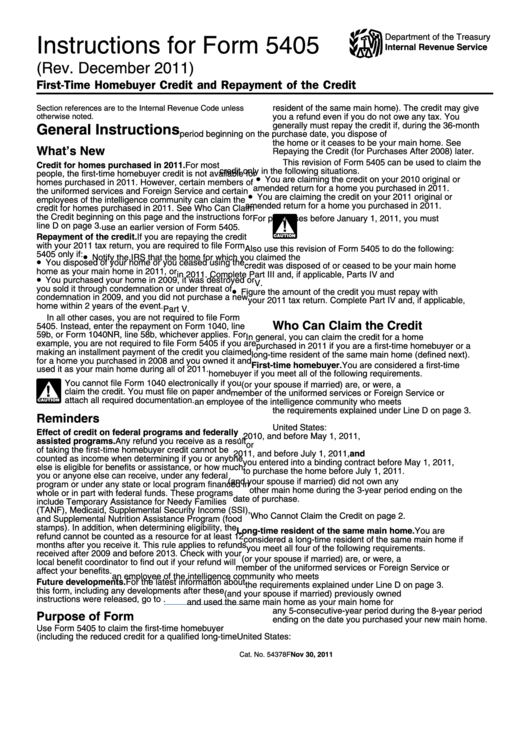

Form 5405 Instructions

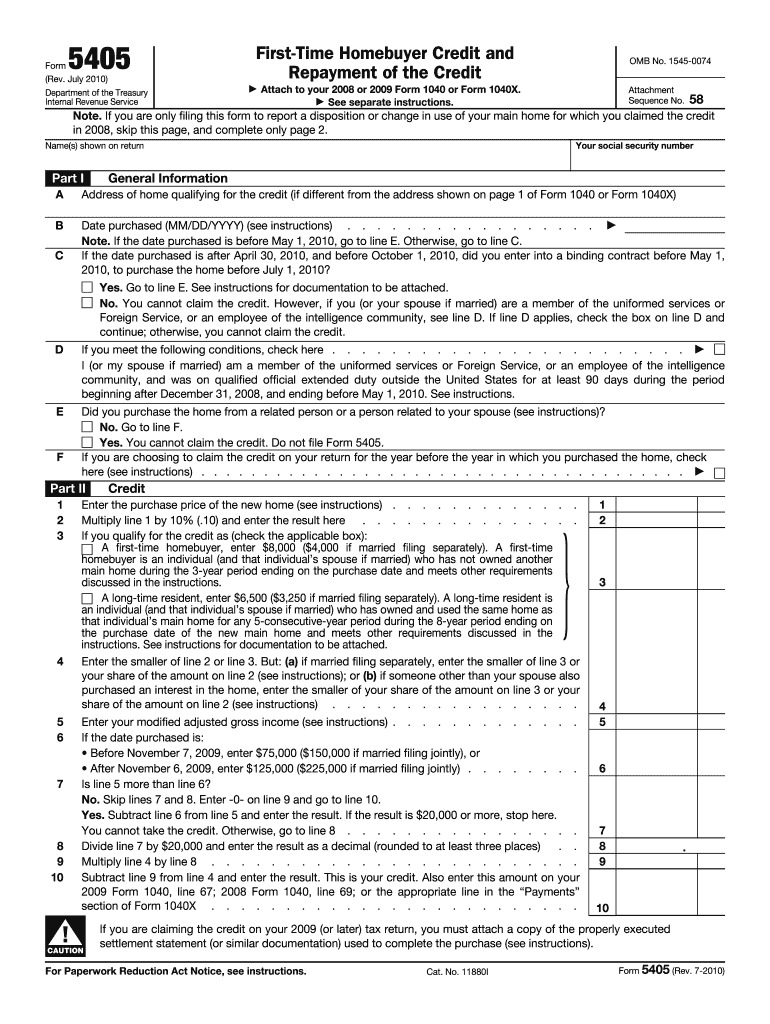

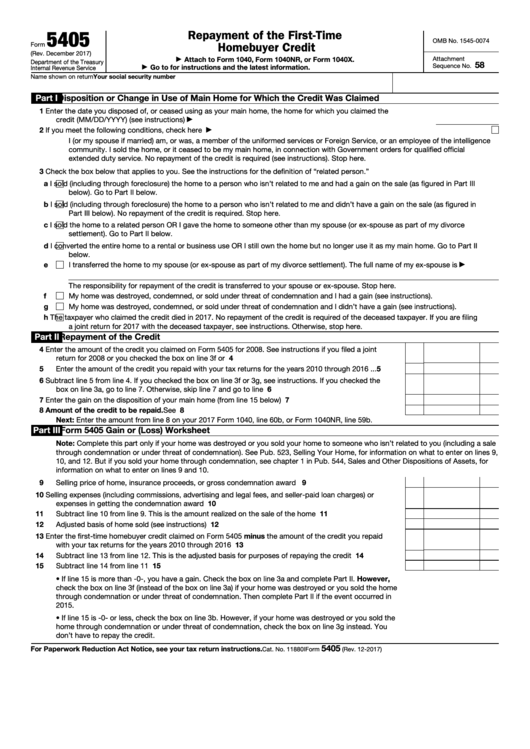

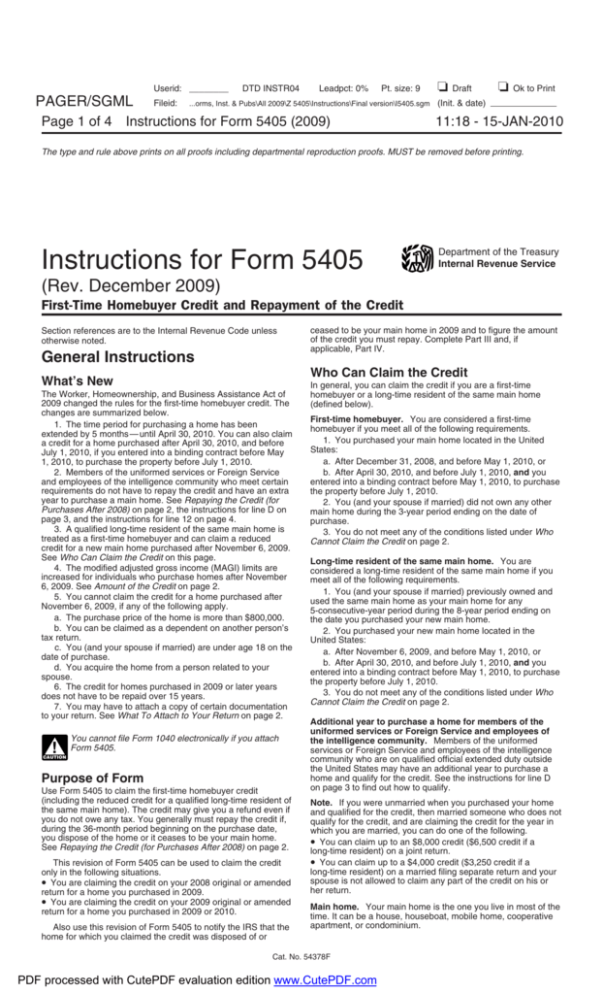

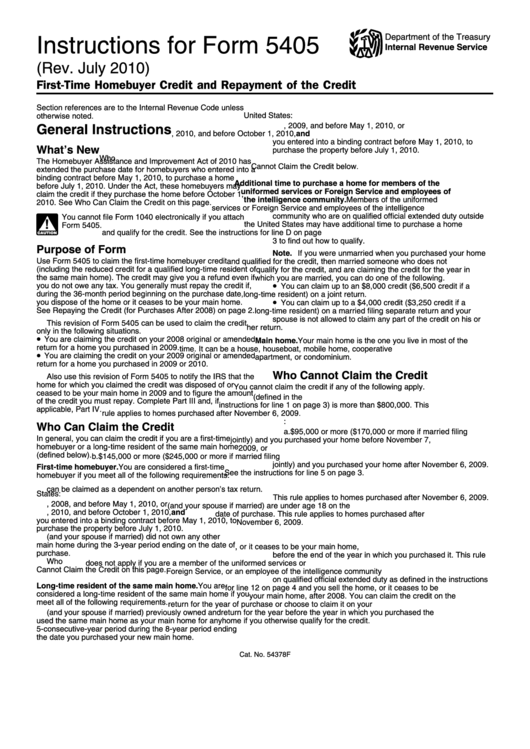

Form 5405 Instructions - Web purpose of form use form 5405 to do the following: Per the irs instructions for form 5405: Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. Instead, enter the repayment on 2022 schedule. See the instructions for line 5. You disposed of it in 2022. Web purpose of form. Web who must file form 5405? You disposed of it in 2022. Part iii form 5405 gain or (loss) worksheet.

Web purpose of form. Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Instead, enter the repayment on 2022 schedule. Complete part i and, if applicable, parts ii and iii. See the instructions for line 5. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2022. You disposed of it in 2022. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You ceased using it as your main home in 2022.

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. Complete part i and, if applicable, parts ii and iii. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home. Web who must file form 5405? Instead, enter the repayment on 2022 schedule. You ceased using it as your main home in 2022. Use form 5405 to do the following. See the instructions for line 5. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. In all other cases, you aren't required to file form 5405.

FIA Historic Database

Part iii form 5405 gain or (loss) worksheet. In all other cases, you aren't required to file form 5405. Complete part i and, if applicable, parts ii and iii. Use form 5405 to do the following. You ceased using it as your main home in 2022.

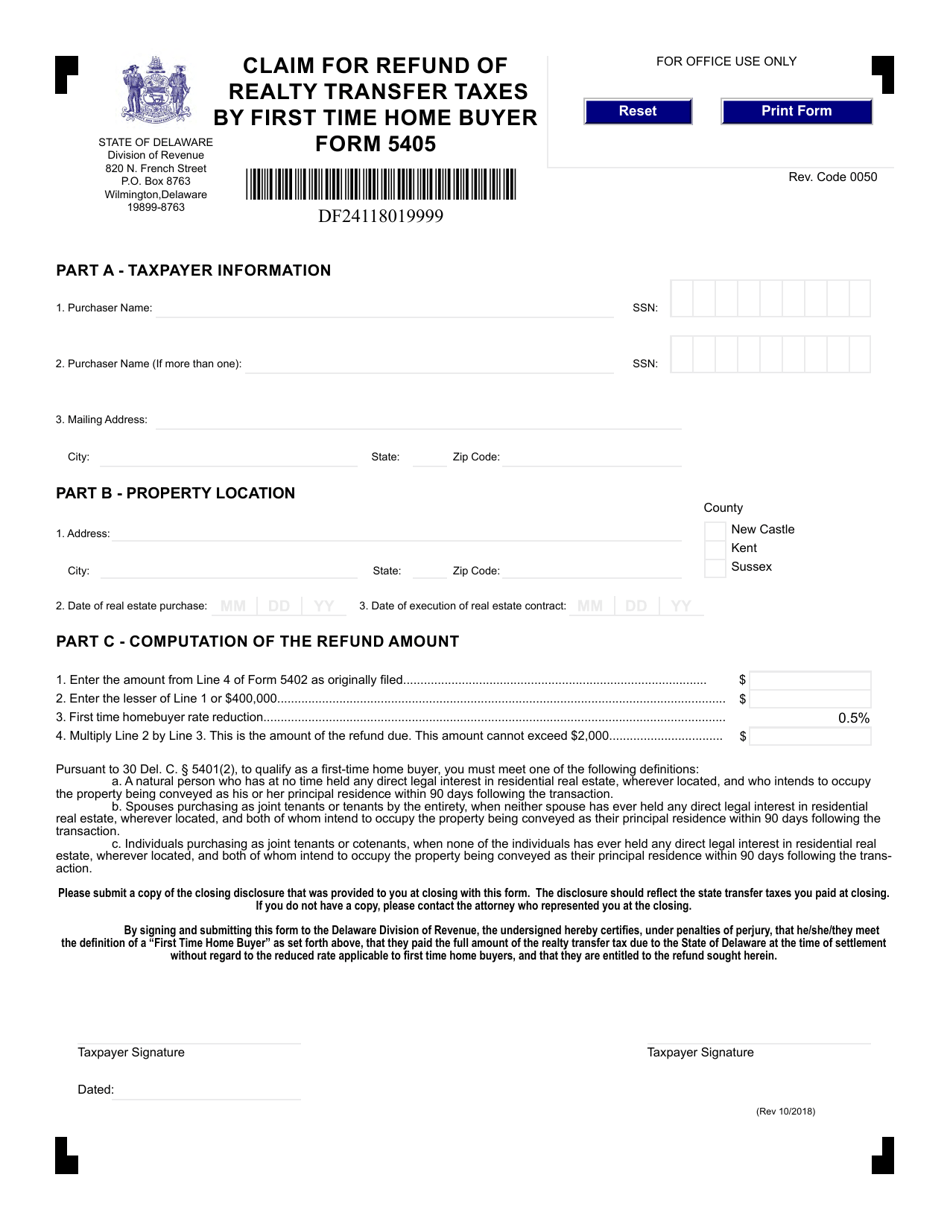

Form 5405 Download Fillable PDF or Fill Online Claim for Refund of

Web purpose of form use form 5405 to do the following: Per the irs instructions for form 5405: You disposed of it in 2022. Instead, enter the repayment on 2022 schedule. Web this program was established to help blind or disabled u.s.

540 Introduction Fall 2016 YouTube

In all other cases, you aren't required to file form 5405. You disposed of it in 2022. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. Web purpose of form. Complete part ii and, if applicable, part iii.

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

Web who must file form 5405? In all other cases, you aren't required to file form 5405. You disposed of it in 2022. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2022. Web use this part to figure the amount.

Form 540 Ca amulette

You ceased using it as your main home in 2022. Web purpose of form. You disposed of it in 2022. Complete part ii and, if applicable, part iii. Web use this part to figure the amount of estimated tax that you were required to pay.

Form 5405 Fill Out and Sign Printable PDF Template signNow

Complete part i and, if applicable, parts ii and iii. In all other cases, you aren't required to file form 5405. Web who must file form 5405? You disposed of it in 2022. Web purpose of form use form 5405 to do the following:

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

Part iii form 5405 gain or (loss) worksheet. Instead, enter the repayment on 2022 schedule. Web purpose of form use form 5405 to do the following: Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Complete part ii and, if applicable, part iii.

Instructions for Form 5405

You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Complete part i and, if applicable, parts ii and iii. Web use this part to figure the amount of estimated tax that you were required to pay. Notify the irs that the home you purchased.

Instructions For Form 5405 (Rev. July 2010) printable pdf download

Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2022. Part iii form 5405 gain or (loss) worksheet. Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including. See.

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. In all other cases, you aren't required to file form 5405. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to.

Web You Must File Form 5405 With Your 2022 Tax Return If You Purchased Your Home In 2008 And You Meet Either Of The Following Conditions.

You disposed of it in 2022. In all other cases, you aren't required to file form 5405. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions.

Notify The Irs That The Home For Which You Claimed The Credit Was Disposed Of Or Ceased To Be Your Main Home.

Per the irs instructions for form 5405: See the instructions for line 5. Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including. Web purpose of form.

Complete Part I And, If Applicable, Parts Ii And Iii.

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. Web purpose of form use form 5405 to do the following: Complete part i and, if applicable, parts ii and iii. Web the purpose of the newly revised form 5405 is to:

You Disposed Of It In 2022.

Web use this part to figure the amount of estimated tax that you were required to pay. Web this program was established to help blind or disabled u.s. Figure the amount of the credit you must repay with your 2013 tax return. You ceased using it as your main home in 2022.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)