Form 5472 Instructions 2021

Form 5472 Instructions 2021 - When and where to file. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Answer this question 1 answers jason knott international tax attorney and u.s. Web do i have to file form 5472? Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. Corporation or a foreign corporation engaged in a u.s. A reporting corporation that engages. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s.

Cpa yes you should be reporting the capital contributions. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. When and where to file. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web july 16, 2021 draft as of form 5472 (rev. Corporations file form 5472 to provide information required. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. You can get the irs form 5472 by clicking here to visit the internal. Corporation or a foreign corporation engaged in a u.s. Web form 5472 filing obligation.

Web form 5472 a schedule stating which members of the u.s. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. Web form 5472 filing obligation. Corporations file form 5472 to provide information required. Corporation or a foreign corporation engaged in a u.s. Web instructions for form 5472 (rev. Answer this question 1 answers jason knott international tax attorney and u.s. You can get the irs form 5472 by clicking here to visit the internal. Web information about form 5472, including recent updates, related forms, and instructions on how to file. When and where to file.

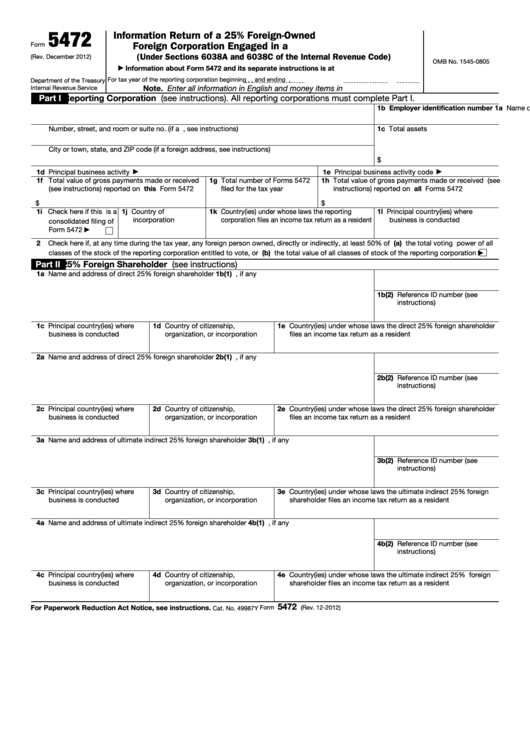

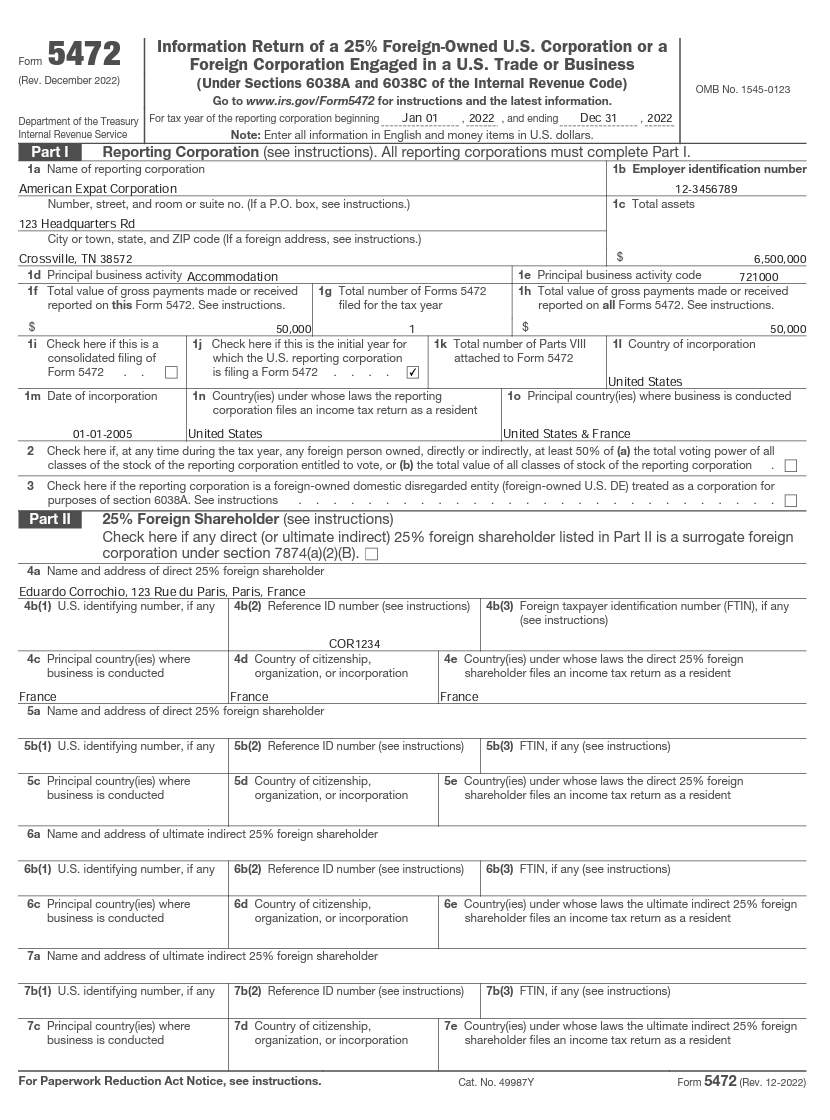

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Corporation or a foreign corporation engaged in a u.s. Corporations file form 5472 to provide information required. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Answer this question 1 answers jason knott international tax attorney and u.s. Web do i have to file form 5472?

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

Answer this question 1 answers jason knott international tax attorney and u.s. Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Web do i have to file form 5472? Cpa yes you should be reporting the capital contributions. Web july 16, 2021 draft as.

Should You File a Form 5471 or Form 5472? Asena Advisors

Answer this question 1 answers jason knott international tax attorney and u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web instructions for form 5472 (rev. Web information.

Instructions & Quick Guides on Form 5472 Asena Advisors

Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Corporations file form 5472 to provide information required. You can get the irs form 5472 by clicking here to visit the internal. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

A reporting corporation that engages. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign. Corporation or a foreign corporation engaged in a u.s. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Web.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

Web instructions for form 5472 (12/2021) | internal revenue service. Answer this question 1 answers jason knott international tax attorney and u.s. Corporations file form 5472 to provide information required. Cpa yes you should be reporting the capital contributions. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or.

Fill Free fillable IRS PDF forms

Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Corporation or a foreign corporation engaged in a u.s. Cpa yes you should be reporting the capital contributions. Corporations file form 5472 to provide information required. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

Web instructions for form 5472 (12/2021) | internal revenue service. You can get the irs form 5472 by clicking here to visit the internal. Web form 5472 filing obligation. Corporations file form 5472 to provide information required. Answer this question 1 answers jason knott international tax attorney and u.s.

Form 5472 Instructions, Examples, and More

Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web july 16, 2021 draft as of form 5472 (rev. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web instructions for form 5472 (rev. Web the internal revenue code.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Corporation or a foreign corporation engaged in a u.s. Answer this question 1 answers jason knott international tax attorney and u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to.

When And Where To File.

Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web july 16, 2021 draft as of form 5472 (rev. Web form 5472 filing obligation. Web instructions for form 5472 (12/2021) | internal revenue service.

Corporations File Form 5472 To Provide Information Required.

Web form 5472 a schedule stating which members of the u.s. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Answer this question 1 answers jason knott international tax attorney and u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file.

Eligible Tax Year 2021 Elections Can Be Made Through April 15, 2022.For Special Instructions Related To This Election, Please See The Department’s January 16, 2022,.

Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Corporation or a foreign corporation engaged in a u.s. Web do i have to file form 5472? Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s.

Web Instructions For Form 5472 (Rev.

A reporting corporation that engages. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign. You can get the irs form 5472 by clicking here to visit the internal. Corporation or a foreign corporation engaged in a u.s.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)