Form 3520 Filing Deadline

Form 3520 Filing Deadline - Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Owner a foreign trust with at least one u.s. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Owner files this form annually to provide information. Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. A calendar year trust is due march 15. Talk to our skilled attorneys by scheduling a free consultation today.

A calendar year trust is due march 15. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Owner, is march 15, and the due date for. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner files this form annually to provide information. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Person is required to file the form, and the related party rules apply. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Owner, is march 15, and the due date for. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web there are certain filing threshold requirements that the gift (s) must meet before the u.s. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. Owner files this form annually to provide information. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. This deadline applies to any individual or small business seeking to file their taxes with the.

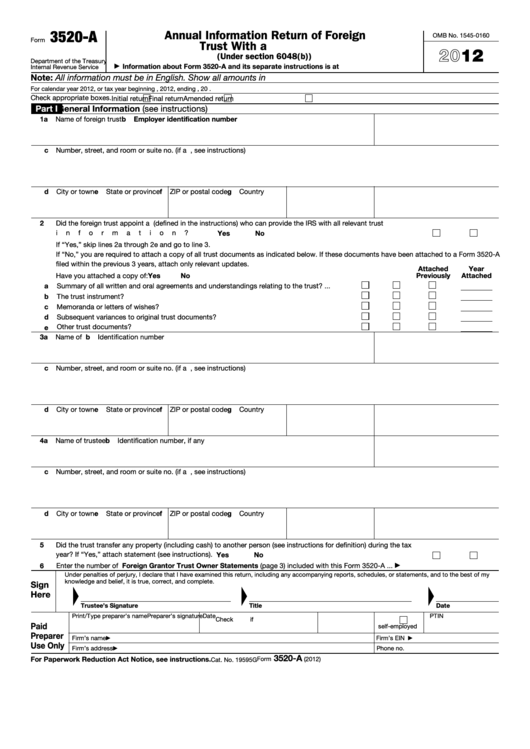

Form 3520 Blank Sample to Fill out Online in PDF

Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. A calendar year trust is due march 15. Owner files this form annually to provide information. Web information reporting form 3520 in general, a form 3520, annual return to.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. It.

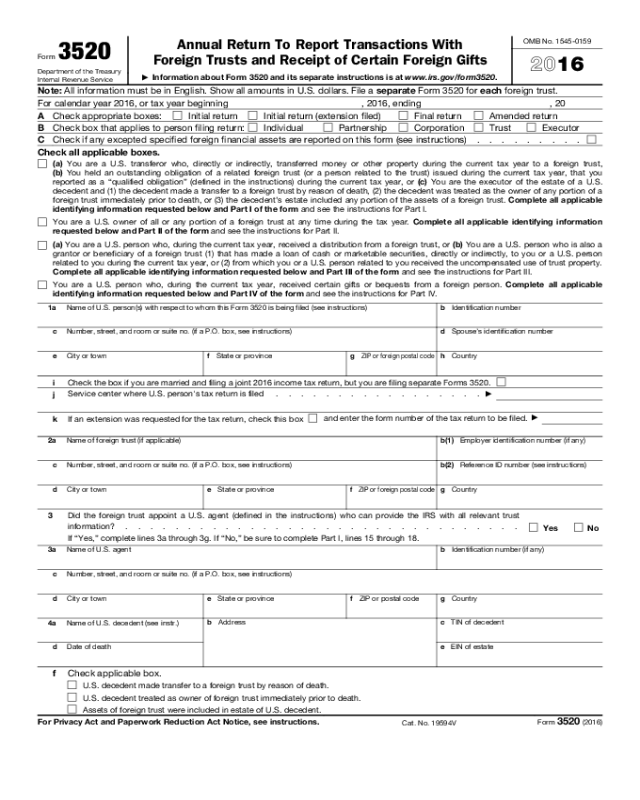

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Owner files this form annually to provide information. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Person is required.

Steuererklärung dienstreisen Form 3520

A calendar year trust is due march 15. It does not have to be a “foreign gift.” rather, if a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web form 3520 & instructions: Ad don’t.

Relief from Filing Forms 3520 and Form 3520A for Some SF Tax Counsel

Web form 3520 & instructions: Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web the form is due when a person’s tax return is due to be filed. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should.

IRS Form 3520 Reporting Foreign Trusts for Expats Bright!Tax

Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Owner files this form annually to provide information. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 filing requirements. Web the form is due when.

IRS 3520 A FILING DEADLINE FAST APPROACHING Southpac Group

Web form 3520 filing requirements. Web there are certain filing threshold requirements that the gift (s) must meet before the u.s. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts.

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Talk to our skilled attorneys by scheduling a free consultation today. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. Web the form is due when a person’s tax return is due to be filed. This deadline applies.

IRS FILING OBLIGATIONS FORM 3520A Southpac Group

Talk to our skilled attorneys by scheduling a free consultation today. Web form 3520 filing requirements. Owner files this form annually to provide information. It does not have to be a “foreign gift.” rather, if a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

A calendar year trust is due march 15. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web the form is due when a person’s tax return is due to be filed. It does not have to be a “foreign gift.” rather, if a. Web the irs changed.

Person Is Granted An Extension Of Time To File An Income Tax Return, The Due Date For Filing Form 3520 Is The 15Th Day Of The 10Th Month (October 15) Following The End Of The.

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner a foreign trust with at least one u.s.

Form 3520 Is Technically Referred To As The Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 filing requirements. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner, is march 15, and the due date for.

Person Is Required To File The Form, And The Related Party Rules Apply.

This deadline applies to any individual or small business seeking to file their taxes with the. Web there are certain filing threshold requirements that the gift (s) must meet before the u.s. Owner files this form annually to provide information. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required.

It Does Not Have To Be A “Foreign Gift.” Rather, If A.

A calendar year trust is due march 15. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: But what happens if the taxpayer never files. Talk to our skilled attorneys by scheduling a free consultation today.