Form 1120 Schedule G Instructions

Form 1120 Schedule G Instructions - Proconnect tax will automatically carry your entry in. It is important to highlight. To kick off form 1120, you need to enter some information about your corporation, including your: Instructions for form 1120 reit, u.s. Solved•by intuit•1•updated july 13, 2022. Web under the special rule, any amount of money or property received after december 31, 2020, as a contribution in aid of construction or a contribution to the capital of a regulated public. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Income tax return for real estate investment trusts. Web for purposes of schedule g (form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock. Complete, edit or print tax forms instantly.

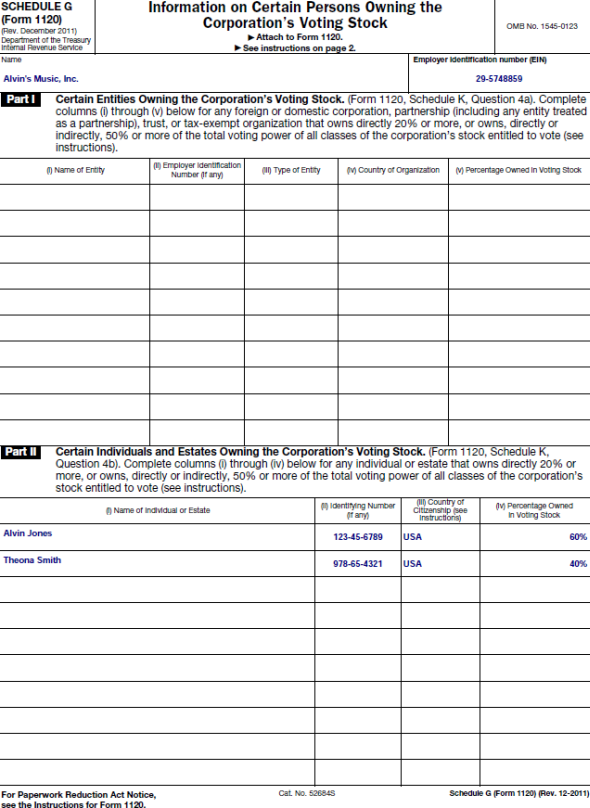

Solved•by intuit•1•updated july 13, 2022. Income tax return for real estate investment trusts. Web under the special rule, any amount of money or property received after december 31, 2020, as a contribution in aid of construction or a contribution to the capital of a regulated public. Hit the get form button on this page. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web information on certain shareholders of an s corporation. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Internal revenue serviceginformation about form 1120 and its separate. See schedule i and its separate instructions for additional information. Web understanding the constructive ownership percentage for form 1120.

Get ready for tax season deadlines by completing any required tax forms today. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Complete, edit or print tax forms instantly. Web for purposes of schedule g (form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock. Web information on certain shareholders of an s corporation. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Web show sources > 1120 (schedule g) is a federal individual income tax form. It is important to highlight. Internal revenue serviceginformation about form 1120 and its separate. Web under the special rule, any amount of money or property received after december 31, 2020, as a contribution in aid of construction or a contribution to the capital of a regulated public.

Form 1120 (Schedule G) Information on Certain Persons Owning the

It is important to highlight. To kick off form 1120, you need to enter some information about your corporation, including your: Web information on certain shareholders of an s corporation. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Web schedule g is included with your form 1120 filing if you.

General InstructionsPurpose of FormUse Schedule G (Form...

Income tax return for real estate investment trusts. To kick off form 1120, you need to enter some information about your corporation, including your: Web for purposes of schedule g (form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock. Web schedule g (form 1120) department of the treasury internal.

irs form 1120 schedule g

Hit the get form button on this page. Solved•by intuit•1•updated july 13, 2022. Internal revenue serviceginformation about form 1120 and its separate. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Ad access irs tax forms.

irs form 1120 schedule g

It is important to highlight. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Income tax return for real estate investment trusts. Get ready for tax.

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

Proconnect tax will automatically carry your entry in. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web understanding the constructive ownership percentage for form 1120. Web information on certain shareholders of an s corporation. Ad access irs tax forms.

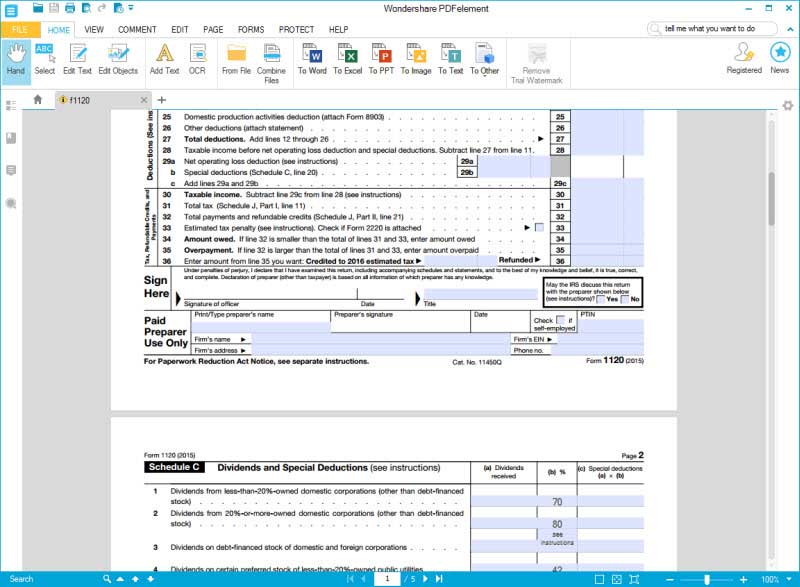

Form 1120 Schedule J Instructions

Web for purposes of schedule g (form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock. For calendar year 2016 or tax year beginning , 2016, ending , department of the treasury2016. Web fill out business information. Complete, edit or print tax forms instantly. Web under the special rule, any.

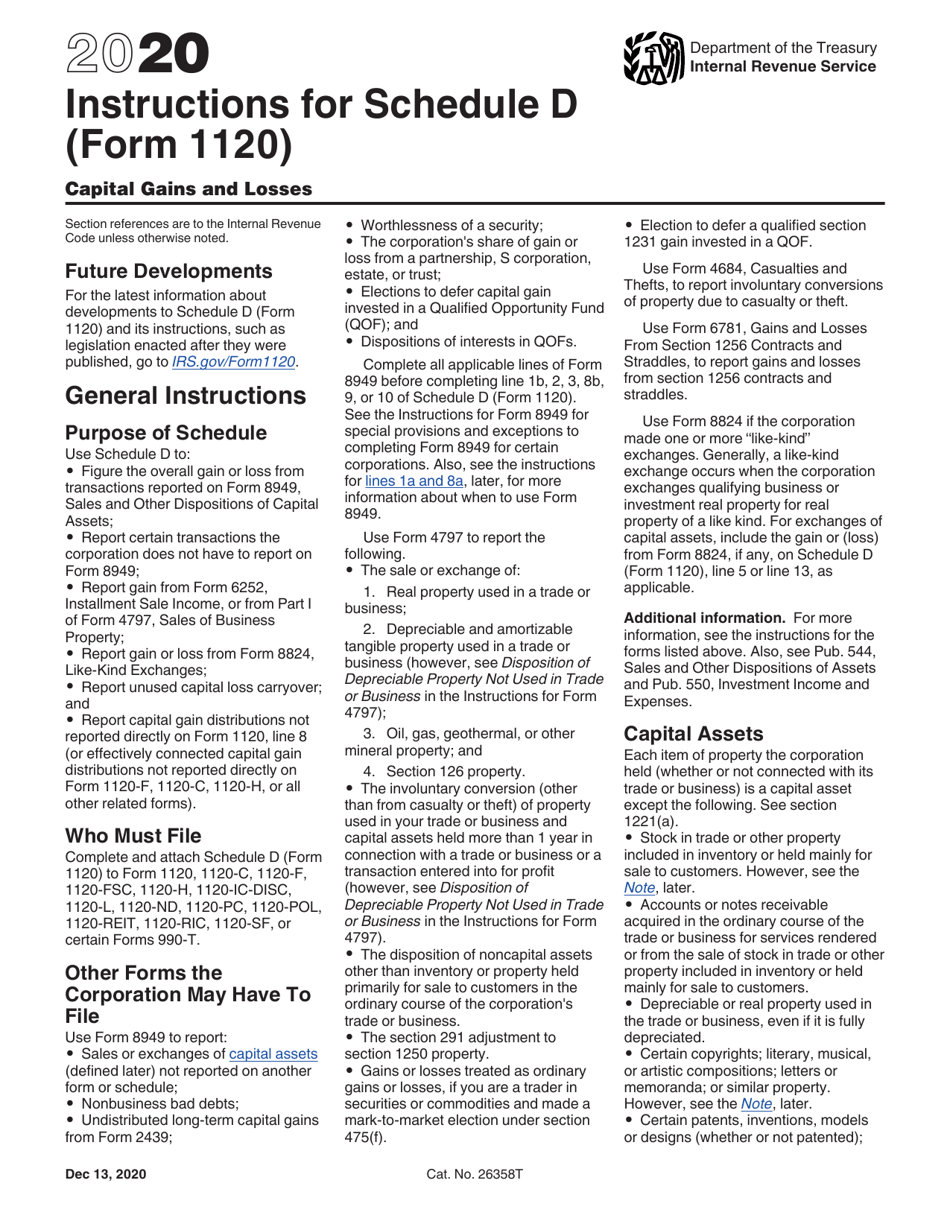

1120s schedule d instructions

Hit the get form button on this page. Ad access irs tax forms. Internal revenue serviceginformation about form 1120 and its separate. To kick off form 1120, you need to enter some information about your corporation, including your: For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate.

irs form 1120 schedule g

Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web schedule g (form 1120) department of the treasury internal revenue service name information on certain persons owning the corporation's voting stock attach see omb. It is important to highlight. See schedule i and.

Download Instructions for IRS Form 1120 Schedule D Capital Gains and

Proconnect tax will automatically carry your entry in. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Instructions for form 1120 reit, u.s. Web if you are curious about customize and create a form 1120 schedule g instructions, here are the easy.

20112022 Form IRS 1120 Schedule G Fill Online, Printable, Fillable

Get ready for tax season deadlines by completing any required tax forms today. Income tax return for real estate investment trusts. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web information on certain shareholders of an s corporation. It is important to.

Web Schedule G Is Included With Your Form 1120 Filing If You Have Shareholders That Own More Than 20% Of The Voting Stock In A Corporation.

Web schedule g (form 1120) department of the treasury internal revenue service name information on certain persons owning the corporation's voting stock attach see omb. Income tax return for real estate investment trusts. Solved•by intuit•1•updated july 13, 2022. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a.

For Calendar Year 2016 Or Tax Year Beginning , 2016, Ending , Department Of The Treasury2016.

Web for purposes of schedule g (form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock. Web understanding the constructive ownership percentage for form 1120. Web information on certain shareholders of an s corporation. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,.

Web Use Schedule G (Form 1120) To Provide Information Applicable To Certain Entities, Individuals, And Estates That Own, Directly, 20% Or More, Or Own, Directly Or.

Complete, edit or print tax forms instantly. Web if you are curious about customize and create a form 1120 schedule g instructions, here are the easy guide you need to follow: Get ready for tax season deadlines by completing any required tax forms today. Internal revenue serviceginformation about form 1120 and its separate.

Proconnect Tax Will Automatically Carry Your Entry In.

To kick off form 1120, you need to enter some information about your corporation, including your: Hit the get form button on this page. It is important to highlight. Web under the special rule, any amount of money or property received after december 31, 2020, as a contribution in aid of construction or a contribution to the capital of a regulated public.