California Form 565 Instructions 2021

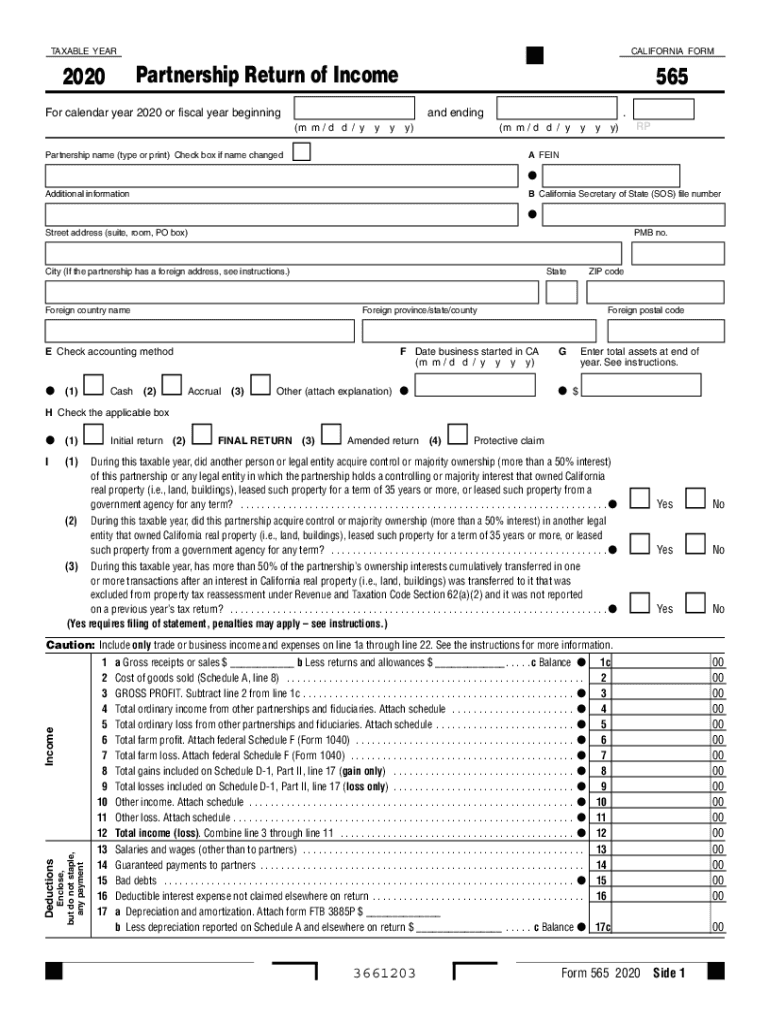

California Form 565 Instructions 2021 - Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that are specially allocated to. (1) during this taxable year, did another person or legal entity acquire control or. 2021 instructions for form 565 partnership pay booklet revised: Web filling out the ca form 565 instructions 2021 with signnow will give greater confidence that the output template will be legally binding and safeguarded. Web as per the guidance provided, taxpayers filing form 565/568 may use federal tax basis for the 2021 tax year; Handy tips for filling out ca. However, for the 2022 tax year and beyond, tax basis must be. Web see the instructions for more information. Web 2022 instructions for form 565, partnership return of income. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022.

(1) during this taxable year, did another person or legal entity acquire control or. Limited partnerships may qualify and make an election. Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that are specially allocated to. Web 565 california forms & instructions 2021 partnership tax booklet this booklet contains: 2021 partnership return of income. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web up to $40 cash back fill form 565, edit online. Web 2021 form 565 partnership tax booklet. Web more about the california form 565. However, for the 2022 tax year and beyond, tax basis must be.

See the links below for the california ftb form instructions. Web 565 california forms & instructions 2021 partnership tax booklet this booklet contains: Handy tips for filling out ca. Web 2021 form 565 partnership tax booklet. Limited partnerships may qualify and make an election. 2021 partnership return of income. Form 565, partnership return of income ftb 3885p, depreciation and. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web more about the california form 565. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022.

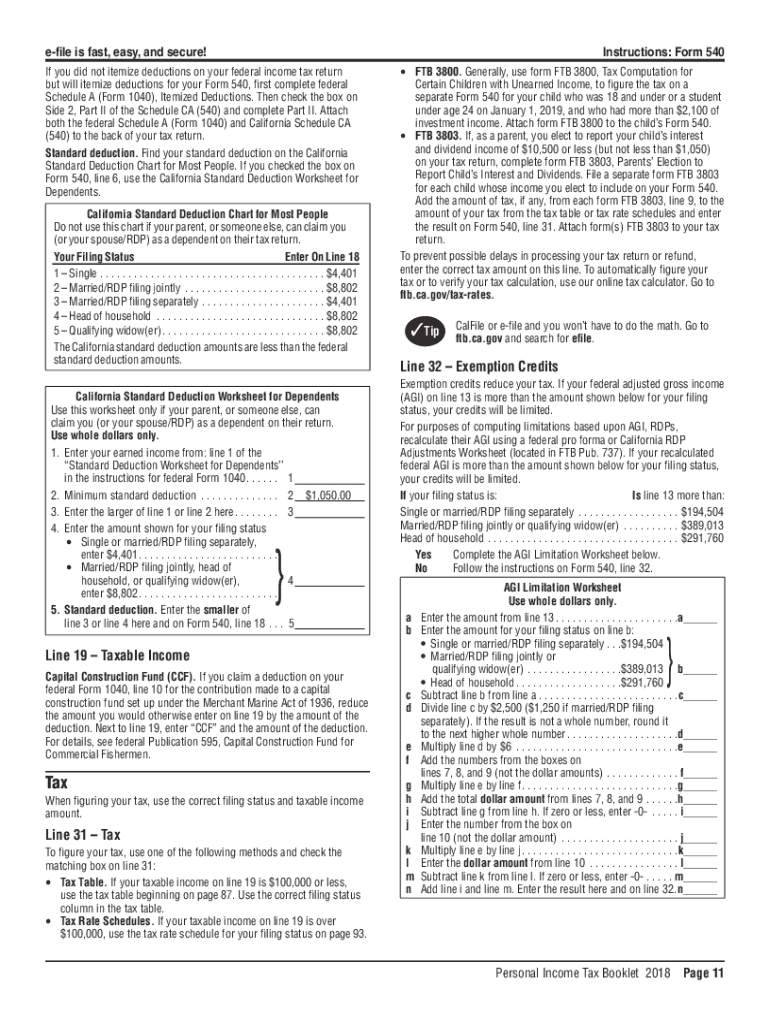

CA FTB 540 Instructions 20182022 Fill out Tax Template Online US

Web 2022 instructions for form 565, partnership return of income. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. However, for the 2022 tax year and beyond, tax basis must be. You can download or print. Web 2021 form 565 partnership tax.

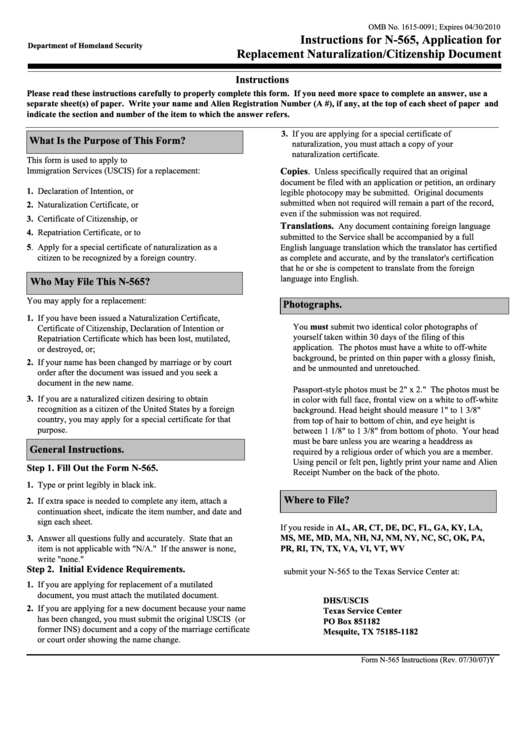

Instructions For N565, Application For Replacement Naturalization

Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that are specially allocated to. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Form 565, partnership.

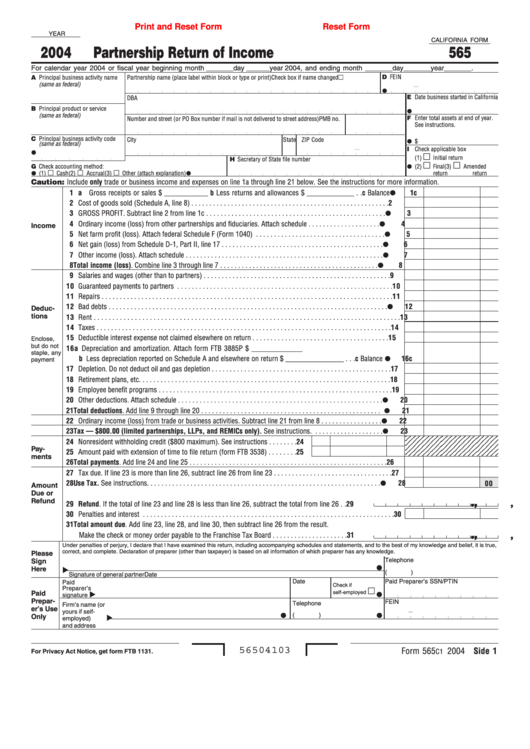

Fillable California Form 565 Partnership Return Of 2004

2021 partnership return of income. Web in early 2022, when the california franchise tax board (ftb) released 2021 tax forms and instructions for partnerships (form 565) and limited liability companies. Web as per the guidance provided, taxpayers filing form 565/568 may use federal tax basis for the 2021 tax year; Web for more information about investment partnerships, view instructions for.

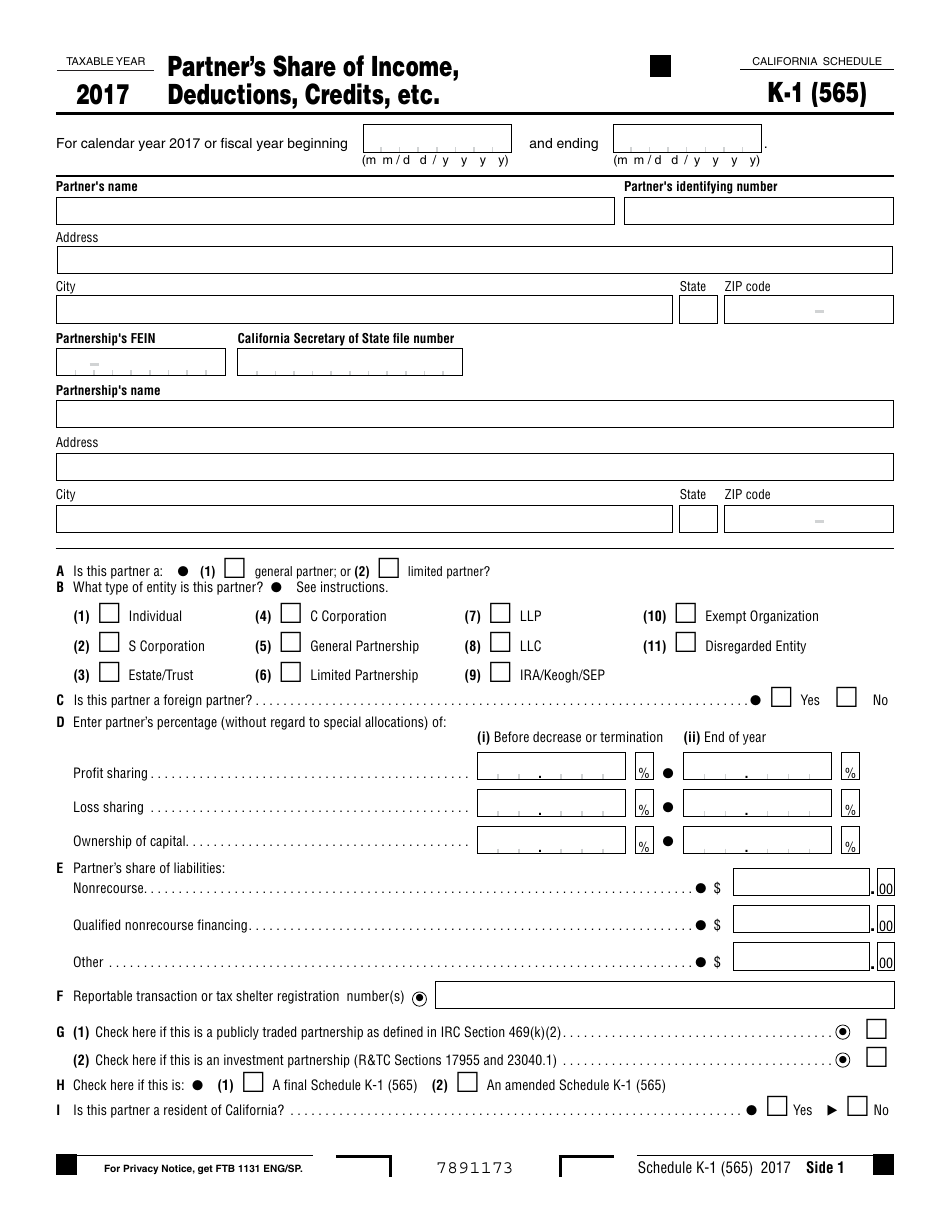

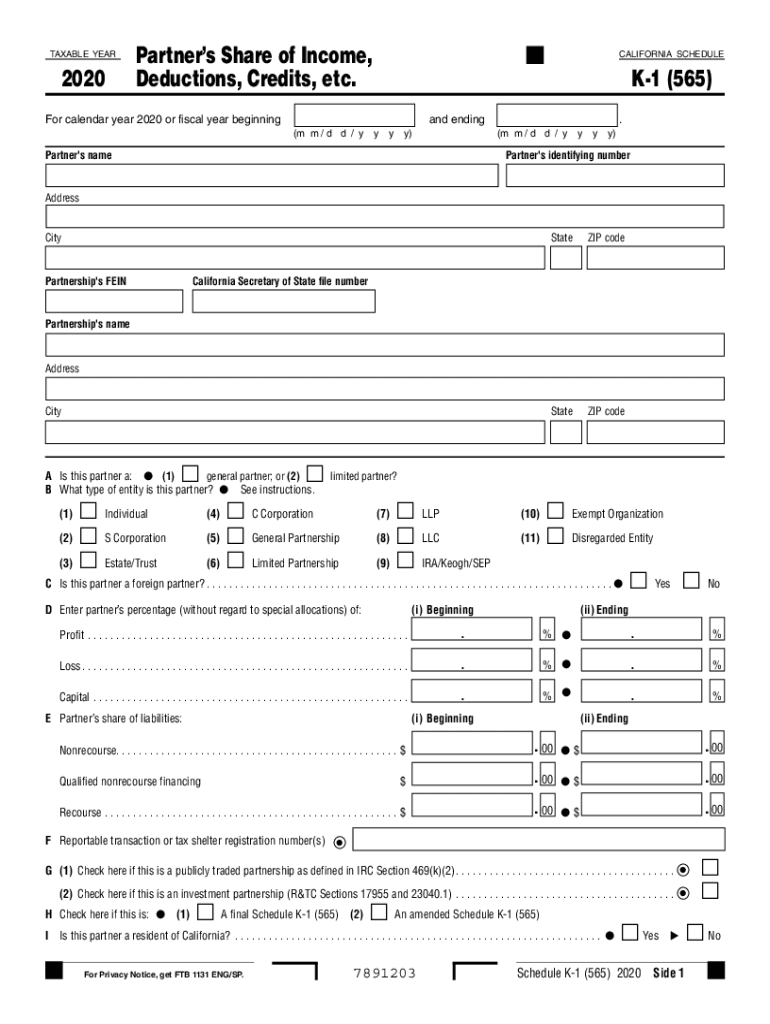

Form 565 Schedule K1 Download Fillable PDF or Fill Online Partner's

Web in early 2022, when the california franchise tax board (ftb) released 2021 tax forms and instructions for partnerships (form 565) and limited liability companies. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. (1) during this taxable year, did another person or legal entity acquire control or. Web 2022 instructions for form 565, partnership return.

Ftb Fill out & sign online DocHub

Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web as per the guidance provided, taxpayers filing form 565/568 may use federal tax basis for the 2021 tax year; Handy tips for filling out ca. Web 2022 instructions for form 565, partnership.

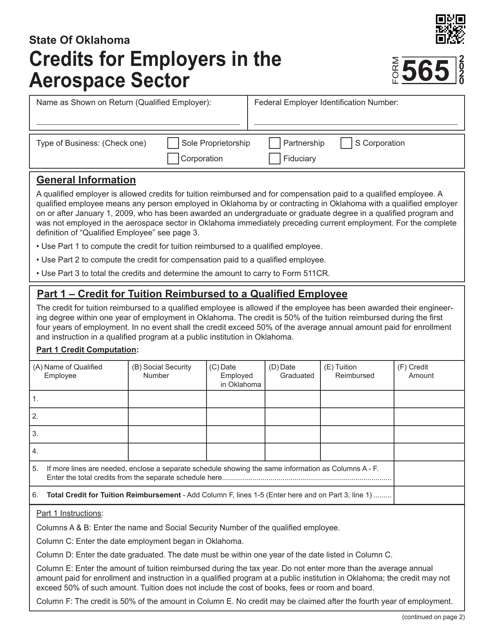

Form 565 Download Fillable PDF or Fill Online Credits for Employers in

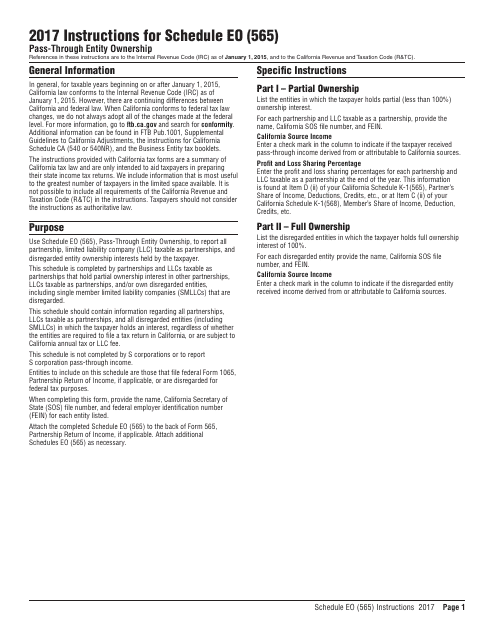

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. However, for the 2022 tax year and beyond, tax basis must be. 2021 partnership return of income. Handy tips for filling out ca. We last updated california form 565 in january 2023 from the california franchise tax board.

Download Instructions for Form 565 Schedule EO PassThrough Entity

Form 565, partnership return of income ftb 3885p, depreciation and. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web 2022 instructions for.

2011 ca form 565 Fill out & sign online DocHub

Web for more information about investment partnerships, view instructions for form 565. Web more about the california form 565. 2021 instructions for form 565 partnership pay booklet revised: You can download or print. Form 565, partnership return of income ftb 3885p, depreciation and.

Fillable California Form 3538 (565) Payment Voucher For Automatic

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Limited partnerships may qualify and make an election. You can download or print. This form is for income earned in tax. Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that.

California Schedule K 1 565 Partner's Share Of Fill Out and

This form is for income earned in tax. Handy tips for filling out ca. Web 2021 form 565 partnership tax booklet. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that.

Web See The Instructions For More Information.

Web ca form 565, partnership return of income. We last updated california form 565 in january 2023 from the california franchise tax board. Web more about the california form 565. See the links below for the california ftb form instructions.

Web 565 California Forms & Instructions 2021 Partnership Tax Booklet This Booklet Contains:

Web filling out the ca form 565 instructions 2021 with signnow will give greater confidence that the output template will be legally binding and safeguarded. Web up to $40 cash back fill form 565, edit online. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web 2022 instructions for form 565, partnership return of income.

References In These Instructions Are To The Internal Revenue Code (Irc) As Of January 1, 2015, And To The.

Web as per the guidance provided, taxpayers filing form 565/568 may use federal tax basis for the 2021 tax year; 2021 partnership return of income. However, for the 2022 tax year and beyond, tax basis must be. Web 2021 form 565 partnership tax booklet.

2021 Instructions For Form 565 Partnership Pay Booklet Revised:

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. This form is for income earned in tax. Web use schedule d (565), capital gain or loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that are specially allocated to. (1) during this taxable year, did another person or legal entity acquire control or.