Ca Form 3522

Ca Form 3522 - Look for form 3522 and click the download link. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Web we last updated california form 3522 in january 2023 from the california franchise tax board. For instructions on filing form 3522, please see. The four months to pay the corresponding fee begins to run from the time that a new llc is formed in california. All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Said another way, there’s no way to avoid this fee. Acquiring form 3522 is as simple as applying to the. Form 3536 only needs to be filed if your income is $250,000 or more. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800.

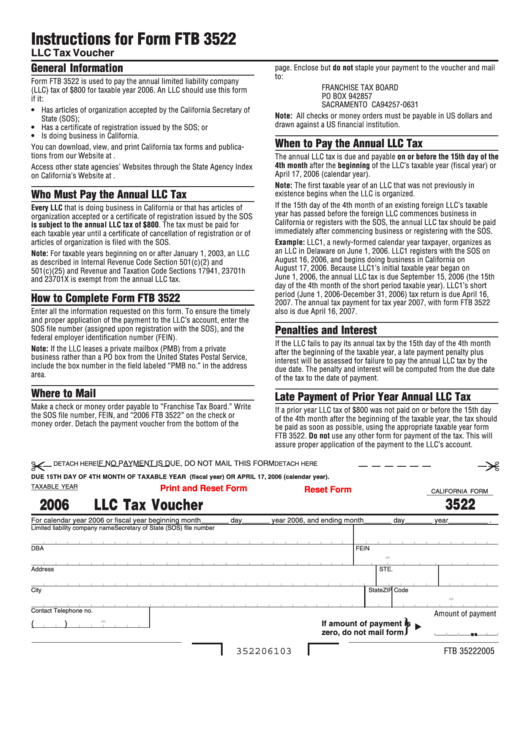

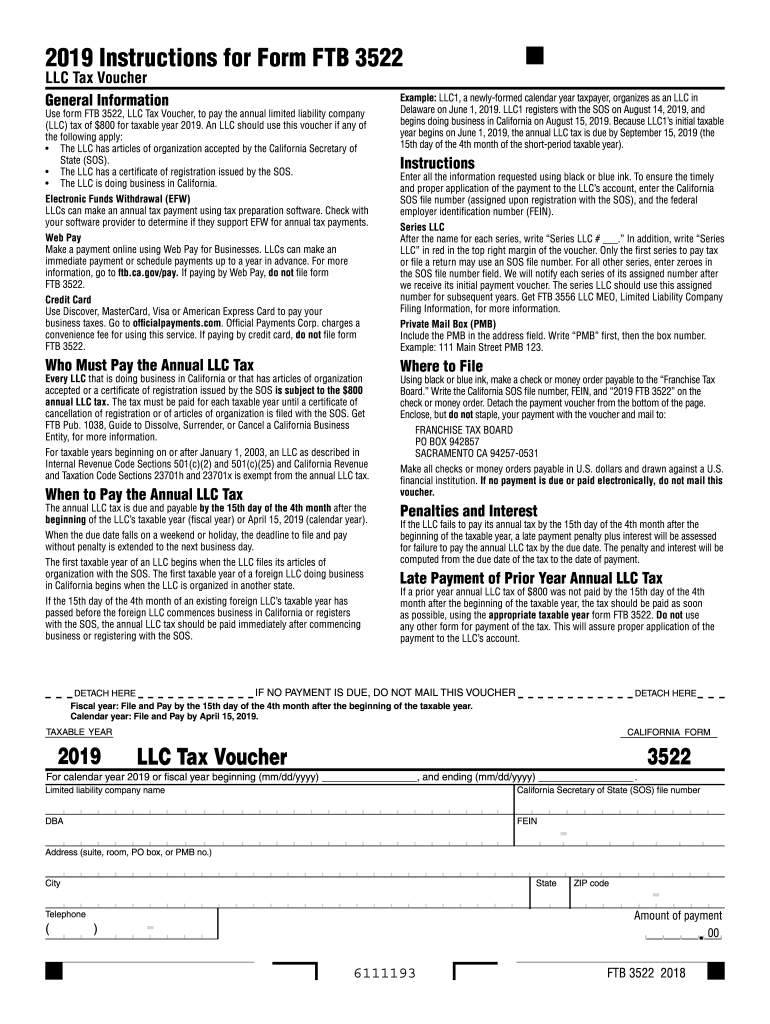

For tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. Web file form ftb 3522. Said another way, there’s no way to avoid this fee. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year, you don’t need to file form 3522. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Who must pay the annual llc tax. That is doing business in california or that has articles of organization accepted or a certificate of registration issued by the sos. Use ftb 3522 when paying by mail.

Acquiring form 3522 is as simple as applying to the. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Exceptions to the first year annual tax. That is doing business in california or that has articles of organization accepted or a certificate of registration issued by the sos. Secure and trusted digital platform! For tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. This form is for income earned in tax year 2022, with tax returns due in april 2023. All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. For instructions on filing form 3522, please see.

MTH3522 Belaruƈ for Farming Simulator 2015

Who must pay the annual llc tax. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web form 3522 is used by llcs in california to make a business annual tax payment of $800. This form is for income earned in tax year 2022, with tax.

MTH3522 Belarus for Farming Simulator 2015

That is doing business in california or that has articles of organization accepted or a certificate of registration issued by the sos. Form 3536 only needs to be filed if your income is $250,000 or more. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Is subject.

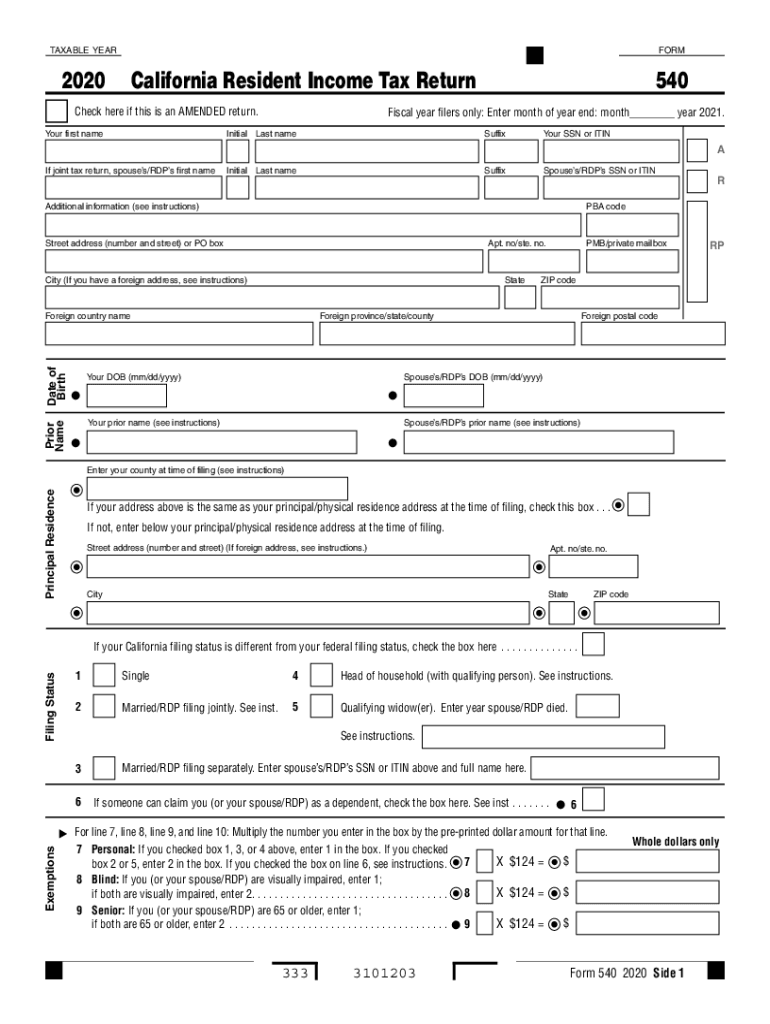

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Who must pay the annual llc tax. That is doing business in california or that has articles of organization accepted or a certificate of registration issued by the sos. Web form 3522 is used by llcs in california to make a business annual tax payment of $800. Web form 3522 is a form used by llcs in california to pay.

Belarus 3522 animation parts for Farming Simulator 2015

Form 3522 will need to be filed in the 2nd year. The tax must be paid for each taxable year until a certificate of We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. That is doing business in california or that has articles of.

Fillable Form 3522 Llc Tax Voucher California Franchise Tax Board

The tax must be paid for each taxable year until a certificate of When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Who must pay the annual llc.

Ca Form 3522 amulette

For instructions on filing form 3522, please see. That is doing business in california or that has articles of organization accepted or a certificate of registration issued by the sos. Web form 3522 is used by llcs in california to make a business annual tax payment of $800. Each company qualified as llc must pay the amount of this tax.

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

Complete, sign, print and send your tax documents easily with us legal forms. Acquiring form 3522 is as simple as applying to the. Use ftb 3522 when paying by mail. Form 3536 only needs to be filed if your income is $250,000 or more. Web form 3522 is used by llcs in california to make a business annual tax payment.

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Form 3536 only needs to be filed if your income is $250,000 or more. Download blank or fill out online in pdf format. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Exceptions to the first year annual tax. Form 3522 will need to be filed in the 2nd year.

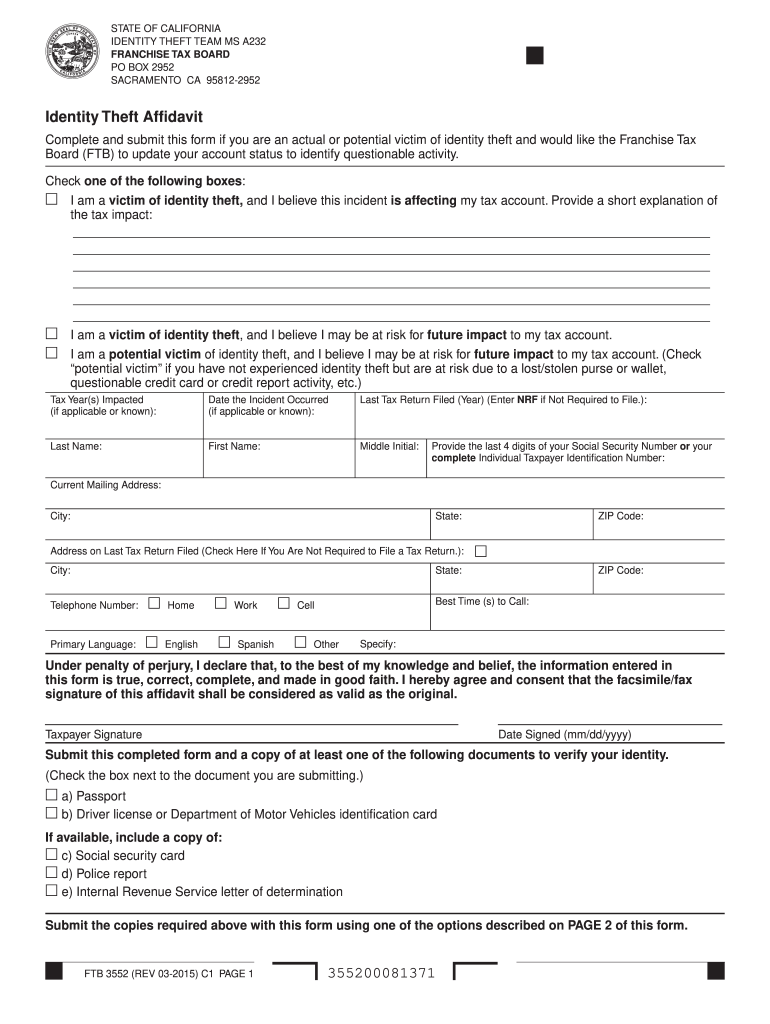

2015 Form CA FTB 3552 PC Fill Online, Printable, Fillable, Blank

Secure and trusted digital platform! All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. The four months to pay the corresponding fee begins to run from the time that a new llc is formed in california. You use form ftb 3522, llc tax voucher to pay the.

MTZ3522 Belarus for Farming Simulator 2013

Form 3536 only needs to be filed if your income is $250,000 or more. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. That is doing business.

Acquiring Form 3522 Is As Simple As Applying To The.

You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Web You Need To Submit Form 3522 With The California Ftb Yearly, But You Can Also Do It Any Time Before The June 30 Due Date.

Form 3522 will need to be filed in the 2nd year. Web file form ftb 3522. All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Web we last updated california form 3522 in january 2023 from the california franchise tax board.

Download Blank Or Fill Out Online In Pdf Format.

For tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. For instructions on filing form 3522, please see. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Look for form 3522 and click the download link.

The Four Months To Pay The Corresponding Fee Begins To Run From The Time That A New Llc Is Formed In California.

Exceptions to the first year annual tax. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Said another way, there’s no way to avoid this fee. Secure and trusted digital platform!