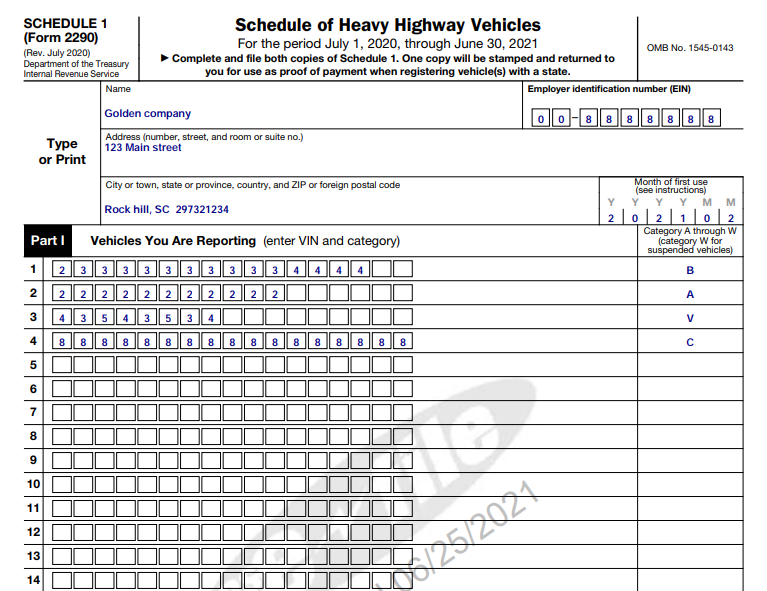

Federal Form 2290 Schedule 1

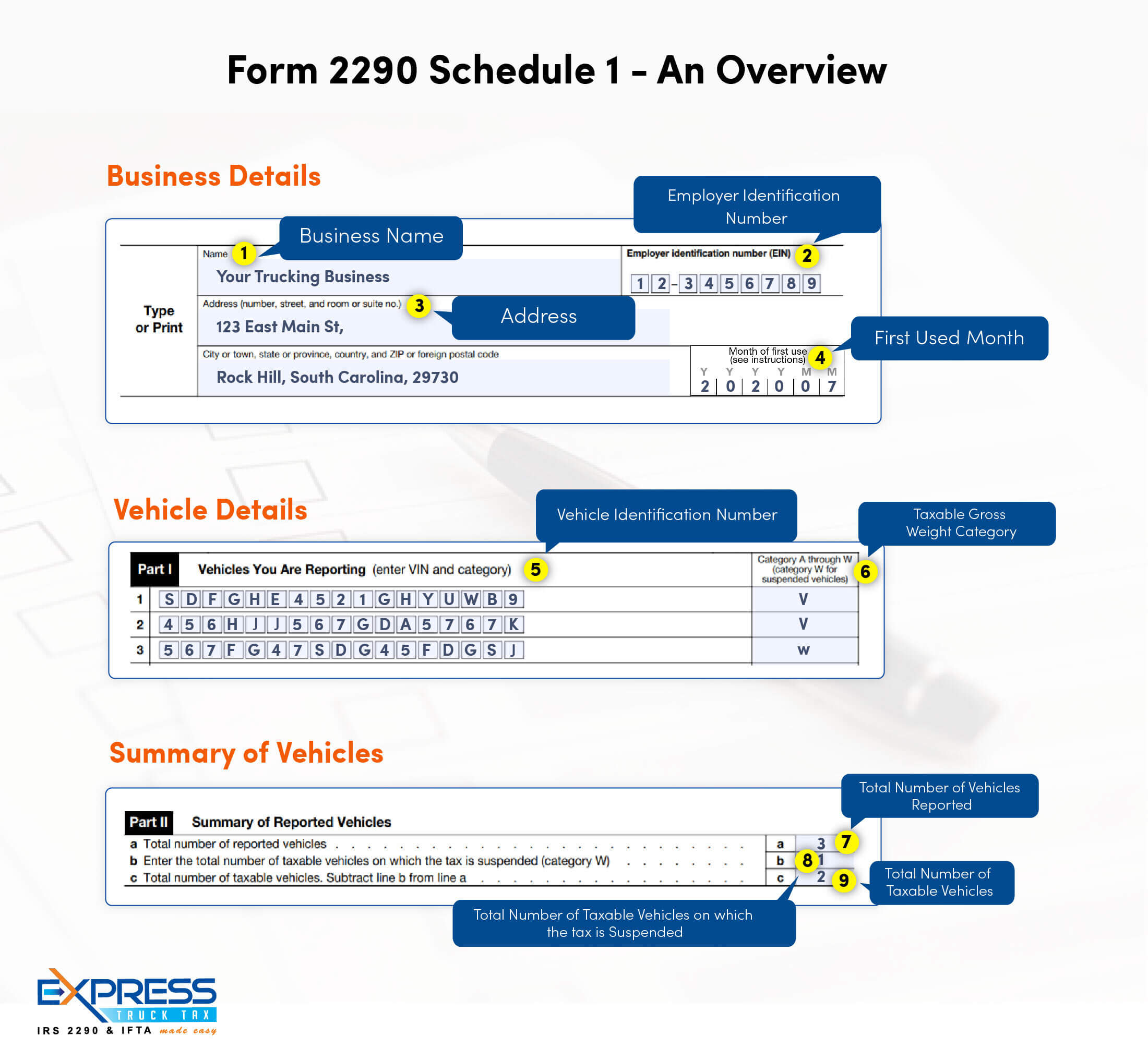

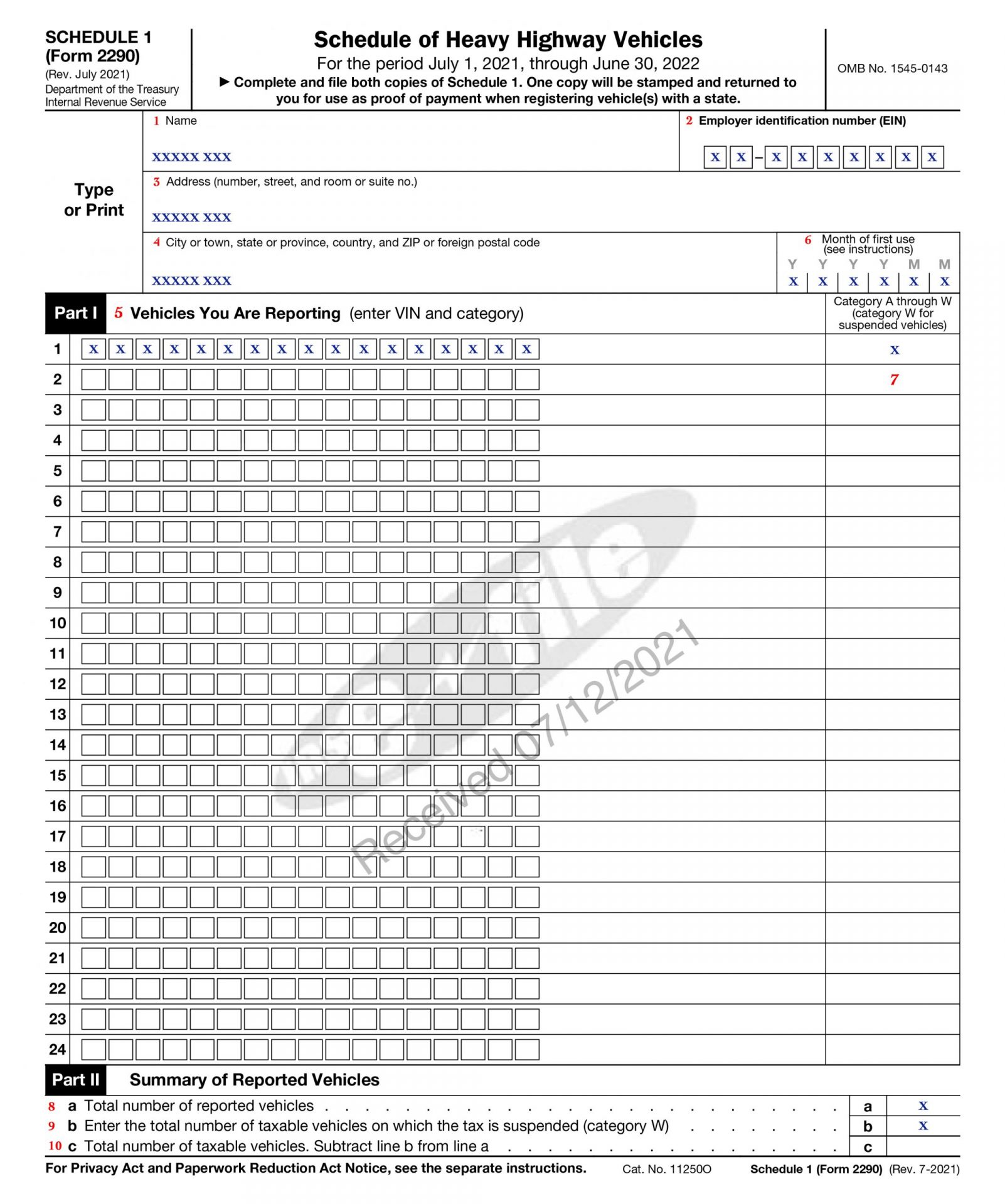

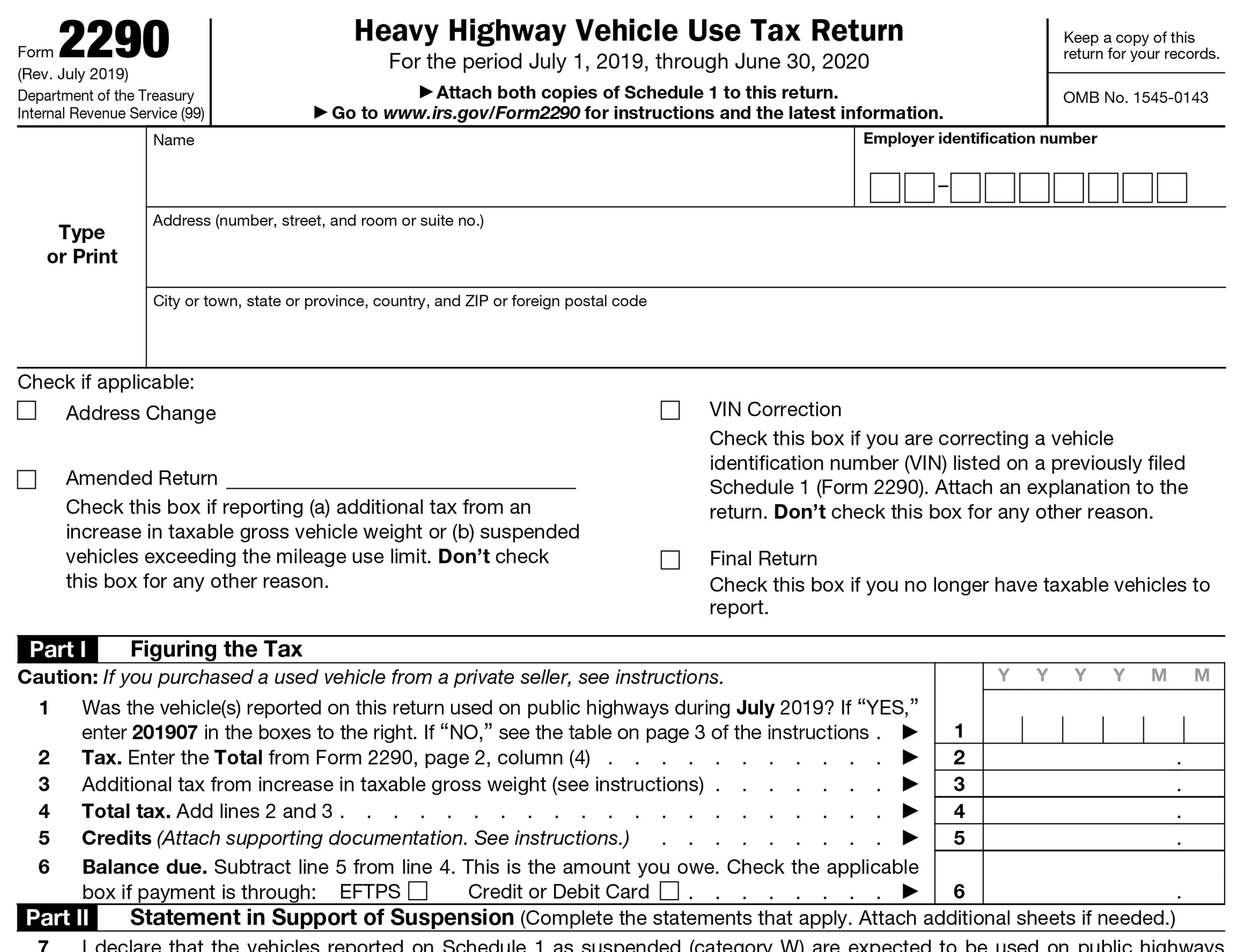

Federal Form 2290 Schedule 1 - Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. See month of first use under schedule 1 (form 2290) ,. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. You can choose to use v version as a payment voucher. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads.

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Provide consent to tax information disclosure as part of schedule 1. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the period and the vehicle h. Keep a copy of this return for your records. Web schedule 1 (form 2290)—month of first use. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

See when to file form 2290 for more details. Provide consent to tax information disclosure as part of schedule 1. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. You can choose to use v version as a payment voucher. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. Keep a copy of this return for your records. Web go to www.irs.gov/form2290 for instructions and the latest information. This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the period and the vehicle h.

Federal Form 2290 Schedule 1 Universal Network

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web go to www.irs.gov/form2290 for instructions and the latest information. Keep a copy of this return for your records. See when to file form 2290 for more details. Web you must file form 2290 and schedule 1 for.

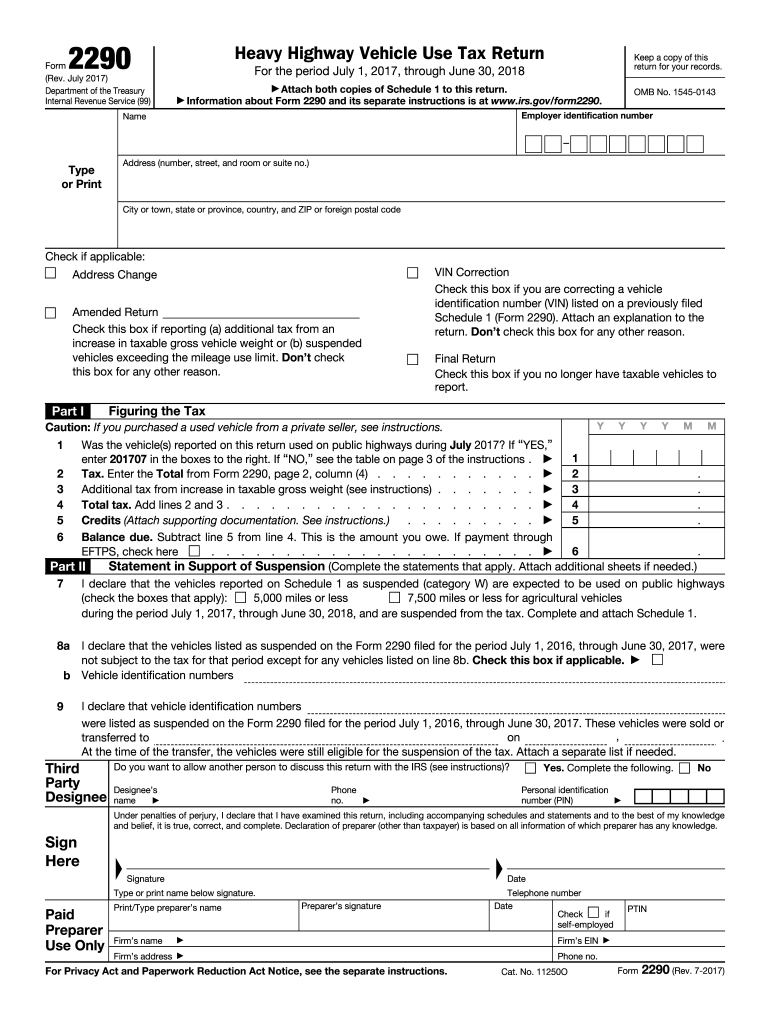

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

You can choose to use v version as a payment voucher. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. Web schedule 1 form.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Web schedule 1 (form 2290)—month of first use. Web you.

Understanding Form 2290 StepbyStep Instructions for 20222023

Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. You can choose to use v version as a payment voucher. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. See when to.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. Web schedule 1 (form 2290)—month of first use. Web file form 2290 for any.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Web schedule 1 form 2290 acts as proof of highway tax paid to the irs for operating vehicles weighing 55,000 pounds or more. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Form 2290 filers must enter the month of first use in schedule 1 to indicate.

Printable IRS Form 2290 for 2020 Download 2290 Form

This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. You can choose to use v version as a payment voucher. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. Form 2290 is used to figure and pay the tax due on.

A Guide to Form 2290 Schedule 1

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. See month of first use under schedule 1 (form 2290) ,. Web you must file form 2290 and schedule 1 for the.

Free Printable Form 2290 Printable Templates

Keep a copy of this return for your records. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law.

File IRS 2290 Form Online for 20222023 Tax Period

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if.

Keep A Copy Of This Return For Your Records.

Web go to www.irs.gov/form2290 for instructions and the latest information. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You can choose to use v version as a payment voucher.

Web File Form 2290 For Any Taxable Vehicles First Used On A Public Highway During Or After July 2022 By The Last Day Of The Month Following The Month Of First Use.

Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. See month of first use under schedule 1 (form 2290) ,. Web schedule 1 (form 2290)—month of first use. Web schedule 1 form 2290 acts as proof of highway tax paid to the irs for operating vehicles weighing 55,000 pounds or more.

Provide Consent To Tax Information Disclosure As Part Of Schedule 1.

See when to file form 2290 for more details. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file.

Web Complete And File Two Copies Of Schedule 1, Schedule Of Heavy Highway Vehicles.

Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the period and the vehicle h. This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads.