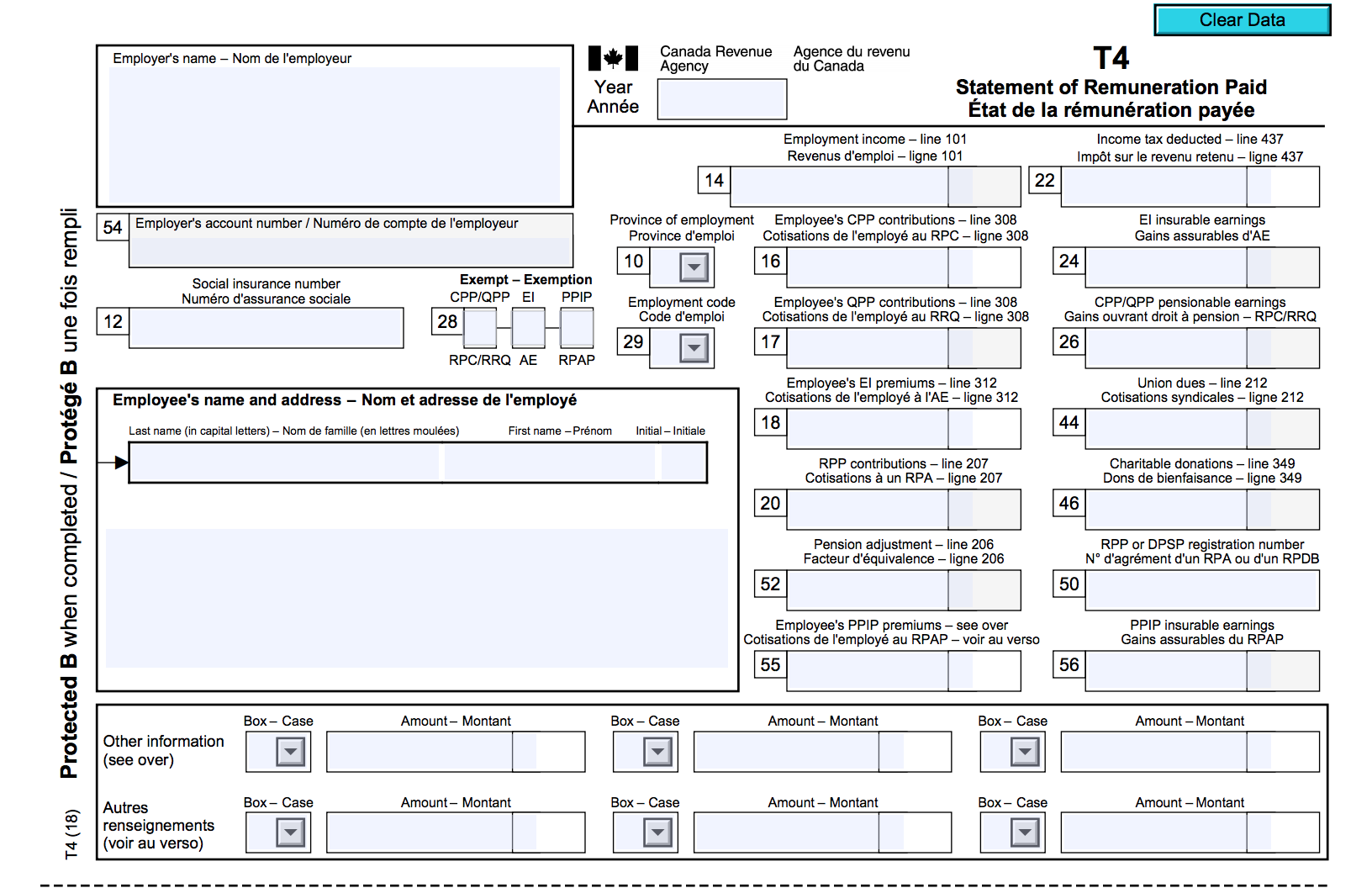

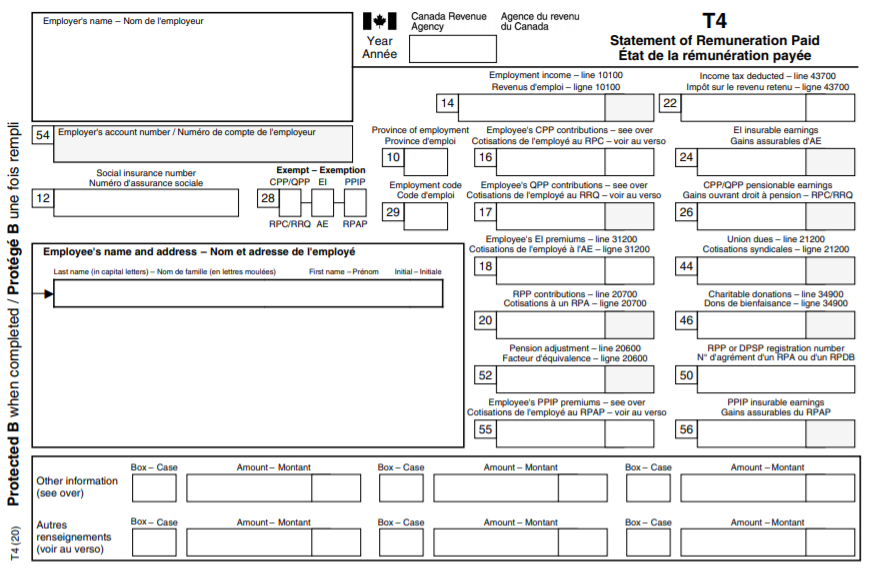

Canada Form T4

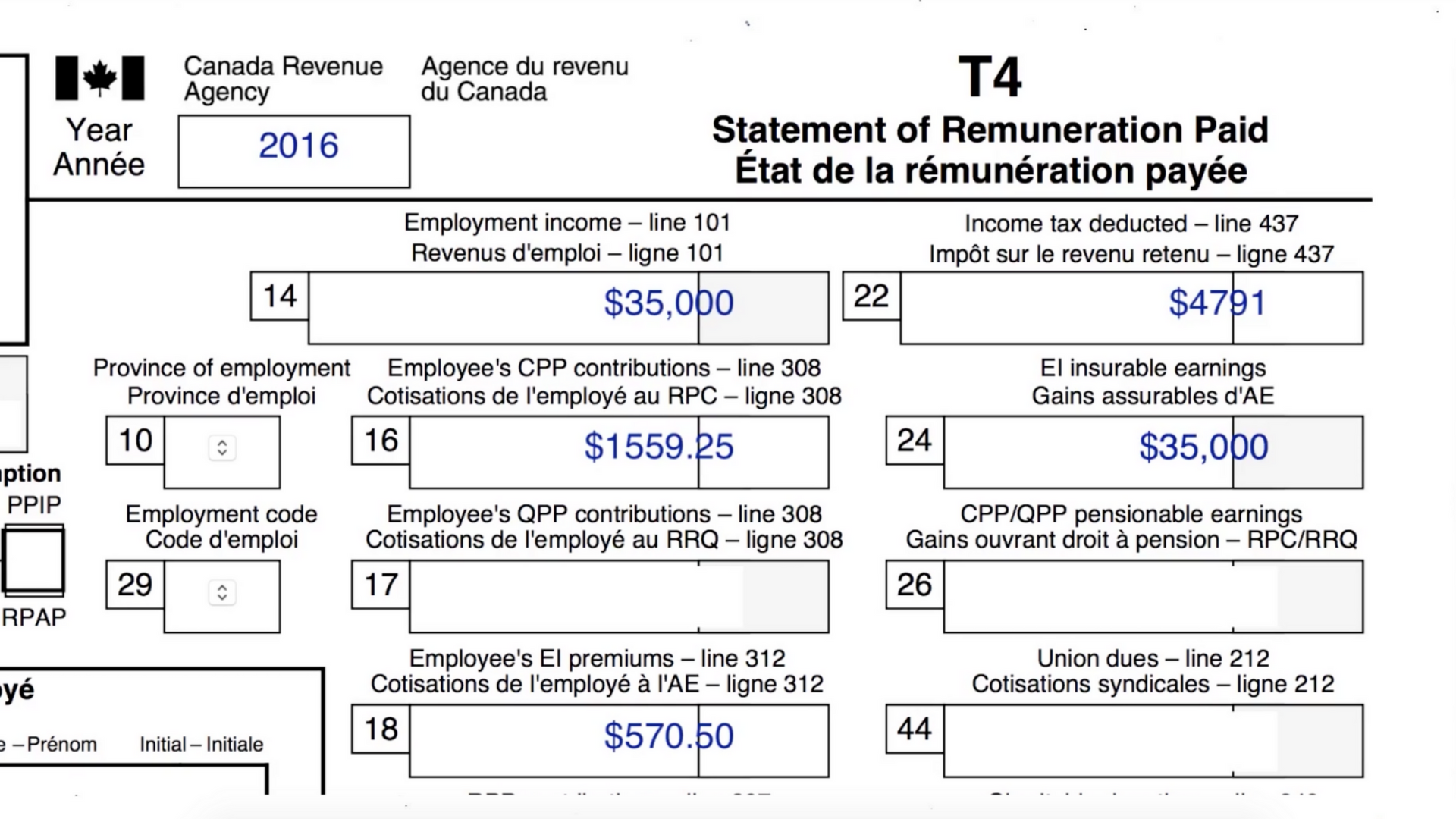

Canada Form T4 - How to fill out the t4 summary. For the tax year 2020, in addition to reporting employment income in box 14 or code 71, use new other information codes for periods from march 15 to september 26, 2020. Note you have to enter valid data in any field followed by an asterisk (*). Salary, wages, tips or gratuities, bonuses, vacation pay, employment commissions and other remuneration. Slips are prepared by your employer, payer, administrator or financial institution. You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Web if you are employed by a canadian company, you’ll receive a t4 slip. Web what is a t4 slip? Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips.

You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. If you file electronically using web forms, this application will prepare the t4 slips for you. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. How to fill out the t4 summary. Most employers send your t4 electronically by february. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. Hairdressers, taxi drivers, indians, fishing income, and more. Web if you are employed by a canadian company, you’ll receive a t4 slip. Scroll down the t4 web forms information return to access the following sections: Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year.

Most employers send your t4 electronically by february. Scroll down the t4 web forms information return to access the following sections: Slips are prepared by your employer, payer, administrator or financial institution. For the tax year 2020, in addition to reporting employment income in box 14 or code 71, use new other information codes for periods from march 15 to september 26, 2020. Web employers must complete t4 slips for all employees who received: Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. This slip is issued by your employer and the most common slip reported on the annual tax return. You will need to use it to file your taxes. The business you work for will also send a copy of the t4 slip to the canadian. Salary, wages, tips or gratuities, bonuses, vacation pay, employment commissions and other remuneration.

The Canadian Employer's Guide to the T4 Bench Accounting

Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Most employers send your t4 electronically by february. For the tax year 2020, in addition to reporting employment income in box 14 or code 71, use new other information codes for.

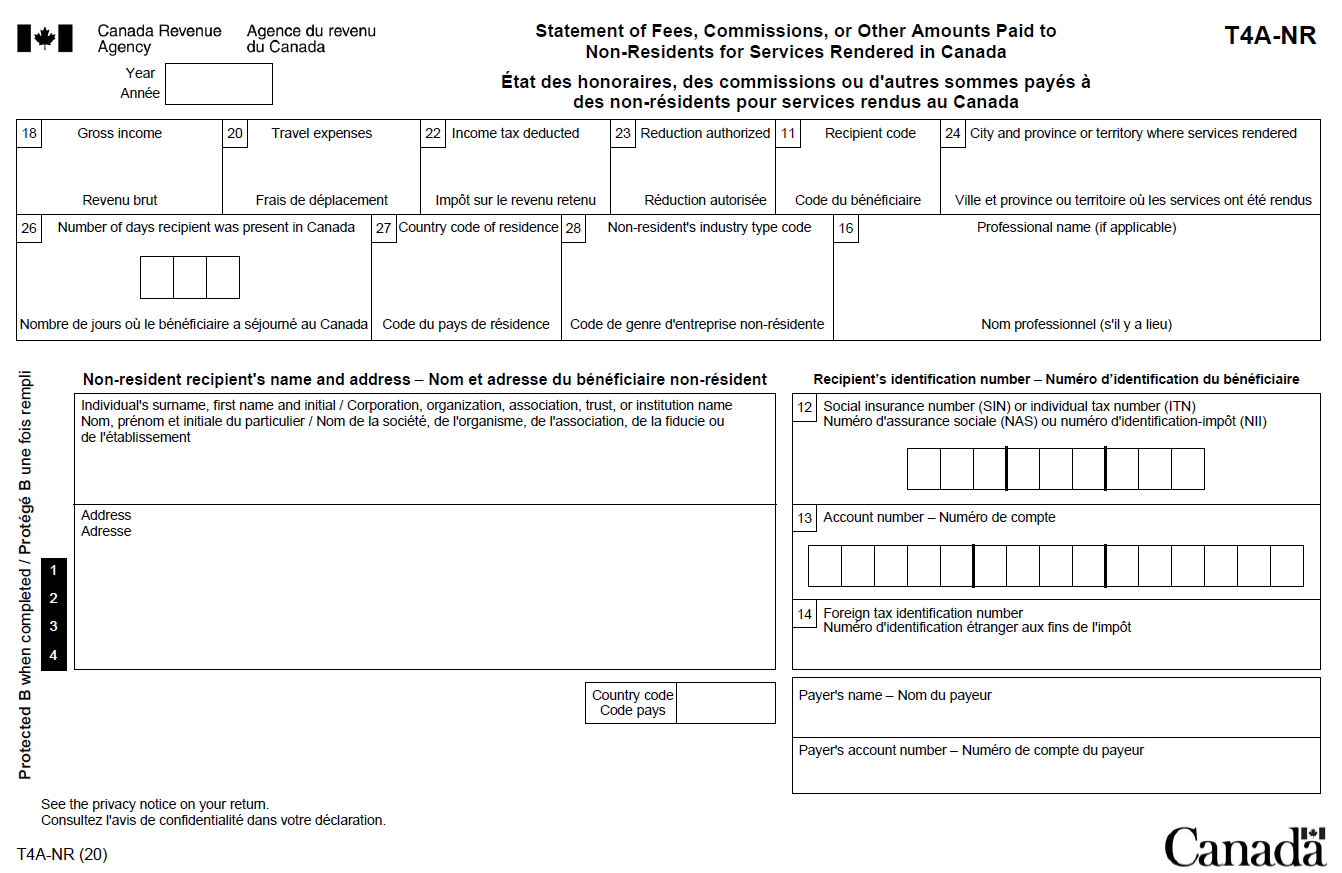

Desktop Entering Canadian Form T4 & T4ANR Support

Note you have to enter valid data in any field followed by an asterisk (*). How to fill out the t4 summary. Web if you are employed by a canadian company, you’ll receive a t4 slip. You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. This slip is.

What is a T4 slip? Canada.ca

You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. Hairdressers, taxi drivers, indians, fishing income, and more. Most employers send your t4 electronically by february. Salary, wages, tips or gratuities, bonuses, vacation pay, employment commissions and other remuneration. Filing deadline, filing methods, balance due and what happens after.

T4 form PaymentEvolution

You will need to use it to file your taxes. Salary, wages, tips or gratuities, bonuses, vacation pay, employment commissions and other remuneration. Most employers send your t4 electronically by february. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. How to fill out the t4 summary.

How to Prepare a T4 Slip in 12 Easy Steps Madan CPA

If you file electronically using web forms, this application will prepare the t4 slips for you. Hairdressers, taxi drivers, indians, fishing income, and more. Filing deadline, filing methods, balance due and what happens after you file. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. Most employers send your.

the SUPER BASIC story of Canadian Tax Rags to Reasonable

Filing deadline, filing methods, balance due and what happens after you file. If you file electronically using web forms, this application will prepare the t4 slips for you. Web what is a t4 slip? You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. Most employers send your t4.

ProWeb Entering Canadian Form T4 & T4ANR Support

Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Web employers must complete t4 slips for all employees who received: How to fill out the t4 summary. This slip is issued by your employer and the most common slip reported.

TAX 7가지 급여혜택에 대한 과세여부 소개 토론토 생활의 달인과 함께하는 포탈사이트

How to fill out the t4 summary. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. If you file electronically using web forms, this application will prepare the t4 slips for you. Most employers send your t4 electronically by february. Web employers must complete t4 slips for all employees.

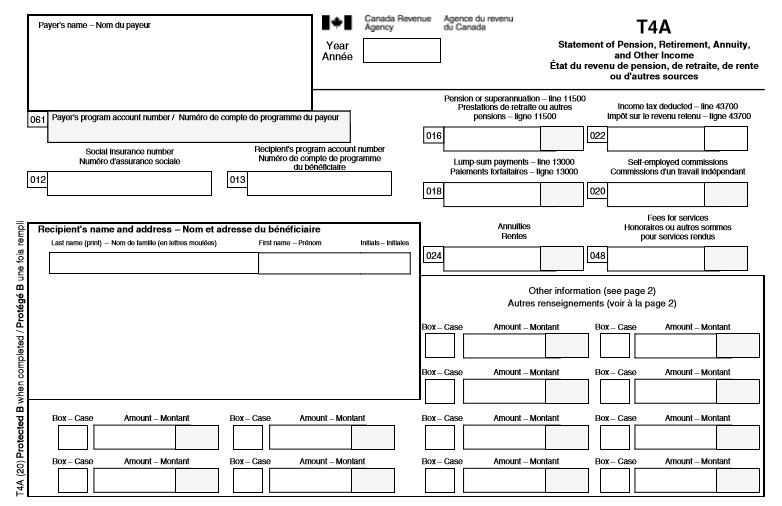

T4A slip Statement of Pension, Retirement, Annuity, and Other

Most employers send your t4 electronically by february. Web if you are employed by a canadian company, you’ll receive a t4 slip. Web employers must complete t4 slips for all employees who received: Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a.

Print T4 Slips

Hairdressers, taxi drivers, indians, fishing income, and more. Web what is a t4 slip? This slip is issued by your employer and the most common slip reported on the annual tax return. Note you have to enter valid data in any field followed by an asterisk (*). Scroll down the t4 web forms information return to access the following sections:

This Slip Is Issued By Your Employer And The Most Common Slip Reported On The Annual Tax Return.

Salary, wages, tips or gratuities, bonuses, vacation pay, employment commissions and other remuneration. Most employers send your t4 electronically by february. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. Web employers must complete t4 slips for all employees who received:

Web When To Fill Out A T4 Slip, Filling Out T4 Slips, Distributing T4 Slips To Employees, Customized T4 Slips.

You will need to use it to file your taxes. How to fill out the t4 summary. Web a t4 slip, or statement of remuneration paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Note you have to enter valid data in any field followed by an asterisk (*).

If You File Electronically Using Web Forms, This Application Will Prepare The T4 Slips For You.

Scroll down the t4 web forms information return to access the following sections: Web what is a t4 slip? Filing deadline, filing methods, balance due and what happens after you file. Web if you are employed by a canadian company, you’ll receive a t4 slip.

For The Tax Year 2020, In Addition To Reporting Employment Income In Box 14 Or Code 71, Use New Other Information Codes For Periods From March 15 To September 26, 2020.

The business you work for will also send a copy of the t4 slip to the canadian. Hairdressers, taxi drivers, indians, fishing income, and more. You should receive most of your slips (including your t4, t4a, and t5 slips) and receipts by the end of february. Slips are prepared by your employer, payer, administrator or financial institution.