Form 1120-X

Form 1120-X - Solved•by intuit•updated september 22, 2022. Disclose information for each reportable transaction in which the corporation participated. Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, to correct a previously filed form 1120. You will need a digital or printed copy of your original return to copy from. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. See section 6511 for more details and other special rules. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. It often takes 3 to 4 months to process form 1120x.

Corporation income tax return, including recent updates, related forms, and instructions on how to file. See section 6511 for more details and other special rules. You will need a digital or printed copy of your original return to copy from. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. See section 6511 for more details and other special rules. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. It often takes 3 to 4 months to process form 1120x. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Disclose information for each reportable transaction in which the corporation participated.

Disclose information for each reportable transaction in which the corporation participated. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Or, you may need to amend your form if you claimed a deduction you. Web common questions regarding corporate amended return (form 1120x) in lacerte. You will need a digital or printed copy of your original return to copy from. See section 6511 for more details and other special rules. It often takes 3 to 4 months to process form 1120x. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. See section 6511 for more details and other special rules.

Form 1120 Amended Return Overview & Instructions

It often takes 3 to 4 months to process form 1120x. Web common questions regarding corporate amended return (form 1120x) in lacerte. You will need a digital or printed copy of your original return to copy from. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Web a form 1120x based on a.

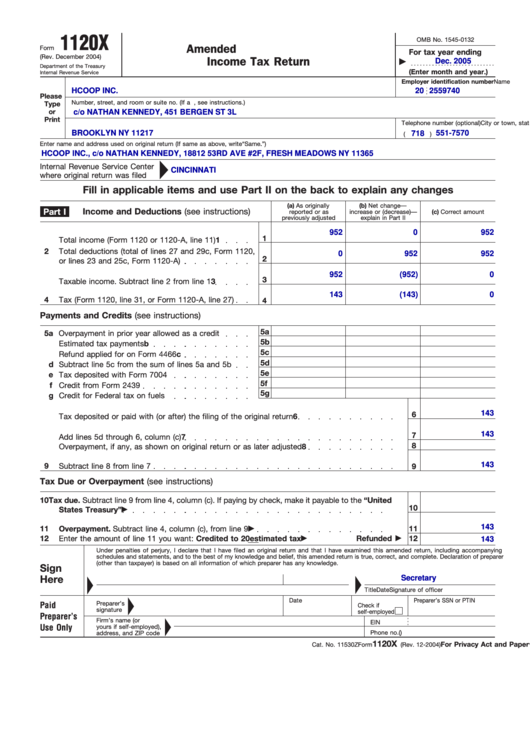

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Or, you may need to amend your form if you claimed a deduction you. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in.

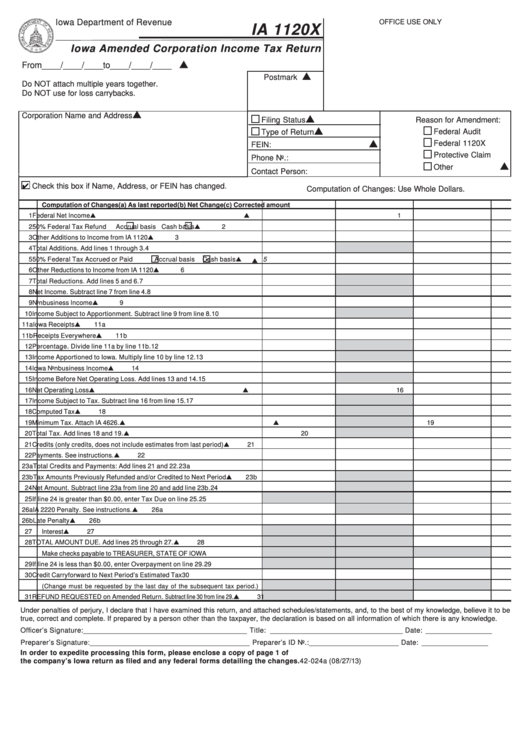

Fillable Form Ia 1120x Iowa Amended Corporation Tax Return

Corporation income tax return, to correct a previously filed form 1120. It often takes 3 to 4 months to process form 1120x. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. Web a form 1120x based on a bad debt or worthless security must be filed within.

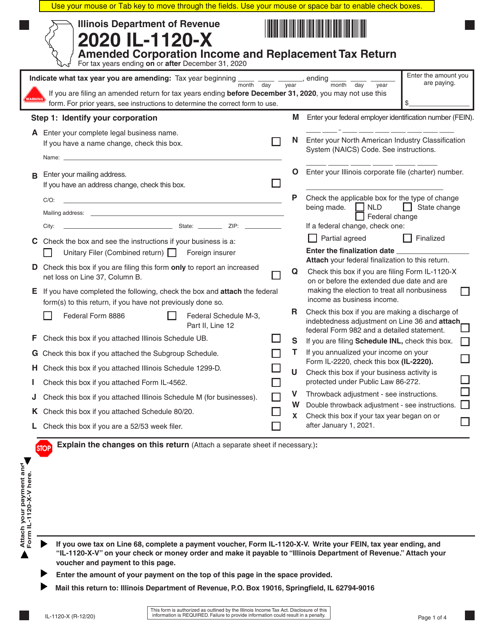

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

It often takes 3 to 4 months to process form 1120x. Web form 1120x, amended u.s. Or, you may need to amend your form if you claimed a deduction you. Solved•by intuit•updated september 22, 2022. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable.

Form 1120x Amended U.s. Corporation Tax Return printable pdf

It often takes 3 to 4 months to process form 1120x. You will need a digital or printed copy of your original return to copy from. See section 6511 for more details and other special rules. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t).

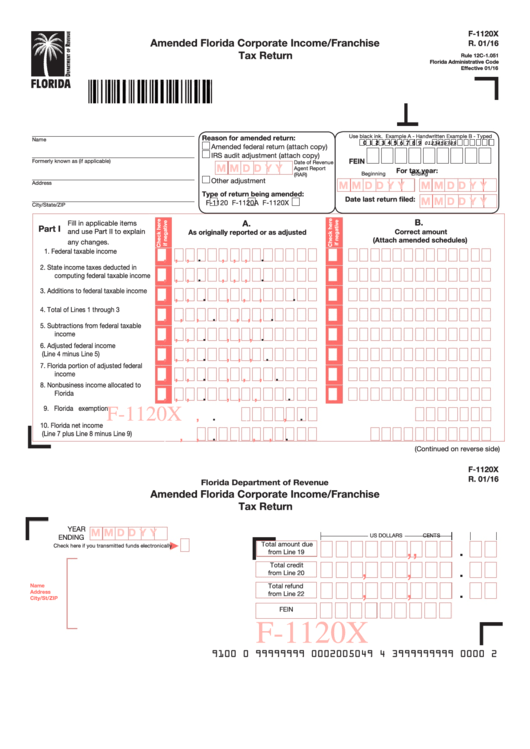

Form F1120x Amended Florida Corporate Tax Return

It often takes 3 to 4 months to process form 1120x. Web form 1120x, amended u.s. See section 6511 for more details and other special rules. Disclose information for each reportable transaction in which the corporation participated. See section 6511 for more details and other special rules.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Disclose information for each reportable transaction in which the corporation participated. Web common questions regarding corporate amended return (form 1120x) in lacerte. It often takes 3 to 4 months to process form 1120x. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, to correct a previously filed form 1120. Solved•by intuit•updated september 22, 2022. Web common questions regarding corporate amended return.

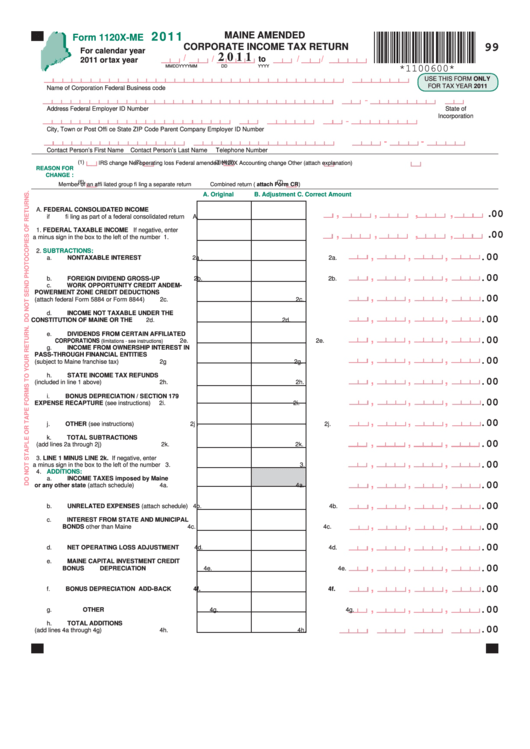

Form 1120xMe Maine Amended Corporate Tax Return 2011

Or, you may need to amend your form if you claimed a deduction you. Web form 1120x, amended u.s. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. You may need to.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, allows businesses to correct mistakes.

It Often Takes 3 To 4 Months To Process Form 1120X.

Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Web form 1120x, amended u.s.

See Section 6511 For More Details And Other Special Rules.

Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). See section 6511 for more details and other special rules. Web common questions regarding corporate amended return (form 1120x) in lacerte. Corporation income tax return, to correct a previously filed form 1120.

It Often Takes 3 To 4 Months To Process Form 1120X.

You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Disclose information for each reportable transaction in which the corporation participated. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable.

Solved•By Intuit•Updated September 22, 2022.

Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. You will need a digital or printed copy of your original return to copy from.