwise, your employer must withhold state income tax from your. A single ticket won in california.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

According to its website , here are. Ar1023ct application for income tax exempt status. Web 42 rows arkansas efile; Web $2.04 billion, powerball, nov. Web employee’s state withholding exemption certificate (form ar4ec) contact.

Arkansas State Withholding Form 2019 Fill Out And Sign Online Dochub

Enter the amount paid for this monthly reporting period only. Web the arkansas department of finance and administration (dfa) has published updated 2022 withholding tax tables, effective october 1, 2022. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Ar1100esct corporation estimated tax vouchers. Web want.

Form 8948 Instructions To File 2021 2022 IRS Forms Zrivo

Web $2.04 billion, powerball, nov. A single ticket won in california. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If too little is withheld, you will generally owe tax when you file your tax return. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph.

Blank W9 Form For 2021 Calendar Template Printable

Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. Fiduciary and estate income tax forms; Web 42 rows arkansas efile; Enter the amount paid for this monthly reporting period only. If too little is withheld, you will generally owe tax when you file your tax return.

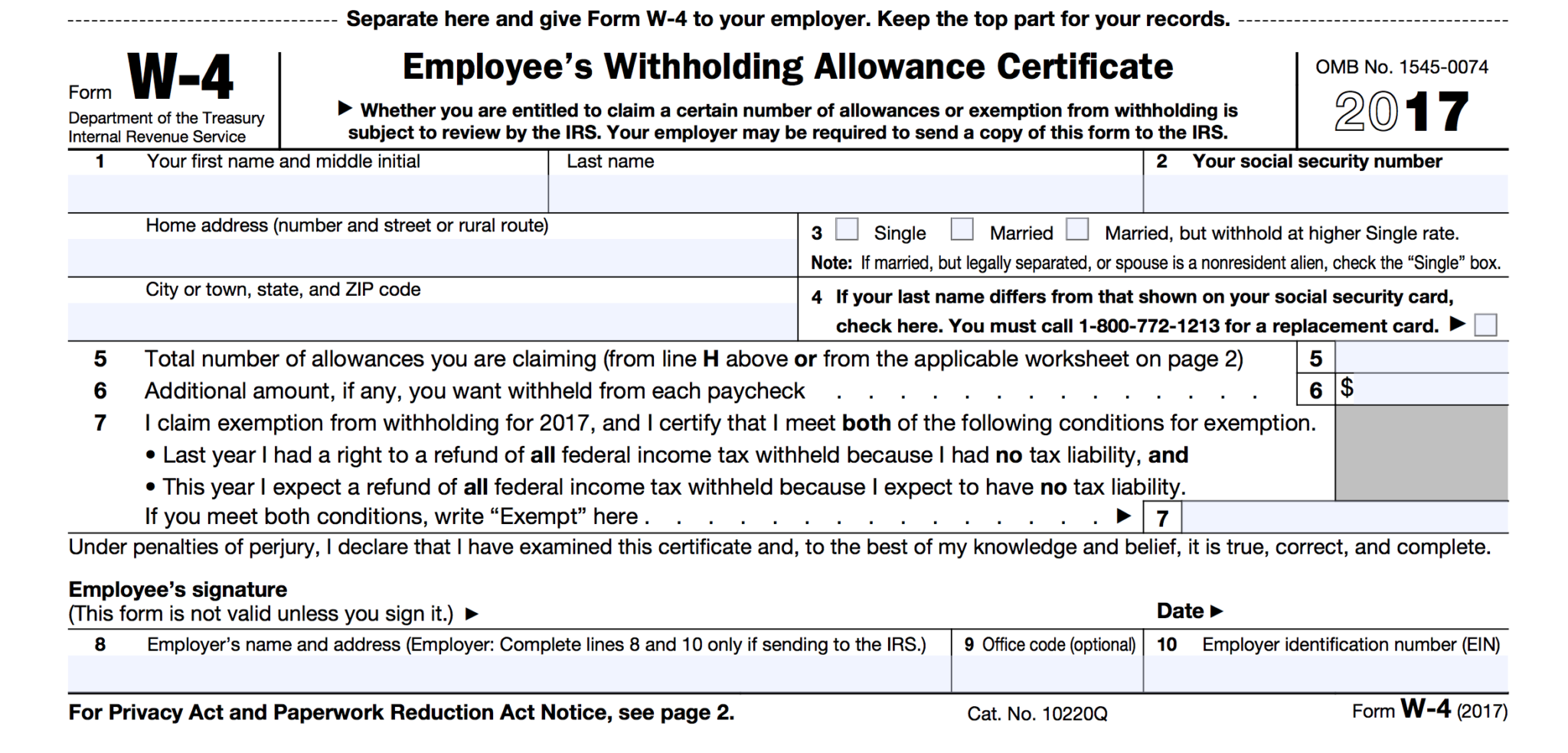

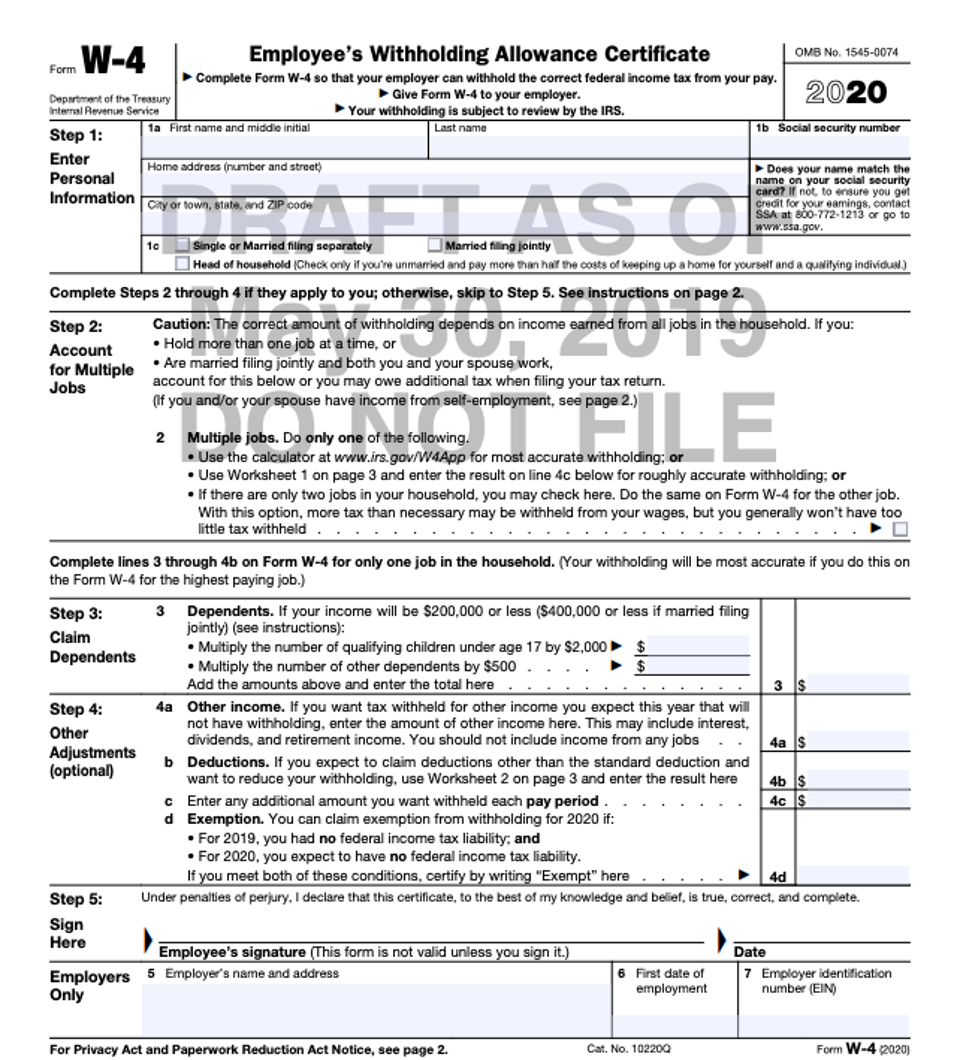

Federal W4 2022 W4 Form 2022 Printable

If too little is withheld, you will generally owe tax when you file your tax return. Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. Fiduciary and estate income tax forms; Web how to claim your withholding state zip number of exemptions employee: Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate.

IRS Form W4 2022 W4 Form 2022 Printable

Ar1023ct application for income tax exempt status. Web 42 rows arkansas efile; Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the. Ar1100esct corporation estimated tax vouchers. If too little is withheld, you will generally owe tax when you file your tax return.

How to fill out w4 TechStory

The top individual tax rate is now. Otherwise, your employer must withhold state income tax from your. According to its website , here are. Web enter the total amount of arkansas income tax withheld for this monthly reporting period only. Web how to claim your withholding state zip number of exemptions employee:

Fillable 2021 w4 Fill out & sign online DocHub

According to its website , here are. Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the. Enter the amount paid for this monthly reporting period only. Web $2.04 billion, powerball, nov. Otherwise, your employer must withhold state income tax from your.

A Single Ticket Won In California.

Ssc 425 little rock, ar. Single married filing jointly $13,055 to $15,700 $22,016 to $26,100 or less. Ar1100esct corporation estimated tax vouchers. According to its website , here are.

Web Enter The Total Amount Of Arkansas Income Tax Withheld For This Monthly Reporting Period Only.

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Web ar4ec ar4ec state of arkansas employee’s withholding exemption certificate printfull name socialsecurity number printhomeaddress city state zip certifythat the. Vice chancellor for finance & administration 2801 s.

Web Employee’s State Withholding Exemption Certificate (Form Ar4Ec) Contact.

The top individual tax rate is now. Web want withholding, write “revoked” next to the checkbox on line 1 and submit form ar4p to your payer. Fiduciary and estate income tax forms; File this form with your employer.

Ar1023Ct Application For Income Tax Exempt Status.

Web how to claim your withholding state zip number of exemptions employee: Web $2.04 billion, powerball, nov. What are the top 10 largest mega millions jackpots ever? Enter the amount paid for this monthly reporting period only.