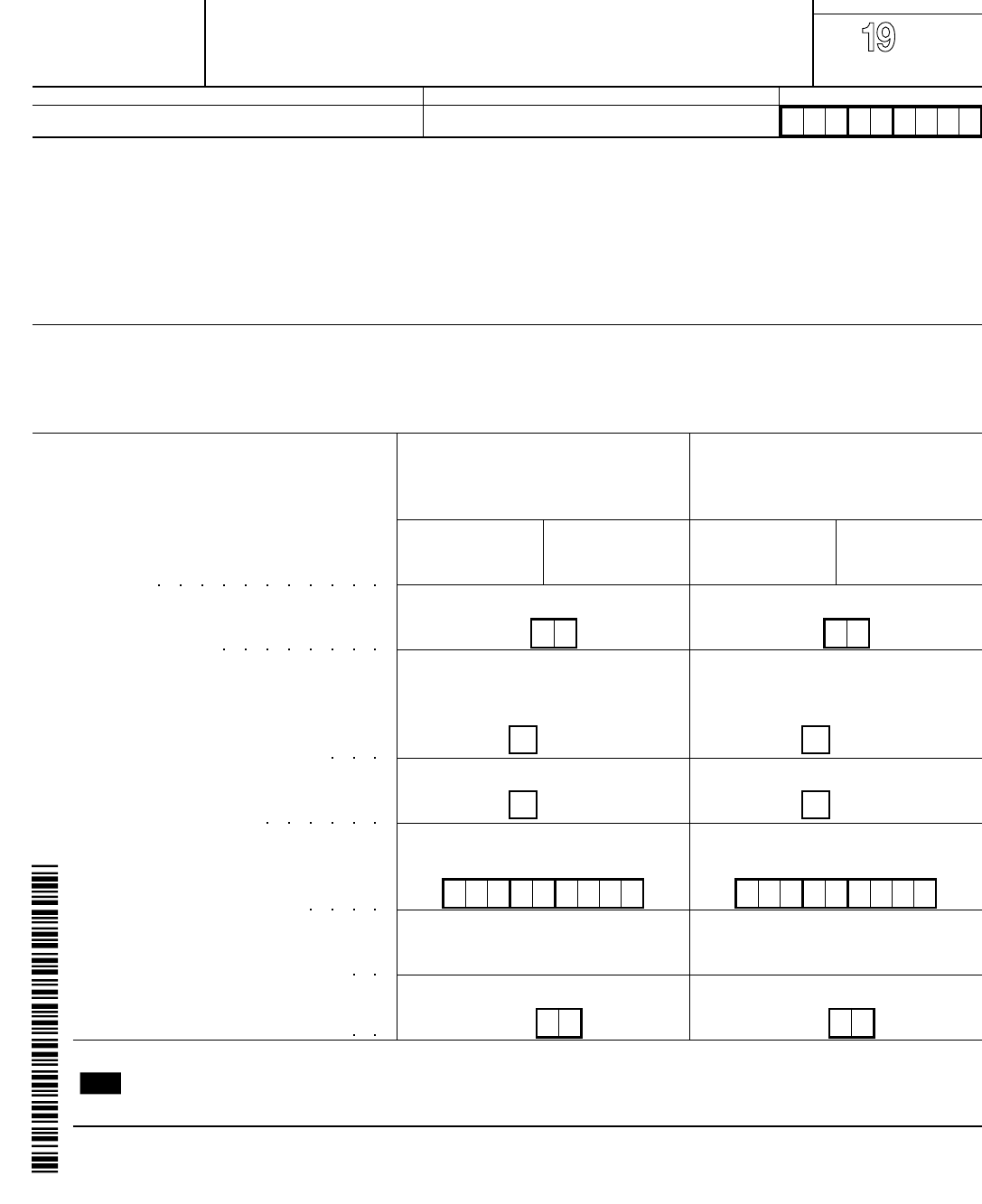

Eic Form 15112

Eic Form 15112 - “please place a check mark if this describes you: I completed taxes for my mother back in february 2022 (i've done them for her every year) and noticed the website (freetaxusa.com) did not add in eic. By law, the irs cannot. Web fill online, printable, fillable, blank form 15112: The credit may give you a refund even if you do not owe any tax. Web my form 15112 that i sent them was dated march 24. Web first time filing taxes. If you are eligible for the credit. I had a principle place of. Web to claim the earned income tax credit (eitc), you must qualify and file a federal tax return.

If you are eligible for the credit. Web first time filing taxes. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. First, review your form 1040 as filed with the irs. Mail the signed form 15112 in the. I had a principle place of. If you qualify, you can use the credit to reduce the taxes you. I'm not sure what the difference between federal/state tax refund and eic refund is. Current revision publication 596 pdf ( html | ebook epub ) Web to claim the earned income tax credit (eitc), you must qualify and file a federal tax return.

Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. I had a principle place of. I completed taxes for my mother back in february 2022 (i've done them for her every year) and noticed the website (freetaxusa.com) did not add in eic. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. Web first time filing taxes. If you are eligible for the credit. Web to claim the earned income tax credit (eitc), you must qualify and file a federal tax return. Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent on another person's return,. When i filled out my tax returns, i provided my bank account details so i. The credit may give you a refund even if you do not owe any tax.

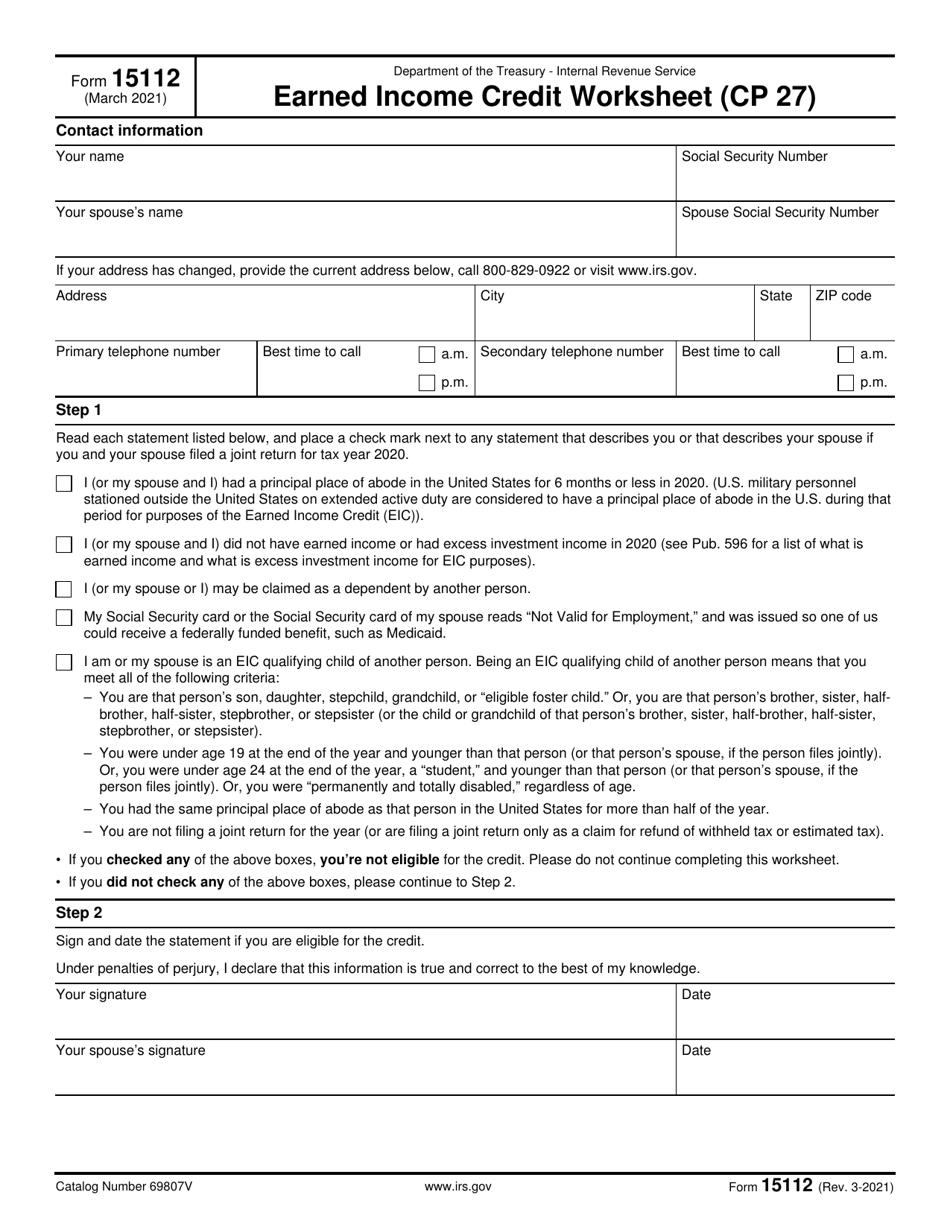

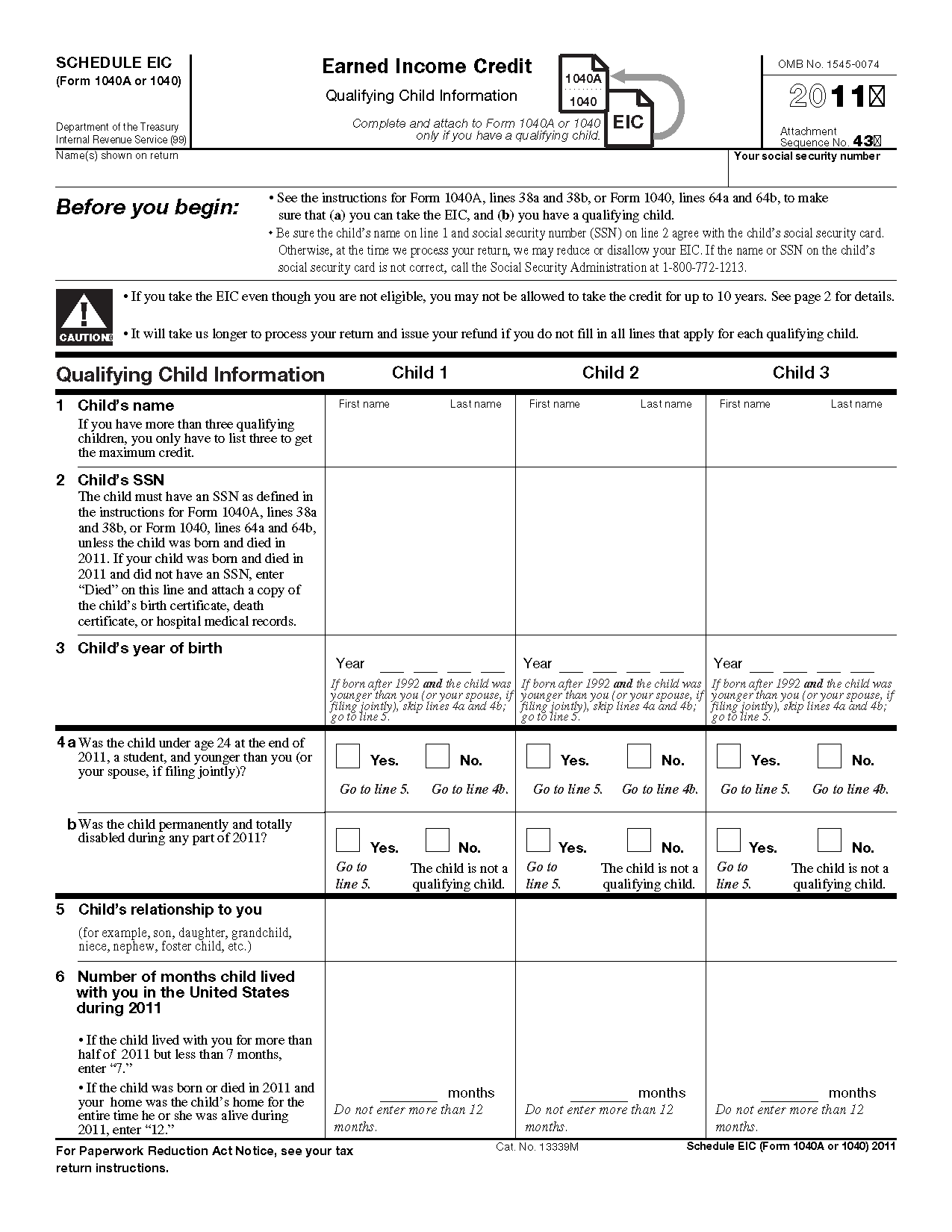

1996 Form 1040 (Schedule Eic) Edit, Fill, Sign Online Handypdf

Sign and date form 15112. Mail the signed form 15112 in the. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. Web to claim the earned income tax credit (eitc), you must qualify and file a.

Form 15112 I got a notice from IRS to sign and date Form 15112. But

When i filled out my tax returns, i provided my bank account details so i. First, review your form 1040 as filed with the irs. If you qualify, you can use the credit to reduce the taxes you. Web to claim the earned income tax credit (eitc), you must qualify and file a federal tax return. Web what is earned.

social security worksheet 2022

Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. “please place a check mark if this describes you: I completed taxes for my mother back in february 2022 (i've done them for her every year) and noticed the website (freetaxusa.com) did not add in eic. Mail the signed.

what is Form 1040 (Schedule EIC) Fill Online, Printable, Fillable

Use fill to complete blank online irs pdf forms for. By law, the irs cannot. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Web to claim the earned income tax credit (eitc), you must qualify and file a federal tax return. Web respond to notice cp27.

Fill Free fillable F1040sei 2019 Schedule EIC (Form 1040 or 1040SR

Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. “please place a check mark if this describes you: Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. Web for most years, you can claim the eitc.

Eic Tax Table 2017 Matttroy

Sign and date form 15112. Web fill online, printable, fillable, blank form 15112: The purpose of the eic is to reduce the tax burden and to. If you qualify, you can use the credit to reduce the taxes you. I'm not sure what the difference between federal/state tax refund and eic refund is.

Form 1040 Schedule EIC Earned Credit 1040 Form Printable

Your refund if you claim the eitc, your refund may be delayed. I'm not sure what the difference between federal/state tax refund and eic refund is. Current revision publication 596 pdf ( html | ebook epub ) Earned income credit worksheet (cp 27) (irs) form. Web first time filing taxes.

Help Form 15112 EIC CP27 r/IRS

Earned income credit worksheet (cp 27) (irs) form. Mail the signed form 15112 in the. By law, the irs cannot. Web fill online, printable, fillable, blank form 15112: The eic is a credit for certain people who work and have earned income.

2013 Form IRS 1040 Schedule EIC Fill Online, Printable, Fillable

Earned income credit worksheet (cp 27) (irs) form. I had a principle place of. When i filled out my tax returns, i provided my bank account details so i. Web respond to notice cp27. Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent.

Irs Schedule Eic Instructions 2022

Web my form 15112 that i sent them was dated march 24. If you are eligible for the credit. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. First, review your form 1040 as filed with.

Your Refund If You Claim The Eitc, Your Refund May Be Delayed.

If you qualify, you can use the credit to reduce the taxes you. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. When i filled out my tax returns, i provided my bank account details so i. Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me.

“Please Place A Check Mark If This Describes You:

Web what is earned income credit (eic)? Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Earned income credit worksheet (cp 27) (irs) form.

The Purpose Of The Eic Is To Reduce The Tax Burden And To.

Web first time filing taxes. You do not fix it in your return. If you are eligible for the credit. Use fill to complete blank online irs pdf forms for.

By Law, The Irs Cannot.

Web fill online, printable, fillable, blank form 15112: I completed taxes for my mother back in february 2022 (i've done them for her every year) and noticed the website (freetaxusa.com) did not add in eic. Current revision publication 596 pdf ( html | ebook epub ) The credit may give you a refund even if you do not owe any tax.