Form 1127 Nyc

Form 1127 Nyc - Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Open the pdf sample in the editor. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Amendedreturn taxpayer’s email address home address (number and. Shouldn't it be reported on line 5 as a local income tax? Now it will take at most thirty minutes, and you can do it from any place. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city. The form will be tentatively available on. Here you can put in your data. Refer to the outlined fillable lines.

An 1127 in most return. The form will be tentatively available on. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Shouldn't it be reported on line 5 as a local income tax? Here you can put in your data. Amendedreturn taxpayer’s email address home address (number and. Refer to the outlined fillable lines. Open the pdf sample in the editor. Now it will take at most thirty minutes, and you can do it from any place. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city.

Refer to the outlined fillable lines. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city. Now it will take at most thirty minutes, and you can do it from any place. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Amendedreturn taxpayer’s email address home address (number and. Here you can put in your data. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Open the pdf sample in the editor. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. An 1127 in most return.

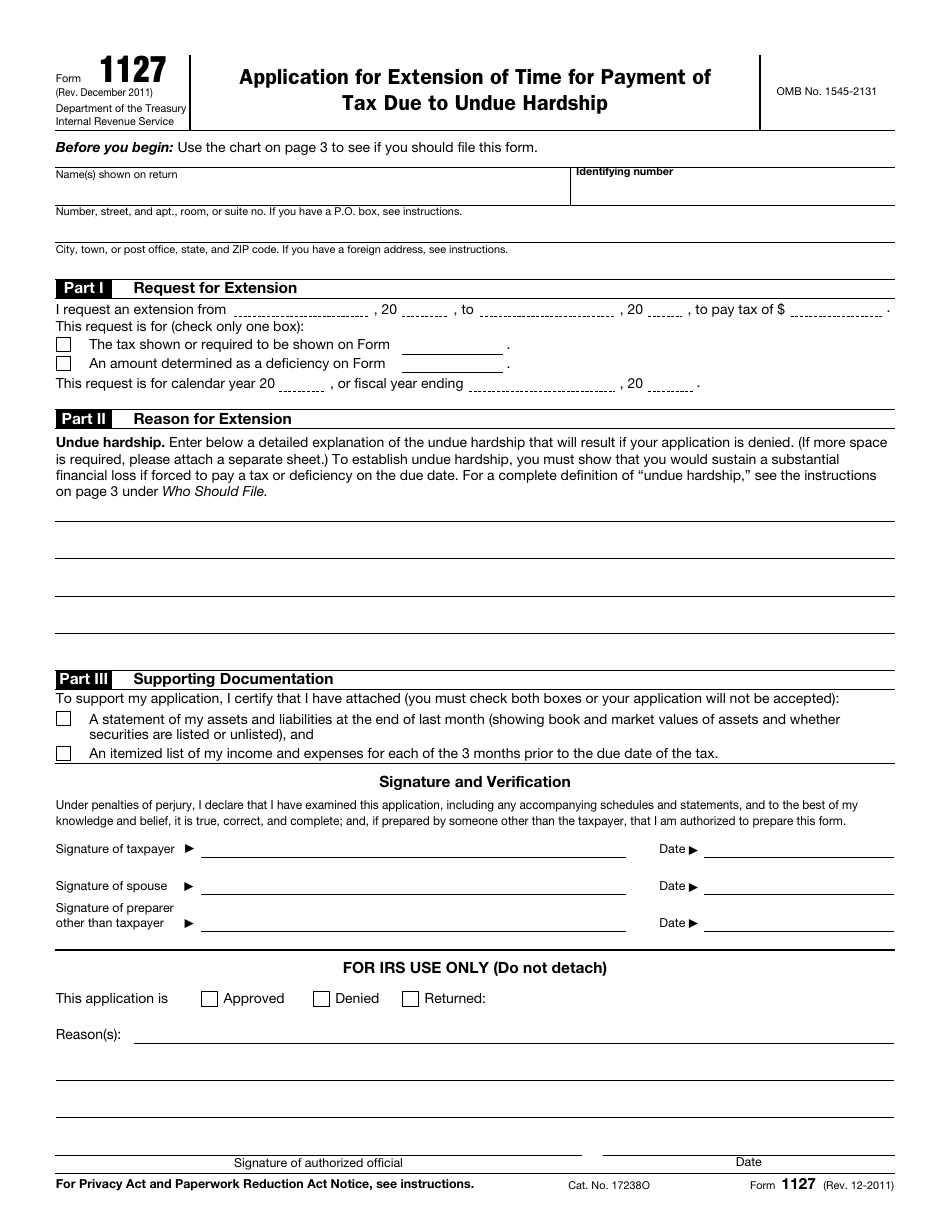

IRS Form 1127 Download Fillable PDF or Fill Online Application for

Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york.

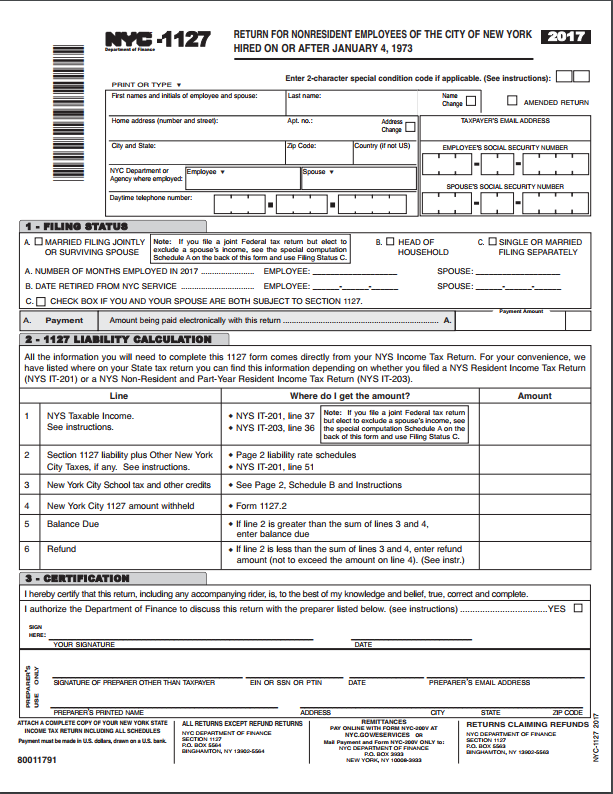

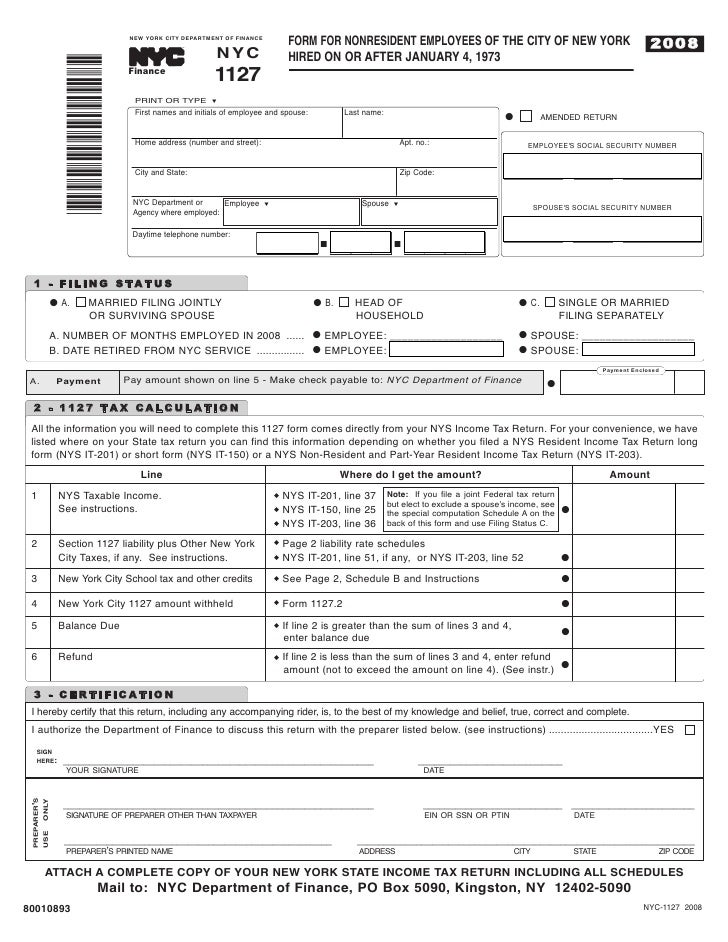

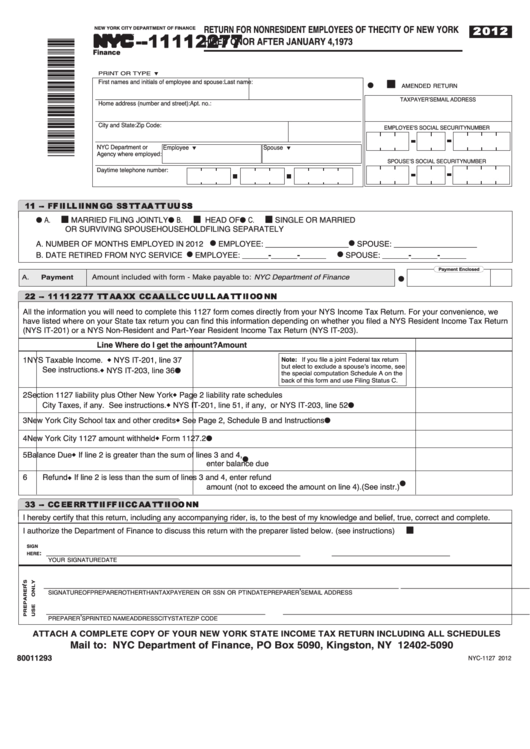

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Here you can put in your data. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Shouldn't it be reported on line 5 as a local income tax? The form will be tentatively available on. Change of residence if you were a resident of the city of new.

NYC1127 (2017) Edit Forms Online PDFFormPro

The form will be tentatively available on. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment.

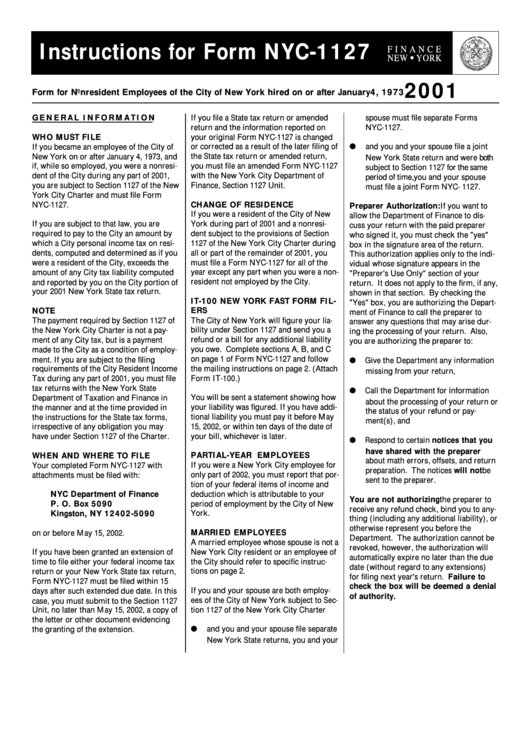

Instructions For Form Nyc1127 For Nonresident Employees Of The City Of

Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Shouldn't it be reported on line 5 as a local income tax? Change of residence if you were a resident of the city of new york during part of 2022 and a.

New York City Form 1127 Blank Sample to Fill out Online in PDF

Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Web under section 1127 of the city charter, if you are.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Now it will take at most thirty minutes, and you can do it from any place. Here you can put in your data. Shouldn't it be reported on line 5 as a local income tax? The form will be tentatively available on. Refer to the outlined fillable lines.

Form 1127 Application for Extension of Time for Payment of Tax Due To

This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city.

Fillable Form Nyc1127 Return For Nonresident Employees Of The City

Amendedreturn taxpayer’s email address home address (number and. Shouldn't it be reported on line 5 as a local income tax? Open the pdf sample in the editor. The form will be tentatively available on. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Now it will take at most thirty minutes, and you can do it from any place. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a.

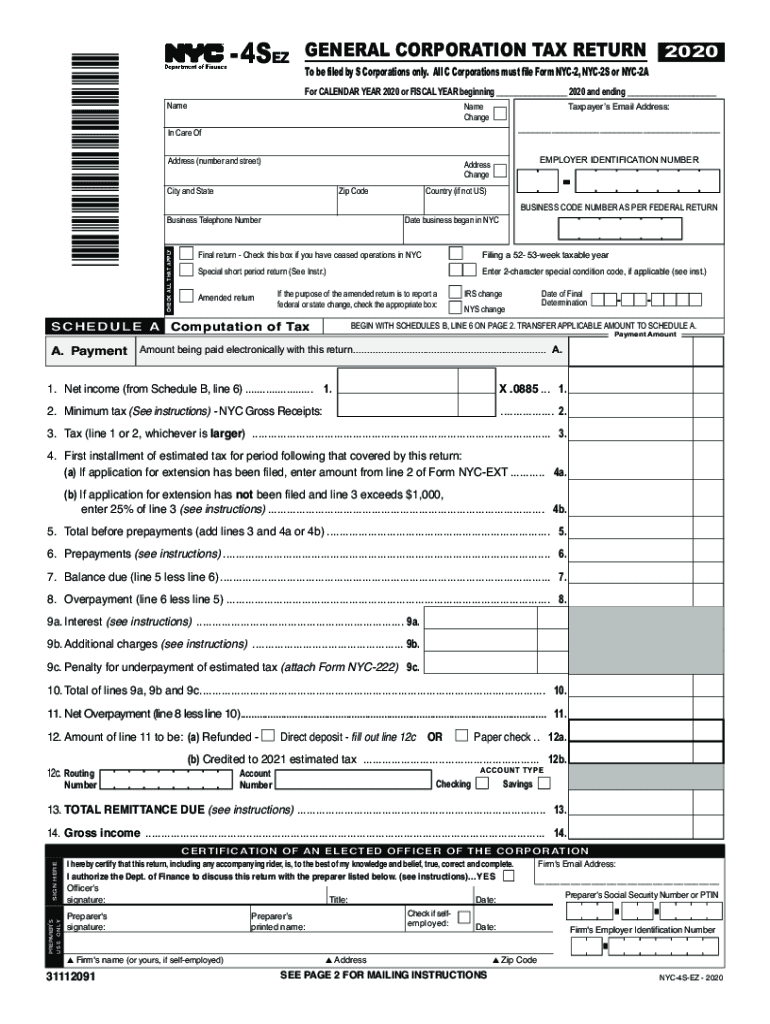

2020 Form NYC DoF NYC4SEZ Fill Online, Printable, Fillable, Blank

Amendedreturn taxpayer’s email address home address (number and. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Refer to the outlined fillable lines. Shouldn't it be reported on line 5 as a local income tax? Web under section 1127 of the city charter, if you are a city.

Now It Will Take At Most Thirty Minutes, And You Can Do It From Any Place.

The form will be tentatively available on. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return.

Here You Can Put In Your Data.

An 1127 in most return. Open the pdf sample in the editor. Amendedreturn taxpayer’s email address home address (number and. Refer to the outlined fillable lines.

Change Of Residence If You Were A Resident Of The City Of New York During Part Of 2022 And A Nonresident Subject To The Provisions Of Section 1127 Of The New York City Charter During All Or Part Of The Remainder Of 2022, You Must

Shouldn't it be reported on line 5 as a local income tax?