Can You Reaffirm A Debt In Chapter 13

Can You Reaffirm A Debt In Chapter 13 - You usually have to formally reaffirm the debt. The last blog post was about when to reaffirm a secured debt under chapter 7 and when to handle that under chapter 13 instead. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. At the end of your repayment period, any remaining debt is discharged. Web when you file for chapter 13, you'll have a choice for debt secured by collateral, such as your house, car, or other property: The federal bankruptcy code states that if you do not reaffirm that the secured creditor can repossess even if you remain current with the payments. In both cases, you can surrender the collateral, which means the debt. In chapter 13, you repay secured debts through the repayment plan. Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy. Web chapter 13 bankruptcy.

Web in chapter 13 bankruptcy, you and your attorney will work to prove your eligibility for a debt reorganization to a bankruptcy trustee, who administers the proceedings. To do so, you may need to reaffirm the debt. These are assets that you cannot. Web when you file for chapter 13, you'll have a choice for debt secured by collateral, such as your house, car, or other property: When you’re able to keep the collateral in chapter 7 if you are current on your debt payments, you would very likely be able to keep your collateral/vehicle under chapter 7. You may lose the property if you can… Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. Web you should only reaffirm a debt if you are current with your payments and know you can keep up with future payments. This kind of comparison of options can. Keep the secured property and continue paying the monthly amount, plus arrearages, in your repayment plan, or.

To do so, you may need to reaffirm the debt. With a chapter 7 bankruptcy, the trustee gathers and liquidates your nonexempt assets. The federal bankruptcy code states that if you do not reaffirm that the secured creditor can repossess even if you remain current with the payments. As long as the codebtor stay is in effect, your creditors can… Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. Those who want to keep their mortgage or other secured debt as is during a chapter 13 bankruptcy filing will need to reaffirm the account during their bankruptcy proceeding, essentially agreeing to continue paying on the debt. You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. The lender and the court must be persuaded to approve your reaffirmation. When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy.

Reaffirming Debts After Chapter 7 Bankruptcy By Petitioners

That means you exclude that debt from the discharge (legal write off) that chapter. Web in chapter 13 bankruptcy, you and your attorney will work to prove your eligibility for a debt reorganization to a bankruptcy trustee, who administers the proceedings. Keep the secured property and continue paying the monthly amount, plus arrearages, in your repayment plan, or. Web when.

All About Reaffirmation Agreements in Bankruptcy

This kind of comparison of options can. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. With a chapter 7 bankruptcy, the trustee gathers and liquidates your.

SHOULD I REAFFIRM MY MORTGAGE AGREEMENT AFTER MY CHAPTER 7 BANKRUPTCY?

Web here are examples of the reaffirmation of a secured debt (like a vehicle loan) in a chapter 7 case vs. When you’re able to keep the collateral in chapter 7 if you are current on your debt payments, you would very likely be able to keep your collateral/vehicle under chapter 7. In chapter 13, you repay secured debts through.

Bankruptcy FAQs Sagre Law Firm

With a chapter 7 bankruptcy, the trustee gathers and liquidates your nonexempt assets. Web but since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt. It is however very unlikely that if you continue to repay the note that the bank would foreclose anyway. Addressing it in a chapter 13 case..

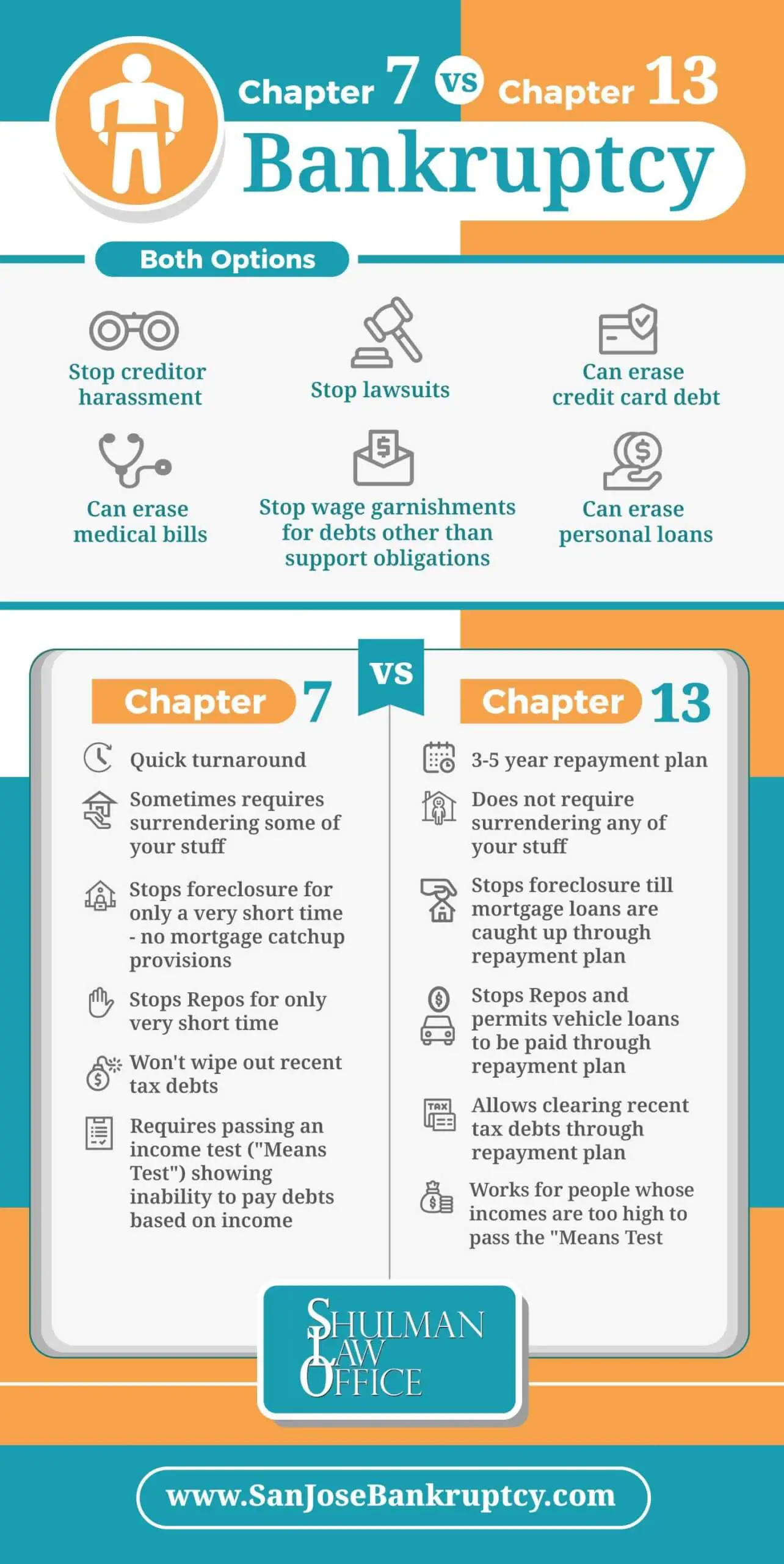

Infographic Chapter 7 vs. Chapter 13 BankruptcyWeaver Bankruptcy Law Firm

This kind of comparison of options can. Web chapter 13 bankruptcy. To do so, you may need to reaffirm the debt. With a chapter 7 bankruptcy, the trustee gathers and liquidates your nonexempt assets. You usually have to formally reaffirm the debt.

6 Things You Can Reaffirm for Positive Change and Validation

Web reaffirming your mortgage creates new debt: Web in chapter 13 bankruptcy, you and your attorney will work to prove your eligibility for a debt reorganization to a bankruptcy trustee, who administers the proceedings. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit.

What Is The Difference In Chapter 7 And 13 Bankruptcy

Web you should only reaffirm a debt if you are current with your payments and know you can keep up with future payments. That means you exclude that debt from the discharge (legal write off) that chapter. The federal bankruptcy code states that if you do not reaffirm that the secured creditor can repossess even if you remain current with.

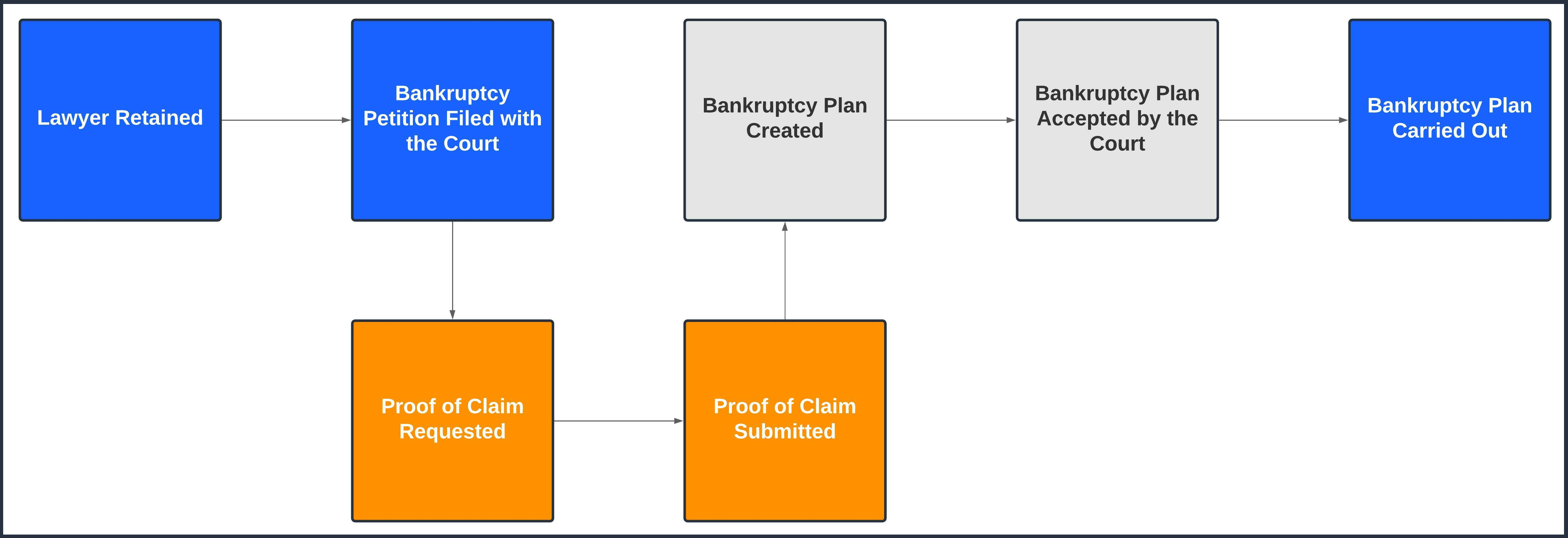

What Happens After You File Bankruptcy

Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in.

Bankruptcy 101 LoanPro Help

Web certain debts can not be discharged in a chapter 7 or a chapter 13 bankruptcy case. Those who want to keep their mortgage or other secured debt as is during a chapter 13 bankruptcy filing will need to reaffirm the account during their bankruptcy proceeding, essentially agreeing to continue paying on the debt. With this type of bankruptcy, you.

Neil T Anderson Quote “The more you reaffirm who you are in Christ

You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. Web chapter 13 bankruptcy. Web you should have already paid off the mortgage arrears in your chapter 13 if it is complete and there is no need to reaffirm. You may lose the property.

If You Want To Refinance To Get A Lower Interest Rate It Should Be No Problem.

Those who want to keep their mortgage or other secured debt as is during a chapter 13 bankruptcy filing will need to reaffirm the account during their bankruptcy proceeding, essentially agreeing to continue paying on the debt. The federal bankruptcy code states that if you do not reaffirm that the secured creditor can repossess even if you remain current with the payments. These are assets that you cannot. Web you will need to reaffirm or renegotiate your mortgage.

The Last Blog Post Was About When To Reaffirm A Secured Debt Under Chapter 7 And When To Handle That Under Chapter 13 Instead.

When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. Web you should have already paid off the mortgage arrears in your chapter 13 if it is complete and there is no need to reaffirm. Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter.

To Do So, You May Need To Reaffirm The Debt.

As long as the codebtor stay is in effect, your creditors can… Keep the secured property and continue paying the monthly amount, plus arrearages, in your repayment plan, or. Web reaffirming your mortgage creates new debt: Web but since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt.

Web You Should Only Reaffirm A Debt If You Are Current With Your Payments And Know You Can Keep Up With Future Payments.

Web you are not required to sig a reaffirmation agreement. This means that you will be responsible for paying the mortgage, even if the value of your home has decreased. Web chapter 13 bankruptcy. The lender and the court must be persuaded to approve your reaffirmation.