Form 2848 Fax Number

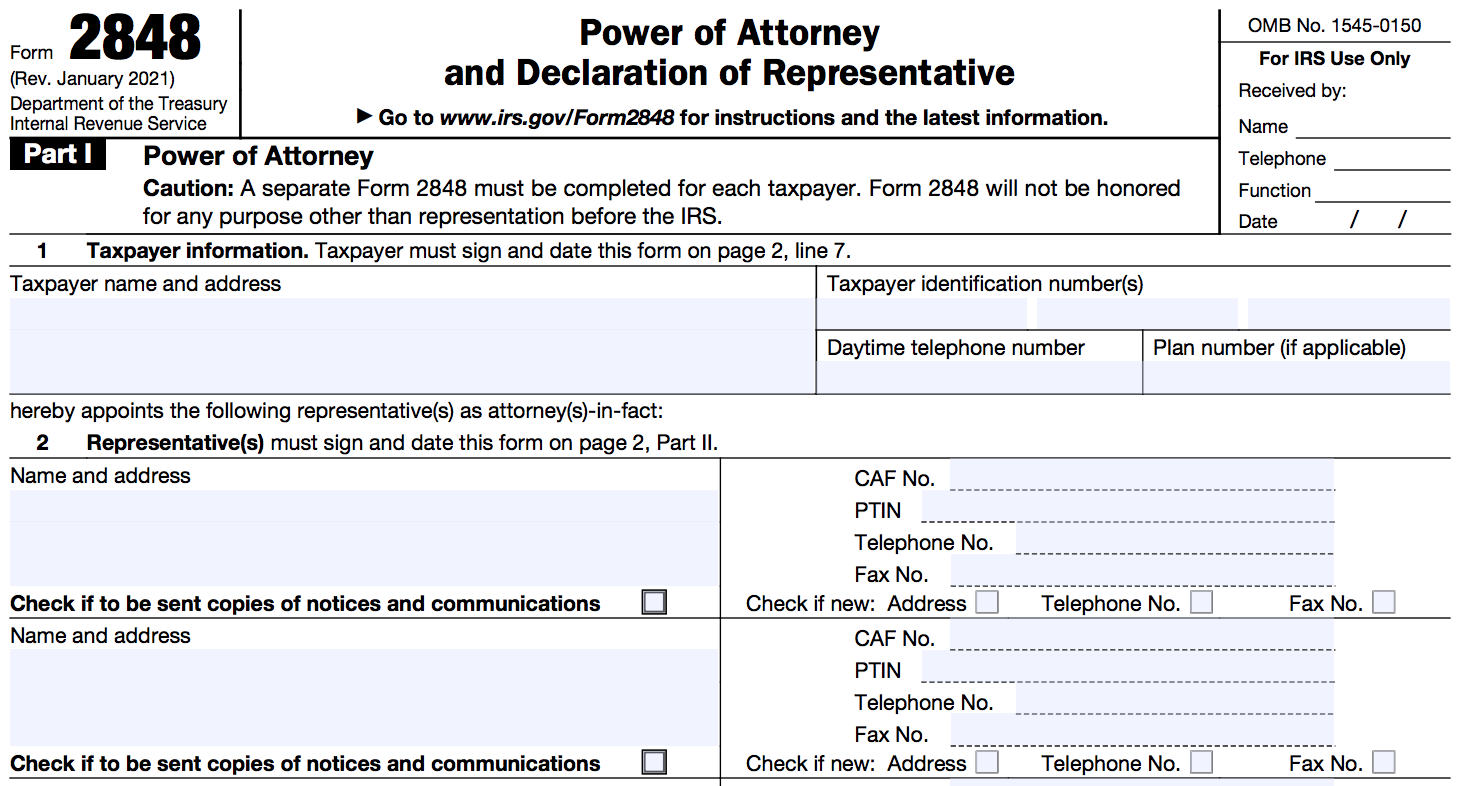

Form 2848 Fax Number - Web about form 2848, power of attorney and declaration of representative. Use form 2848 to authorize an individual to represent you before the irs. Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. To submit multiple forms, select “submit another form and answer the questions about the authorization. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Web even better than fax is to submit the form online. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Web (such as an audit) you can mail, email, or fax the sc2848 to the scdor division that is handling the tax matter. Upload a completed version of a signed form 8821 or form 2848. Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact.

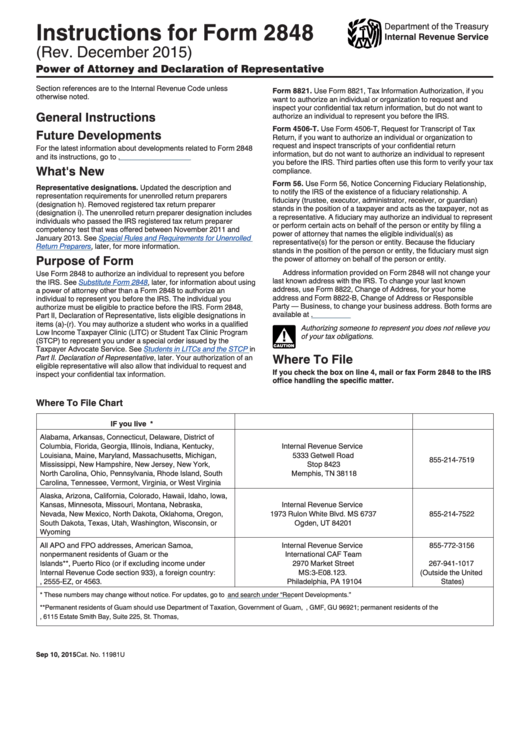

Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. If form 2848 is for a specific use, mail or fax it to the Web one fax account, unlimited faxes. Where to file chart if you live in. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Do not submit a form online if you've already submitted it by fax or mail. The individual you authorize must be a person eligible to practice before the irs.

Web (such as an audit) you can mail, email, or fax the sc2848 to the scdor division that is handling the tax matter. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Web one fax account, unlimited faxes. Web you can only submit one form at a time. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. To submit multiple forms, select “submit another form and answer the questions about the authorization. Fax number* alabama, arkansas, connecticut, delaware, district of To find the service center address, see the related tax return instructions. Where to file chart if you live in. Use form 2848 to authorize an individual to represent you before the irs.

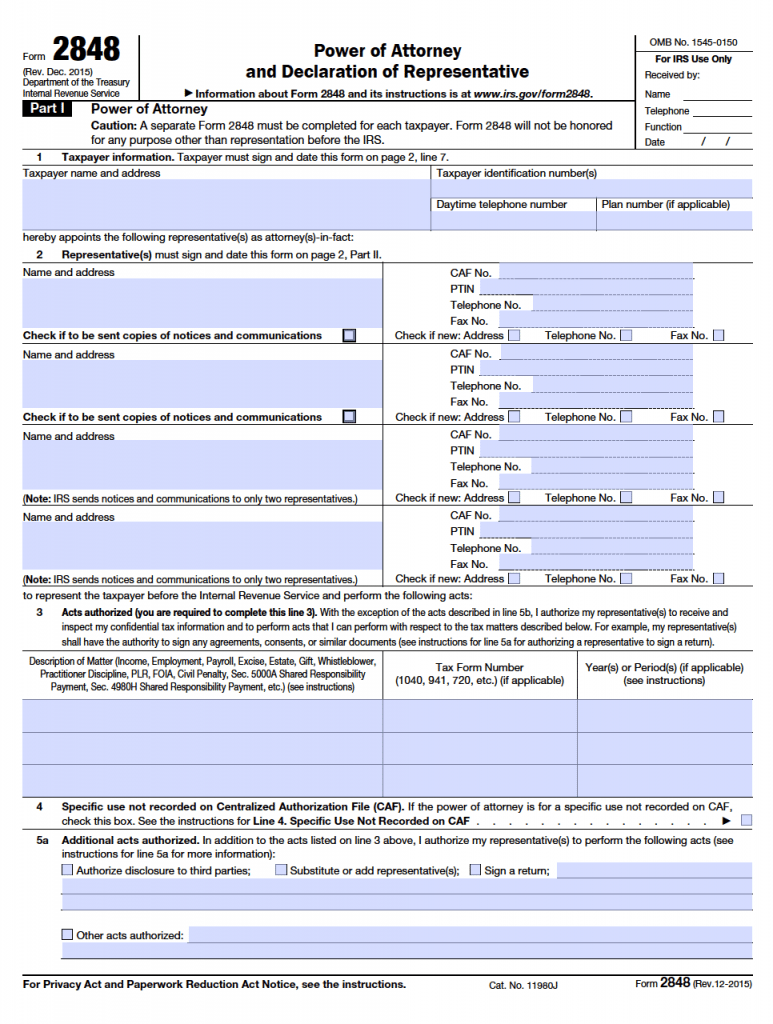

IRS Power of Attorney Form 2848 Year 2016 Power of Attorney

Mail your form 2848 directly to the irs address in the where to file chart. Meet all your fax demands with one purchase. To submit multiple forms, select “submit another form and answer the questions about the authorization. The individual you authorize must be a person eligible to practice before the irs. Web if you check the box on line.

Breanna Form 2848 Fax Number Irs

Web even better than fax is to submit the form online. Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Meet all your fax demands with one purchase. To find the service center address, see the related tax.

Breanna Form 2848 Fax Number

The individual you authorize must be a person eligible to practice before the irs. Upload a completed version of a signed form 8821 or form 2848. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Web (such as an audit) you can mail, email, or fax the sc2848 to the scdor.

Breanna Form 2848 Fax Number Irs

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Where to file chart if you live in. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Web you can only submit.

Form 2848 Example

Fax number* alabama, arkansas, connecticut, delaware, district of Where to file chart if you live in. To find the service center address, see the related tax return instructions. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Otherwise, mail or fax.

ICANN Application for TaxExempt Status (U.S.) Form 2848 Page 2

Where to file chart if you live in. Mail your form 2848 directly to the irs address in the where to file chart. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Covers a dedicted fax phone number with no extra cost. We have provided a list of irs fax.

Instructions For Form 2848 (Rev. 2015) printable pdf download

Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Fax number* alabama, arkansas, connecticut, delaware, district of Do not submit a form online if you've already submitted it by fax or mail. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was,.

All About IRS Form 2848 SmartAsset

Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Web even better than fax is to submit the form online. Web (such as an audit) you.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. Web even better than fax is to submit the form online. Do not submit a form online if you've already submitted it by fax or mail. Otherwise, mail or fax form 2848 directly to the irs.

Form 2848 Power of Attorney and Declaration of Representative IRS

To submit multiple forms, select “submit another form and answer the questions about the authorization. To find the service center address, see the related tax return instructions. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Mail your form 2848 directly to the irs address in the where to file.

To Find The Service Center Address, See The Related Tax Return Instructions.

Fax number* alabama, arkansas, connecticut, delaware, district of The individual you authorize must be a person eligible to practice before the irs. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Web about form 2848, power of attorney and declaration of representative.

Web If You Check The Box On Line 4, Mail Or Fax Form 2848 To The Irs Office Handling The Specific Matter.

Web even better than fax is to submit the form online. Do not submit a form online if you've already submitted it by fax or mail. Fax your form 2848 to the irs fax number in the where to file chart. Use form 2848 to authorize an individual to represent you before the irs.

Web One Fax Account, Unlimited Faxes.

Mail your form 2848 directly to the irs address in the where to file chart. If form 2848 is for a specific use, mail or fax it to the Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. Web you can only submit one form at a time.

Web (Such As An Audit) You Can Mail, Email, Or Fax The Sc2848 To The Scdor Division That Is Handling The Tax Matter.

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Meet all your fax demands with one purchase. Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. Where to file chart if you live in.