Balance Sheet Dividends Example

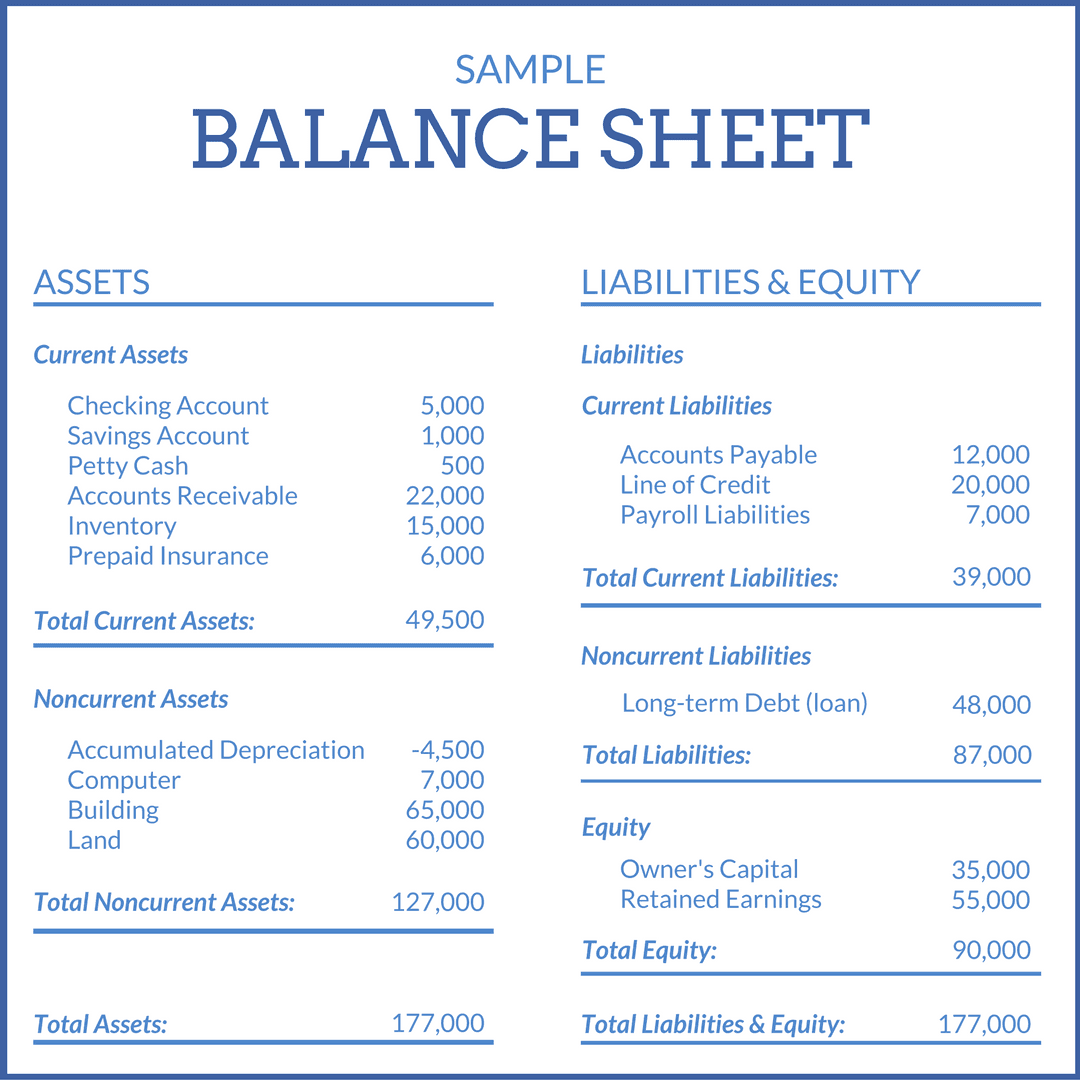

Balance Sheet Dividends Example - Web the answer represents the total amount of dividends paid. For example, say a company earned $100 million in a given year. Assets = liabilities + equity. It started with $50 million in retained earnings and ended the year. Web the balance sheet is based on the fundamental equation: As such, the balance sheet is divided into two sides (or sections). The total value of the dividend is $0.50 x 500,000, or. Large stock dividends, of more than 20% or 25%, could also be considered to be. Web dividends in the balance sheet. Before dividends are paid, there is no impact on the.

As such, the balance sheet is divided into two sides (or sections). Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web the answer represents the total amount of dividends paid. The total value of the dividend is $0.50 x 500,000, or. Before dividends are paid, there is no impact on the. Large stock dividends, of more than 20% or 25%, could also be considered to be. It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity. For example, say a company earned $100 million in a given year. Web the balance sheet is based on the fundamental equation:

It started with $50 million in retained earnings and ended the year. Large stock dividends, of more than 20% or 25%, could also be considered to be. As such, the balance sheet is divided into two sides (or sections). Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation: Web dividends in the balance sheet. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Web the answer represents the total amount of dividends paid. The total value of the dividend is $0.50 x 500,000, or. For example, say a company earned $100 million in a given year.

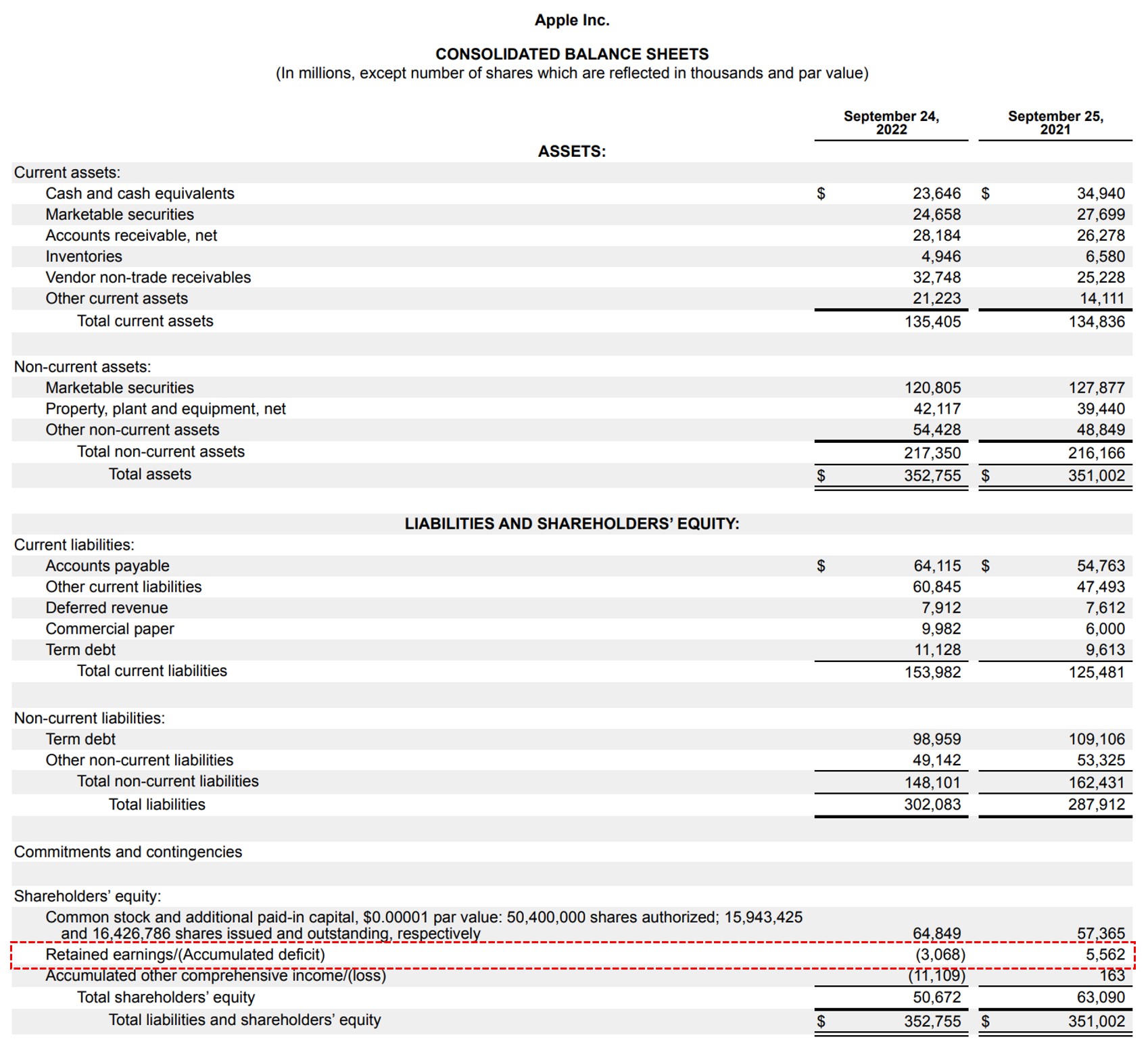

27 Advanced Accounting Dividend Balance Sheet

For example, say a company earned $100 million in a given year. Web dividends in the balance sheet. It started with $50 million in retained earnings and ended the year. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Before dividends are paid, there is no impact.

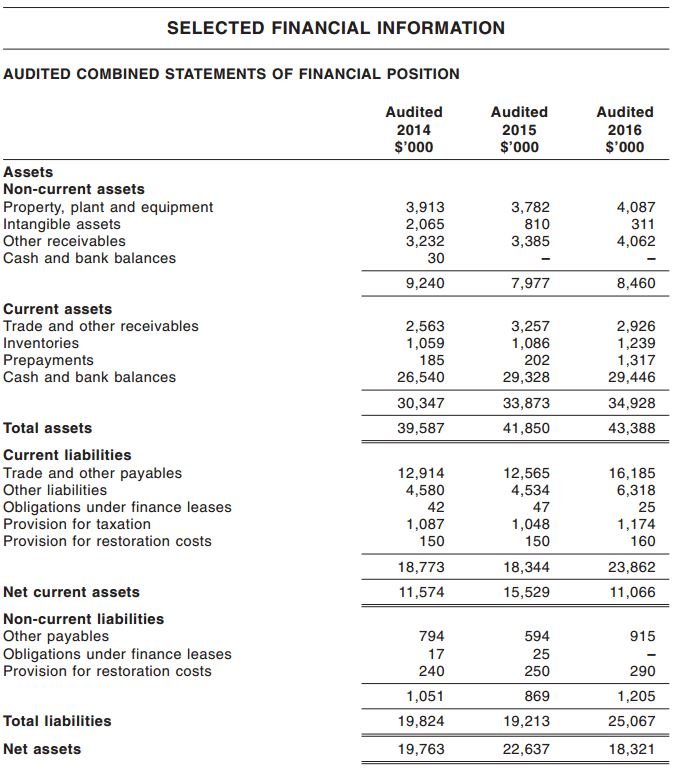

Cool Net Balance Sheet Formula Profit And Loss Adjustment

Large stock dividends, of more than 20% or 25%, could also be considered to be. Web the balance sheet is based on the fundamental equation: It started with $50 million in retained earnings and ended the year. Before dividends are paid, there is no impact on the. Web for example, a company that pays a 2% cash dividend, should experience.

View Single Post Kimly Ltd *Official* (SGX1D0)

Web dividends in the balance sheet. Web the answer represents the total amount of dividends paid. Web the balance sheet is based on the fundamental equation: Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. For example, say a company earned $100 million in a given year.

möglich Wald Trauben 22 44 uhr bedeutung Star erwachsen So viele

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Large stock dividends, of more than 20% or 25%, could also be considered to be. As such, the balance sheet is divided into two sides (or sections). Before dividends are paid, there is no impact on the. The.

5 Minute Guide For All You Need to Know About Kimly’s IPO

Web dividends in the balance sheet. Web the balance sheet is based on the fundamental equation: The total value of the dividend is $0.50 x 500,000, or. Before dividends are paid, there is no impact on the. Web the answer represents the total amount of dividends paid.

Below is the comparative balance sheet for Stevie Wonder Corporation

Web the answer represents the total amount of dividends paid. Web dividends in the balance sheet. As such, the balance sheet is divided into two sides (or sections). It started with $50 million in retained earnings and ended the year. The total value of the dividend is $0.50 x 500,000, or.

Dividend Recap LBO Tutorial With Excel Examples

Web the answer represents the total amount of dividends paid. Web dividends in the balance sheet. The total value of the dividend is $0.50 x 500,000, or. It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity.

5 Percent Stock Dividend On Balance Sheet Best Moving Stocks FullQuick

Large stock dividends, of more than 20% or 25%, could also be considered to be. It started with $50 million in retained earnings and ended the year. For example, say a company earned $100 million in a given year. As such, the balance sheet is divided into two sides (or sections). Web dividends in the balance sheet.

What are Retained Earnings? Formula + Calculator

The total value of the dividend is $0.50 x 500,000, or. For example, say a company earned $100 million in a given year. As such, the balance sheet is divided into two sides (or sections). Assets = liabilities + equity. Web the answer represents the total amount of dividends paid.

Stockholders Equity Balance Sheet Dividends Ppt Powerpoint Presentation

Large stock dividends, of more than 20% or 25%, could also be considered to be. Before dividends are paid, there is no impact on the. The total value of the dividend is $0.50 x 500,000, or. As such, the balance sheet is divided into two sides (or sections). Web the balance sheet is based on the fundamental equation:

Before Dividends Are Paid, There Is No Impact On The.

For example, say a company earned $100 million in a given year. Web the answer represents the total amount of dividends paid. As such, the balance sheet is divided into two sides (or sections). The total value of the dividend is $0.50 x 500,000, or.

Large Stock Dividends, Of More Than 20% Or 25%, Could Also Be Considered To Be.

It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity. Web dividends in the balance sheet. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)