Az W-4 Form

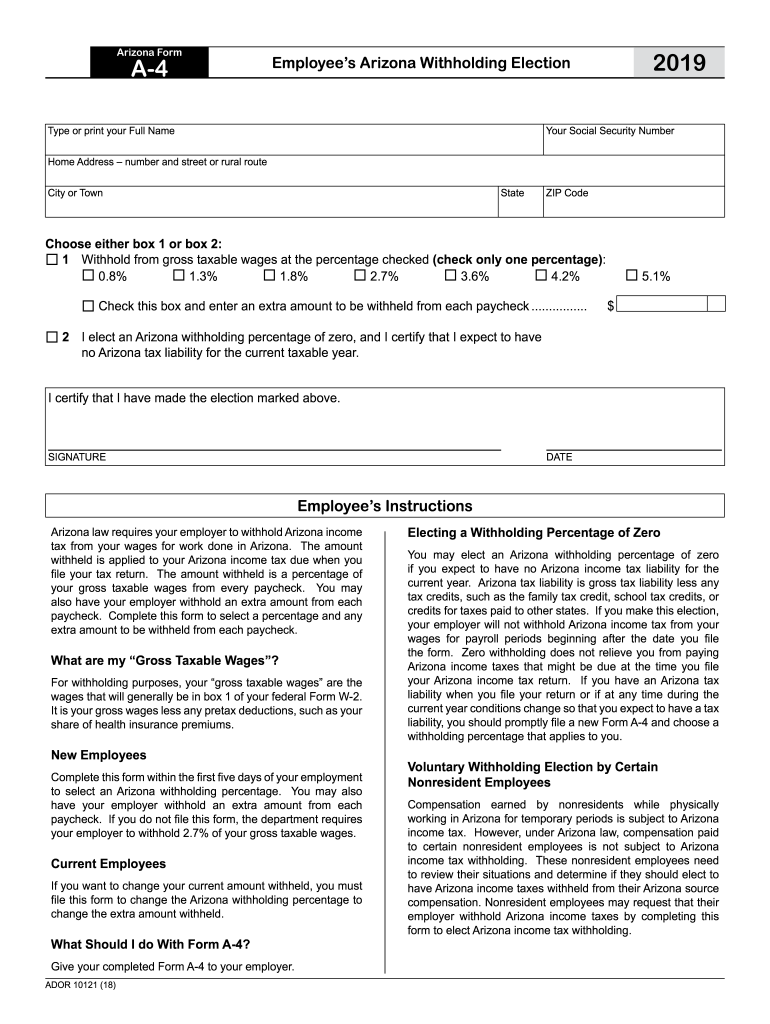

Az W-4 Form - Employers withhold state income taxes from employee wages. Web az state withholding overview. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. This form is for income earned in tax year 2022,. You can use your results from the. 100 n 15th ave, #301. To compute the amount of tax to withhold from compensation paid to employees for services. If too little is withheld, you will generally owe tax when you file your tax return.

Employers withhold state income taxes from employee wages. Web adoa human resources. 100 n 15th ave, #301. You can use your results from the. This form is for income earned in tax year 2022,. To compute the amount of tax to withhold from compensation paid to employees for services. Like most states, arizona has a state income tax. 1 withhold from gross taxable wages at the percentage checked (check only one. Web az state withholding overview. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should.

Employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. Web az state withholding overview. If too little is withheld, you will generally owe tax when. Like most states, arizona has a state income tax. This form is for income earned in tax year 2022,. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. 1 withhold from gross taxable wages at the percentage checked (check only one. Web adoa human resources. You can use your results from the.

California W4 Form 2022 W4 Form

If too little is withheld, you will generally owe tax when you file your tax return. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. Employers withhold state income taxes from employee wages. Web az state withholding overview.

Il W 4 2020 2022 W4 Form

Web az state withholding overview. You can use your results from the. If too little is withheld, you will generally owe tax when. 1 withhold from gross taxable wages at the percentage checked (check only one. This form is for income earned in tax year 2022,.

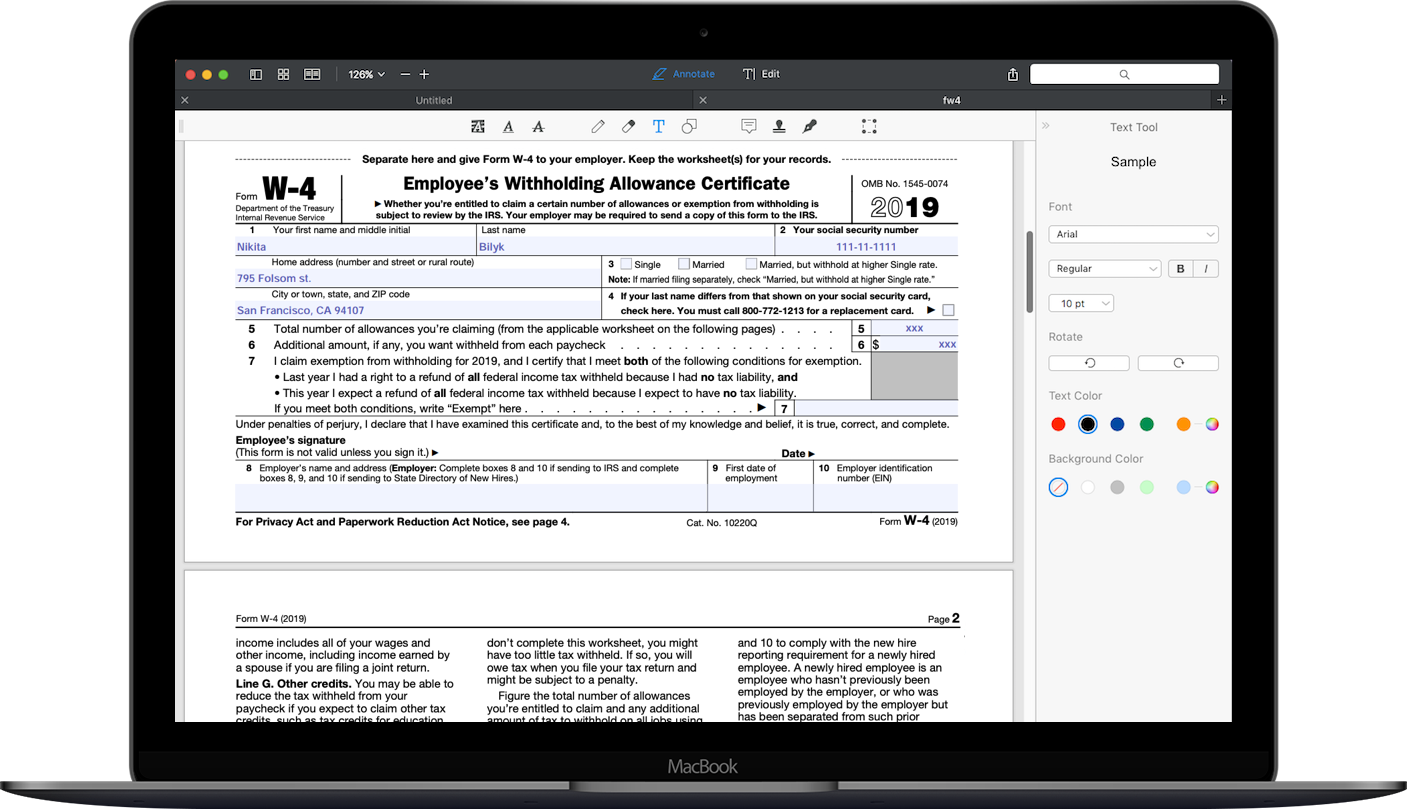

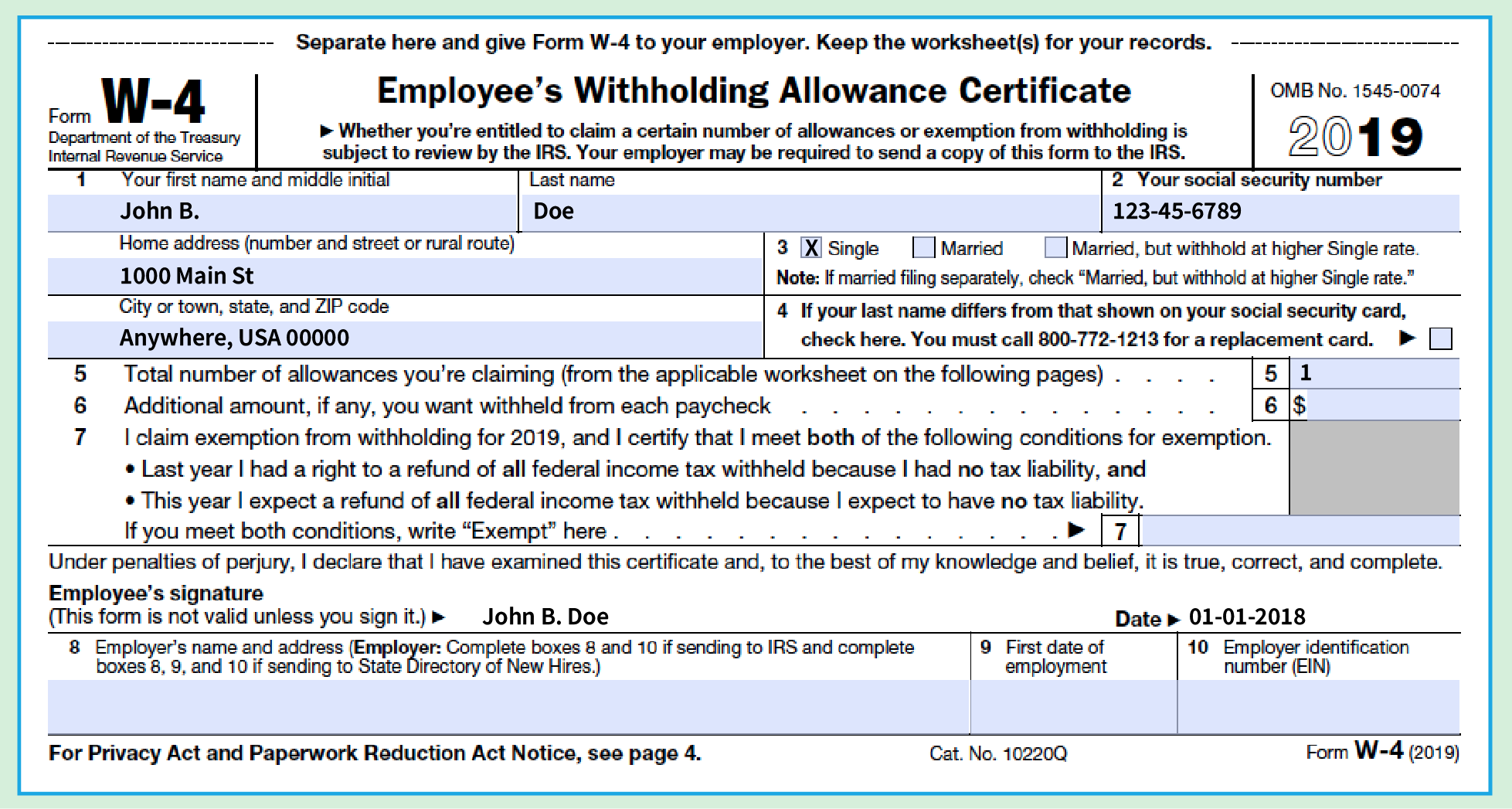

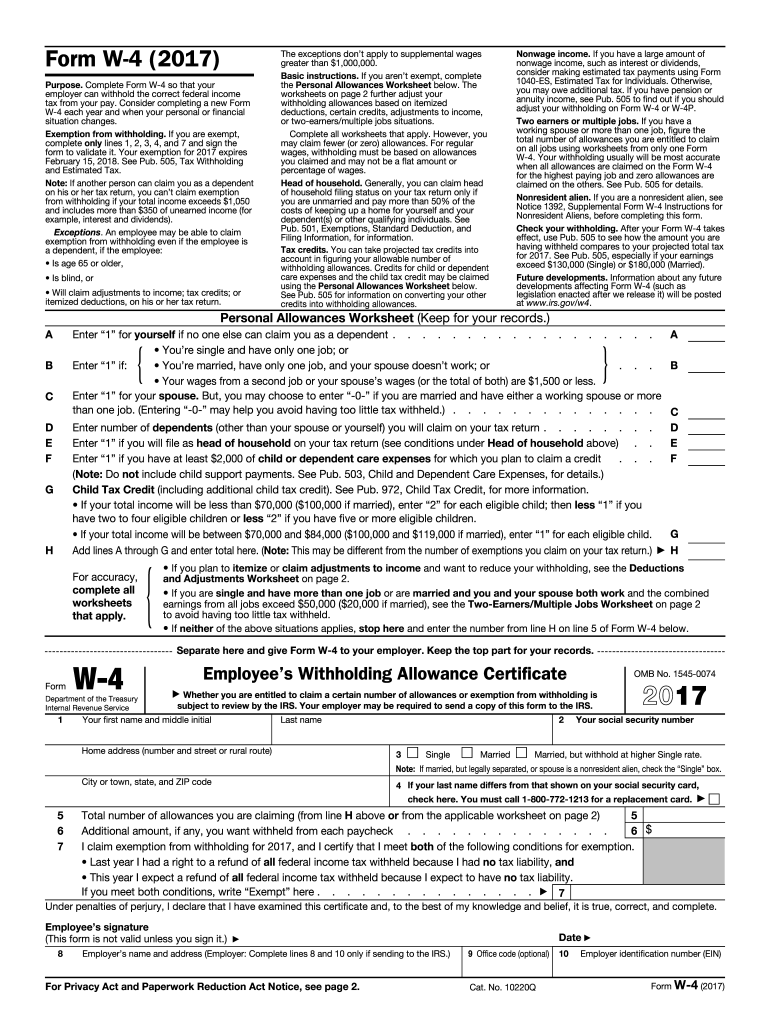

IRS W4 2017 Fill out Tax Template Online US Legal Forms

Employers withhold state income taxes from employee wages. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. Web az state withholding overview. If too little is withheld, you will generally owe tax when. If.

Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]

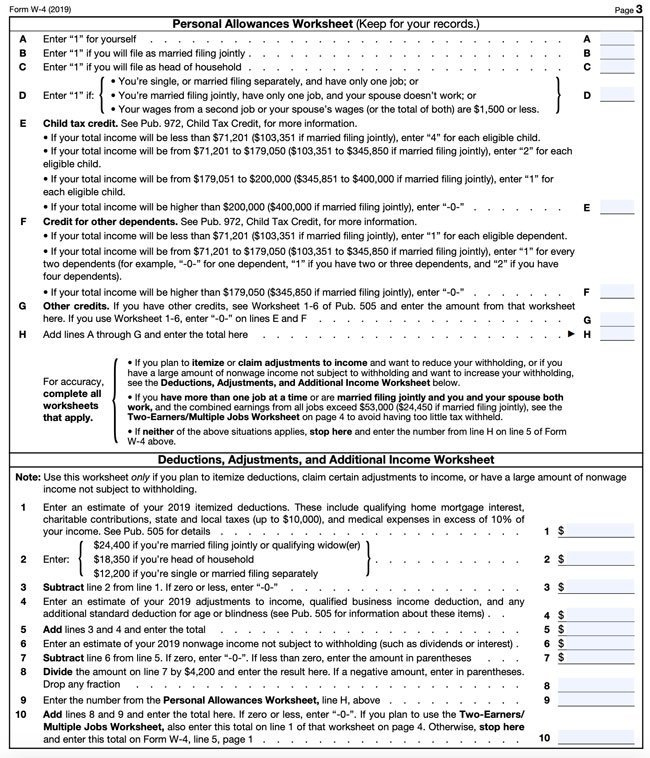

If too little is withheld, you will generally owe tax when you file your tax return. You can use your results from the. 1 withhold from gross taxable wages at the percentage checked (check only one. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income earned in tax.

How to fill out 20192020 IRS Form W4 PDF Expert

1 withhold from gross taxable wages at the percentage checked (check only one. If too little is withheld, you will generally owe tax when. To compute the amount of tax to withhold from compensation paid to employees for services. Web adoa human resources. You can use your results from the.

Form W4 vs. Form W2 Emptech Blog

Employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. To compute the amount of tax to withhold from compensation paid to employees for services. Like most states, arizona has a state income tax. Web az state withholding overview.

Learn about the new W4 form. Plus our free calculators are here to

You can use your results from the. 1 withhold from gross taxable wages at the percentage checked (check only one. This form is for income earned in tax year 2022,. To compute the amount of tax to withhold from compensation paid to employees for services. If too little is withheld, you will generally owe tax when.

A New Form W4 for 2020 Alloy Silverstein

1 withhold from gross taxable wages at the percentage checked (check only one. To compute the amount of tax to withhold from compensation paid to employees for services. Like most states, arizona has a state income tax. Web adoa human resources. Web if you have an arizona tax liability when you file your return or if at any time during.

A4 Form Fill Out and Sign Printable PDF Template signNow

If too little is withheld, you will generally owe tax when. If too little is withheld, you will generally owe tax when you file your tax return. Web adoa human resources. To compute the amount of tax to withhold from compensation paid to employees for services. This form is for income earned in tax year 2022,.

Like Most States, Arizona Has A State Income Tax.

To compute the amount of tax to withhold from compensation paid to employees for services. Employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should.

1 Withhold From Gross Taxable Wages At The Percentage Checked (Check Only One.

If too little is withheld, you will generally owe tax when you file your tax return. Web adoa human resources. 100 n 15th ave, #301. If too little is withheld, you will generally owe tax when.

This Form Is For Income Earned In Tax Year 2022,.

You can use your results from the. Web az state withholding overview.

![Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]](https://assets.cdnpandadoc.com/app/uploads/w4-form-2020.png)