Form 2848 Instruction

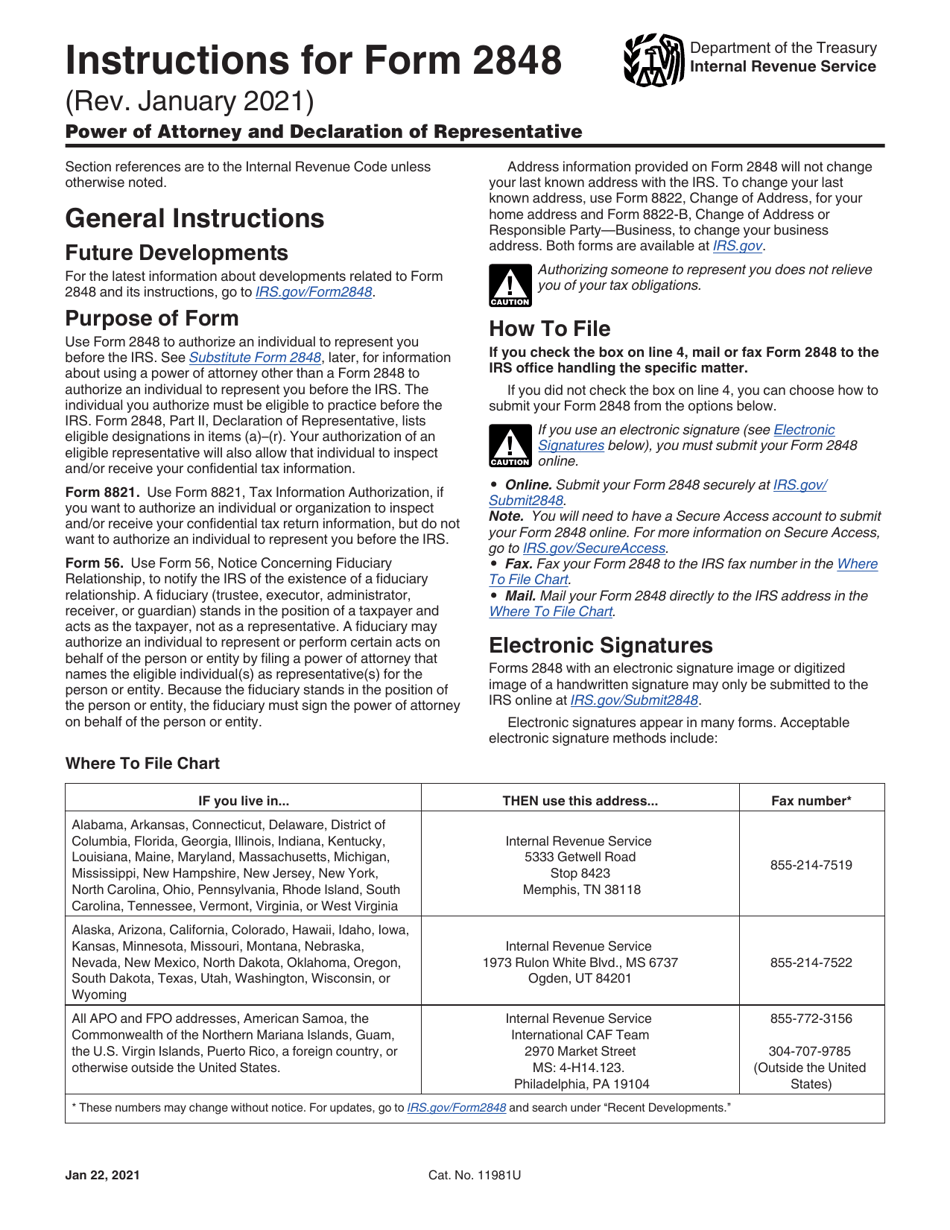

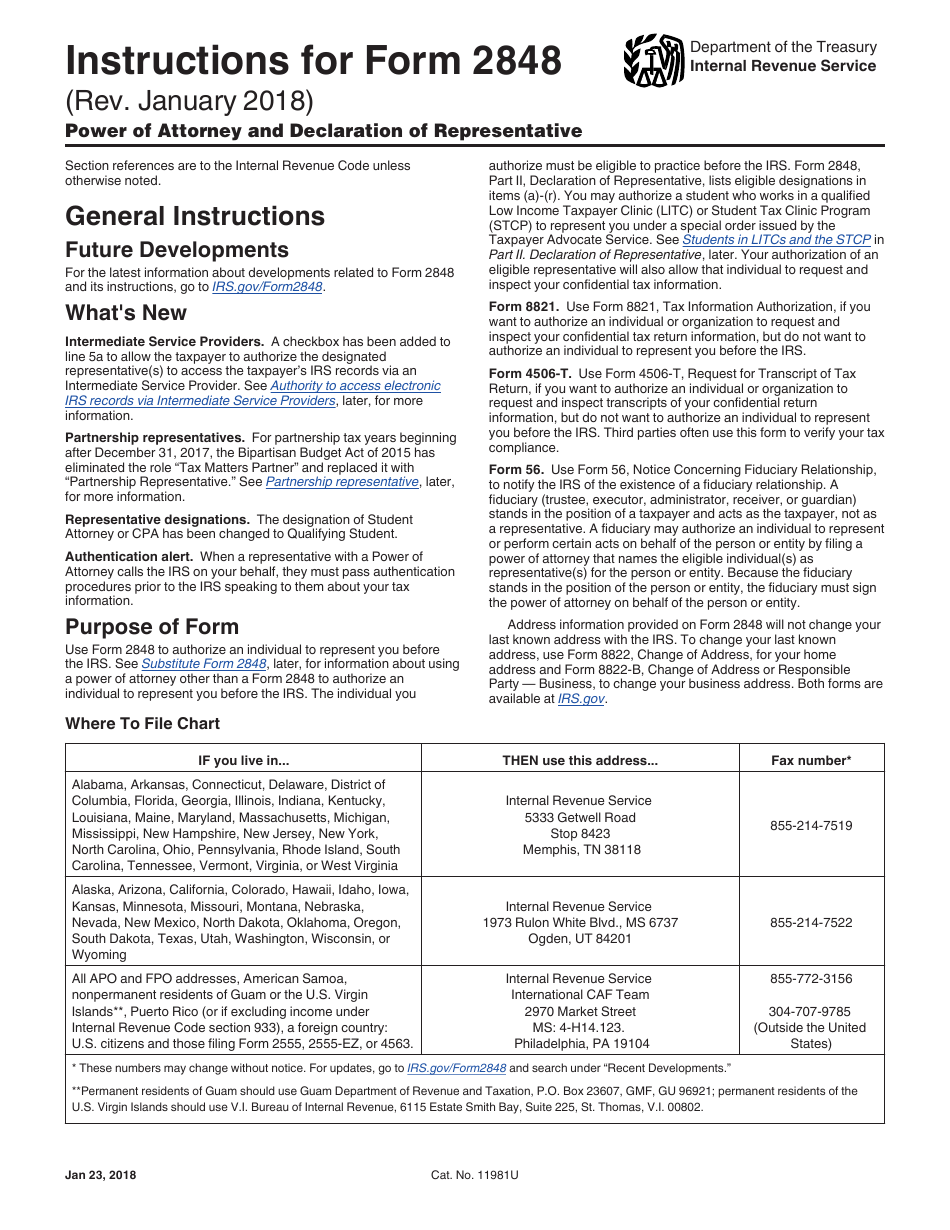

Form 2848 Instruction - You can learn more about power of attorney in this detailed guide. For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: Signing this power of attorney (“poa”) form authorizes mrs to communicate with and provide your confidential information to the individual you name as your representative. Ad get ready for tax season deadlines by completing any required tax forms today. Web the following are the form 2848 instructions that you will need to perform in order to file it properly: Power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to Date / / part i power of attorney. For instructions and the latest information.

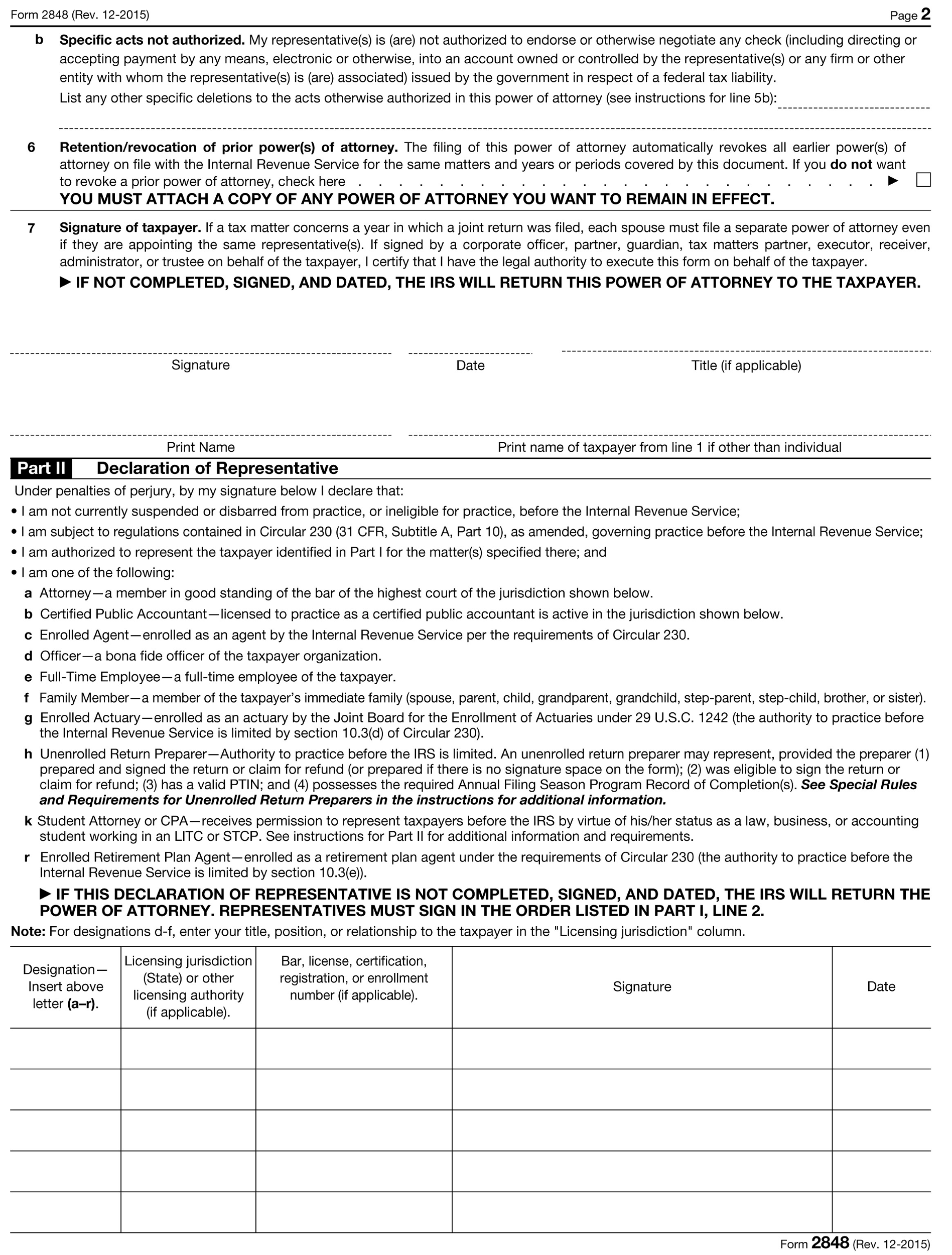

This form is officially called power of attorney and declaration of representative. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web the following are the form 2848 instructions that you will need to perform in order to file it properly: For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: For instructions and the latest information. Do not use the sc2848 for a fiduciary, such as a trustee, executor, administrator, receiver, or guardian. Power of attorney and declaration of representative. The individual you authorize must be eligible to practice before the irs. Web purpose of form use form 2848 to authorize an individual to represent you before the irs.

Complete, edit or print tax forms instantly. A fiduciary stands in the Get ready for tax season deadlines by completing any required tax forms today. Form 2848 instructions embarking upon the journey of comprehending the paramountcy of irs form 2848 instructions, it is incumbent upon us to delve into the labyrinthine nature of this particular tax document, elucidating its objectives and potential applications in the realm of united states taxation. For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: Do not use the sc2848 for a fiduciary, such as a trustee, executor, administrator, receiver, or guardian. January 2021) department of the treasury internal revenue service. Web form 2848 from the internal revenue service (irs) is the form to use if someone will represent on your behalf to the irs. Purpose of form use form 2848 to authorize an individual to represent you before the irs. Complete, edit or print tax forms instantly.

Breanna Form 2848 Pdf

Their name, address, social security number, employer identification number (if a corporation), daytime phone number, and plan number. Web instructions general purpose use the sc2848 to grant authority to an individual to represent you before the south carolina department of revenue (scdor) and to receive tax information. Web form 2848 from the internal revenue service (irs) is the form to.

20182020 Form IRS 2848 Fill Online, Printable, Fillable, Blank PDFfiller

Web instructions general purpose use the sc2848 to grant authority to an individual to represent you before the south carolina department of revenue (scdor) and to receive tax information. You can learn more about power of attorney in this detailed guide. Form 2848 instructions embarking upon the journey of comprehending the paramountcy of irs form 2848 instructions, it is incumbent.

Form 2848 YouTube

Signing this power of attorney (“poa”) form authorizes mrs to communicate with and provide your confidential information to the individual you name as your representative. For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: Web instructions general purpose use the sc2848 to grant authority to an individual to.

Form 2848 Vs 8821

Web purpose of form use form 2848 to authorize an individual to represent you before the irs. You can learn more about power of attorney in this detailed guide. Power of attorney and declaration of representative. Their name, address, social security number, employer identification number (if a corporation), daytime phone number, and plan number. A fiduciary stands in the

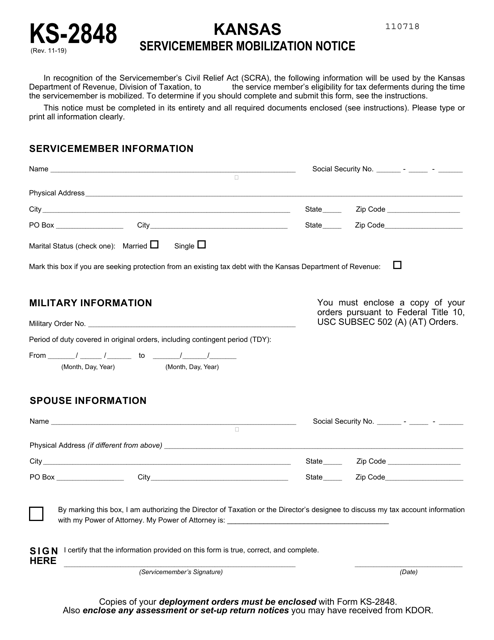

Form KS2848 Download Fillable PDF or Fill Online Servicemember

For instructions and the latest information. Web form 2848 from the internal revenue service (irs) is the form to use if someone will represent on your behalf to the irs. January 2021) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web for the latest information about developments related to form 2848 and its instructions,.

Form 2848 YouTube

Ad get ready for tax season deadlines by completing any required tax forms today. Power of attorney and declaration of representative. This form is officially called power of attorney and declaration of representative. Complete, edit or print tax forms instantly. Date / / part i power of attorney.

Form 2848 Example

Web the following are the form 2848 instructions that you will need to perform in order to file it properly: Web purpose of form use form 2848 to authorize an individual to represent you before the irs. Power of attorney and declaration of representative. See substitute form 2848, later, for information about using a power of attorney other than a.

Download Instructions for IRS Form 2848 Power of Attorney and

Web instructions general purpose use the sc2848 to grant authority to an individual to represent you before the south carolina department of revenue (scdor) and to receive tax information. Complete, edit or print tax forms instantly. Web the following are the form 2848 instructions that you will need to perform in order to file it properly: January 2021) department of.

Download Instructions for IRS Form 2848 Power of Attorney and

For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: Do not use the sc2848 for a fiduciary, such as a trustee, executor, administrator, receiver, or guardian. Form 2848 instructions embarking upon the journey of comprehending the paramountcy of irs form 2848 instructions, it is incumbent upon us to.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web form 2848 from the internal revenue service (irs) is the form to use if someone will represent on your behalf to the irs. Complete, edit or print tax forms instantly. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. See substitute form 2848, later, for.

Web Instructions General Purpose Use The Sc2848 To Grant Authority To An Individual To Represent You Before The South Carolina Department Of Revenue (Scdor) And To Receive Tax Information.

Form 2848 is used to authorize an eligible individual to. Their name, address, social security number, employer identification number (if a corporation), daytime phone number, and plan number. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to Web purpose of form use form 2848 to authorize an individual to represent you before the irs.

You Can Learn More About Power Of Attorney In This Detailed Guide.

Date / / part i power of attorney. Web for the latest information about developments related to form 2848 and its instructions, go to irs.gov/form2848. This form is officially called power of attorney and declaration of representative. Complete, edit or print tax forms instantly.

Power Of Attorney And Declaration Of Representative.

Web form 2848 (poa) instructions for 2023. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. Signing this power of attorney (“poa”) form authorizes mrs to communicate with and provide your confidential information to the individual you name as your representative. Do not use the sc2848 for a fiduciary, such as a trustee, executor, administrator, receiver, or guardian.

Web Information About Form 2848, Power Of Attorney And Declaration Of Representative, Including Recent Updates, Related Forms, And Instructions On How To File.

Purpose of form use form 2848 to authorize an individual to represent you before the irs. For boxes 1 to 5 firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: Get ready for tax season deadlines by completing any required tax forms today. Web the following are the form 2848 instructions that you will need to perform in order to file it properly: