Form 285 Arizona

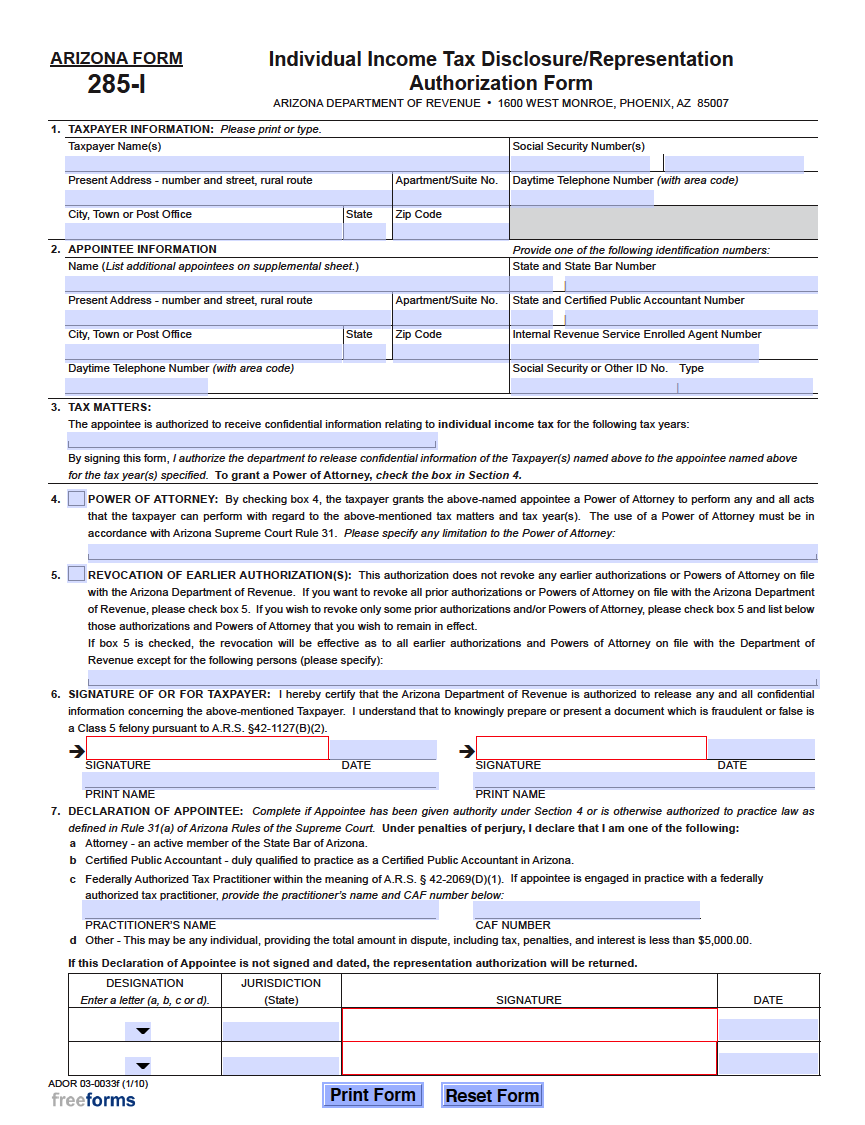

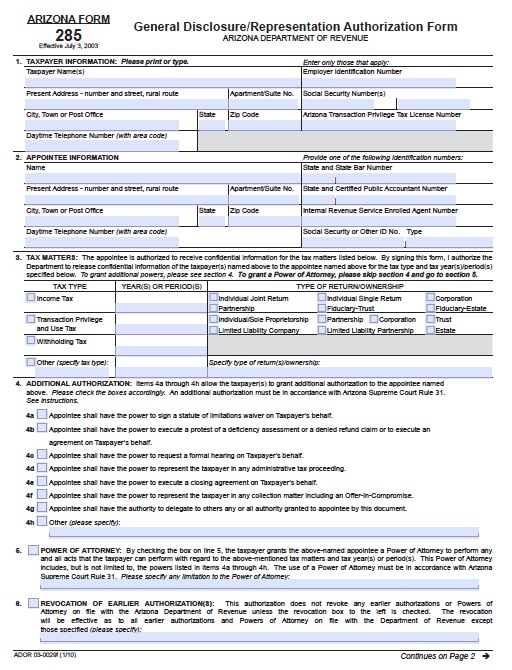

Form 285 Arizona - Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: The form can also grant the appointee a power of attorney. Enter only those that apply: Social security number(s) city, town or post offi ce state zip. Web a taxpayer may now submit the arizona form 285 and form 285b through email or fax, in addition to the mail. Web general disclosure/representation authorization form. You wish to authorize an employee of the pmc to: The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. Appointee information (must sign if any checkboxes in sections 4 or 5 below are selected) enter one of the following identification numbers: Enter only those that apply:

Most times, the appointee will be the principal’s accountant or tax attorney who will be using their expertise to adequately address the. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Social security number(s) city, town or post offi ce state zip. Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: The arizona state tax power of attorney (form 285) is a convenient document for individual taxpayers or business entities to appoint an agent to manage their tax filings/payments. A taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Web power of attorney (poa) / disclosure forms. Enter only those that apply: Web a taxpayer may now submit the arizona form 285 and form 285b through email or fax, in addition to the mail. Enter only those that apply:

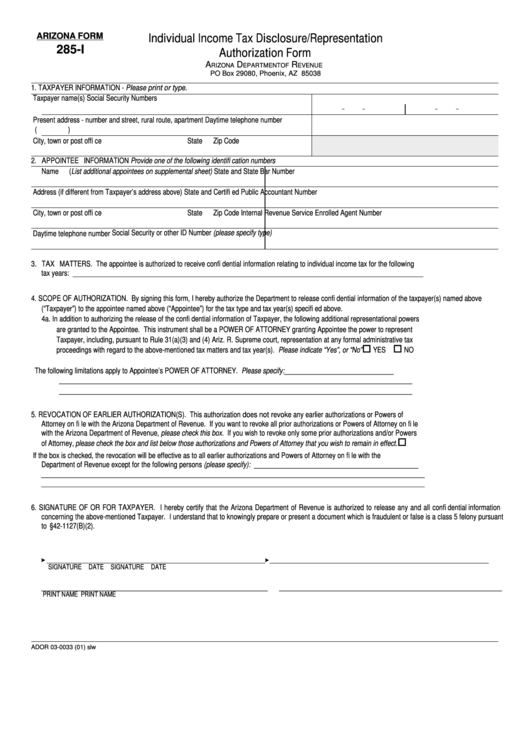

Web updated on june 13th, 2023. Social security number(s) city, town or post offi ce state zip. A taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Enter only those that apply: Individual income tax disclosure/representation authorization form. Web general disclosure/representation authorization form. You hired a property management company (pmc) to file your transaction privilege and use tax (tpt) returns for your rental property business, and 3. A taxpayer may use arizona form 285 to authorize the department to release confidential information to the taxpayer’s appointee. These forms authorize the department to release confidential information to the taxpayer's appointee.

2006 Form AZ DoR 285B Fill Online, Printable, Fillable, Blank pdfFiller

The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. Web general disclosure/representation authorization form. You hired a property management company (pmc) to file your transaction privilege and use tax (tpt) returns for your rental property business, and 3. Most times, the appointee will be the principal’s accountant.

Arizona

Web general disclosure/representation authorization form. Web power of attorney (poa) / disclosure forms. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. A taxpayer may use arizona form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Most times, the appointee will be.

Arizona

The arizona state tax power of attorney (form 285) is a convenient document for individual taxpayers or business entities to appoint an agent to manage their tax filings/payments. Social security number(s) city, town or post offi ce state zip. Most times, the appointee will be the principal’s accountant or tax attorney who will be using their expertise to adequately address.

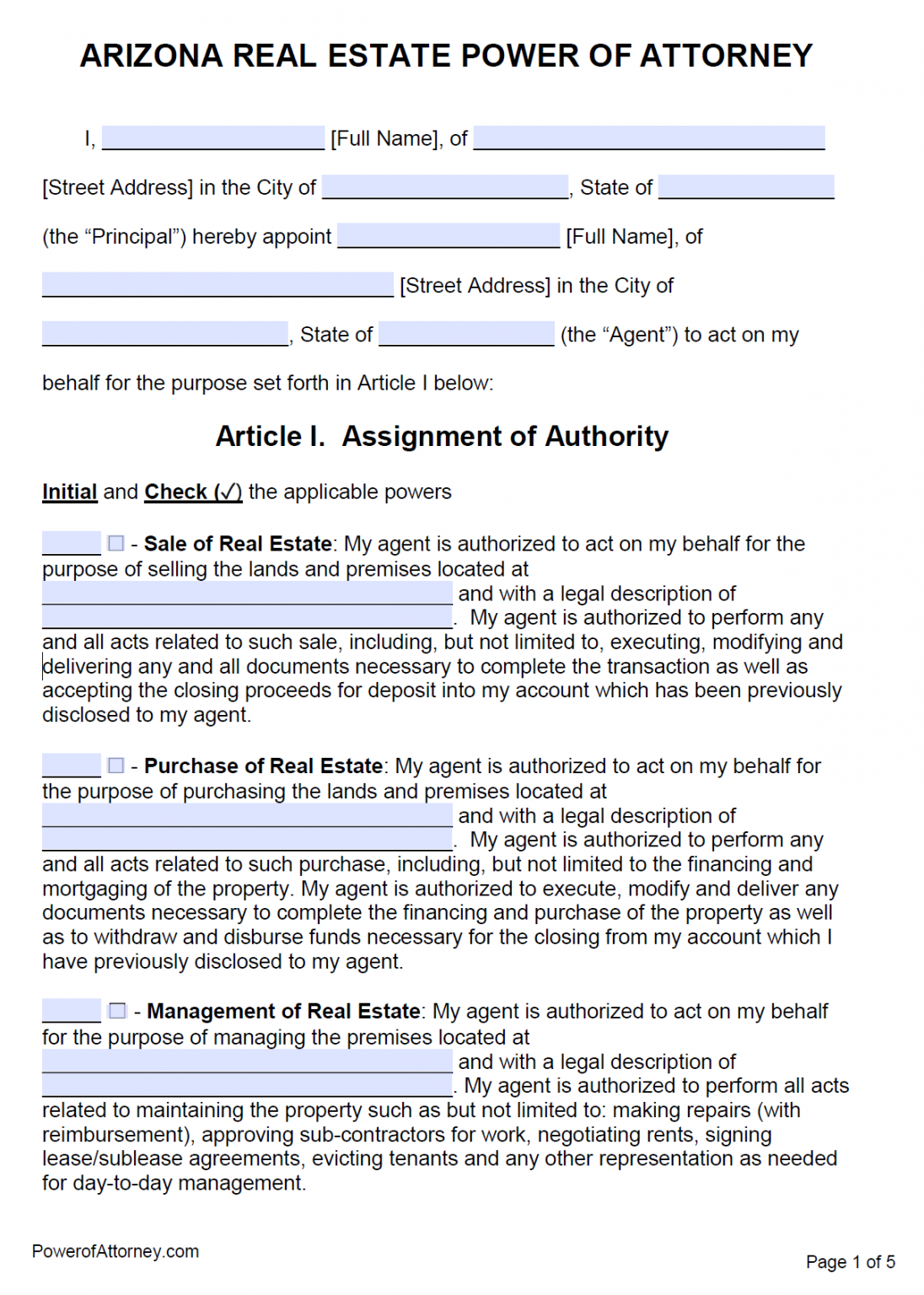

Free Arizona Power Of Attorney Forms PDF Templates

Web arizona department of revenue arizona form 285 effective july 3, 2003 1. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. Communicate with the.

Free Arizona Tax Power of Attorney Form (285I) PDF eForms

Appointee information (must sign if any checkboxes in sections 4 or 5 below are selected) enter one of the following identification numbers: The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. These forms authorize the department to release confidential information to the taxpayer's appointee. Web updated on.

Arizona Form 285 Fill Online, Printable, Fillable, Blank pdfFiller

The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. You wish to authorize an employee of the pmc to: Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: Enter only those that apply: Communicate with the arizona department of revenue

Fillable Arizona Form 285I Individual Tax Disclosure

You hired a property management company (pmc) to file your transaction privilege and use tax (tpt) returns for your rental property business, and 3. Web power of attorney (poa) / disclosure forms. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Enter only those that apply: Web general disclosure/representation authorization form.

Free Arizona State Tax Power of Attorney (Form 285) PDF

Enter only those that apply: Web updated on june 13th, 2023. Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: Web taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. The department may have to disclose confidential information to fully discuss tax issues with, or.

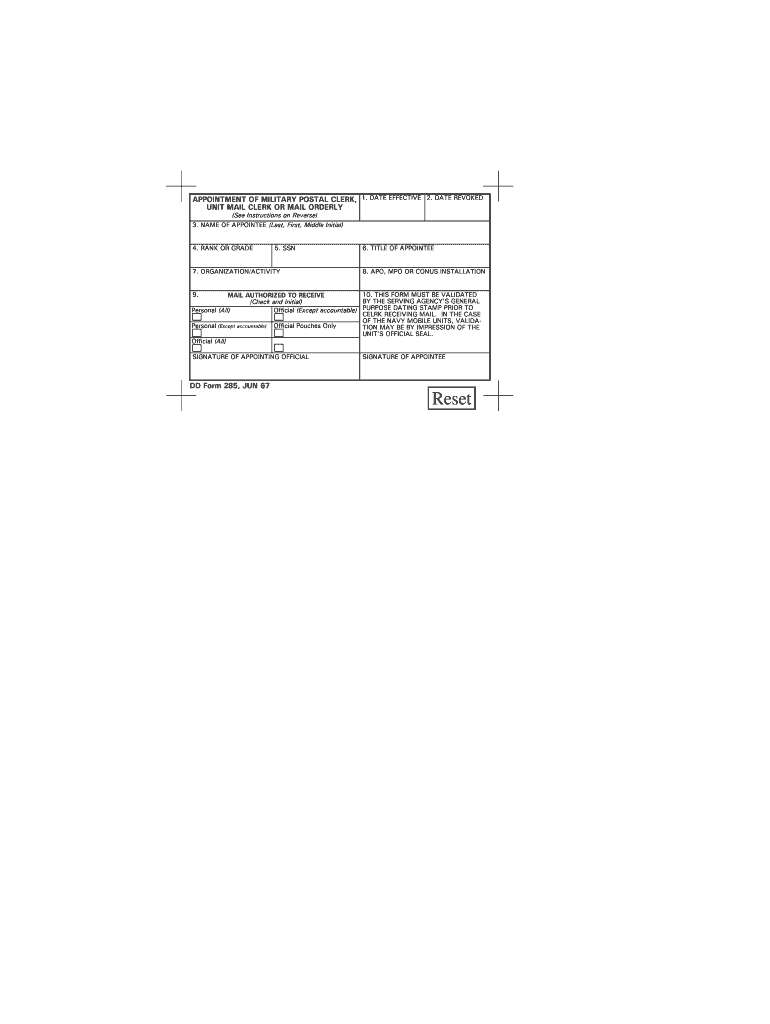

Dd Form 285 Fill Out and Sign Printable PDF Template signNow

Web power of attorney (poa) / disclosure forms. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Most times, the appointee will be the principal’s accountant or tax attorney who will be using their expertise to adequately address the. Web updated on june 13th, 2023. Web general disclosure/representation authorization form.

Free Arizona Tax Power of Attorney Form (285)

Web taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. These forms authorize the department to release confidential information to the taxpayer's appointee. Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: A taxpayer may use form 285 to authorize the department to release confidential.

Communicate With The Arizona Department Of Revenue

Web updated on june 13th, 2023. Web a taxpayer may now submit the arizona form 285 and form 285b through email or fax, in addition to the mail. Web 285 general disclosure/representation authorization form you must sign this form on page 2 taxpayer information: Enter only those that apply:

The Department May Have To Disclose Confidential Information To Fully Discuss Tax Issues With, Or Respond To Tax Questions By, The Appointee.

Web power of attorney (poa) / disclosure forms. You hired a property management company (pmc) to file your transaction privilege and use tax (tpt) returns for your rental property business, and 3. A taxpayer may use arizona form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Social security number(s) city, town or post offi ce state zip.

Web Taxpayer May Use Form 285 To Authorize The Department To Release Confidential Information To The Taxpayer’s Appointee.

Web general disclosure/representation authorization form. You wish to authorize an employee of the pmc to: The form can also grant the appointee a power of attorney. Learn how to complete the arizona form 285, general disclosure/representation authorization form.

Appointee Information (Must Sign If Any Checkboxes In Sections 4 Or 5 Below Are Selected) Enter One Of The Following Identification Numbers:

Enter only those that apply: The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the appointee. Most times, the appointee will be the principal’s accountant or tax attorney who will be using their expertise to adequately address the. You own residential rental property in arizona, and 2.