Form 3921 Tax

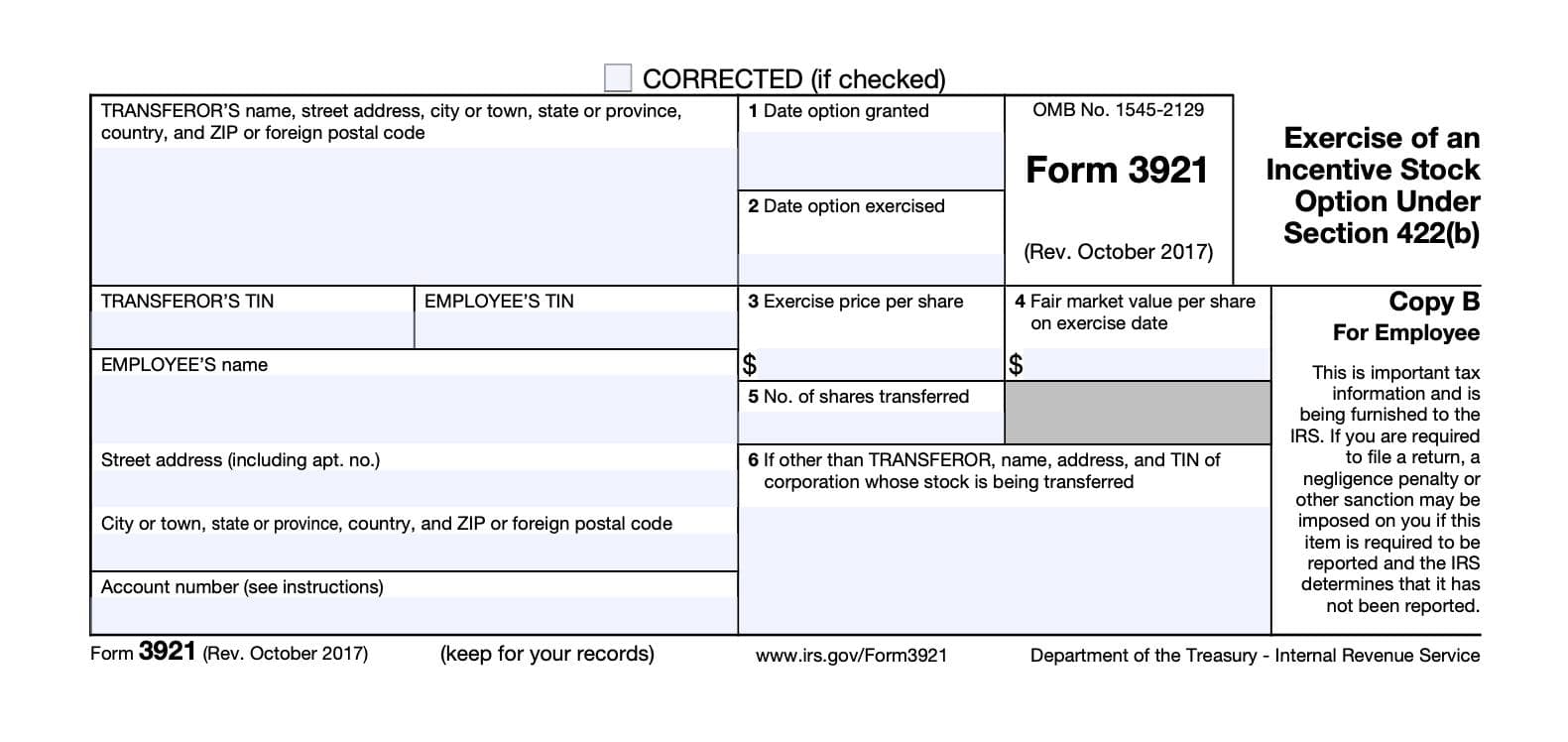

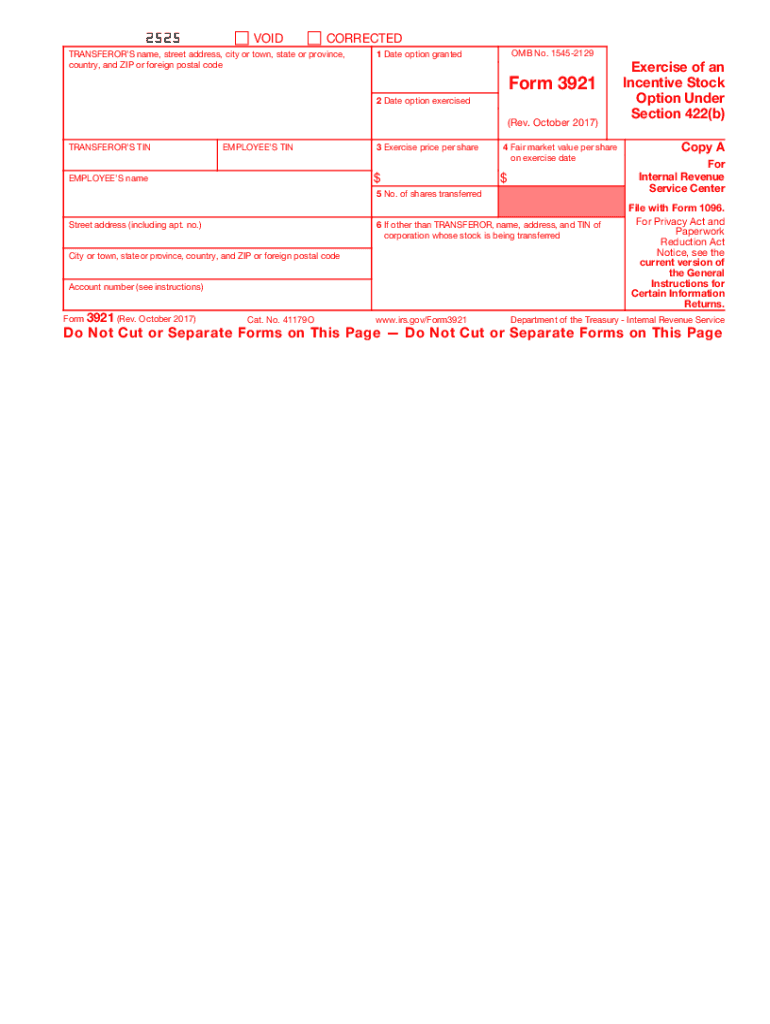

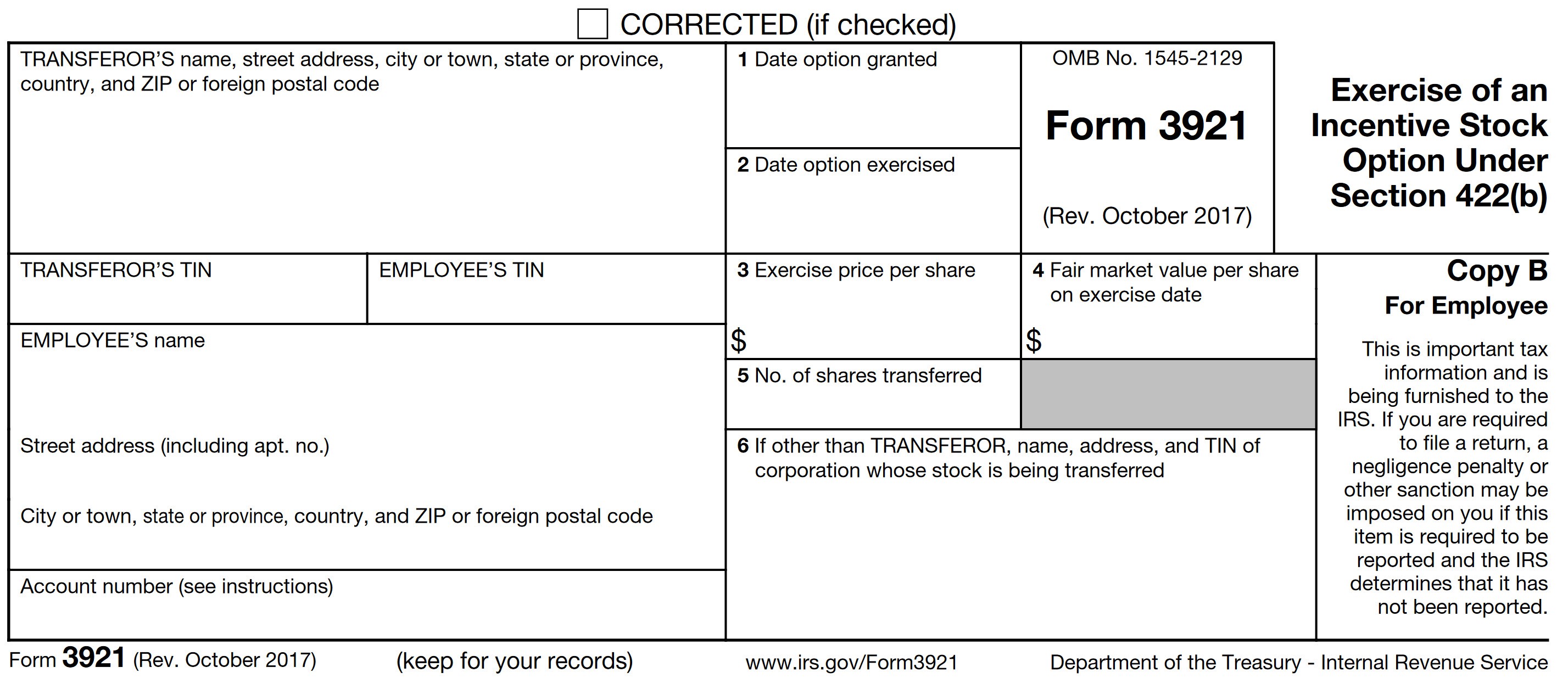

Form 3921 Tax - Ad edit, sign or email irs 3921 & more fillable forms, register and subscribe now! This tax form is about employees who have exercised. Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Web may 5, 2023 form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). If stock acquired through an iso is sold or. Incentive stock options (iso) are compensation to employees in the form of stock rather. Web distributes the tax levies for: Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals.

Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Web 1 best answer tomyoung level 13 actually you do need to report the exercise of iso stock if you did not sell all of the stock before year end, and you do that by. Ad complete irs tax forms online or print government tax documents. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Incentive stock options (iso) are compensation to employees in the form of stock rather. What is 3921 tax form? Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. It does not need to be entered into. Web out of the many irs tax forms, one of the main filings a company has to take care of is the filing of form 3921. This makes it easier for the irs to hold.

Web 1 best answer tomyoung level 13 actually you do need to report the exercise of iso stock if you did not sell all of the stock before year end, and you do that by. If stock acquired through an iso is sold or. This tax form is about employees who have exercised. Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. Web out of the many irs tax forms, one of the main filings a company has to take care of is the filing of form 3921. Web may 5, 2023 form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Web irs tax treatment of incentive stock options forms 3921, 6251, 8949. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web for regular tax purposes, form 3921 is generally informational and the document should be retained for record keeping purposes.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

This makes it easier for the irs to hold. This tax form is about employees who have exercised. If stock acquired through an iso is sold or. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. The form is filed with the internal.

Requesting your TCC for Form 3921 & 3922

Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. This makes it easier for the irs to hold. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web distributes the.

Form 3921 Everything you need to know

It does not need to be entered into. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. Ad complete irs tax forms online or print government tax documents. Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Web these where to file addresses are.

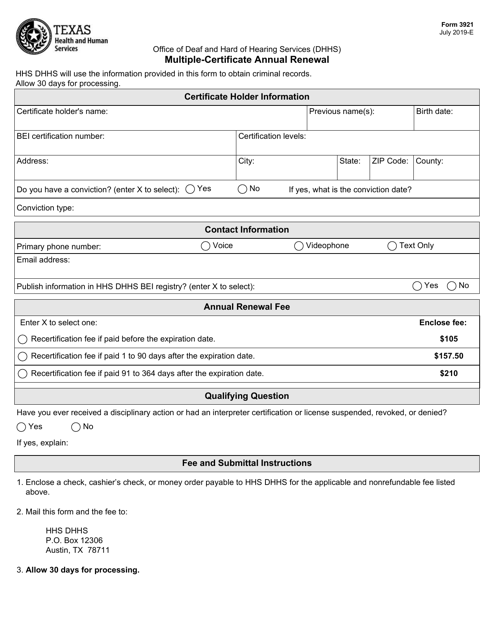

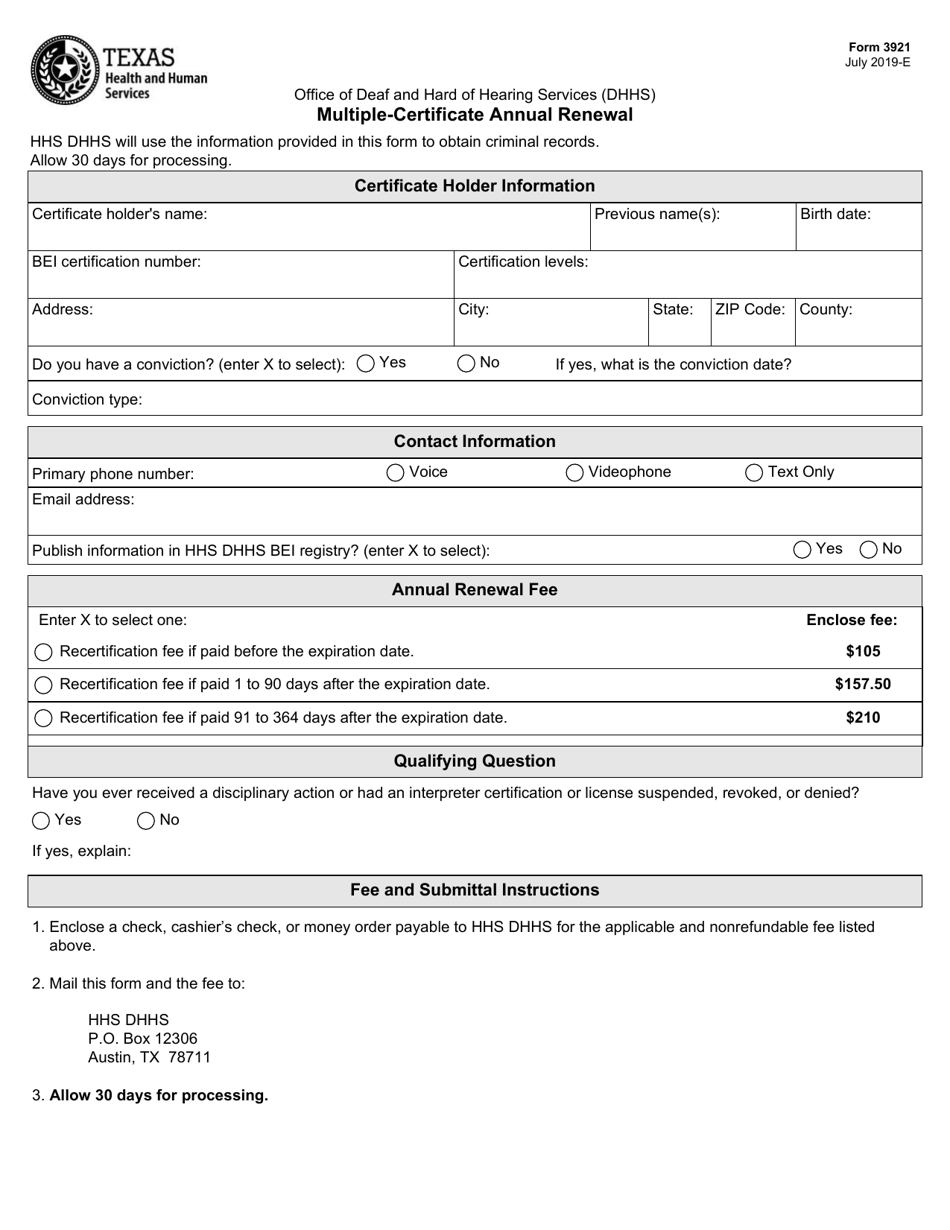

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Although this information is not taxable unless. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web entering amounts from form 3921 in the individual.

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. Web for regular tax purposes, form 3921 is generally informational and the document should be retained for record keeping purposes. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Incentive stock options.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Web irs tax treatment of incentive stock options forms 3921, 6251, 8949. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. 3921 tax forms can be keyed or imported.

Form 3921 Exercise of an Incentive Stock Option under Section 422(b

Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Web who must file. Web form 3921 is an informational report, similar to 1099s, that lets.

Learn About ISO If You Have Stock Options, You Need Tax Form 3921

Ad edit, sign or email irs 3921 & more fillable forms, register and subscribe now! Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. This makes it easier for the irs to hold. Ad complete irs tax forms online or print government.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Complete, edit or print tax forms instantly. Irs form 3921 is.

Web Entering Amounts From Form 3921 In The Individual Module Of Lacerte Solved • By Intuit • 283 • Updated July 19, 2022 This Article Will Help You Enter Amounts.

Web form 3921 is an informational report, similar to 1099s, that lets the irs know that certain individuals/entities received compensation. Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Web out of the many irs tax forms, one of the main filings a company has to take care of is the filing of form 3921. A startup is required to file one.

Web Form 3921 Is A Tax Form Used To Report That A Shareholder Has Exercised The Incentive Stock That The Company Has Granted.

Web for regular tax purposes, form 3921 is generally informational and the document should be retained for record keeping purposes. What is 3921 tax form? Ad edit, sign or email irs 3921 & more fillable forms, register and subscribe now! It does not need to be entered into.

This Tax Form Is About Employees Who Have Exercised.

This makes it easier for the irs to hold. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts.

Web Form 3921 Exercise Of An Incentive Stock Option Under Section 422 (B), Is For Informational Purposes Only And Should Be Kept With Your Records.

If stock acquired through an iso is sold or. Complete, edit or print tax forms instantly. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Web with account ability tax form preparation software, irs 3921 compliance couldn't be easier!