Form 1041 2022

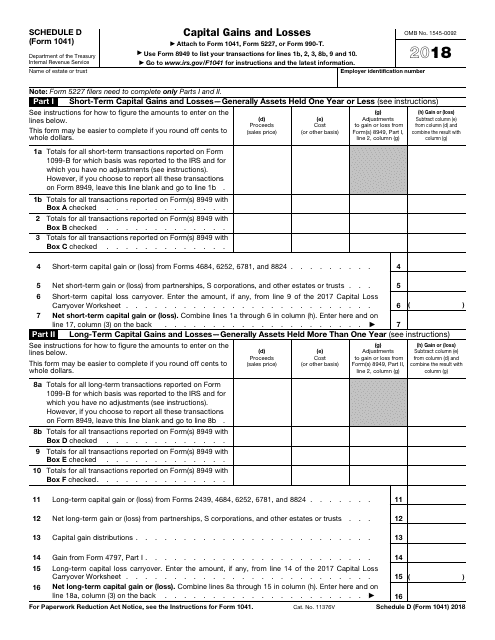

Form 1041 2022 - Complete part iv of the first amt form 1116 only. However, the estate or trust must show its 2023 tax year on the 2022 form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2022. Name of estate or trust Attach to the estate's or trust's return all amt forms 1116 (and if applicable schedule b (form 1116)) you used to figure your amt foreign tax credit. Enter on line 51 of schedule i (form 1041) the amount from line 35 of the first amt form 1116. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Estates and trusts follow their own tax rates and income brackets, which are indexed for inflation each tax year. Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax return. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Web gross income for 2021 or 2022 is from farming or fishing, do one of the following.

Web information about form 1041, u.s. Income tax return for estates and trusts. Name of estate or trust Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Enter on line 51 of schedule i (form 1041) the amount from line 35 of the first amt form 1116. • file form 1041 for 2022 by march 1, 2023, and pay the total tax due. The tax rates and brackets are not the same as estate tax thresholds and exemptions. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. However, the estate or trust must show its 2023 tax year on the 2022 form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2022. Estates and trusts follow their own tax rates and income brackets, which are indexed for inflation each tax year.

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. • pay the total estimated tax (line 16 of the 2022 estimated tax worksheet) by january 17, 2023. Web go to www.irs.gov/form1041 for instructions and the latest information. Enter on line 51 of schedule i (form 1041) the amount from line 35 of the first amt form 1116. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. For instructions and the latest information. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Return to life cycle of a private foundation. • file form 1041 for 2022 by march 1, 2023, and pay the total tax due. Web information about form 1041, u.s.

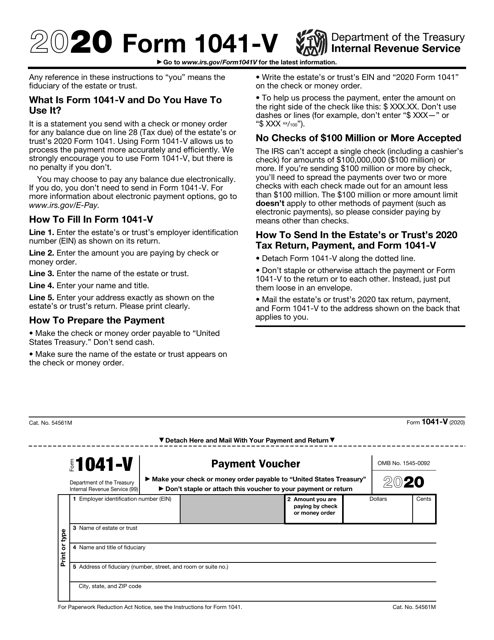

IRS Form 1041V Download Fillable PDF or Fill Online Payment Voucher

• pay the total estimated tax (line 16 of the 2022 estimated tax worksheet) by january 17, 2023. Web estates and trusts are taxed on the income they earn and are required to file irs form 1041, the u.s. Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax return..

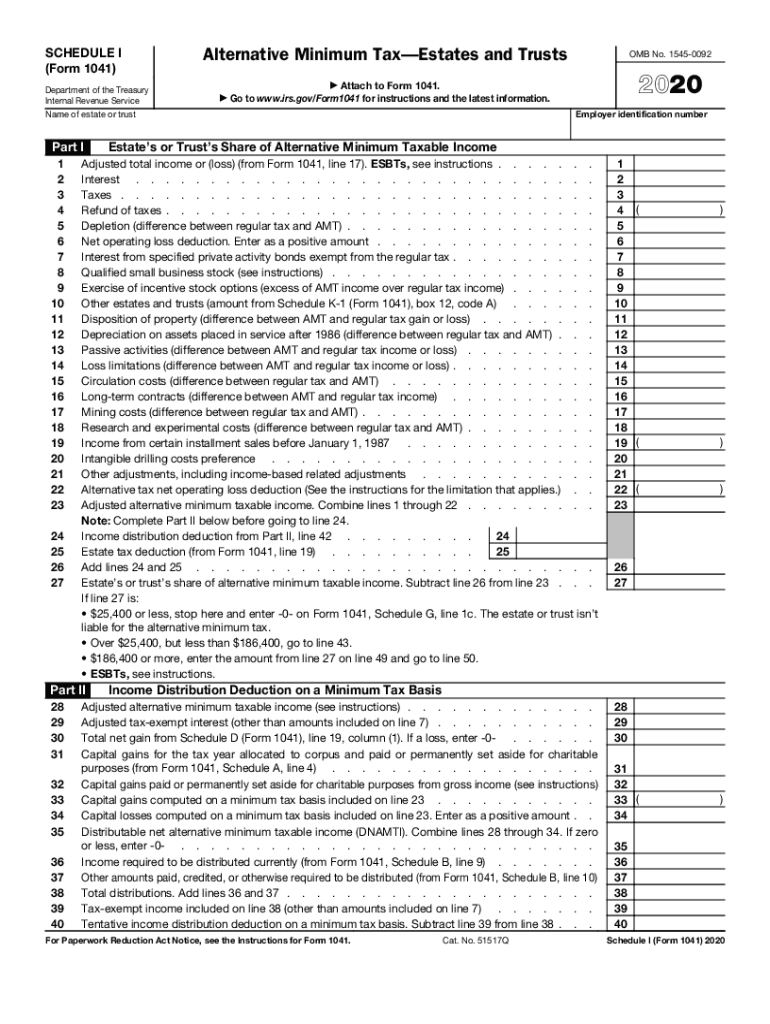

Irs Shedule I Form Fill Out and Sign Printable PDF Template signNow

Web go to www.irs.gov/form1041 for instructions and the latest information. • pay the total estimated tax (line 16 of the 2022 estimated tax worksheet) by january 17, 2023. Income tax return for estates and trusts. Return to life cycle of a private foundation. In this case, don’t make estimated tax payments for 2022.

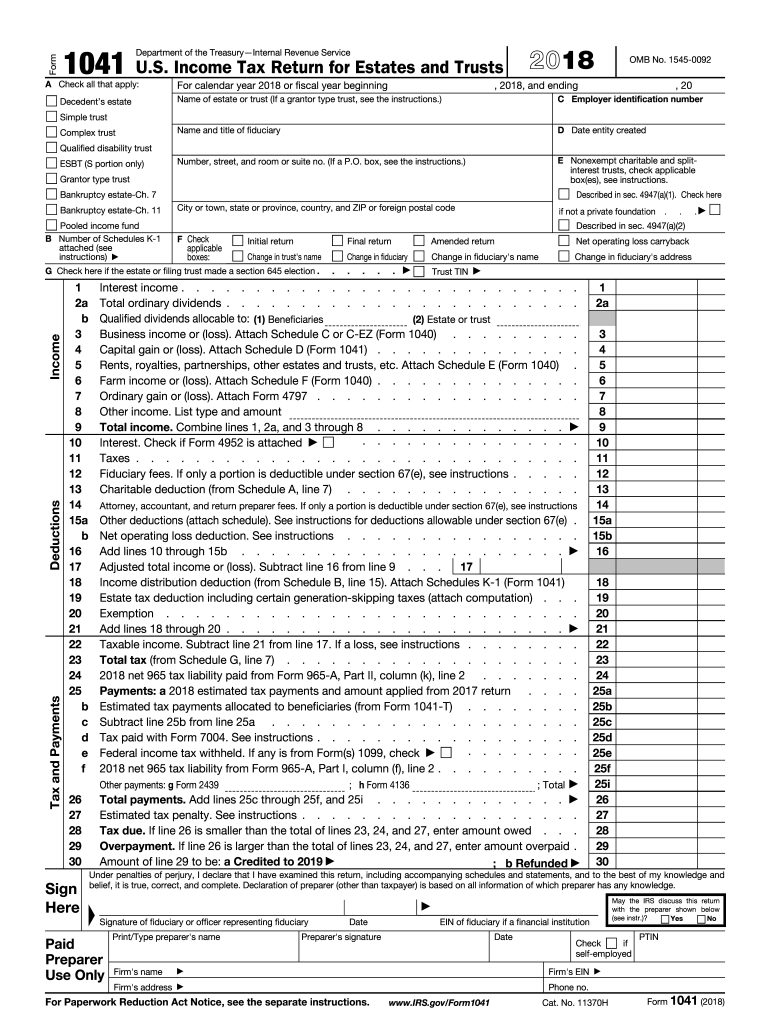

Form Instructions 1041 (Schedule K1) and Form 1041 Main Differences

Name of estate or trust • pay the total estimated tax (line 16 of the 2022 estimated tax worksheet) by january 17, 2023. Web gross income for 2021 or 2022 is from farming or fishing, do one of the following. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross.

irs form 1041 Fill out & sign online DocHub

In this case, don’t make estimated tax payments for 2022. However, the estate or trust must show its 2023 tax year on the 2022 form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2022. Web gross income for 2021 or 2022 is from farming or fishing, do one of the following. Income tax.

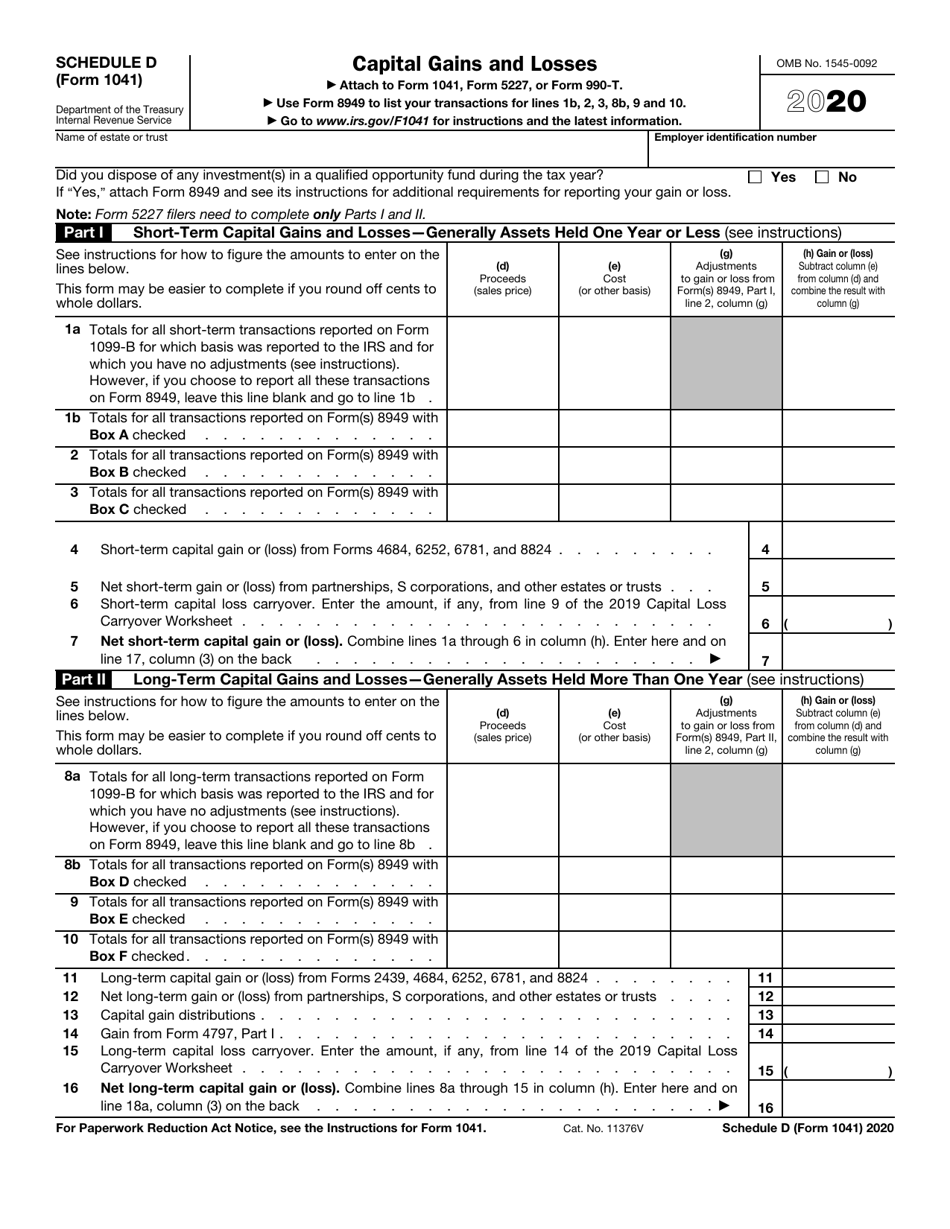

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Web gross income for 2021 or 2022 is from farming or fishing, do one of the following. Name of estate or trust Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross income for.

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross income for 2022 and 2023 is from farming or fishing). Web information about form 1041, u.s. Attach to the estate's or trust's return all.

IRS Form 1041 Download Printable PDF 2018, Beneficiary's Share of

Estates and trusts follow their own tax rates and income brackets, which are indexed for inflation each tax year. In this case, don’t make estimated tax payments for 2022. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Form 1041.

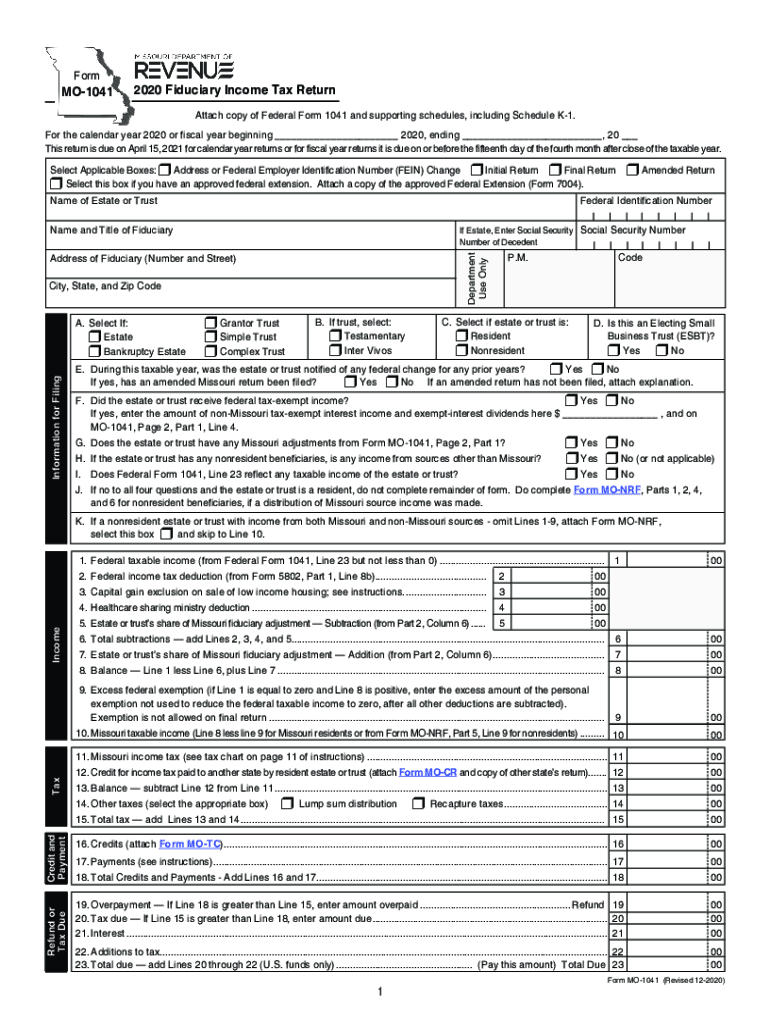

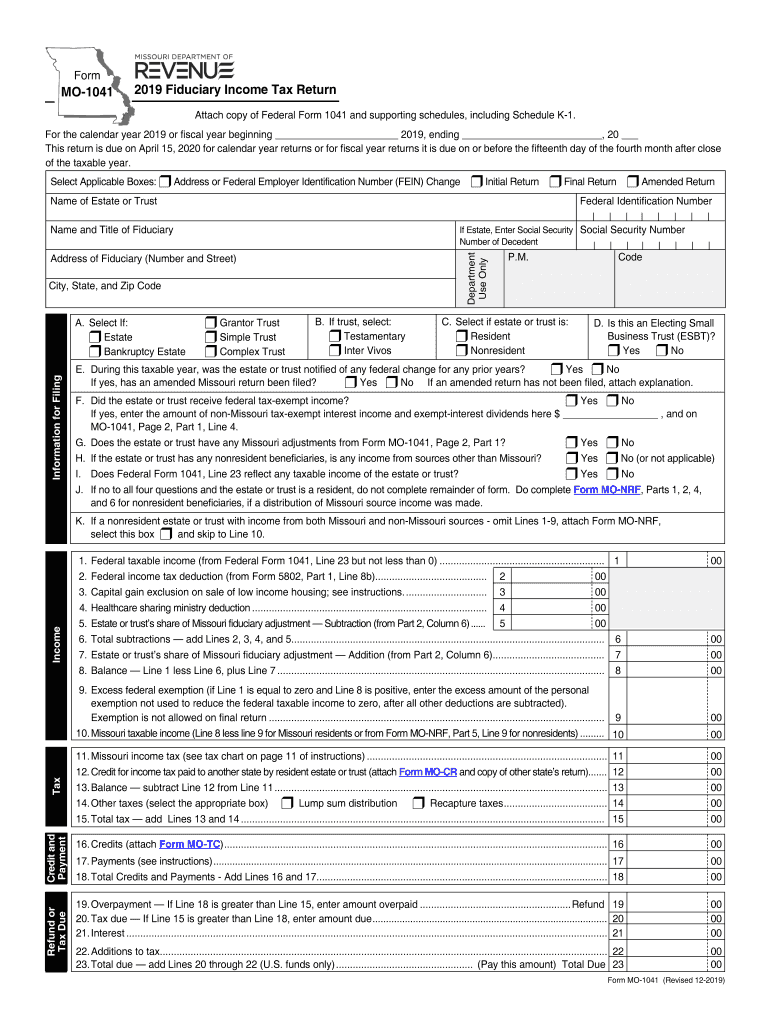

Mo 1041 Instructions Fill Out and Sign Printable PDF Template signNow

Web a trust or estate with a tax year that ends june 30 must file by october 15 of the same year. Enter on line 51 of schedule i (form 1041) the amount from line 35 of the first amt form 1116. In this case, don’t make estimated tax payments for 2022. Web information about form 1041, u.s. Web the.

Missouri Form 1041 Fill Out and Sign Printable PDF Template signNow

Name of estate or trust Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web gross income for 2021 or 2022 is from farming or fishing, do one of the following. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before.

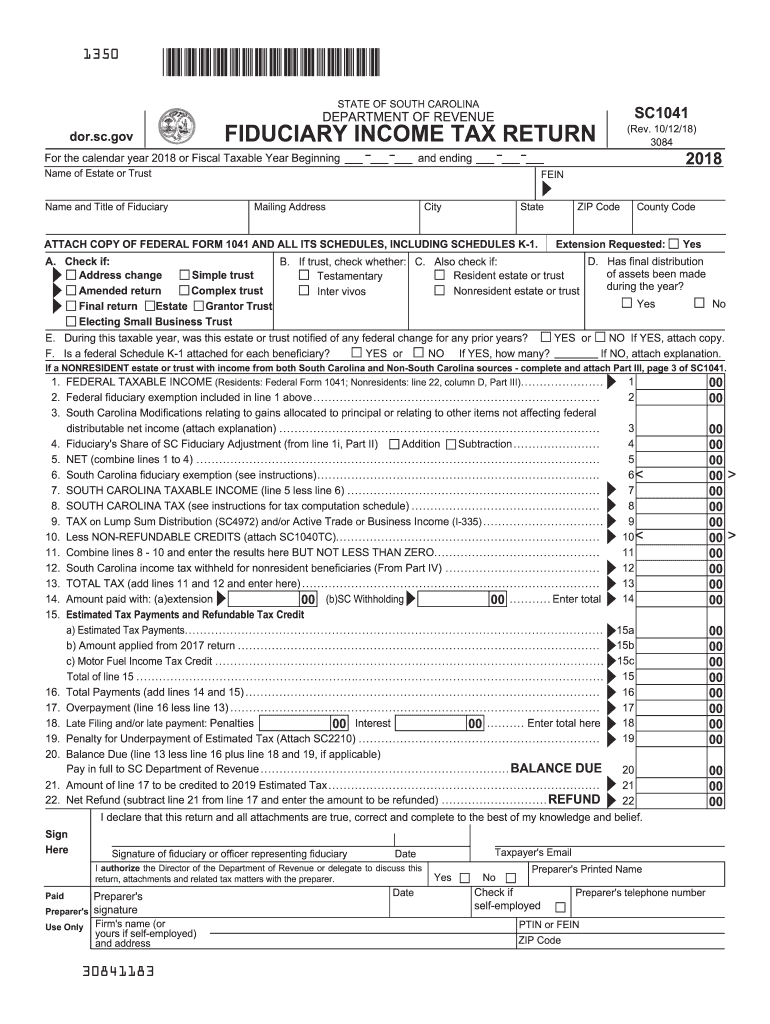

Sc 1041 Fill Out and Sign Printable PDF Template signNow

Return to life cycle of a private foundation. However, the estate or trust must show its 2023 tax year on the 2022 form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2022. The tax rates and brackets are not the same as estate tax thresholds and exemptions. Name of estate or trust Estates.

For Instructions And The Latest Information.

Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. In this case, don’t make estimated tax payments for 2022. Estates and trusts follow their own tax rates and income brackets, which are indexed for inflation each tax year. The tax rates and brackets are not the same as estate tax thresholds and exemptions.

Return To Life Cycle Of A Private Foundation.

However, the estate or trust must show its 2023 tax year on the 2022 form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2022. Attach to the estate's or trust's return all amt forms 1116 (and if applicable schedule b (form 1116)) you used to figure your amt foreign tax credit. Web estates and trusts are taxed on the income they earn and are required to file irs form 1041, the u.s. Web a trust or estate with a tax year that ends june 30 must file by october 15 of the same year.

• File Form 1041 For 2022 By March 1, 2023, And Pay The Total Tax Due.

Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax return. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Web go to www.irs.gov/form1041 for instructions and the latest information.

Name Of Estate Or Trust

Enter on line 51 of schedule i (form 1041) the amount from line 35 of the first amt form 1116. • pay the total estimated tax (line 16 of the 2022 estimated tax worksheet) by january 17, 2023. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross income for 2022 and 2023 is from farming or fishing).