Connecticut Withholding Form

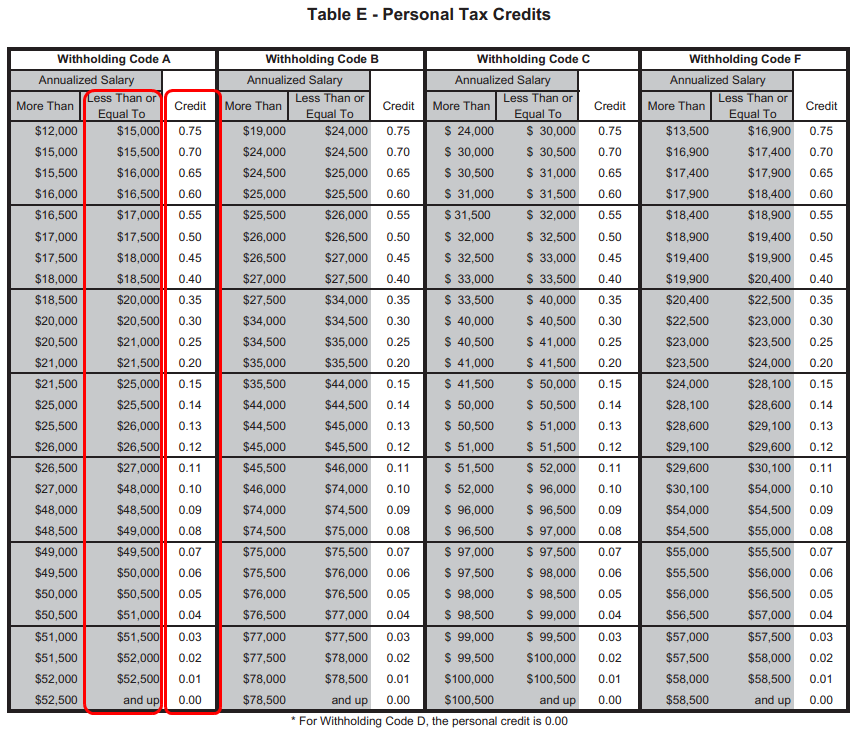

Connecticut Withholding Form - 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Withholding information for nonresidents who work in connecticut. Who must complete a registration application and file a withholding tax return. 2023 connecticut withholding tax payment form for nonpayroll amounts. Determine the total number of allowances field as follows: You are required to pay connecticut income tax as income is earned or received during the year. Web state tax withholding state code: A, b, c, d, or f. Withholding information for connecticut residents who work in another state. 2022 connecticut annual reconciliation of.

Withholding information for nonresidents who work in connecticut. A, b, c, d, or f. You are required to pay connecticut income tax as income is earned or received during the year. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. Withholding information for connecticut residents who work in another state. Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code:

Withholding information for connecticut residents who work in another state. A, b, c, d, or f. Determine the total number of allowances field as follows: You are required to pay connecticut income tax as income is earned or received during the year. 2022 connecticut annual reconciliation of. 2023 connecticut withholding tax payment form for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. Withholding information for nonresidents who work in connecticut. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Web state tax withholding state code:

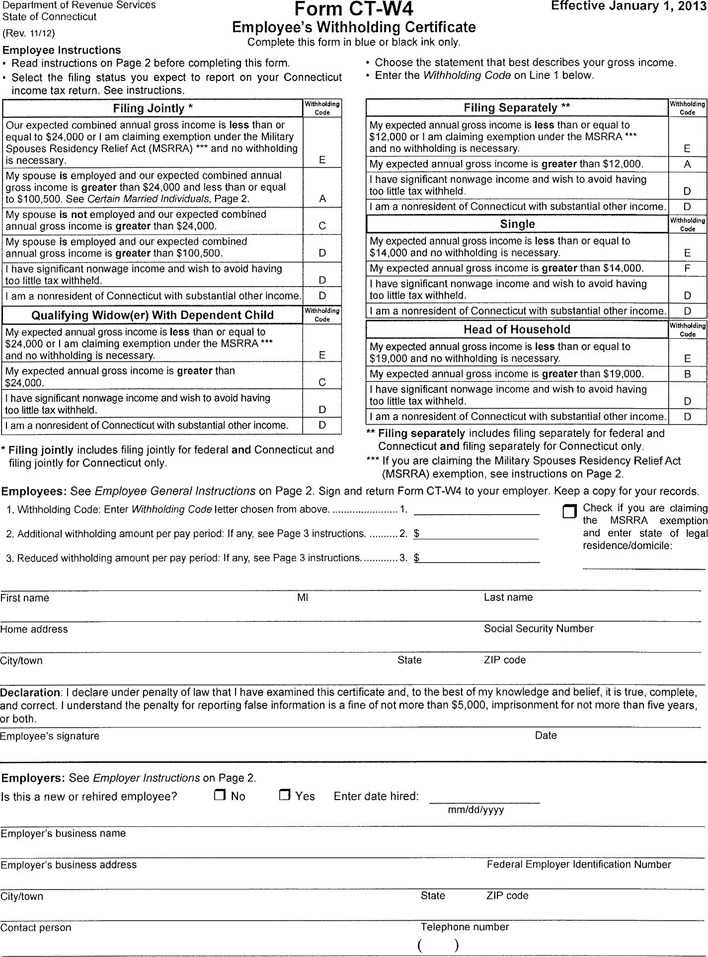

Download Connecticut Form CTW4 (2013) for Free Page 3 FormTemplate

2023 connecticut withholding tax payment form for nonpayroll amounts. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. A, b, c, d, or f. 2022 connecticut annual reconciliation of. Web state tax withholding state code:

W4 Form 2023 Printable Employee's Withholding Certificate 2022 Edd Form

Who must complete a registration application and file a withholding tax return. Web state tax withholding state code: Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of. A, b, c, d, or f.

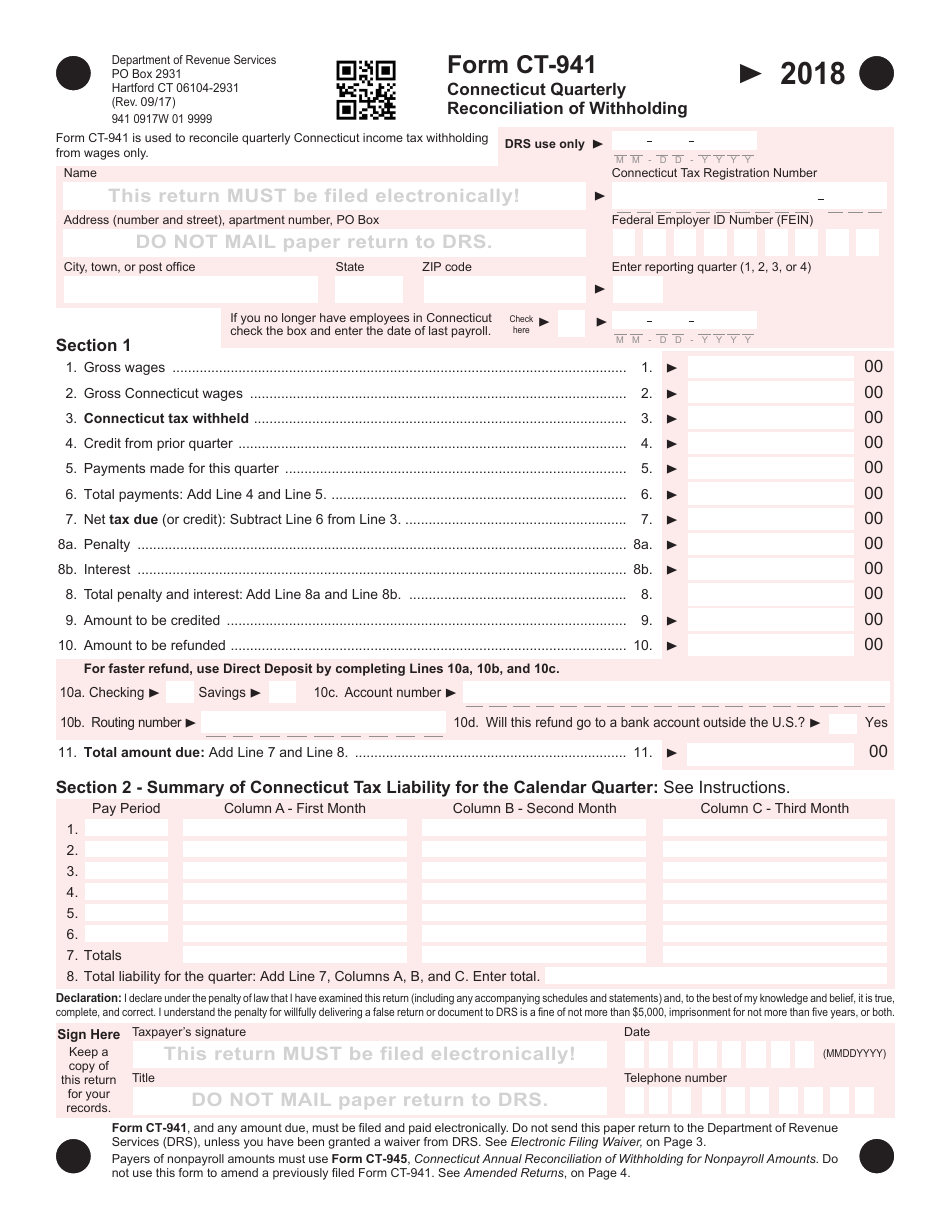

Form CT941 Download Printable PDF or Fill Online Connecticut Quarterly

A, b, c, d, or f. Withholding information for nonresidents who work in connecticut. Who must complete a registration application and file a withholding tax return. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code:

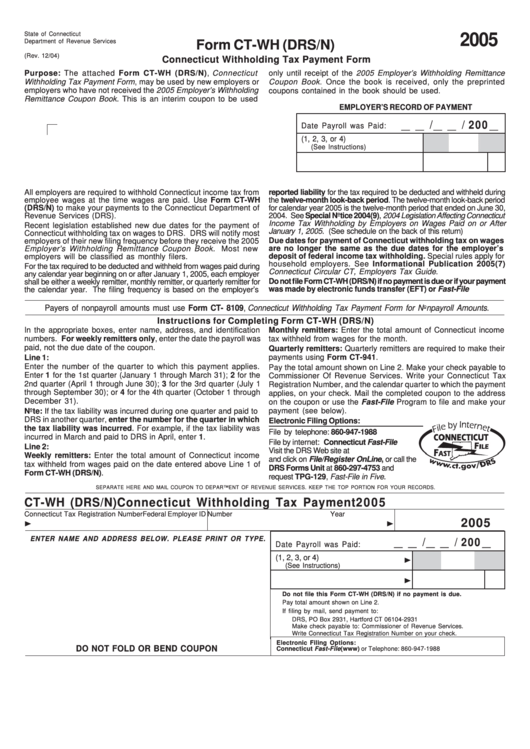

Form CtWh (Drs/n) Connecticut Withholding Tax Payment Form 2005

2023 connecticut withholding tax payment form for nonpayroll amounts. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of. You are required to pay connecticut income tax as income is earned or received during the year.

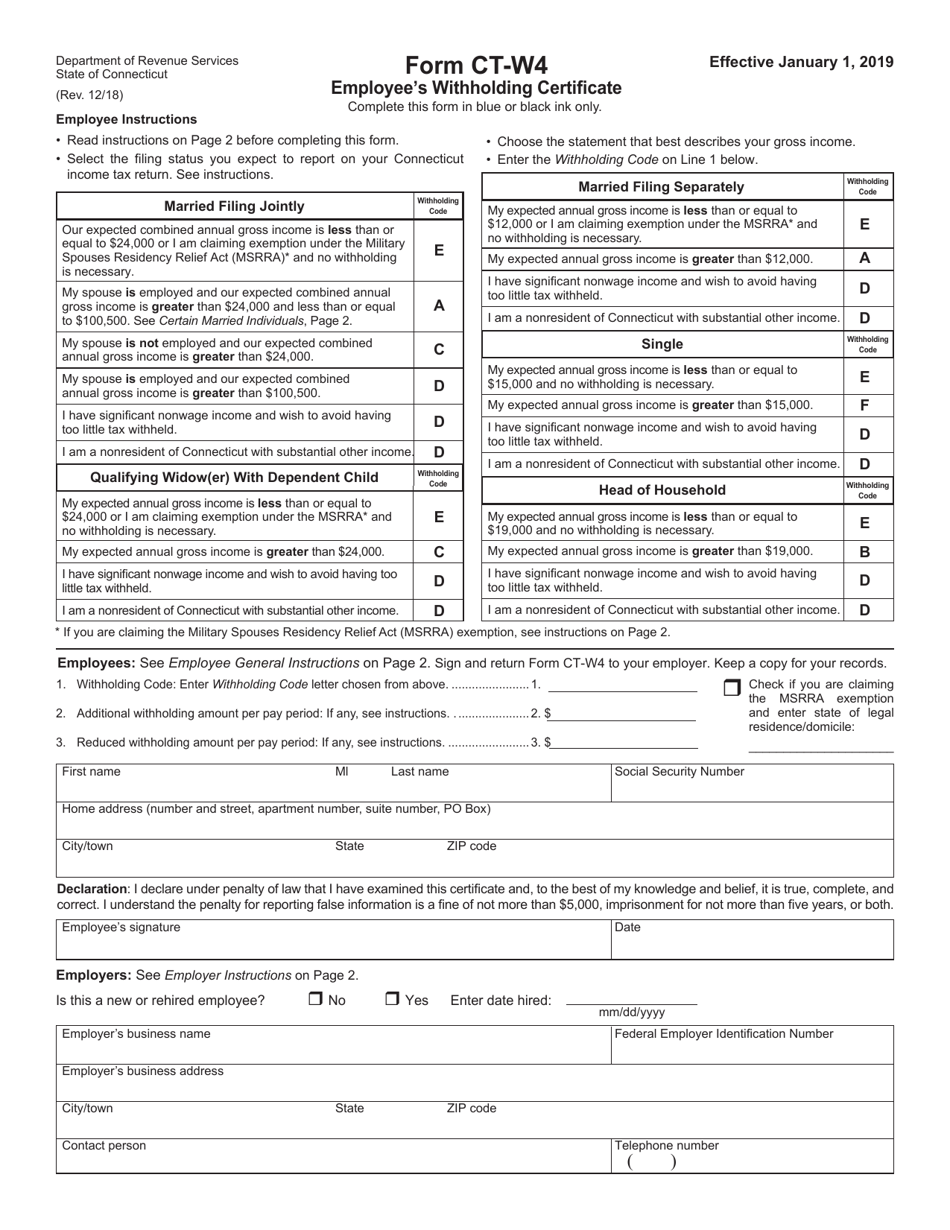

Form CTW4 Download Printable PDF or Fill Online Employee's Withholding

Withholding information for connecticut residents who work in another state. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Determine the total number of allowances field as follows: A, b, c, d, or f. 2022 connecticut annual reconciliation of.

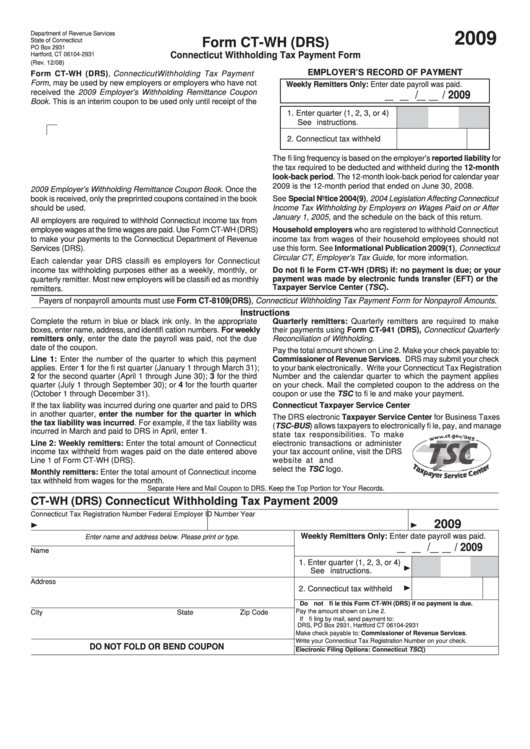

Form CtWh (Drs) Connecticut Withholding Tax Payment Form 2009

2023 connecticut withholding tax payment form for nonpayroll amounts. Determine the total number of allowances field as follows: A, b, c, d, or f. You are required to pay connecticut income tax as income is earned or received during the year. Who must complete a registration application and file a withholding tax return.

Employee's Withholding Certificate Connecticut Free Download

Determine the total number of allowances field as follows: You are required to pay connecticut income tax as income is earned or received during the year. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code: Withholding information for nonresidents who work in connecticut.

Connecticut State Withholding Form 2021 2022 W4 Form

You are required to pay connecticut income tax as income is earned or received during the year. Web state tax withholding state code: 2023 connecticut withholding tax payment form for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. Withholding information for connecticut residents who work in another state.

Connecticut State Tax Withholding Form 2022

2023 connecticut withholding tax payment form for nonpayroll amounts. You are required to pay connecticut income tax as income is earned or received during the year. Withholding information for nonresidents who work in connecticut. 2022 connecticut annual reconciliation of. Determine the total number of allowances field as follows:

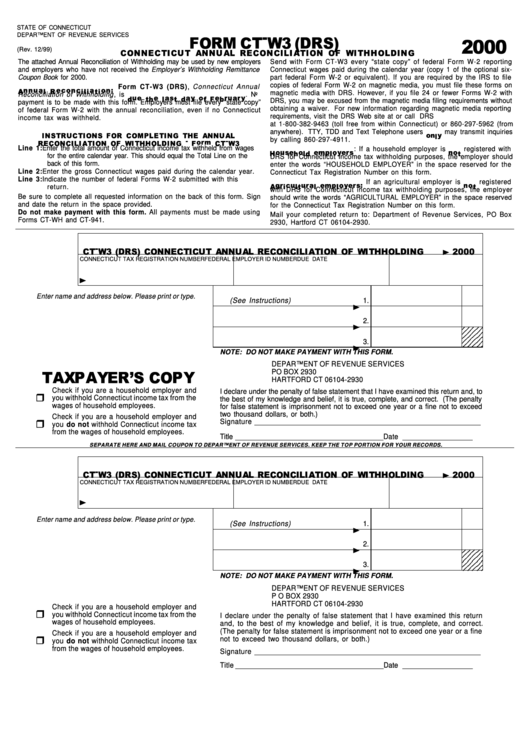

Form CtW3 (Drs) Connecticut Annual Reconciliation Of Withholding

2023 connecticut withholding tax payment form for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. A, b, c, d, or f. 2022 connecticut annual reconciliation of. You are required to pay connecticut income tax as income is earned or received during the year.

2023 Connecticut Withholding Tax Payment Form For Nonpayroll Amounts.

Web state tax withholding state code: Withholding information for nonresidents who work in connecticut. You are required to pay connecticut income tax as income is earned or received during the year. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts.

Withholding Information For Connecticut Residents Who Work In Another State.

Who must complete a registration application and file a withholding tax return. 2022 connecticut annual reconciliation of. Determine the total number of allowances field as follows: A, b, c, d, or f.