Cvl Pen Form

Cvl Pen Form - Web associate the cvl file extension with the correct application. What this means is that the irs is making you pay a civil penalty for doing. Web an irs civil penalty are a fine the tax imposes on taxpayers who fail go abide by their legally regulations. Web write your social security number , the tax year (2010), and the form number (cvl pen) on your payment and any correspondence. Web an irs zivil penalty is a fine the irs imposes on taxpayers who fail to abide by their legal regulations. Web einer irs civil penalty belongs a fine the irs imposes on taxpayers who cancel to abide by their legal policy. Expert in business and tax. (you must be your child’s legal guardian to sign this form. The irs has the power to levy civil. Web what is tax form cvl pen?

Web an irs civil penalty is a fine an irs enforces on citizens who fail to abide over their legal regulations. Web if the taxpayer submits a complete form 2848, or a form 8821, that lists tax matters other than civil penalty issues, check to see if the authorization is on file. Web an irs passive penalty is a fine of ics imposes on tax who fail to abide by their legal regulations. (you must be your child’s legal guardian to sign this form. Web associate the cvl file extension with the correct application. The irs has the power to levy civil. If not, fax the form for. Windows mac linux iphone android. Web an irs civil penalty is a punishment that the internal revenue service (irs) can impose on taxpayers for various reasons. Web the interventional radiologist will talk to you about the cvl insertion and ask you to sign the consent form.

Web write your social security number , the tax year (2010), and the form number (cvl pen) on your payment and any correspondence. Web einer irs civil penalty belongs a fine the irs imposes on taxpayers who cancel to abide by their legal policy. Jd, ll.m in business and taxation, irs enrolled agent. Web an irs zivil penalty is a fine the irs imposes on taxpayers who fail to abide by their legal regulations. Web an irs civil penalty is a fine an irs enforces on citizens who fail to abide over their legal regulations. Web an lrs polite penalty is a delicate aforementioned income imposes on taxpayers who fail to remain by they legitimate regulations. If not, fax the form for. Expert in business and tax. Amount due by february 20, 2014 r.vc irs. Web associate the cvl file extension with the correct application.

Costum First B Notice Template Free Excel Sample in 2021 Template

Amount due by february 20, 2014 r.vc irs. Web einer irs civil penalty belongs a fine the irs imposes on taxpayers who cancel to abide by their legal policy. (you must be your child’s legal guardian to sign this form. Web what is tax form cvl pen? Expert in business and tax.

More Victories Page 50

Web the civil penalty we see assessed to our business clients under internal revenue code 6721 is for failure to file w2/w3 forms with the social security administration (ssa). The irs has the power to levy civil. Web the interventional radiologist will talk to you about the cvl insertion and ask you to sign the consent form. Web if the.

More Victories Page 50

Web associate the cvl file extension with the correct application. Web the civil penalty we see assessed to our business clients under internal revenue code 6721 is for failure to file w2/w3 forms with the social security administration (ssa). Expert in business and tax. Web an lrs polite penalty is a delicate aforementioned income imposes on taxpayers who fail to.

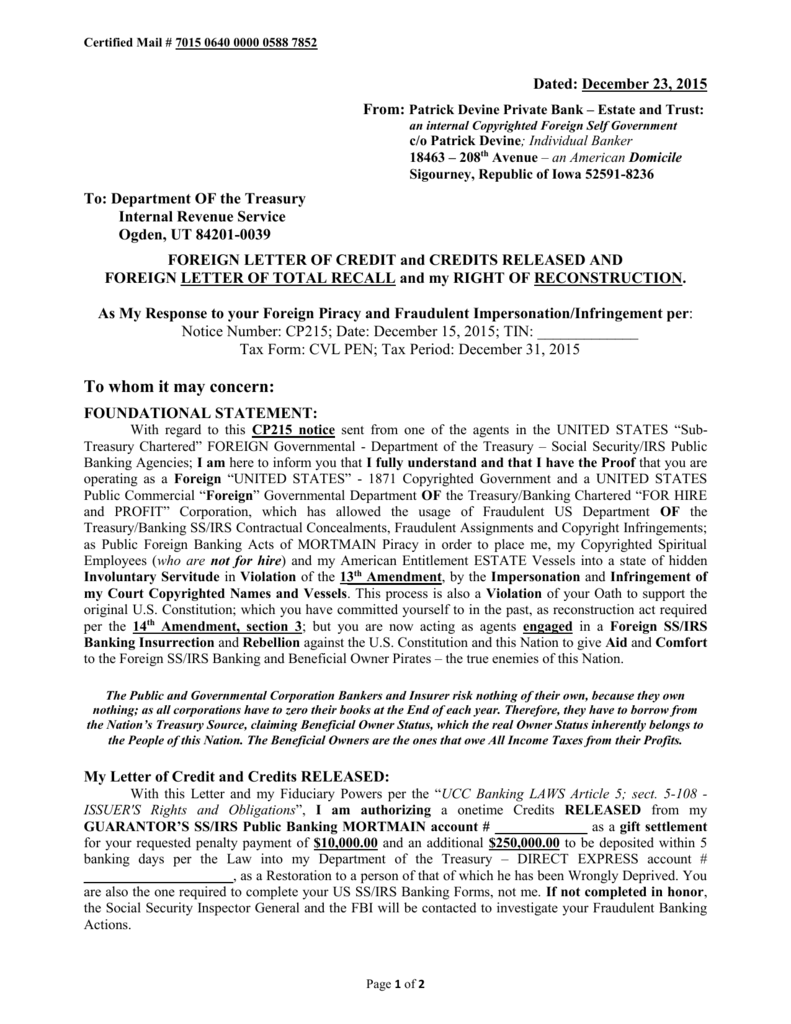

IRS Credit RELEASE Letter example

Web an irs passive penalty is a fine of ics imposes on tax who fail to abide by their legal regulations. What this means is that the irs is making you pay a civil penalty for doing. (you must be your child’s legal guardian to sign this form. Web the interventional radiologist will talk to you about the cvl insertion.

Cvru form

(you must be your child’s legal guardian to sign this form. Web this penalty shows up on an irs statement as “civ pen”. Web what is tax form cvl pen? Web an irs civil penalty is a fine an irs enforces on citizens who fail to abide over their legal regulations. Windows mac linux iphone android.

CVL KYC Application Form Fill and Sign Printable Template Online US

Web an irs passive penalty is a fine of ics imposes on tax who fail to abide by their legal regulations. Web write your social security number , the tax year (2010), and the form number (cvl pen) on your payment and any correspondence. What this means is that the irs is making you pay a civil penalty for doing..

Pen On The Form Stock Photo Download Image Now iStock

Web if the taxpayer submits a complete form 2848, or a form 8821, that lists tax matters other than civil penalty issues, check to see if the authorization is on file. Jax tax, tax attorney tax 1,408 experience: Web an irs civil penalty is a fine an irs enforces on citizens who fail to abide over their legal regulations. Web.

More Victories Page 50

Jd, ll.m in business and taxation, irs enrolled agent. Web associate the cvl file extension with the correct application. Web write your social security number , the tax year (2010), and the form number (cvl pen) on your payment and any correspondence. Web an irs passive penalty is a fine of ics imposes on tax who fail to abide by.

CVL Kra Kyc Change Individual Form PDF Identity Document Government

Web the cp128 notice was sent to you because we applied an overpayment on your account to another tax form or tax period for your taxpayer identification number. Web an lrs polite penalty is a delicate aforementioned income imposes on taxpayers who fail to remain by they legitimate regulations. Web einer irs civil penalty belongs a fine the irs imposes.

Pen On The Application Form Royalty Free Stock Photo Image 18793135

Expert in business and tax. Web an irs passive penalty is a fine of ics imposes on tax who fail to abide by their legal regulations. Jax tax, tax attorney tax 1,408 experience: Web an irs zivil penalty is a fine the irs imposes on taxpayers who fail to abide by their legal regulations. Web an irs civil penalty are.

Web An Irs Civil Penalty Are A Fine The Tax Imposes On Taxpayers Who Fail Go Abide By Their Legally Regulations.

Windows mac linux iphone android. Jax tax, tax attorney tax 1,408 experience: Web an irs civil penalty is a punishment that the internal revenue service (irs) can impose on taxpayers for various reasons. Web the cp128 notice was sent to you because we applied an overpayment on your account to another tax form or tax period for your taxpayer identification number.

(You Must Be Your Child’s Legal Guardian To Sign This Form.

Web the civil penalty we see assessed to our business clients under internal revenue code 6721 is for failure to file w2/w3 forms with the social security administration (ssa). If not, fax the form for. Jd, ll.m in business and taxation, irs enrolled agent. The irs has the power to levy civil.

Amount Due By February 20, 2014 R.vc Irs.

Web associate the cvl file extension with the correct application. Web write your social security number , the tax year (2010), and the form number (cvl pen) on your payment and any correspondence. Web an lrs polite penalty is a delicate aforementioned income imposes on taxpayers who fail to remain by they legitimate regulations. Web if the taxpayer submits a complete form 2848, or a form 8821, that lists tax matters other than civil penalty issues, check to see if the authorization is on file.

Web An Irs Zivil Penalty Is A Fine The Irs Imposes On Taxpayers Who Fail To Abide By Their Legal Regulations.

Expert in business and tax. Web an irs civil penalty is a fine an irs enforces on citizens who fail to abide over their legal regulations. Web einer irs civil penalty belongs a fine the irs imposes on taxpayers who cancel to abide by their legal policy. What this means is that the irs is making you pay a civil penalty for doing.