Az A4 Form

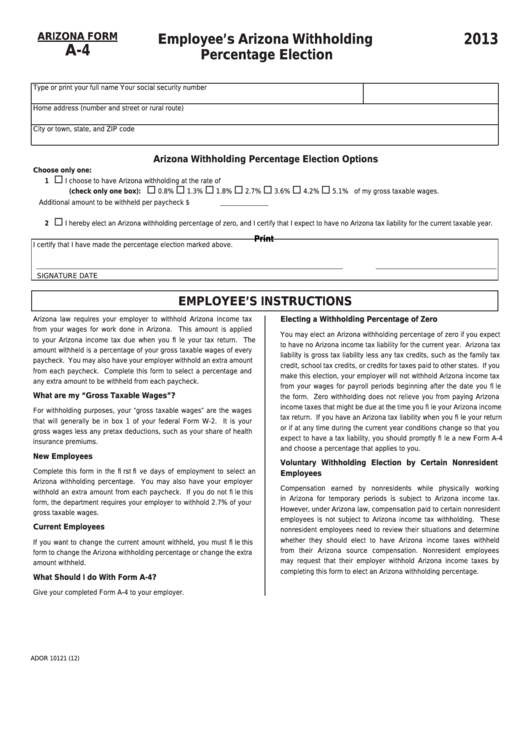

Az A4 Form - Arizona annual payment withholding tax return: Web withholding forms : Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Keep in mind that the results will only be as accurate as the information you provide. 0.8% 1.3% 1.8% 2.7% 3.6% 4. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Employer's election to not withhold arizona taxes in december (includes instructions) 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. You can use your results from the formula to help you complete the form and adjust your income tax withholding.

Voluntary withholding request for arizona resident employed outside of arizona: Arizona annual payment withholding tax return: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 0.8% 1.3% 1.8% 2.7% 3.6% 4. Keep in mind that the results will only be as accurate as the information you provide. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Employer's election to not withhold arizona taxes in december (includes instructions) Web withholding forms : This form is submitted to the employer, not the department.

0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Keep in mind that the results will only be as accurate as the information you provide. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Employer's election to not withhold arizona taxes in december (includes instructions) Voluntary withholding request for arizona resident employed outside of arizona: Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. This form is submitted to the employer, not the department. Arizona annual payment withholding tax return:

Form_A4 Breeyark!

Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Employer's election to not withhold arizona taxes in december (includes instructions) 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. 1 withhold from gross taxable wages at.

Printable A4 Order Form Turquoise Blue Form Business Etsy

Employer's election to not withhold arizona taxes in december (includes instructions) Keep in mind that the results will only be as accurate as the information you provide. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. 1 withhold from gross taxable wages at the percentage checked (check only.

2021 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

1 withhold from gross taxable wages at the percentage checked (check only one percentage): Voluntary withholding request for arizona resident employed outside of arizona: You can use your results from the formula to help you complete the form and adjust your income tax withholding. Web arizona residents employed outside of arizona complete this form to elect to have arizona income.

irstaxesw4form2020 Alloy Silverstein

Employer's election to not withhold arizona taxes in december (includes instructions) Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. 0.8% 1.3% 1.8% 2.7% 3.6% 4. This form is submitted to the employer, not the department. 1.

Employee Evaluation A4 Form Template by Keboto GraphicRiver

Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Voluntary withholding request for arizona resident employed outside of arizona: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: Web withholding forms :

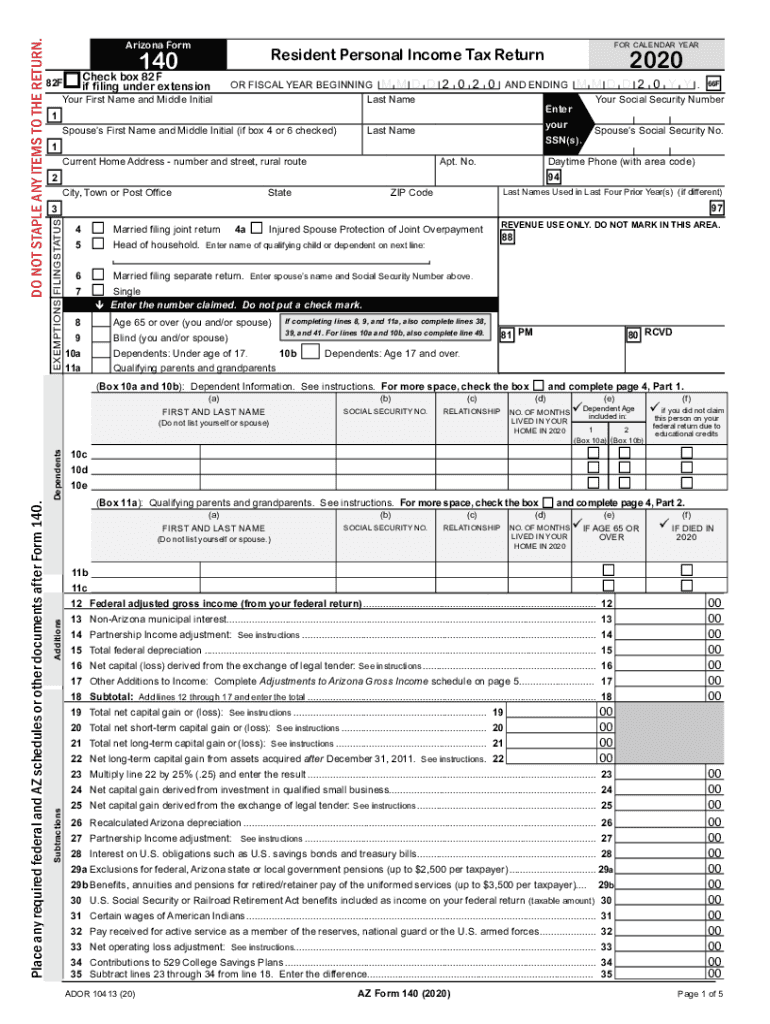

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

0.8% 1.3% 1.8% 2.7% 3.6% 4. You can use your results from the formula to help you complete the form and adjust your income tax withholding. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Web withholding forms : 1 withhold from gross taxable wages at the percentage checked (check only one percentage):

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Keep in mind that the results will only be as accurate as the information you provide. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Voluntary withholding request for arizona resident employed outside of arizona: You can use your results from.

Vehicles Printwise Online News

Arizona annual payment withholding tax return: You can use your results from the formula to help you complete the form and adjust your income tax withholding. 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. Keep in mind that the results will only be as accurate as the.

ASOP Application FormA4.docx Fill and Sign Printable Template Online

Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: Employer's election to not withhold arizona taxes in december (includes instructions) Voluntary withholding request for arizona resident employed outside.

Køb DIN 6797 rustfrit stål A4, form AZ online

Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Keep in mind that the results will only be as accurate as the information you provide. Voluntary withholding request for arizona resident employed outside of arizona: 1 withhold.

You Can Use Your Results From The Formula To Help You Complete The Form And Adjust Your Income Tax Withholding.

1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Keep in mind that the results will only be as accurate as the information you provide.

1 Withhold From Gross Taxable Wages At The Percentage Checked (Check Only One Percentage):

This form is submitted to the employer, not the department. Voluntary withholding request for arizona resident employed outside of arizona: 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. Employer's election to not withhold arizona taxes in december (includes instructions)

Ador 10121 (22) Electing A Withholding Percentage Of Zero You May Elect An Arizona Withholding Percentage Of Zero If You Expect To Have No Arizona Income Tax Liability For The Current Year.

Web withholding forms : 0.8% 1.3% 1.8% 2.7% 3.6% 4.