Calendar Year Vs Annual Year

Calendar Year Vs Annual Year - Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. Web a calendar year is simply the traditional year, spanning january 1 to december 31. It holds significance in individual and. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web calendar year is the period from january 1st to december 31st. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Many companies find it easy to align their financial reporting with the beginning and end of the year. Generally, taxpayers filing a version of form 1040 use the calendar year. Learn when you should use each. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two.

Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. 31, and usually concludes at the end of a month. Web a calendar year is simply the traditional year, spanning january 1 to december 31. Web calendar year is the period from january 1st to december 31st. Web what differences are there between annually, yearly, and every year? In this article, we define a fiscal and calendar year, list the. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. It holds significance in individual and. Many companies find it easy to align their financial reporting with the beginning and end of the year. An individual can adopt a fiscal year.

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. 31, and usually concludes at the end of a month. Asked 7 years, 7 months ago. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. Web calendar year is the period from january 1st to december 31st. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Learn when you should use each. Web the key difference is their alignment with the calendar: Modified 2 years, 4 months ago. Generally, taxpayers filing a version of form 1040 use the calendar year.

What is the difference between a financial year and a calendar year

Web calendar year is the period from january 1st to december 31st. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12.

What is the Difference Between Fiscal Year and Calendar Year

The choice between plan year. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Learn when you should use each. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web while a calendar.

Fiscal Year vs Calendar Year Difference and Comparison

An individual can adopt a fiscal year. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web calendar year is the period from january 1st to december 31st. The choice between plan year. Comparing these two terms helps in understanding how insurance coverage.

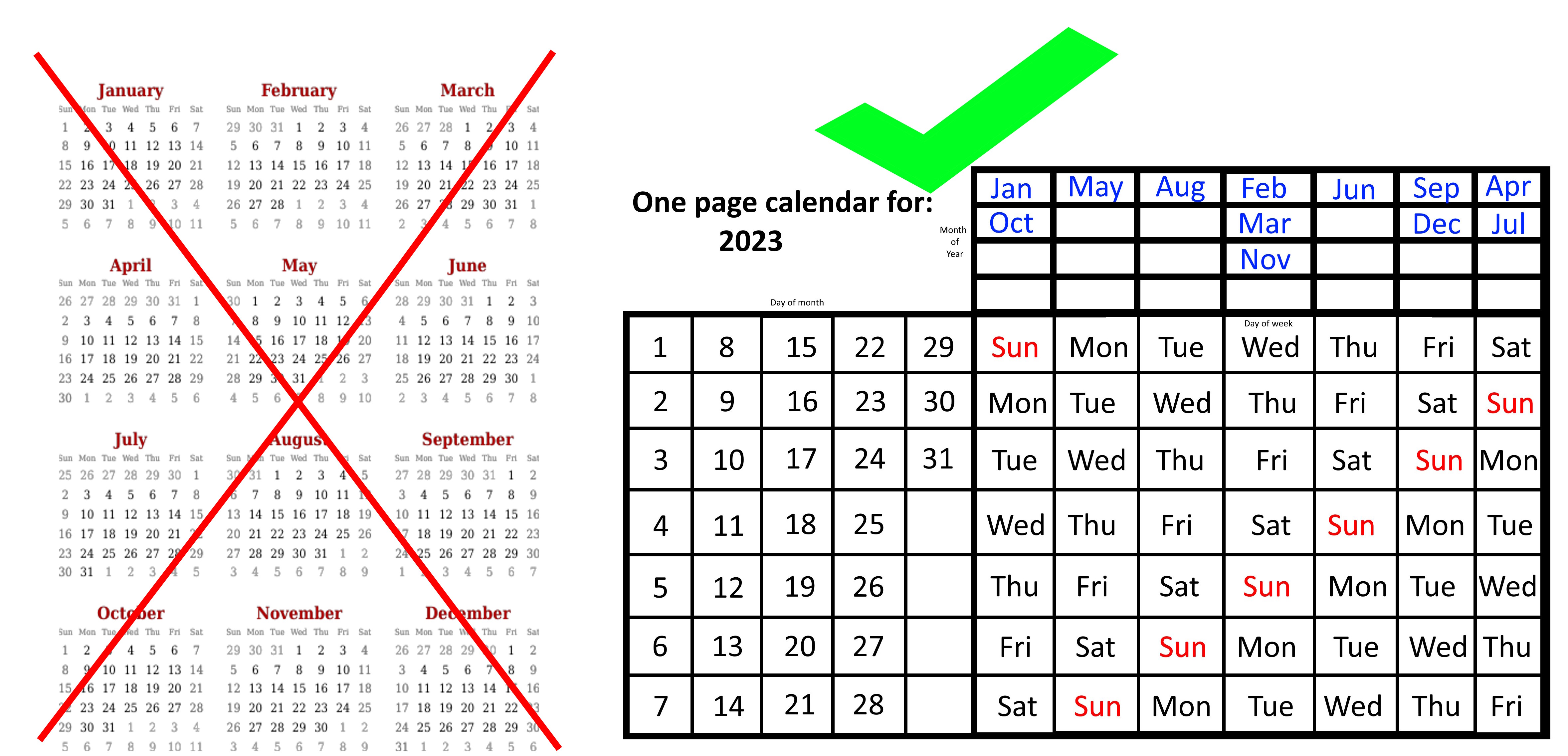

The simple, onepage calendar that lasts all year Big Think

It holds significance in individual and. Web understanding what each involves can help you determine which to use for accounting or tax purposes. In this article, we define a fiscal and calendar year, list the. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day.

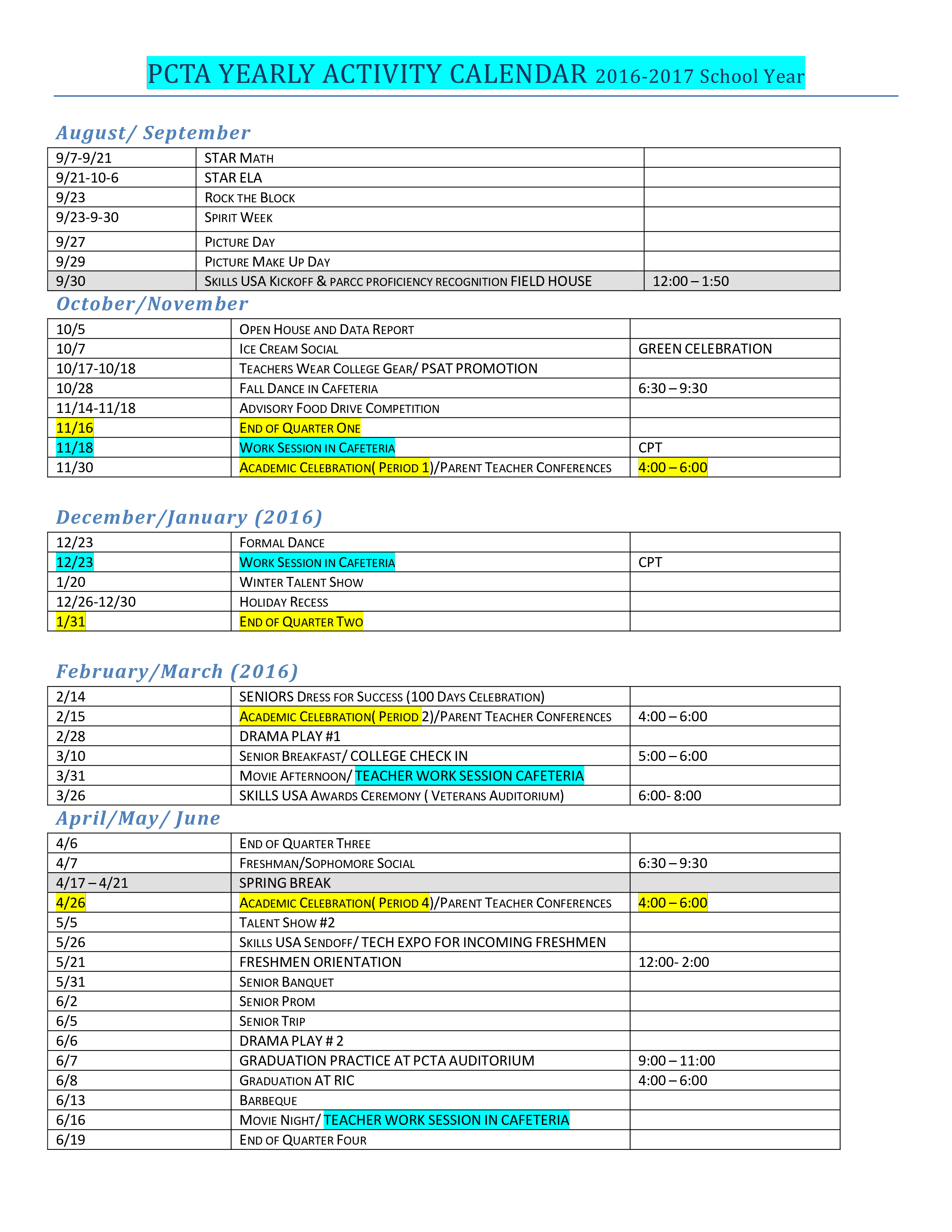

Plan Year Vs Calendar Year

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Modified 2 years, 4 months ago. In this article, we define a fiscal and calendar year, list the. Web calendar year is the period from january 1st to december 31st..

Calendar Year Vs Annual Year prntbl.concejomunicipaldechinu.gov.co

31, and usually concludes at the end of a month. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web while a calendar year end is simple and more common, a fiscal year can present a more accurate picture.

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web calendar year is the period from january 1st to december 31st. Comparing these two terms helps in understanding how insurance coverage and costs are managed over time. The choice between plan year. Web a fiscal year is 12 months chosen by a.

"Annual" vs. "Yearly" vs. "Every Year" Difference Revealed

Web the fiscal year may differ from the calendar year, which ends dec. Asked 7 years, 7 months ago. Governments and organizations can choose fiscal years to align with their budgeting and tax requirements. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web understanding what each.

What Is The Difference Between Plan Year And Calendar Year Meara

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web the fiscal year may differ from the calendar year, which ends dec. A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar..

Fiscal Year vs Calendar Year What is the Difference?

Web the key difference is their alignment with the calendar: Web the fiscal year may differ from the calendar year, which ends dec. In this article, we define a fiscal and calendar year, list the. Web while a calendar year end is simple and more common, a fiscal year can present a more accurate picture of a company’s performance. Generally,.

Web Understanding What Each Involves Can Help You Determine Which To Use For Accounting Or Tax Purposes.

Asked 7 years, 7 months ago. Web the fiscal year may differ from the calendar year, which ends dec. Web the key difference is their alignment with the calendar: Web what differences are there between annually, yearly, and every year?

It Holds Significance In Individual And.

Learn when you should use each. Comparing these two terms helps in understanding how insurance coverage and costs are managed over time. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.

The Choice Between Plan Year.

Many companies find it easy to align their financial reporting with the beginning and end of the year. Governments and organizations can choose fiscal years to align with their budgeting and tax requirements. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar.

This Often Is The Case With Seasonal.

31, and usually concludes at the end of a month. Generally, taxpayers filing a version of form 1040 use the calendar year. An individual can adopt a fiscal year. Web calendar year is the period from january 1st to december 31st.