Call Calendar

Call Calendar - Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web zinger key points. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Page through charts of the. Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. You may go long or short. Web what is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations.

Customize your iphone further by arranging your home. Select a previously saved set of screener filters to view today's results. Web ein long call calendar spread (auch: Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Meanwhile, a put calendar spread utilizes two puts. Web zinger key points. During this session, attorneys and. Web what is a call calendar spread? Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected.

Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Learn how to optimize this. Web what is a calendar spread? You may go long or short. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Select a previously saved set of screener filters to view today's results. Web load a saved screener: Page through charts of the. Meanwhile, a put calendar spread utilizes two puts.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web ein long call calendar spread (auch: Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. Select a.

Calendar Call Definition, Purpose, Advantages, and Disadvantages 7

Web ein long call calendar spread (auch: Learn how to optimize this. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Page through charts of the. You may go long or short.

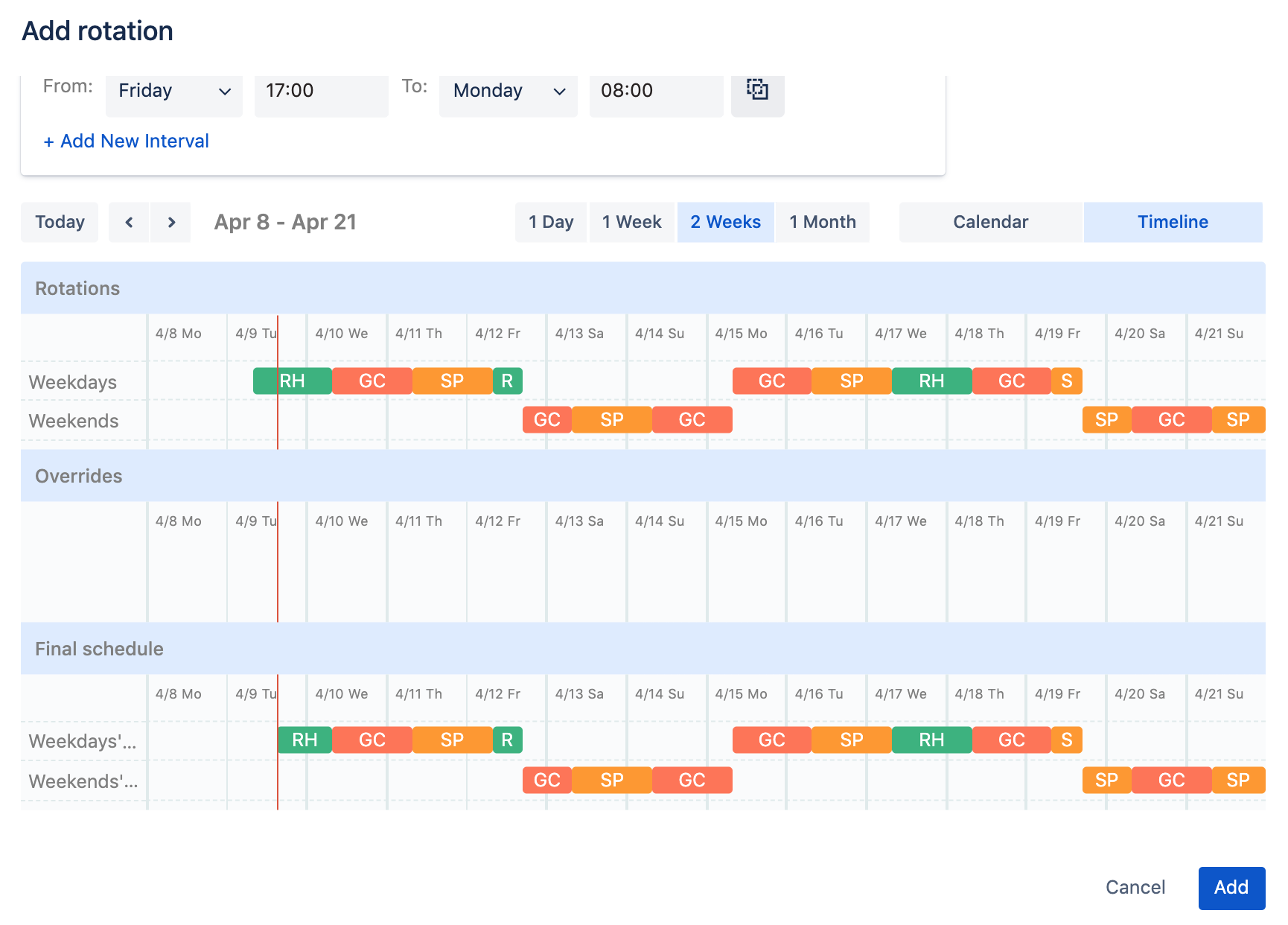

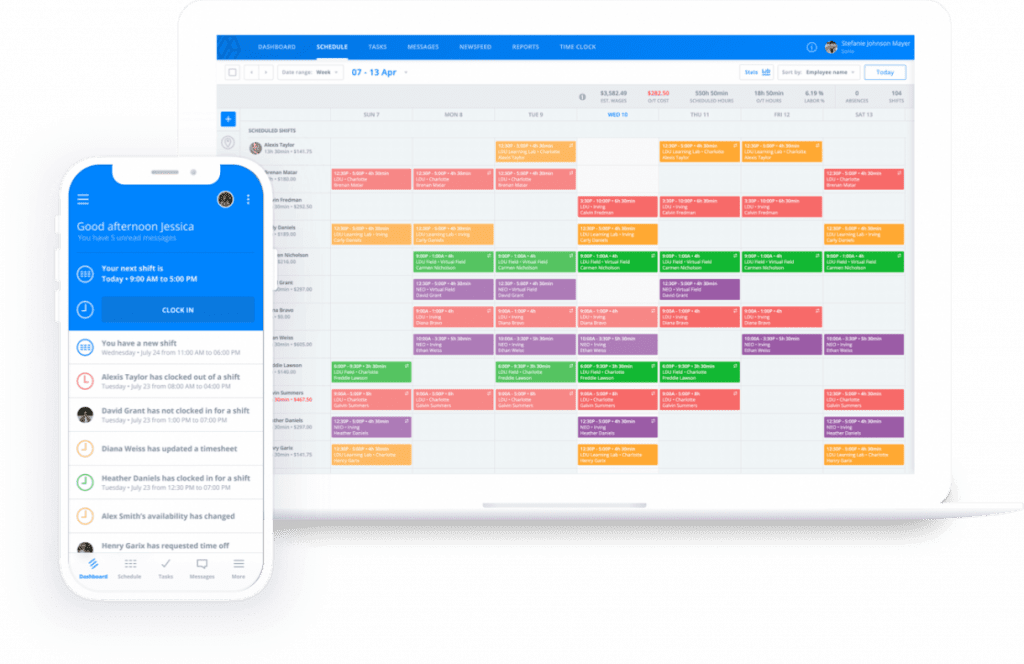

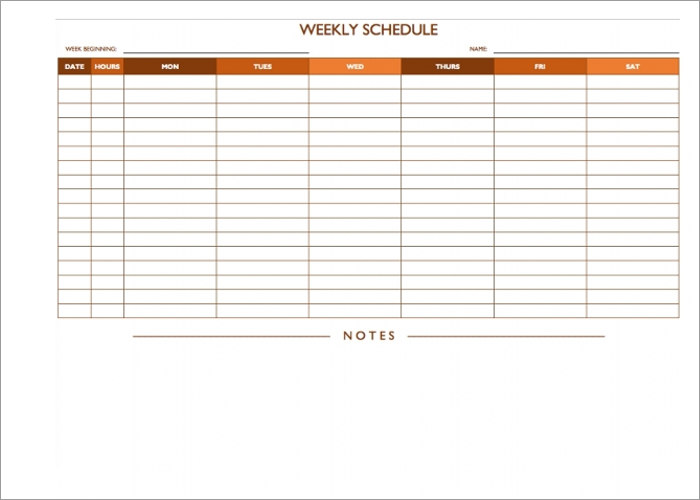

How To Create An OnCall Schedule That Won’t Frustrate Employees Sling

Web zinger key points. Learn how to optimize this. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

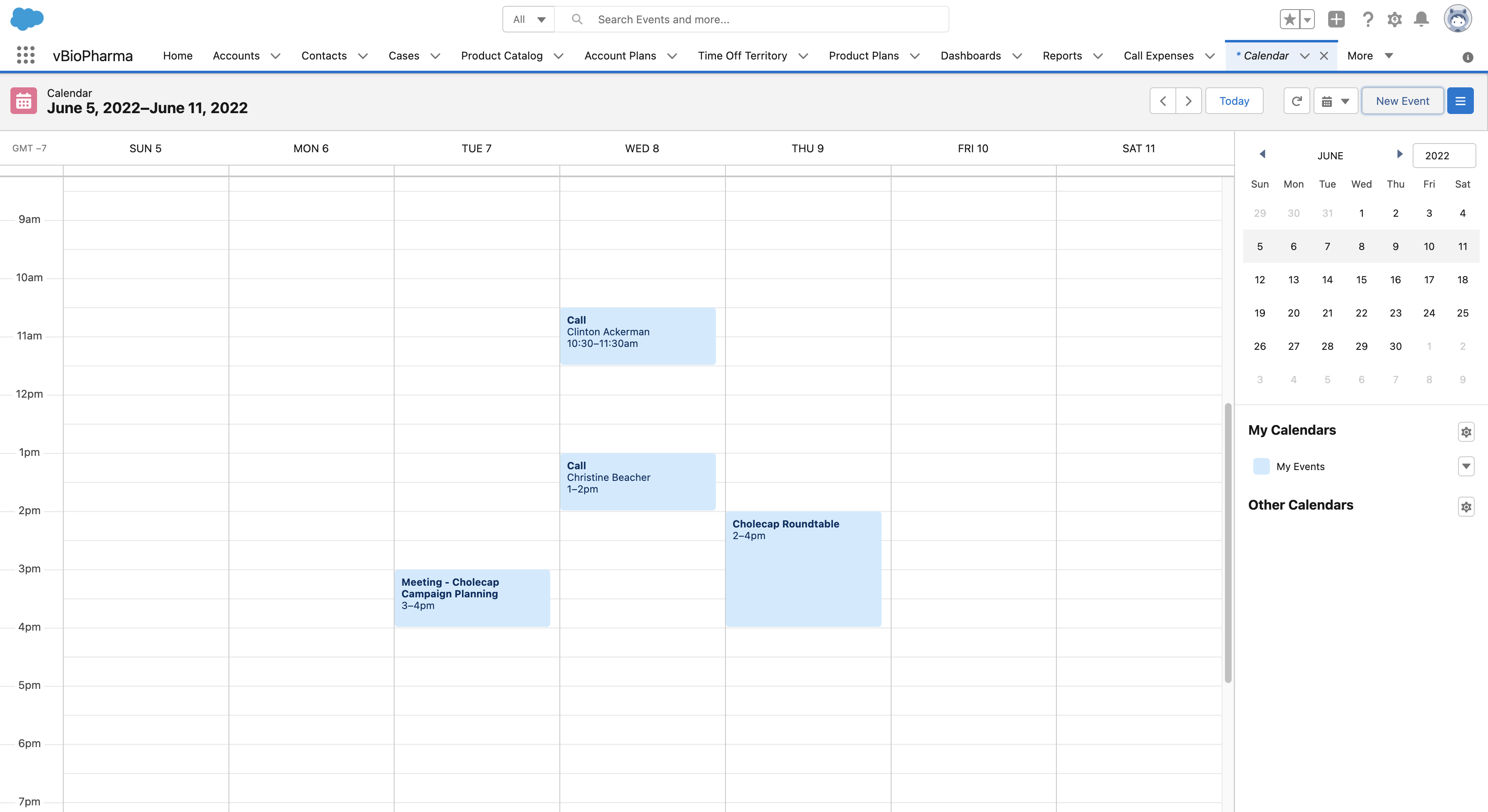

Managing Calls in the Salesforce Calendar

Summed up, a call calendar spread utilizes two calls. Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. Web what is a call calendar spread? A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price.

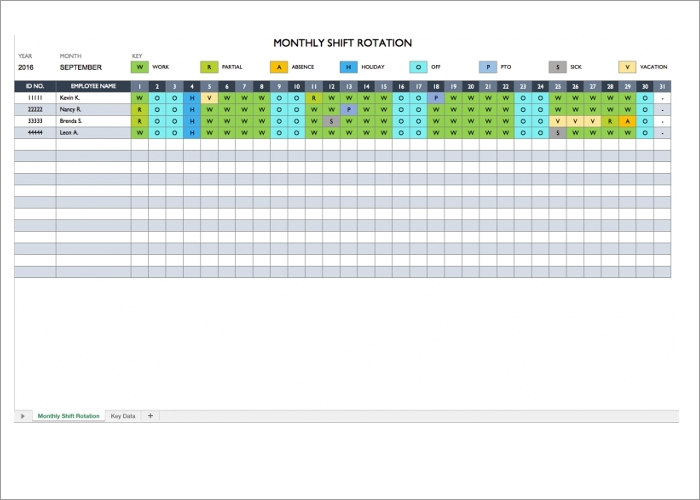

10+ On Call Schedule Templates Free Word, PDF, Excel Formats

Web what is a call calendar spread? Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web load a saved screener: Web ein long call calendar spread (auch: Web what is a calendar spread?

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. A calendar spread is an options trading strategy.

How To On Call Rotation Calendar Template Get Your Ca vrogue.co

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Meanwhile, a put calendar spread utilizes two puts. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ios 18 brings new ways to customize the iphone.

On Call Schedule Template Excel Inspirational Call Calendar Template

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. General mills reported adjusted eps.

10+ On Call Schedule Templates Free Word, PDF, Excel Formats

Web zinger key points. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web load a saved screener: Web a long calendar spread with calls is the strategy of choice when the forecast is for.

What Is a Call Calendar Spread YouTube

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. View the results using flipcharts: Page through charts of the. General mills reported adjusted eps of $1.07, beating estimates, but net sales fell 1% amid rising.

Page Through Charts Of The.

During this session, attorneys and. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates.

Summed Up, A Call Calendar Spread Utilizes Two Calls.

View the results using flipcharts: A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web what is a call calendar spread? You may go long or short.

Web Learn How To Use A Long Call Calendar Spread To Combine A Bullish And A Bearish Outlook On A Stock.

Web ein long call calendar spread (auch: General mills reported adjusted eps of $1.07, beating estimates, but net sales fell 1% amid rising costs and lower profits. Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little.

Web A Long Calendar Spread With Calls Is The Strategy Of Choice When The Forecast Is For Stock Price Action Near The Strike Price Of The Spread, Because The Strategy Profits From Time.

Web what is a calendar spread? Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web zinger key points. Learn how to optimize this.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)