Calendar Spread

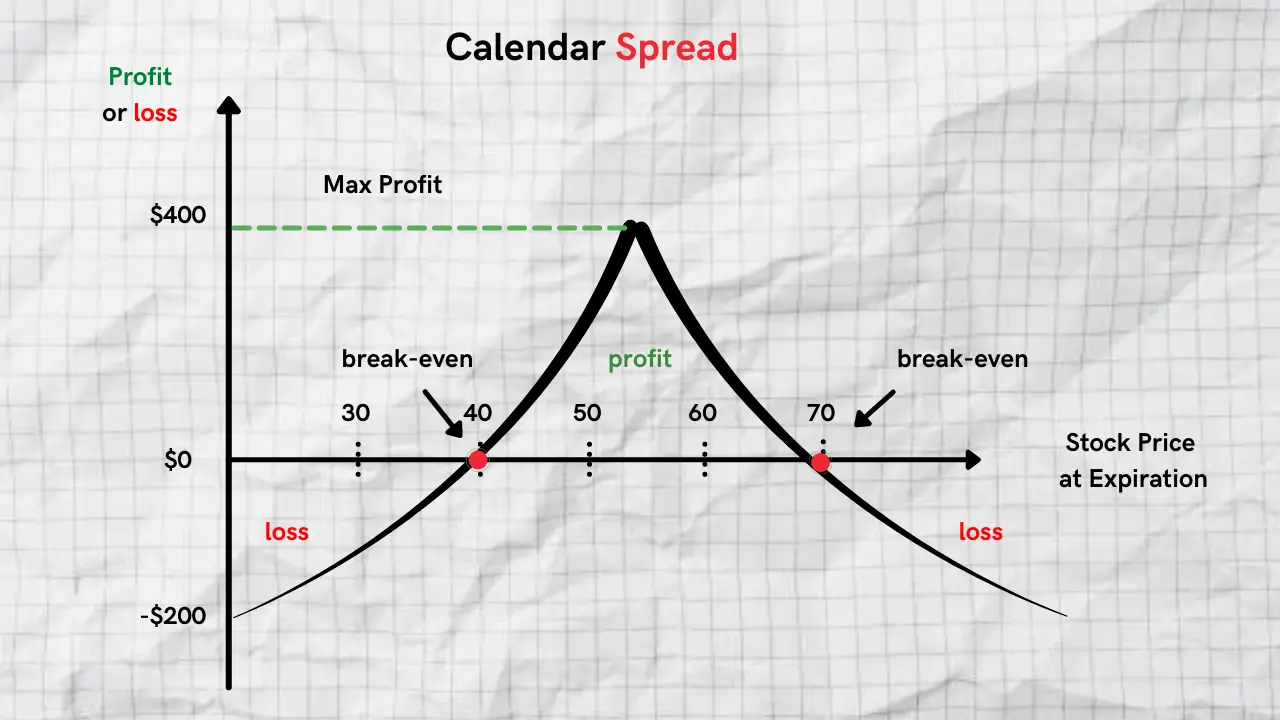

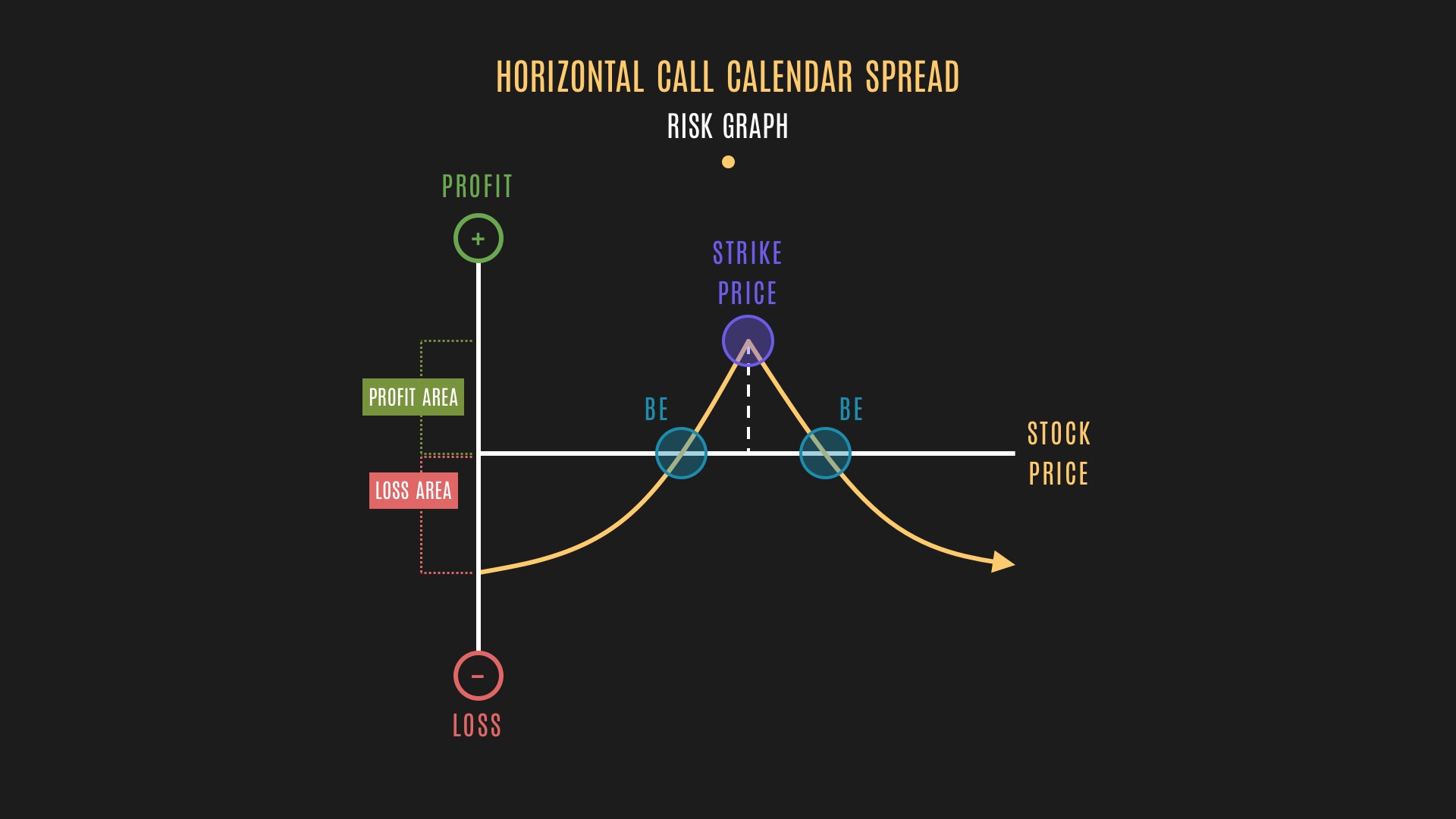

Calendar Spread - Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates. In diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web calendar spreads werden auch als horizontale spreads oder time spreads bezeichnet. A calendar spread involves buying and selling the same. Find out the advantages, disadvantages, and examples of long and short. Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Web learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Web learn how to use calendar spreads, a type of option trading strategy that takes advantage of implied volatility and time decay. Eine händlerin glaubt, dass der markt sehr still und sehr. Learn how it can be used to profit from implied volatility, how.

Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Die theorie hinter calendar spreads geht. Web calendar spreads werden auch als horizontale spreads oder time spreads bezeichnet. A calendar spread involves buying and selling the same. Find out the advantages, disadvantages, and examples of long and short. Web learn how to use calendar spreads, a type of option trading strategy that takes advantage of implied volatility and time decay. Web learn how to use a calendar spread to earn money when a stock price stays flat over a short period of time. Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates. Web learn how to use calendar spreads to profit from time decay and volatility with options.

A calendar spread involves buying and selling the same. Web learn how to use calendar spreads, an options strategy that involves buying and selling options of the same type and strike, but different expiration cycles. Eine händlerin glaubt, dass der markt sehr still und sehr. Sehen wir uns ein beispiel an. Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates. Web learn how to use calendar spreads, a type of option trading strategy that takes advantage of implied volatility and time decay. Die theorie hinter calendar spreads geht. Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web learn how to use calendar spreads, a type of option trading strategy that takes advantage of implied volatility and time decay. Eine händlerin glaubt, dass der markt sehr still und sehr. Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Find out how they work, what are. Find.

Calendar Box Spread Sheba Domeniga

Web learn how to use calendar spreads, an options strategy that involves buying and selling options of the same type and strike, but different expiration cycles. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Eine händlerin glaubt, dass der markt sehr still und sehr. Web mit dem calendar.

Spread Calendar Ardyce

Learn how it can be used to profit from implied volatility, how. Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time. Web learn how to use calendar spreads to profit from time decay and volatility with options. Web calendar.

Everything You Need to Know about Calendar Spreads

Eine händlerin glaubt, dass der markt sehr still und sehr. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates. Learn how it can be used to profit from implied volatility, how. Sehen wir uns ein beispiel an. Die theorie.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Web learn how to use a calendar spread to earn money when a stock price stays flat over a short period of time. Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Web a calendar spread is a trade involving the purchase and sale of futures or options with.

Printable Calendar Spreads on Behance

Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates. Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Web learn how to use calendar.

How Calendar Spreads Work (Best Explanation) projectoption

Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Sehen wir uns ein beispiel an. Find out how they work, what are. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the.

Calendar Spread Kiah Selene

Die theorie hinter calendar spreads geht. In diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Web learn how to use a calendar spread, an options strategy that involves buying.

Long Calendar Spreads Unofficed

Web calendar spreads werden auch als horizontale spreads oder time spreads bezeichnet. A calendar spread involves buying and selling the same. Web learn how to use calendar spreads, an options strategy that involves buying and selling options of the same type and strike, but different expiration cycles. Web learn how to use calendar spreads, a neutral strategy that profits from.

Calendar Spreads in Futures and Options Trading Explained

Web learn how to use a calendar spread to earn money when a stock price stays flat over a short period of time. Web mit dem calendar spread zielen investoren einerseits auf die volatilität im basiswert ab, sowie auf die entwicklung des zeitwerts. Web learn how to use calendar spreads, an options strategy that involves buying and selling options of.

Die Theorie Hinter Calendar Spreads Geht.

Sehen wir uns ein beispiel an. Web calendar spreads werden auch als horizontale spreads oder time spreads bezeichnet. Web learn how to use calendar spreads to profit from time decay and volatility with options. In diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können.

Web Mit Dem Calendar Spread Zielen Investoren Einerseits Auf Die Volatilität Im Basiswert Ab, Sowie Auf Die Entwicklung Des Zeitwerts.

Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Web learn how to use calendar spreads, an options strategy that involves buying and selling options of the same type and strike, but different expiration cycles. Web learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but expiring on different dates. Learn how it can be used to profit from implied volatility, how.

Find Out How They Work, What Are.

Find out the advantages, disadvantages, and examples of long and short. Web learn how to use calendar spreads, a type of option trading strategy that takes advantage of implied volatility and time decay. Eine händlerin glaubt, dass der markt sehr still und sehr. A calendar spread involves buying and selling the same.

Web A Calendar Spread Is A Trade Involving The Purchase And Sale Of Futures Or Options With Different Expiration Dates.

Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time. Web learn how to use a calendar spread to earn money when a stock price stays flat over a short period of time. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts on the same underlying asset but different expiry dates.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)