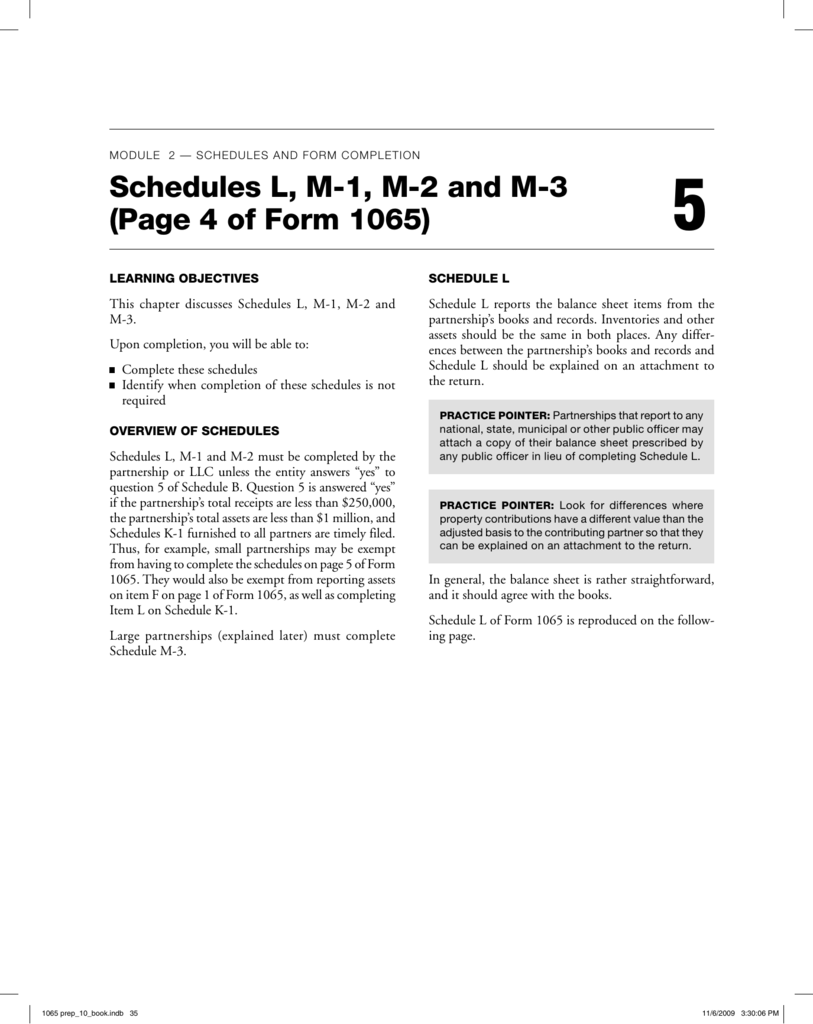

Form 1065 Other Deductions

Form 1065 Other Deductions - Web form 1065, u.s. Web a 1065 form is the annual us tax return filed by partnerships. Other deductions, for an individual return in intuit. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Has an amount in box 13 (code w) with instructions that state form 1040. Web select the other rental activities folder. Select the type of specially allocated depreciation (section 754,. The amounts shown in boxes 1 through 21 reflect your share of income,. Form 1065 is filed by domestic. Web irs form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes.

Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Click on the specially allocated depreciation folder. Web a 1065 form is the annual us tax return filed by partnerships. Web select the other rental activities folder. Has an amount in box 13 (code w) with instructions that state form 1040. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Select the type of specially allocated depreciation (section 754,. Form 1065 is filed by domestic. Web form 1065, u.s. Other deductions, for an individual return in intuit.

Web form 1065, u.s. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. The amounts shown in boxes 1 through 21 reflect your share of income,. Click on the specially allocated depreciation folder. Web irs form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. This section of the program contains information for part iii of the schedule k. Partner's share of current year income, deductions, credits, and other items. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Return of partnership income are reported on line 20.

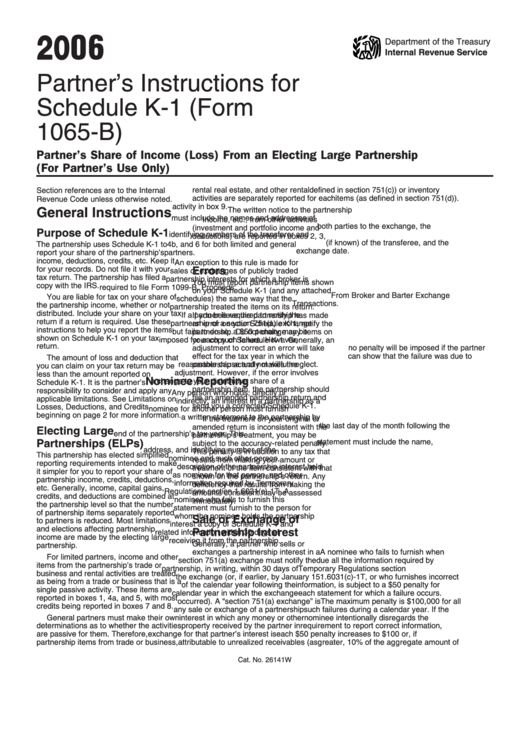

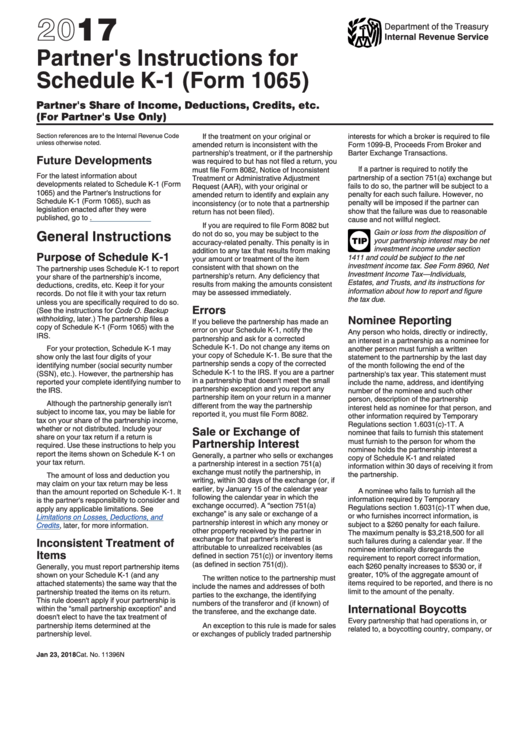

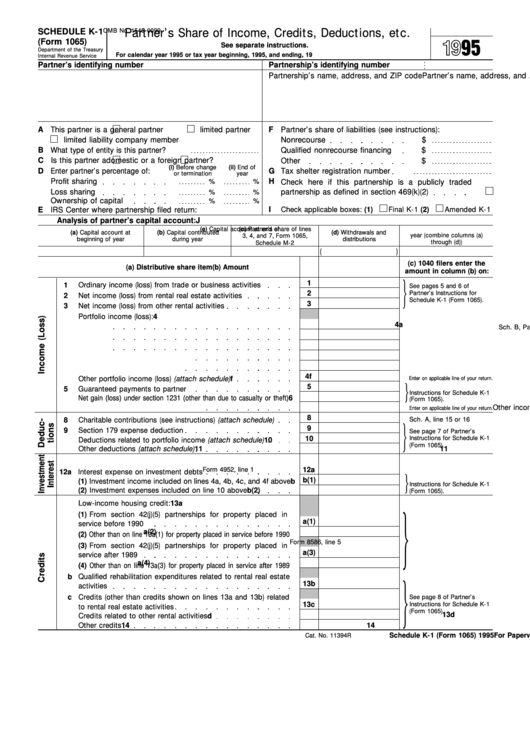

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Below are the box 13. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Click on the specially allocated depreciation folder. Return of partnership income are reported on line 20. This section of the program contains information for part iii of the schedule k.

How to fill out an LLC 1065 IRS Tax form

Has an amount in box 13 (code w) with instructions that state form 1040. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited.

41 1120s other deductions worksheet Worksheet Works

The amounts shown in boxes 1 through 21 reflect your share of income,. Web irs form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. This section of the program contains information for part iii of the schedule k. It is used to report the partnership’s income, gains, losses, deductions, and.

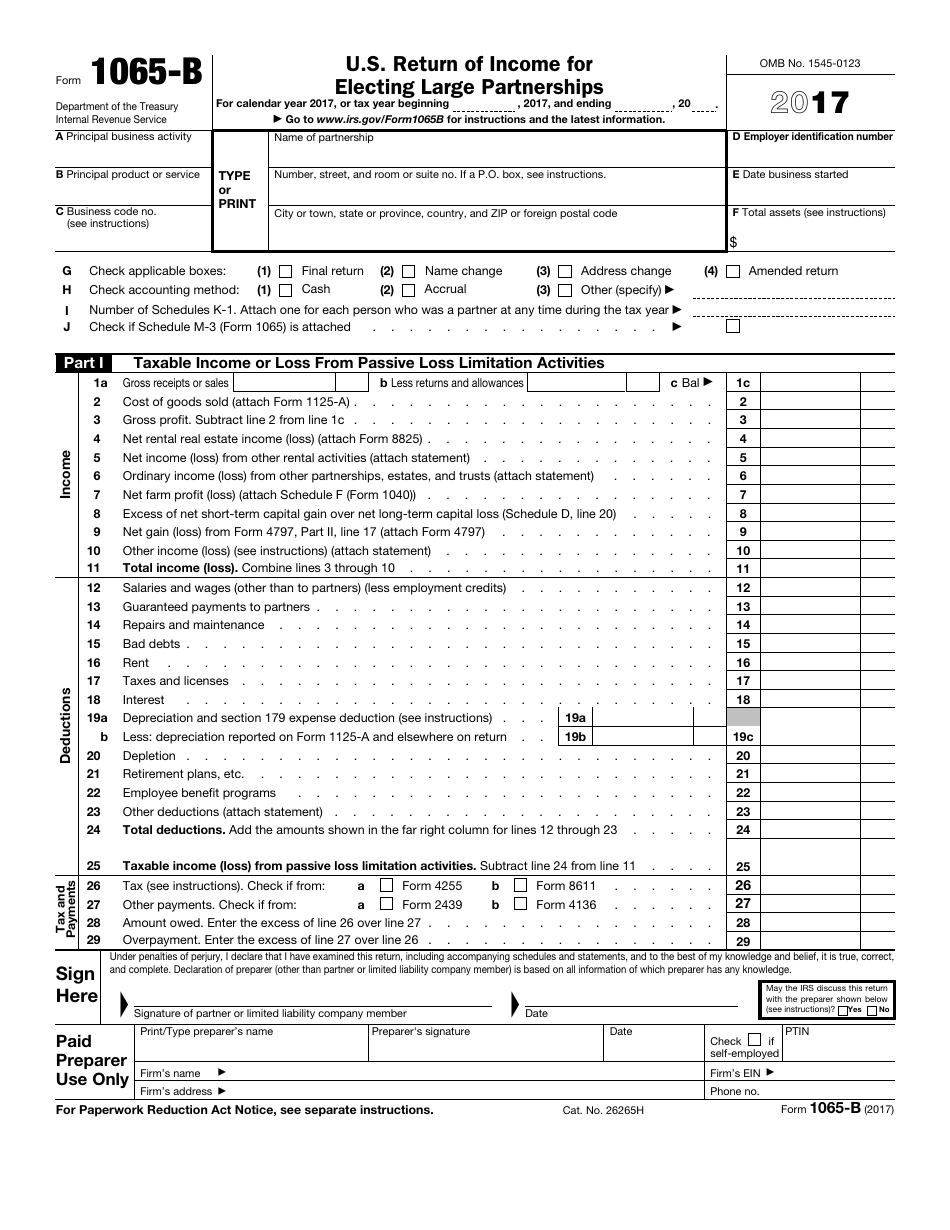

IRS Form 1065B Download Fillable PDF or Fill Online U.S. Return of

Web select the other rental activities folder. Click on the specially allocated depreciation folder. Web purpose of form form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Form 1065 is filed by domestic. Web a 1065 form is the annual us tax return filed by.

Form 1065 Line 20 Other Deductions Worksheet

Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Partner's share of current year income, deductions, credits, and other items. Click on the specially allocated depreciation folder. Return of partnership income are reported on line 20. Other deductions, for an individual return in intuit.

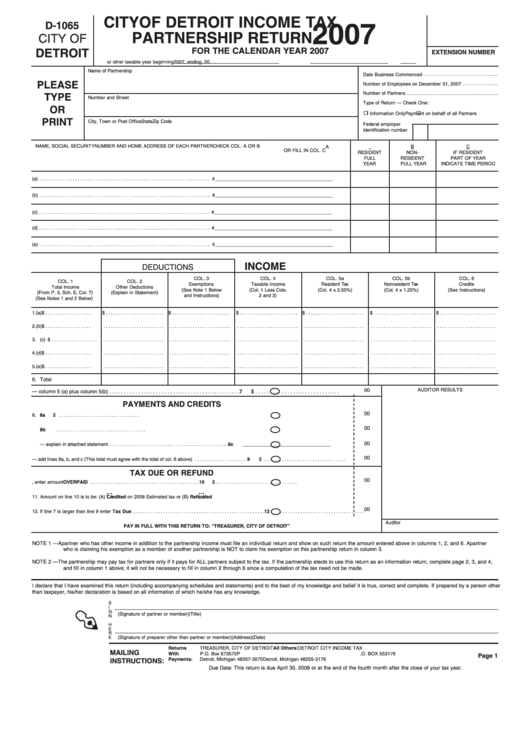

Form D1065 Tax Partnership Return 2007 printable pdf download

This section of the program contains information for part iii of the schedule k. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web a 1065 form is the annual us tax return filed by partnerships. Below are the box 13. Web purpose of form form 1065 is an information.

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Web a 1065 form is the annual us tax return filed by partnerships. Click on the specially allocated depreciation folder. Partner's share of current year income, deductions, credits, and other items. Other deductions, for an individual return in intuit. Below are the box 13.

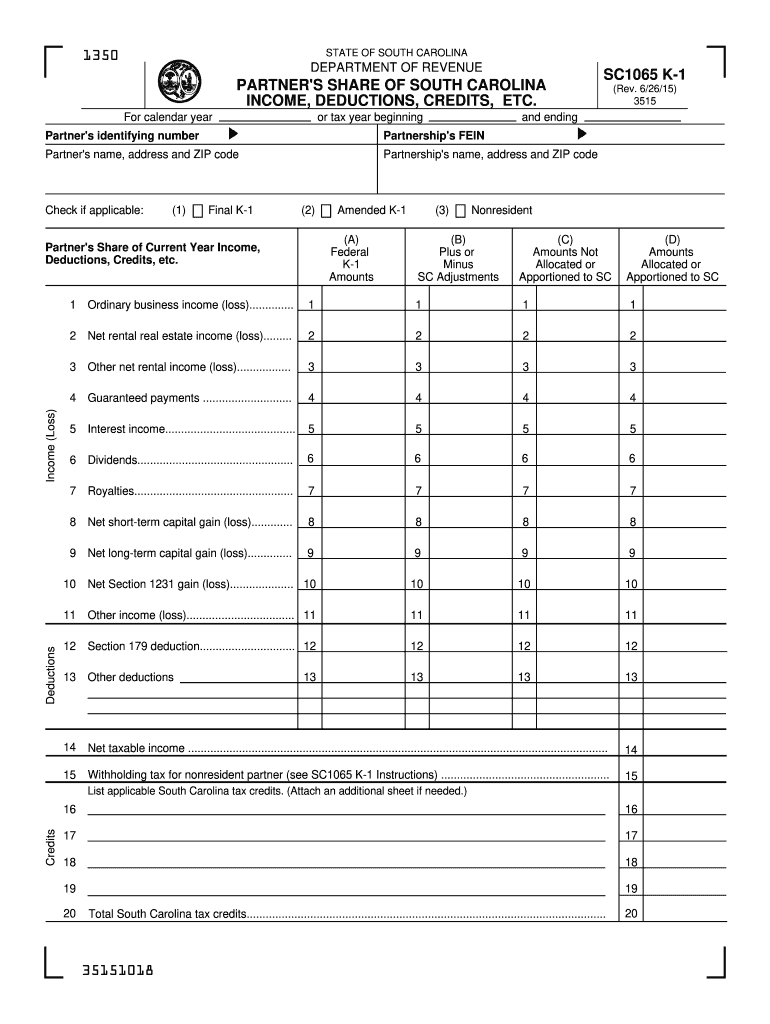

Sc Dept of Revenue Form 1065 K 1 Fill Out and Sign Printable PDF

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web a 1065 form is the annual us tax return filed by partnerships. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Form 1065 is filed by domestic. Partner's share of current year income,.

Partner'S Instructions For Schedule K1 (Form 1065B) Partner'S Share

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. This section of the program contains information for part iii of the schedule k. Partner's share of current year income, deductions, credits, and other items. Has an amount in box 13 (code w) with instructions that state form 1040. The amounts shown in boxes.

Form 9 Portfolio Deductions Five Questions To Ask At Form 9 Portfolio

Web a 1065 form is the annual us tax return filed by partnerships. Return of partnership income are reported on line 20. Web select the other rental activities folder. Other deductions, for an individual return in intuit. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s.

Web Purpose Of Form Form 1065 Is An Information Return Used To Report The Income, Gains, Losses, Deductions, Credits, And Other Information From The Operation Of A Partnership.

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Select the type of specially allocated depreciation (section 754,. Form 1065 is filed by domestic. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and.

This Section Of The Program Contains Information For Part Iii Of The Schedule K.

Click on the specially allocated depreciation folder. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Below are the box 13. Has an amount in box 13 (code w) with instructions that state form 1040.

Return Of Partnership Income Are Reported On Line 20.

Web select the other rental activities folder. Partner's share of current year income, deductions, credits, and other items. Other deductions, for an individual return in intuit. The amounts shown in boxes 1 through 21 reflect your share of income,.

It Is Used To Report The Partnership’s Income, Gains, Losses, Deductions, And Credits To The Irs.

Web irs form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. Web form 1065, u.s. Web a 1065 form is the annual us tax return filed by partnerships.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/form-1065-income-and-expenses-section.png)