Form 2290 Instructions 2022

Form 2290 Instructions 2022 - Web general instructions purpose of form use form 2290 for the following actions. •figure and pay the tax due on highway motor vehicles used during the period with a taxable. Web form 2290 is used for: Web the form 2290 instructions 2022 apply to the relevant tax year. Enter the sum you get on page 2, column 4 of form. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Also, late filers may face a. Web according to the form 2290 instructions for 2022, the penalty is typically 4.5% of the total tax due, assessed on a monthly basis for up to five months. Web form 2290 due dates for vehicles placed into service during reporting period. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps.

Month new vehicle is first used. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. File your 2290 online & get schedule 1 in minutes. Pay heavy vehicle use taxes (hvut) for highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more. Month form 2290 must be filed. Enter the sum you get on page 2, column 4 of form. The current period begins july 1, 2023, and. However, for owners of newly. The deadline for filing the 2290 hvut tax returns is arriving fast.

Web general instructions purpose of form use form 2290 for the following actions. Web the 2290 form is due annually between july 1 and august 31. Month new vehicle is first used. Web if you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of every year. Pay heavy vehicle use taxes (hvut) for highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Enter the tax year and month you put your vehicles on the road during the tax period. Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more. Web the irs form 2290 is used to: Enter the sum you get on page 2, column 4 of form. Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any.

Understanding Form 2290 StepbyStep Instructions for 20222023

Web if you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of every year. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. Web the irs form 2290 is used to: •figure and.

Irs Form 2290 Printable Form Resume Examples

Do your truck tax online & have it efiled to the irs! The deadline for filing the 2290 hvut tax returns is arriving fast. Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any. July 2023) department of the treasury.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Also, late filers may face a. Do your truck tax online & have it efiled to the irs! Enter the tax year and month you put your vehicles on the road during the tax period. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Enter the sum.

IRS Form 2290 Instructions for 20232024 How to fill out 2290?

July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. This ensures legal operation on public highways. These forms are available right now. Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

•figure and pay the tax due on highway motor vehicles used during the period with a taxable. Month new vehicle is first used. Pay heavy vehicle use taxes (hvut) for highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Also, late filers may face a. Web the form 2290 instructions 2022 apply to the relevant tax.

Irs Form 2290 Instructions Form Resume Examples

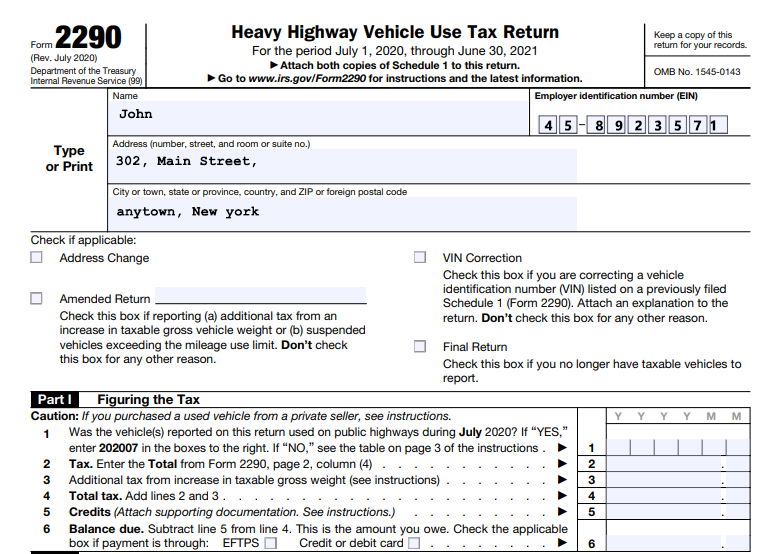

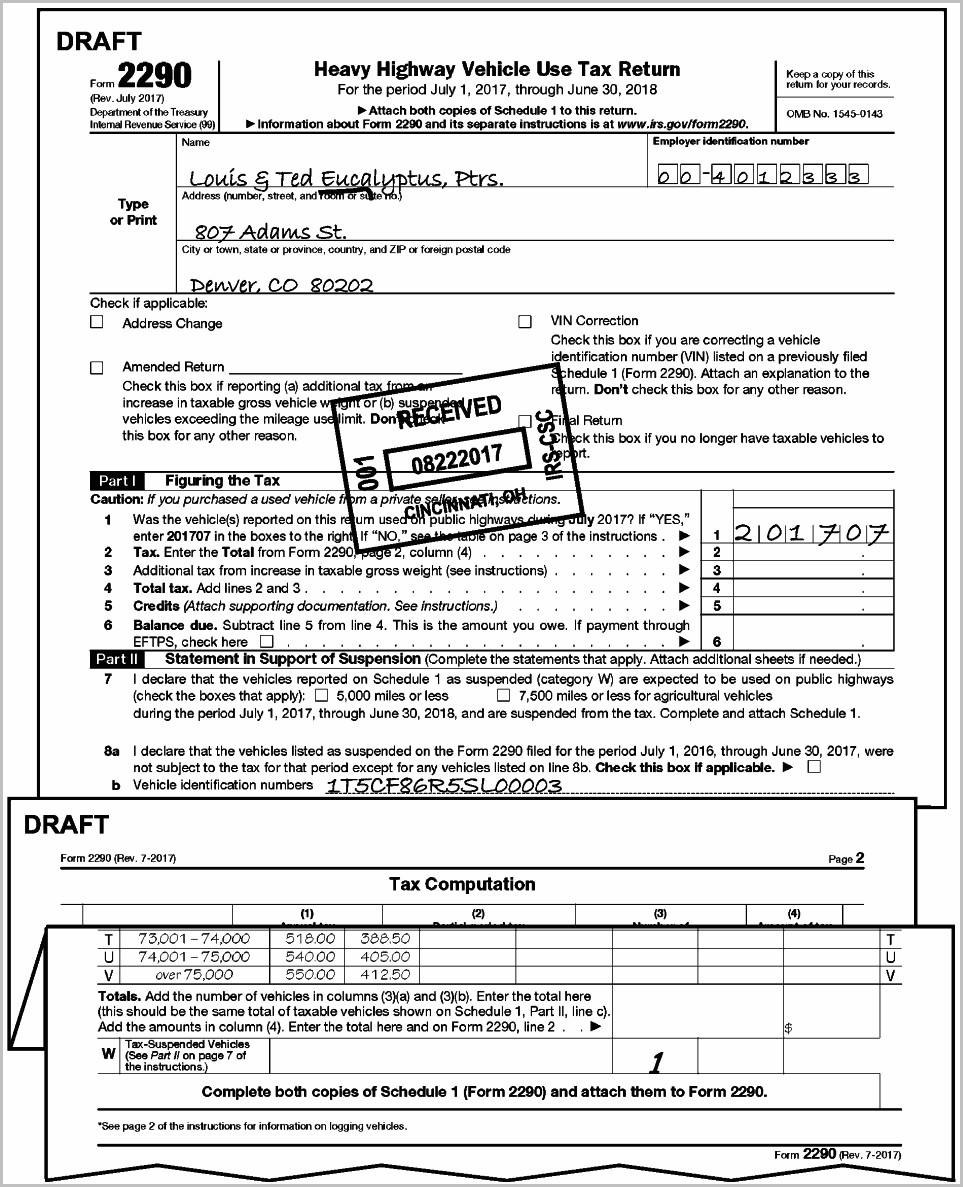

Easy, fast, secure & free to try. Web december 6, 2022 draft as of form 2290 (rev. Also, late filers may face a. This ensures legal operation on public highways. Web according to the form 2290 instructions for 2022, the penalty is typically 4.5% of the total tax due, assessed on a monthly basis for up to five months.

Efiling IRS Form 2290 EFile 2290 for lowest price 6.90

Month form 2290 must be filed. The deadline for filing the 2290 hvut tax returns is arriving fast. Web general instructions purpose of form use form 2290 for the following actions. This ensures legal operation on public highways. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps.

How to file form 2290 Electronically For the Tax Year 20212022 by Form

Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Month form 2290 must be filed. Month new vehicle is first used. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. With accurate form 2290 instructions, you’ll know how to report mileage on taxable.

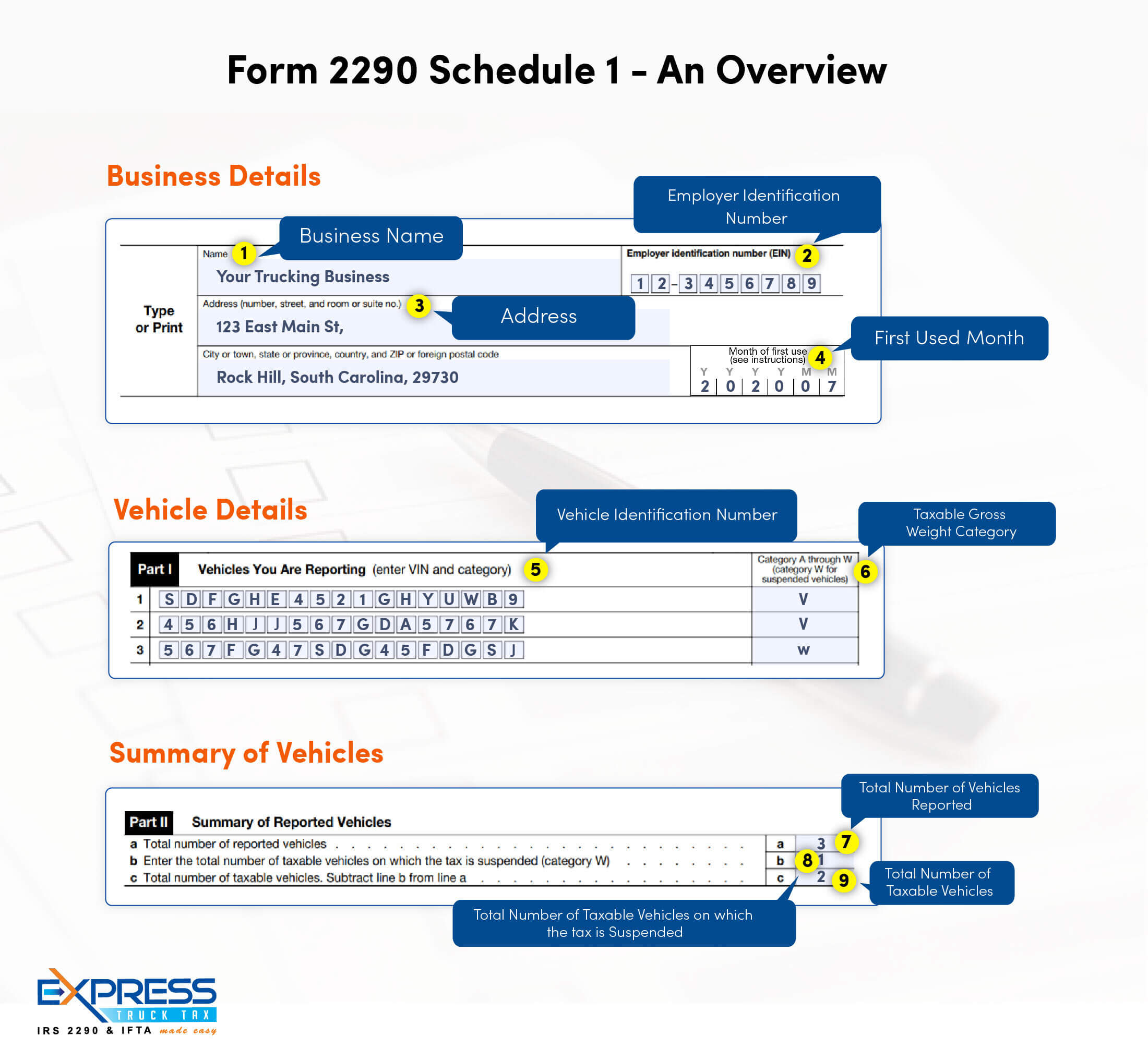

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

With accurate form 2290 instructions, you’ll know how to report mileage on taxable vehicles. Web general instructions purpose of form use form 2290 for the following actions. Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv). Web form 2290 must be filed for the month the taxable vehicle is first used.

IRS Form 2290 Instructions for 20222023

Month form 2290 must be filed. Also, late filers may face a. Web if you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of every year. The deadline for filing the 2290 hvut tax returns is arriving fast. Enter the tax year and month.

Ad With 2290 Online, You Can File Your Heavy Vehicle Use Tax Form In Just 3 Easy Steps.

Web form 2290 is used for: Web if you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of every year. Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv). Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more.

Web The Irs Form 2290 Is Used To:

•figure and pay the tax due on highway motor vehicles used during the period with a taxable. Web december 6, 2022 draft as of form 2290 (rev. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Enter the sum you get on page 2, column 4 of form.

The Deadline For Filing The 2290 Hvut Tax Returns Is Arriving Fast.

Web general instructions purpose of form use form 2290 for the following actions. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web the 2290 form is due annually between july 1 and august 31. Web the form 2290 instructions 2022 apply to the relevant tax year.

Web Form 2290 Must Be Filed For The Month The Taxable Vehicle Is First Used On Public Highways During The Current Period.

Do your truck tax online & have it efiled to the irs! Month form 2290 must be filed. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any.