Ca Form 587

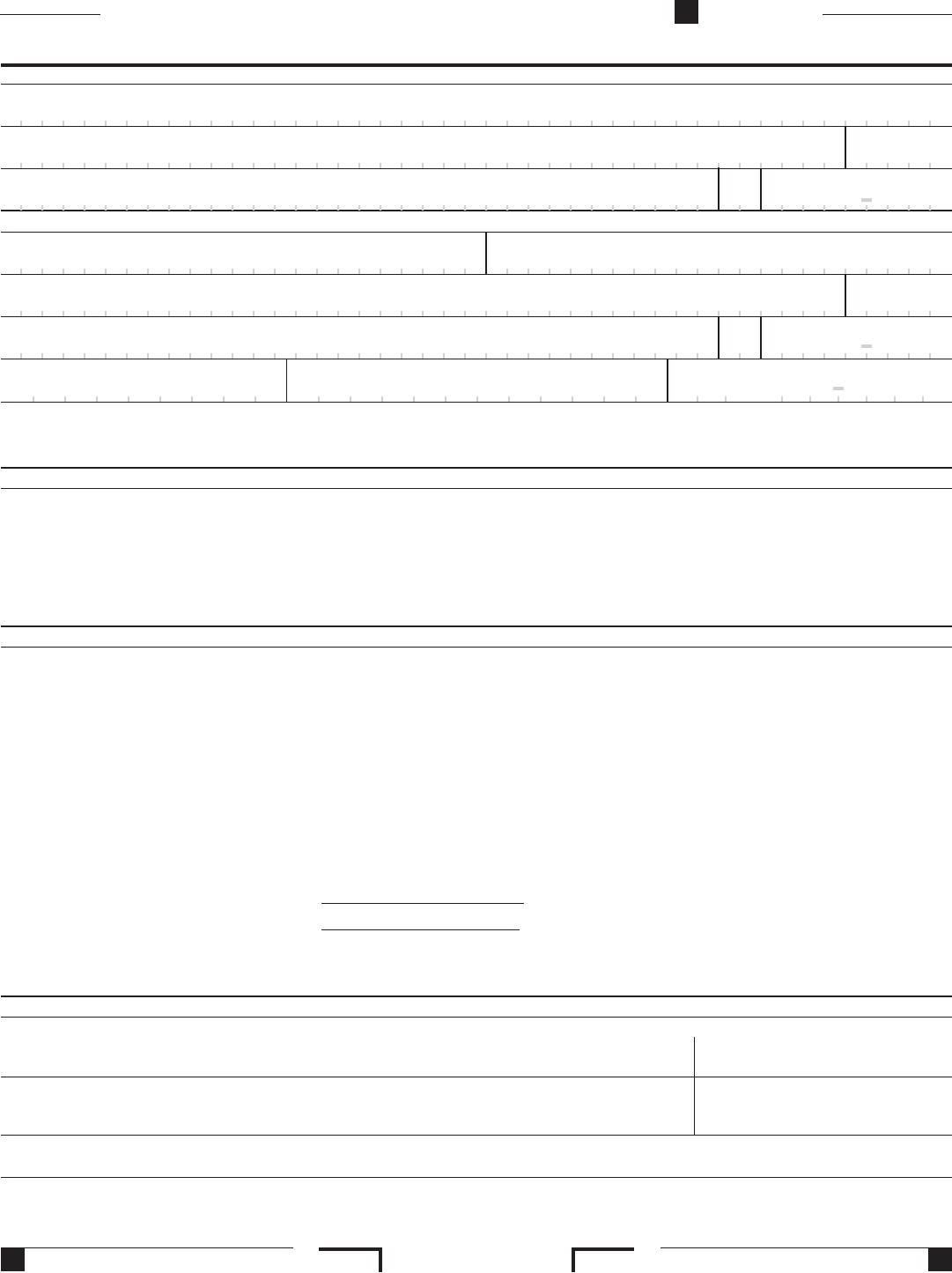

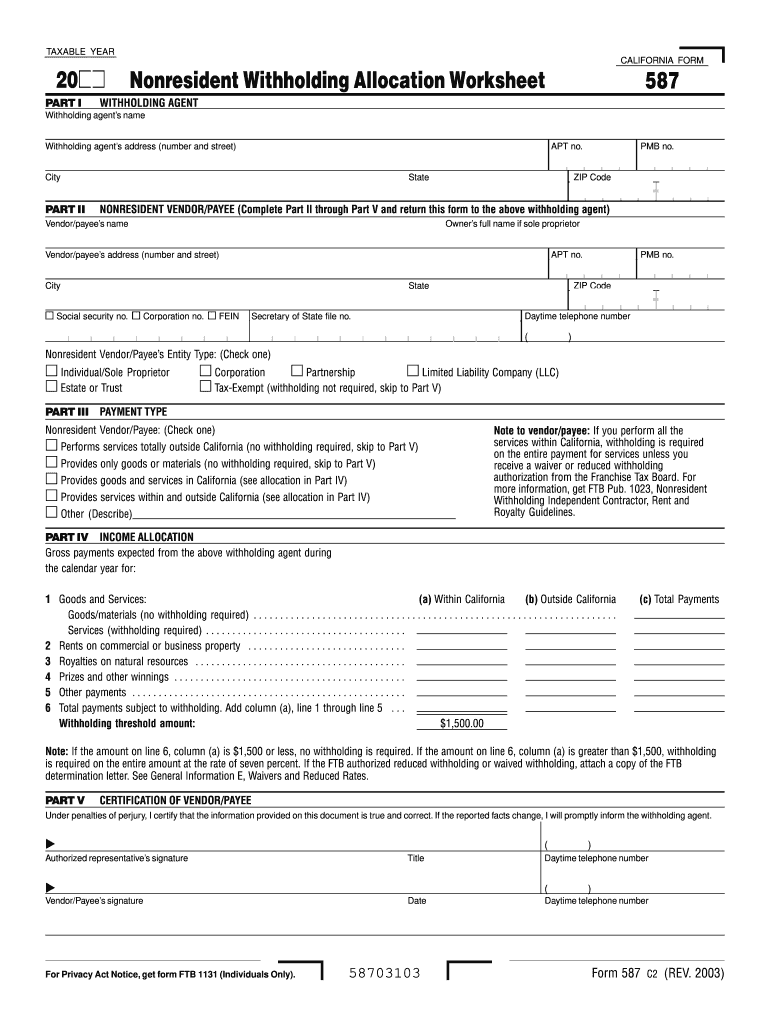

Ca Form 587 - Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. • you sold california real estate. Web signed form 587 is accepted in good faith. Web 2020 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. 2003) page 1 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to withholding. Web form 587 instructions (rev. Web use form 587 if any of the following apply: The payee is a corporation, partnership, or limited liability

You sold california real estate. Do not use form 587 if any of the following applies: Web signed form 587 is accepted in good faith. Once this form is completed, the payee must submit it to the withholding agent. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. 2003) page 1 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). Web use form 587 if any of the following apply: Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: Use form 590, withholding exemption certificate. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on.

• you sold california real estate. Once this form is completed, the payee must submit it to the withholding agent. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. You sold california real estate. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to (check one) the payee completes this form and returns it to the withholding agent. Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to withholding. Web signed form 587 is accepted in good faith. • payment to a nonresident is only for the purchase of goods.

Ppq 587 Form ≡ Fill Out Printable PDF Forms Online

Do not use form 587 if any of the following applies: Web performs services totally outside california (no withholding required, skip to certification of nonresident payee) provides only goods or materials (no withholding required, skip to certification of nonresident payee) provides goods and services in california (see part iv, income allocation) We will update this page with a new version.

ftb.ca.gov forms 09_588

You sold california real estate. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb upon request. Use form 593,.

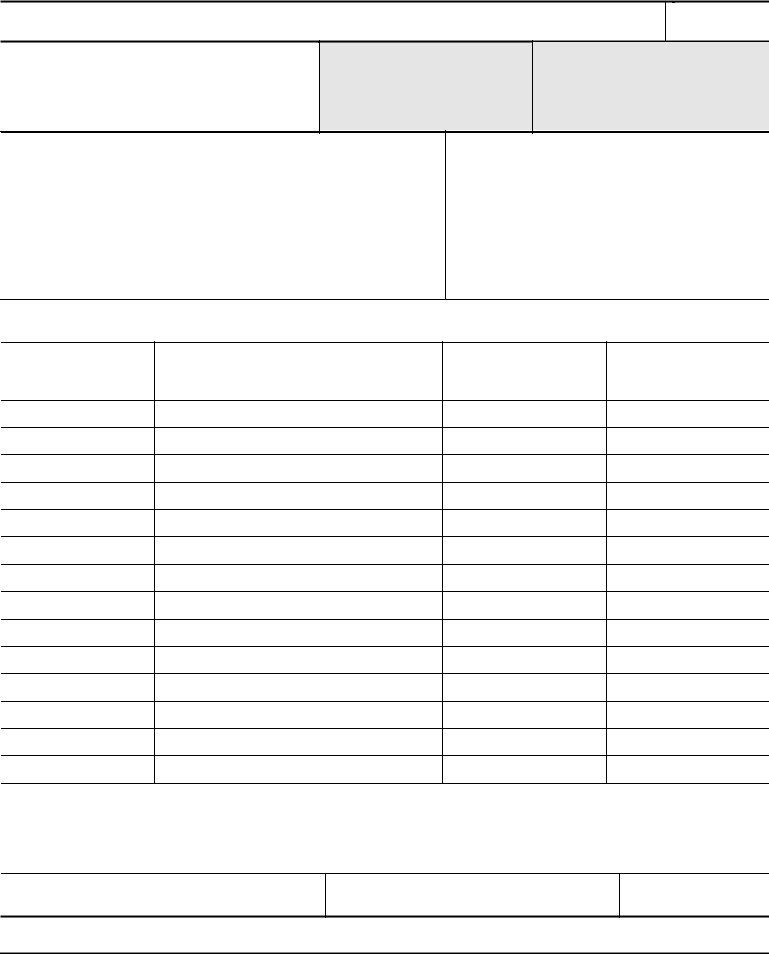

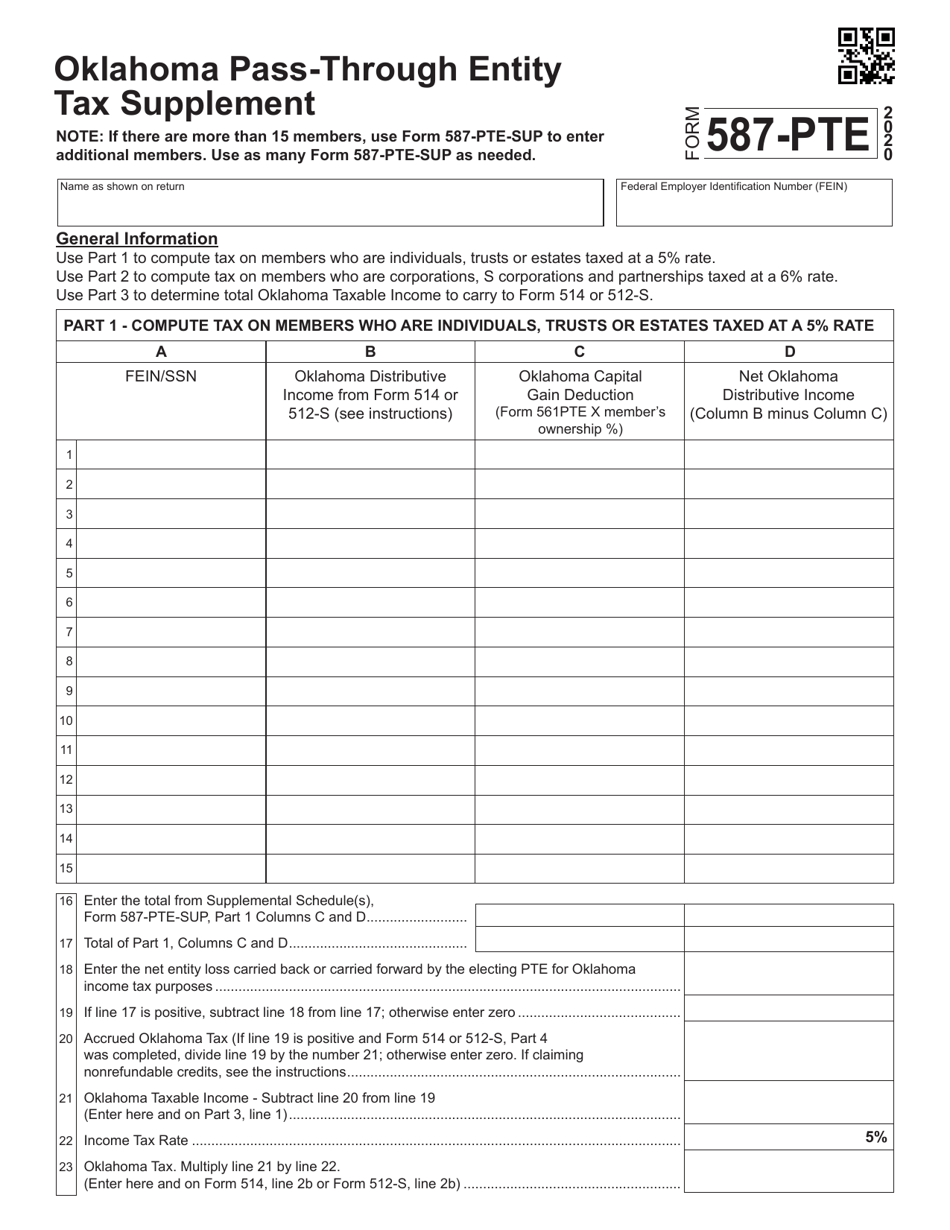

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. • payment to a nonresident is only for the purchase of goods. The withholding agent keeps this form with their. Use form 593, real estate withholding statement. Do not use form 587 if any of the following applies:

2013 Form 587 Nonresident Withholding Allocation Worksheet Edit

Once this form is completed, the payee must submit it to the withholding agent. Do not use form 587 if any of the following applies: The payee is a corporation, partnership, or limited liability Web form 587 instructions (rev. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Fillable California Form 587 Nonresident Withholding Allocation

Web form 587 instructions (rev. You sold california real estate. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. (check one) the payee completes this form and returns it to the withholding agent. Once this form is completed, the payee must submit it to the withholding agent.

ftb.ca.gov forms 09_587

Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: The payee is a corporation, partnership, or limited liability This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. Web more about the california form.

ca form 587 Fill out & sign online DocHub

Withholding is not required if payees are residents or have a permanent place of business in california. Web signed form 587 is accepted in good faith. • payment to a nonresident is only for the purchase of goods. The payee is a corporation, partnership, or limited liability Do not use form 587 if any of the following applies:

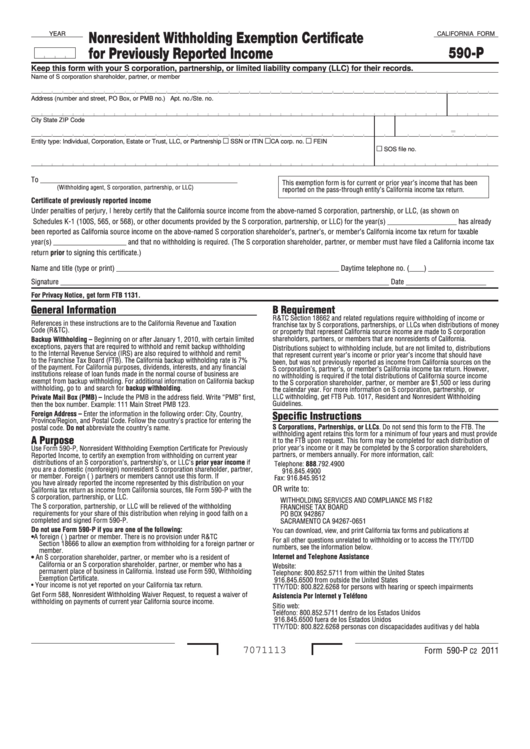

Fillable California Form 590P Nonresident Withholding Exemption

Web we last updated california form 587 in february 2023 from the california franchise tax board. • you sold california real estate. The withholding agent keeps this form with their. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type:.

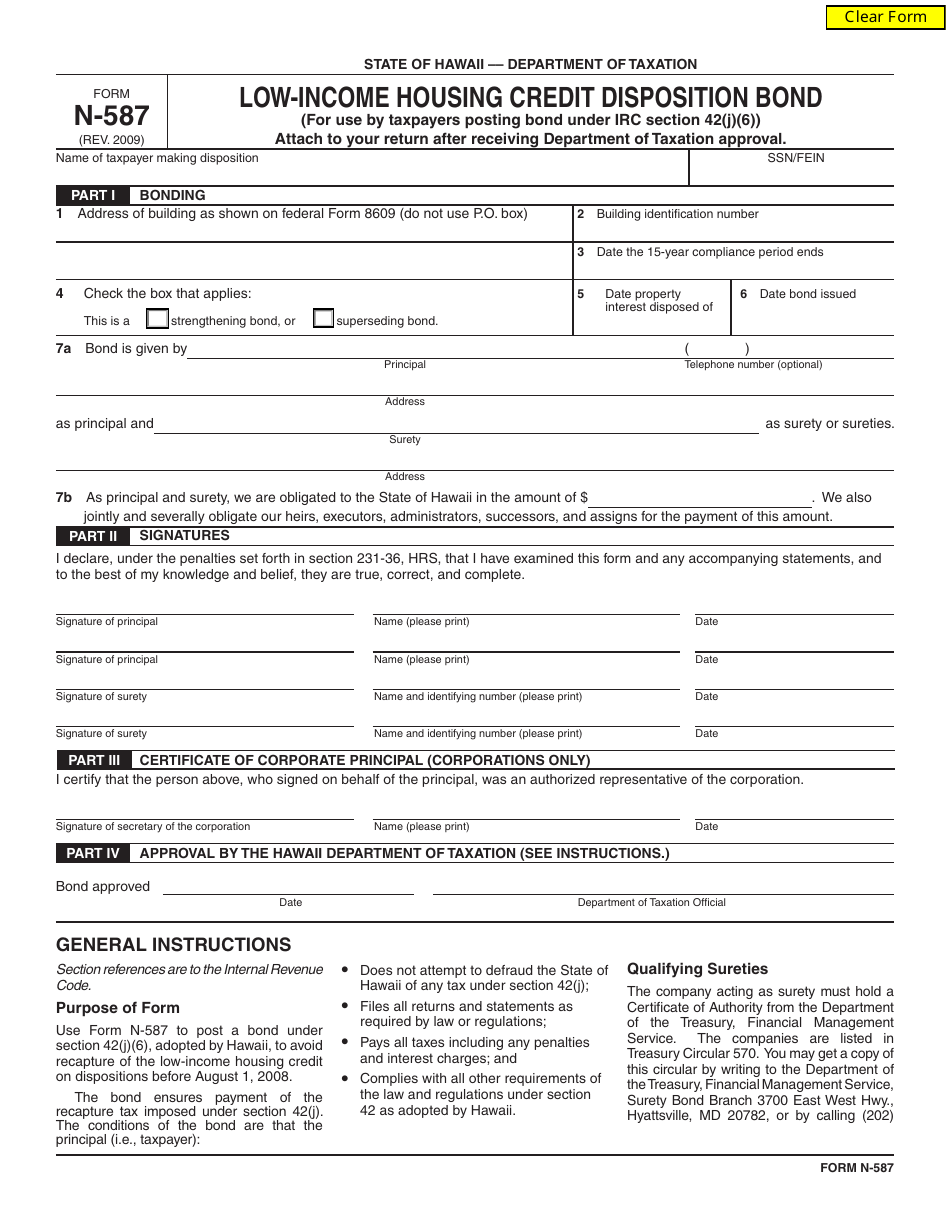

Form N587 Download Fillable PDF or Fill Online Housing

The payee is a corporation, partnership, or limited liability • you sold california real estate. Web signed form 587 is accepted in good faith. The payee is a resident of california or is a nongrantor trust that has at least one california resident trustee. Web form 587 instructions (rev.

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

Web we last updated california form 587 in february 2023 from the california franchise tax board. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. Web 2020 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). The withholding agent.

Web Use Form 587 If Any Of The Following Apply:

(check one) the payee completes this form and returns it to the withholding agent. Use form 590, withholding exemption certificate. General information a purpose use form 587, nonresident withholding allocation worksheet, to determine if withholding is required on. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government.

Once This Form Is Completed, The Payee Must Submit It To The Withholding Agent.

Web form 587 instructions (rev. • payment to a nonresident is only for the purchase of goods. This form requires the withholding agent's information, nonresident payee information, payment type, and income allocation. Web signed form 587 is accepted in good faith.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

2003) page 1 instructions for form 587 nonresident withholding allocation worksheet references in these instructions are to the california revenue and taxation code (r&tc). Withholding is not required if payees are residents or have a permanent place of business in california. The payee is a corporation, partnership, or limited liability Use form 593, real estate withholding statement.

The Withholding Agent Keeps This Form With Their.

• you sold california real estate. Web california form 587 part i withholding agent information part ii nonresident payee information part iii payment type part iv income allocation certification of nonresident payee nonresident payee’s entity type: Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to withholding. You sold california real estate.