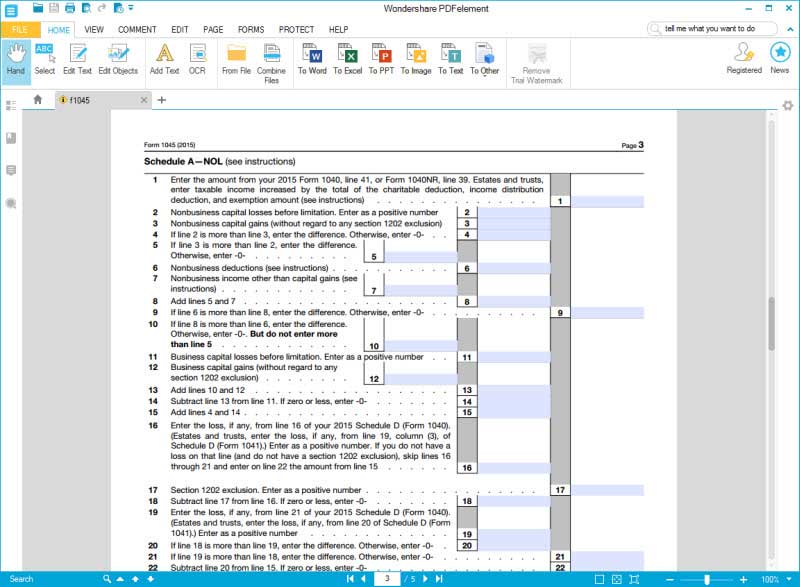

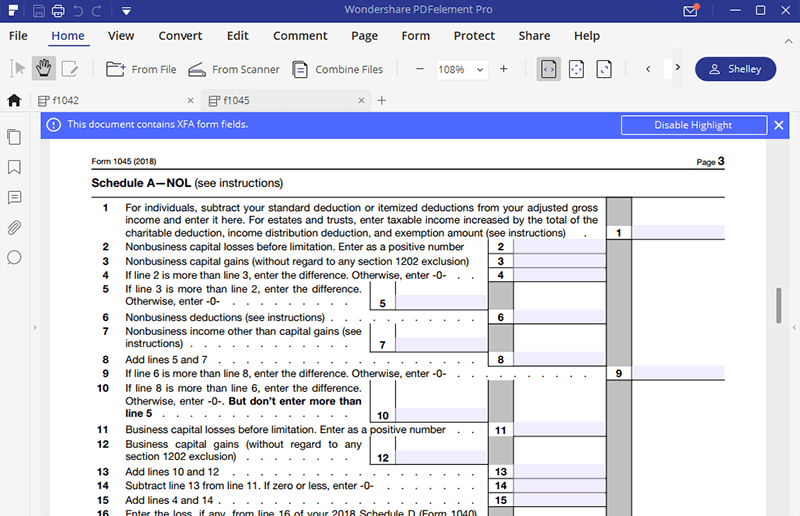

Form 1045 Schedule A

Form 1045 Schedule A - Web attach a computation of your nol using schedule a (form 1045) and, if it applies, your nol carryover using schedule b (form 1045), discussed later. If the amount is less than the overall net operating loss,. Web to figure a charitable contribution deduction, do not include deductions for nol carrybacks in the change in (1) but do include deductions for nol carryforwards from tax years. What is irs form 1045? Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Ad access irs tax forms. Web federal form 1040x or federal form 1045, and federal examining officer’s reports, including preliminary, revised, a copy of your federal form 1045 schedule b for an nol. Those with a negative balance on form. See how to use form 1040x. Instructions for this form can be found in the ohio individual income and school district income tax.

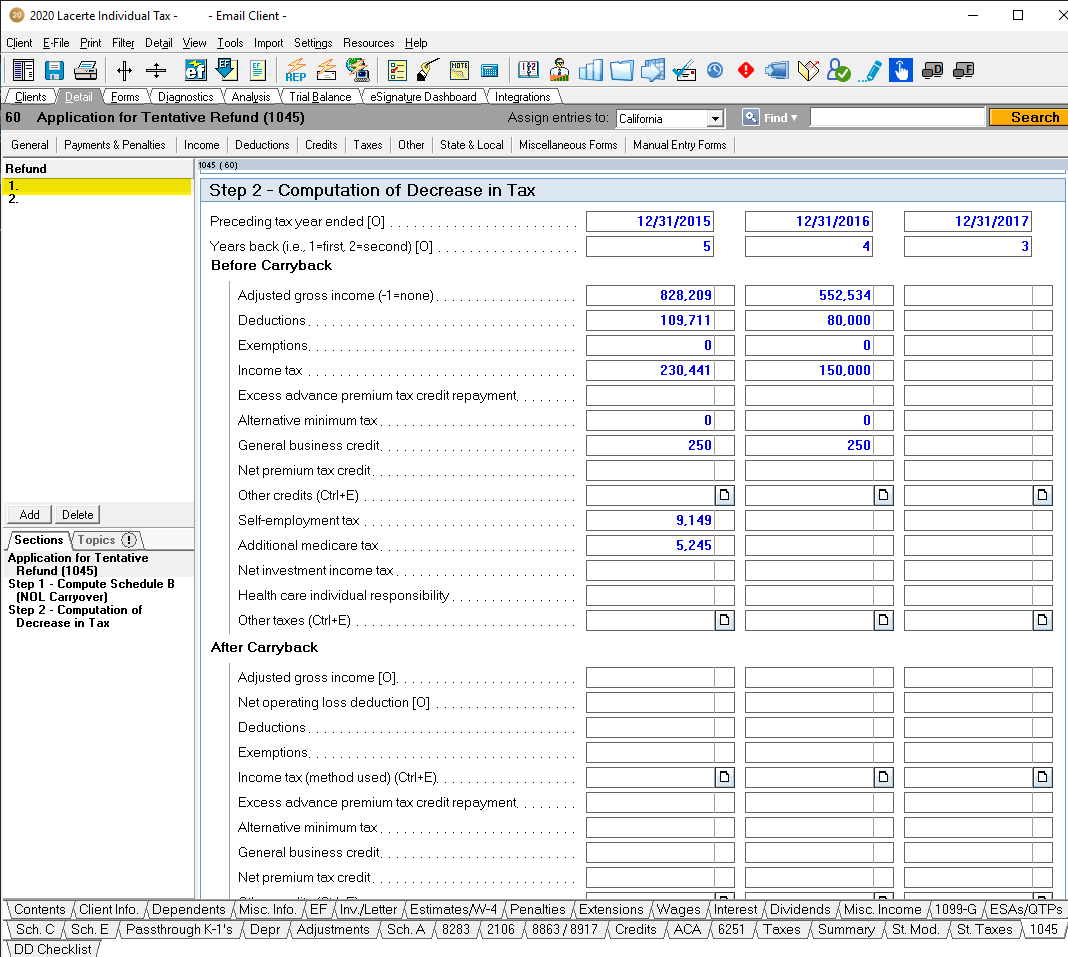

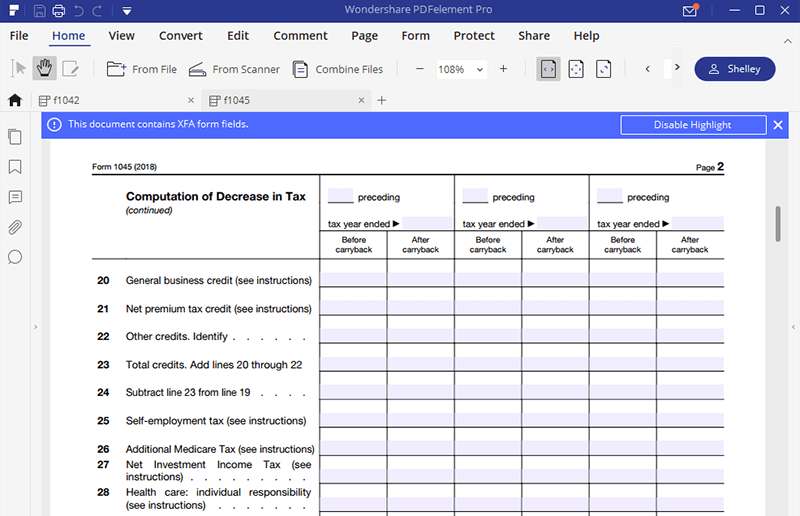

Web form 1045, schedule a (see instructions). Line 1 flows from form 1040, line 11 minus line 12 (form 1040, line 9 minus line 8b in. Get ready for tax season deadlines by completing any required tax forms today. The irs form 1045 is also known as the application for. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Go to the 1045 screen in the 1045 & nol folder. Refer to irs instructions for form 1045 for additional information about where. Web if you are reporting a tax loss carryforward for a year, use irs form 1045, schedule b to calculate the loss, then add it to your tax return. Mark the farm loss carryback. Web follow these steps to complete form 1045, application for tentative refund.

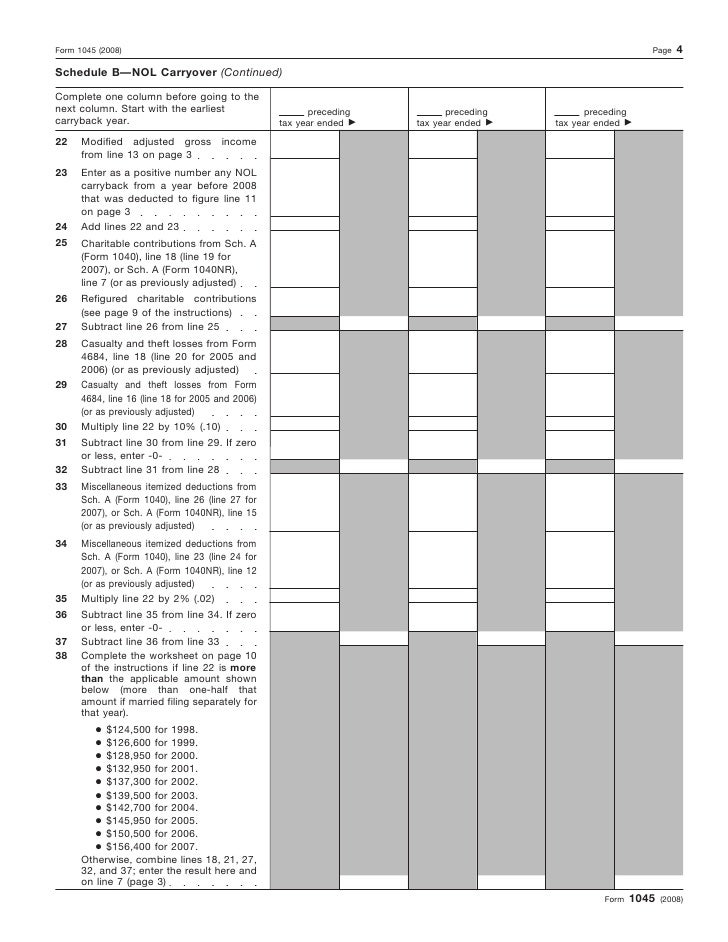

Web this article covers nol carrybacks on form 1045. Is there a maximum loss. Web federal form 1040x or federal form 1045, and federal examining officer’s reports, including preliminary, revised, a copy of your federal form 1045 schedule b for an nol. If the amount is less than the overall net operating loss,. Determine the amount of net operating loss. Mark the farm loss carryback. Web follow these steps to complete form 1045, application for tentative refund. Web complete this form once. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Web follow these steps to complete form 1045, application for tentative refund. Go to the 1045 screen in the 1045 & nol folder. Is there a maximum loss. And include a copy with each amended return. Web complete this form once.

IRS Form 1045 Fill it as You Want

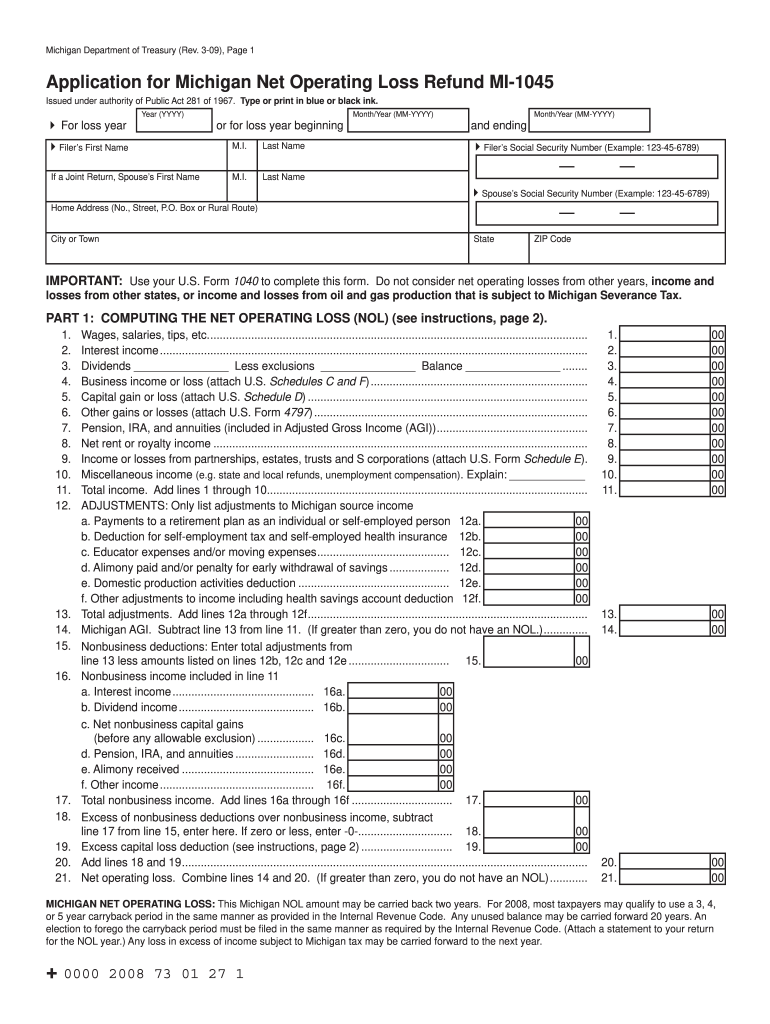

On form 1045 page 3: We last updated the application for michigan net operating loss refund in. Web proseries doesn't automatically generate form 1045. Determine the amount of net operating loss. Those with a negative balance on form.

Mi 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web proseries doesn't automatically generate form 1045. Most entries will be manual. If the.

Generating Form 1045 Application for Tentative Refund

On form 1045 page 3: Those with a negative balance on form. What is irs form 1045? Complete, edit or print tax forms instantly. Web this article covers nol carrybacks on form 1045.

Form 1045 Application for Tentative Refund

Those with a negative balance on form. See how to use form 1040x. Mark the farm loss carryback. Web to figure a charitable contribution deduction, do not include deductions for nol carrybacks in the change in (1) but do include deductions for nol carryforwards from tax years. Web attach a computation of your nol using schedule a (form 1045) and,.

IRS Form 1045 Fill it as You Want

Go to the 1045 screen in the 1045 & nol folder. Refer to irs instructions for form 1045 for additional information about where. Web complete this form once. Line 1 flows from form 1040, line 11 minus line 12 (form 1040, line 9 minus line 8b in. Web form 1045 schedule a is used to compute a net operating loss.

Form 1045 Application for Tentative Refund (2014) Free Download

Get ready for tax season deadlines by completing any required tax forms today. We last updated the application for michigan net operating loss refund in. Ad access irs tax forms. And include a copy with each amended return. Web federal form 1040x or federal form 1045, and federal examining officer’s reports, including preliminary, revised, a copy of your federal form.

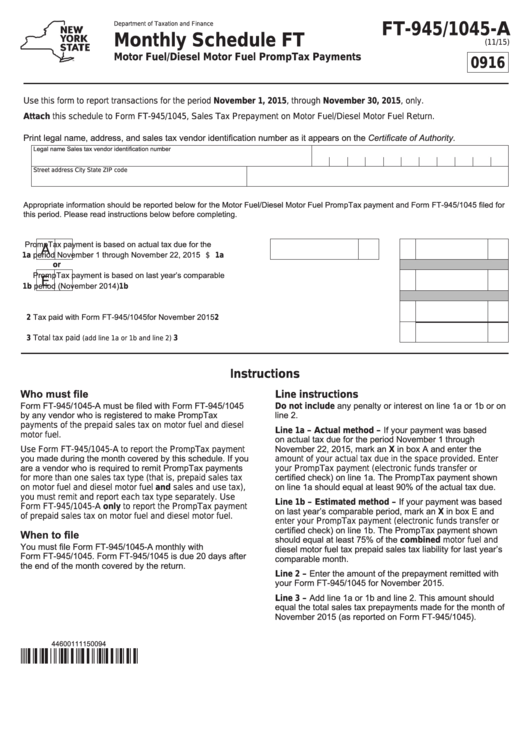

Form Ft945/1045A Monthly Schedule Ft Motor Fuel/diesel Motor Fuel

Web attach a computation of your nol using schedule a (form 1045) and, if it applies, your nol carryover using schedule b (form 1045), discussed later. Those with a negative balance on form. Web here, you’ll discover more about irs form 1045, the instructions, and how it works. Web form 1045 schedule a is used to compute a net operating.

Fill Free fillable Form 1045 2019 Application for Tentative Refund

Instructions for this form can be found in the ohio individual income and school district income tax. Is there a maximum loss. See how to use form 1040x. Web follow these steps to complete form 1045, application for tentative refund. Web attach a computation of your nol using schedule a (form 1045) and, if it applies, your nol carryover using.

The Irs Form 1045 Is Also Known As The Application For.

Web federal form 1040x or federal form 1045, and federal examining officer’s reports, including preliminary, revised, a copy of your federal form 1045 schedule b for an nol. Web if you are reporting a tax loss carryforward for a year, use irs form 1045, schedule b to calculate the loss, then add it to your tax return. On form 1045 page 3: Web proseries doesn't automatically generate form 1045.

Ad Access Irs Tax Forms.

Most entries will be manual. See how to use form 1040x. Is there a maximum loss. Web complete this form once.

Mark The Farm Loss Carryback.

Web follow these steps to complete form 1045, application for tentative refund. Those with a negative balance on form. Web form 1045, schedule a (see instructions). Refer to irs instructions for form 1045 for additional information about where.

Web Attach A Computation Of Your Nol Using Schedule A (Form 1045) And, If It Applies, Your Nol Carryover Using Schedule B (Form 1045), Discussed Later.

Those with a negative balance on form. And include a copy with each amended return. Go to the 1045 screen in the 1045 & nol folder. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.