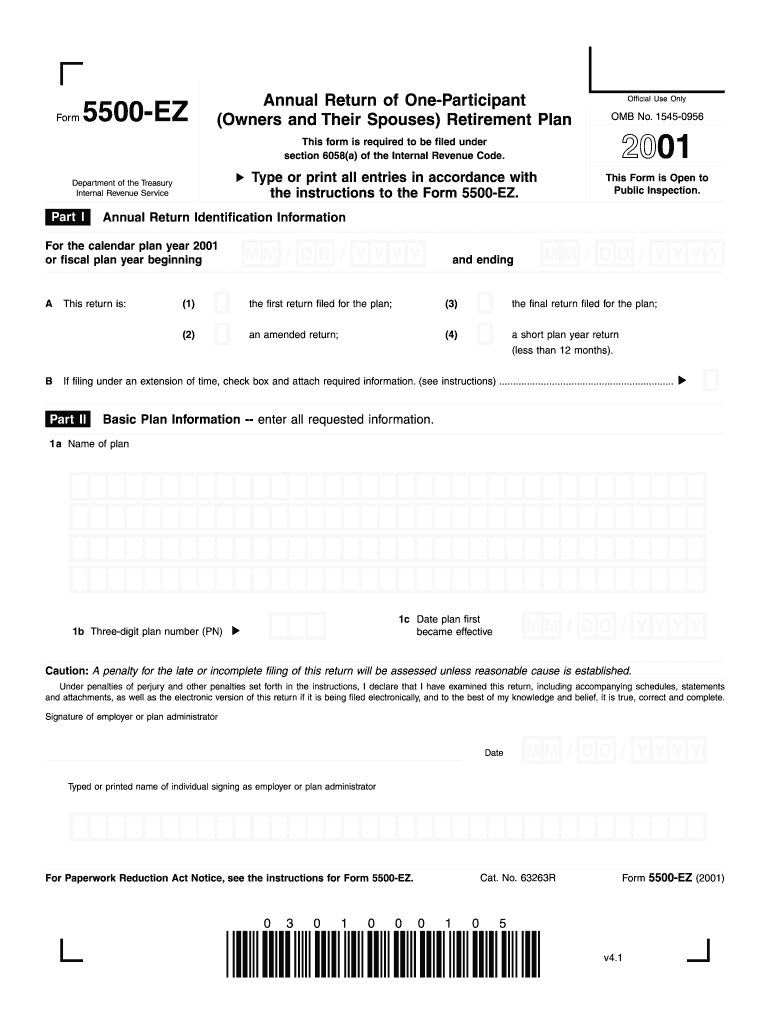

Form 5500 Ez 2022

Form 5500 Ez 2022 - Or use approved software, if available. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. What is the irs penalty relief program? Requesting a waiver of the electronic filing requirements: Web paper forms for filing. (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Who is eligible to participate in the irs penalty relief program? On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp.

Who is eligible to participate in the irs penalty relief program? Web paper forms for filing. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. Requesting a waiver of the electronic filing requirements: On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. Or use approved software, if available. What is the irs penalty relief program?

Requesting a waiver of the electronic filing requirements: Web paper forms for filing. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Or use approved software, if available. Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. Who is eligible to participate in the irs penalty relief program? (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. What is the irs penalty relief program?

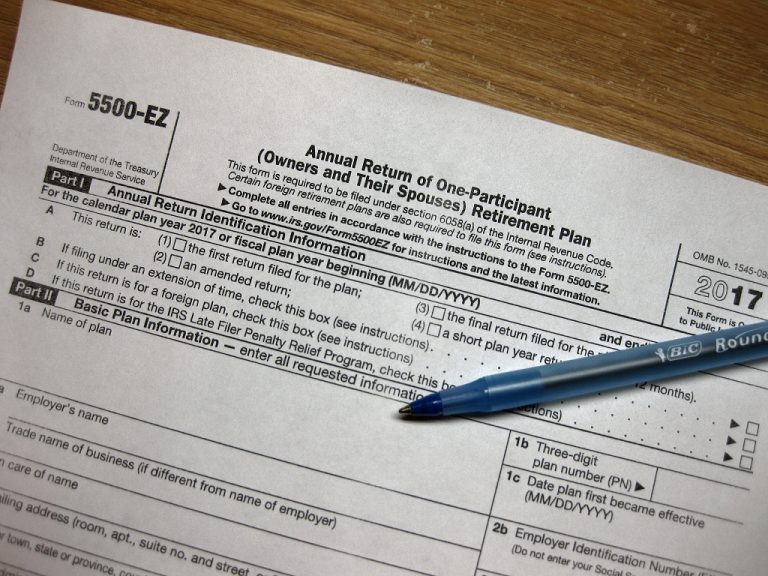

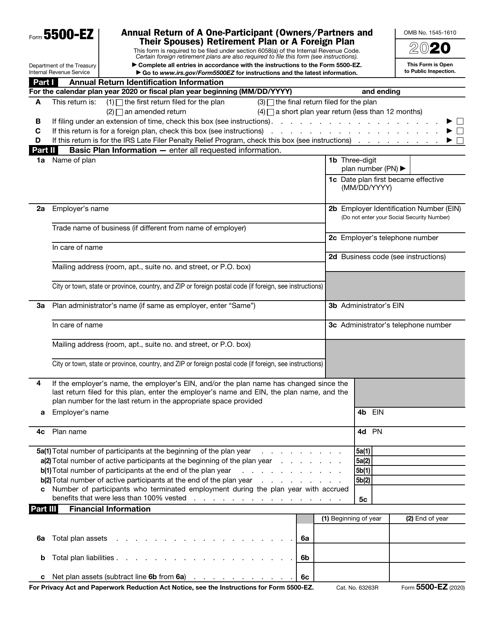

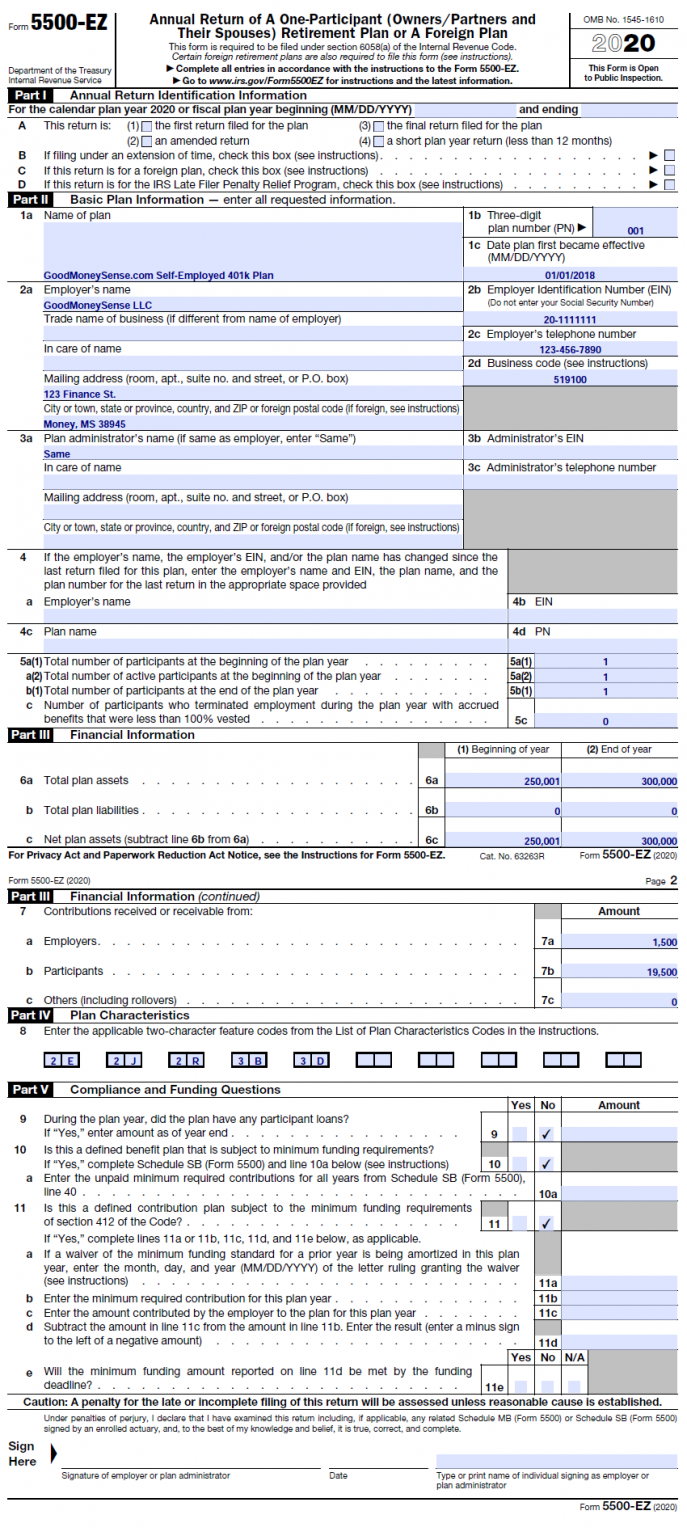

How to File Form 5500EZ Solo 401k

Who is eligible to participate in the irs penalty relief program? Requesting a waiver of the electronic filing requirements: On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. For information on filing a request for a hardship waiver for 2022 or 2023.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Requesting a waiver of the electronic filing requirements: Or use approved software, if available. Who is eligible to participate in the irs penalty relief program? On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. Department of labor’s employee benefits security administration, the.

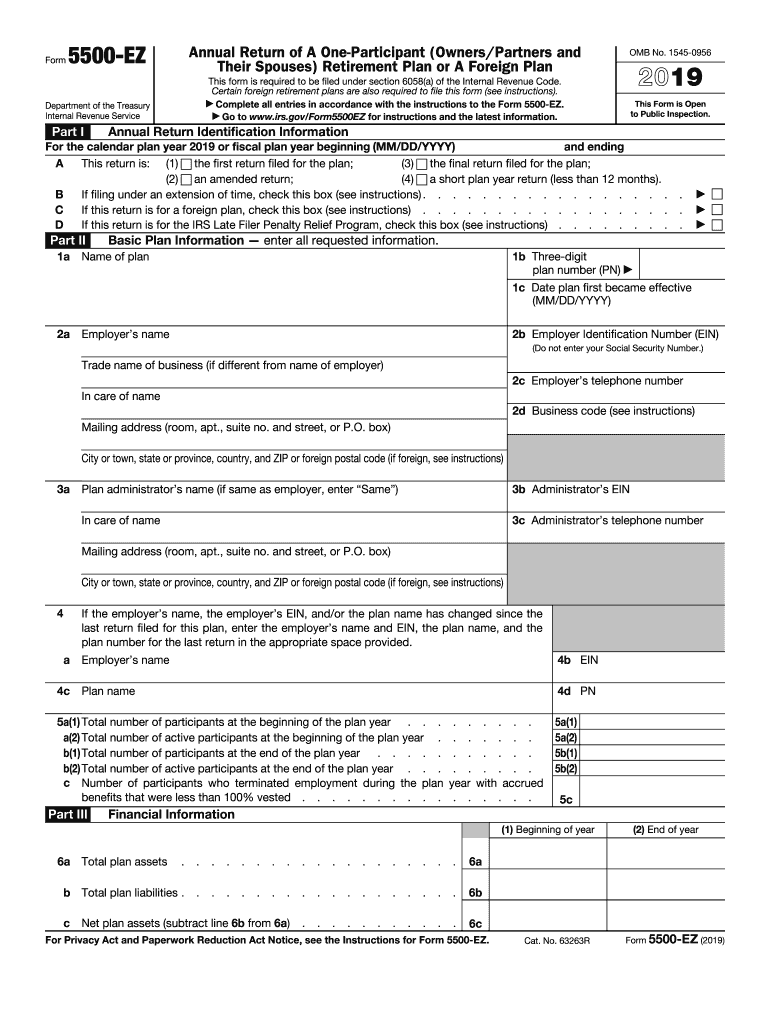

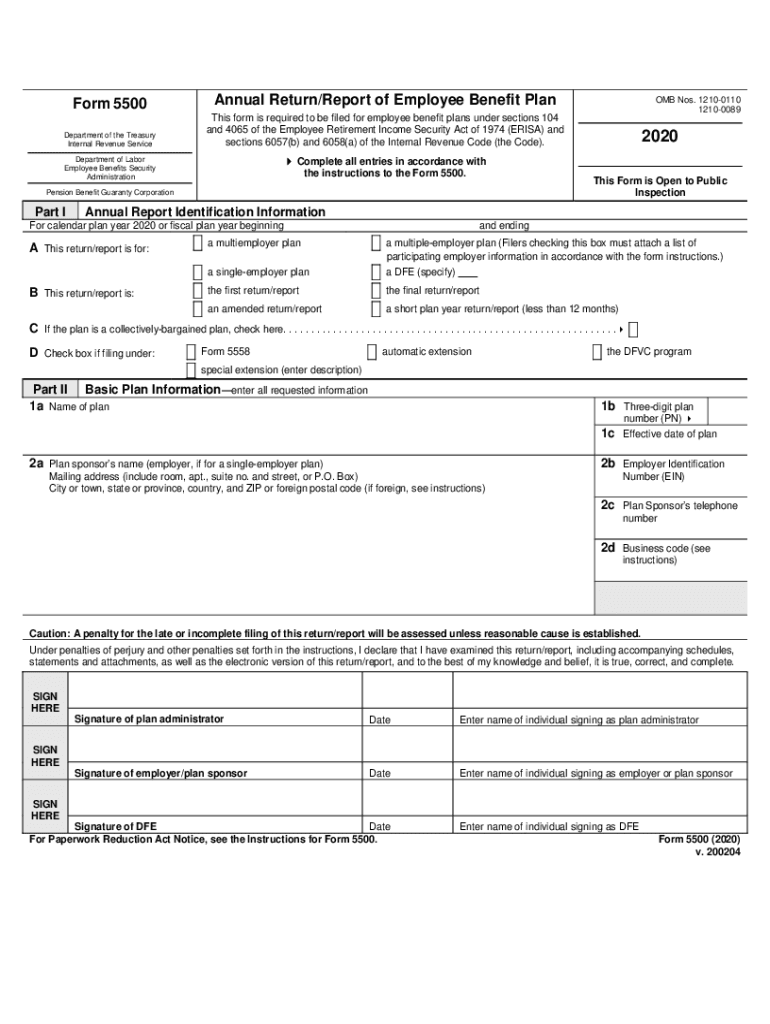

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. Web paper forms for filing. (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Requesting a waiver of the electronic filing requirements: Or use.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. Or use approved software, if available. Who is eligible to participate in the irs penalty relief program? Requesting a waiver of the electronic filing requirements: What is the irs penalty relief program?

Understanding the Form 5500 for Defined Contribution Plans Fidelity

Or use approved software, if available. (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Web paper forms for filing. Who.

2020 Form 5500 Fill and Sign Printable Template Online US Legal Forms

Who is eligible to participate in the irs penalty relief program? Or use approved software, if available. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. What is the irs penalty relief program?

IRS Form 5500EZ Download Fillable PDF or Fill Online Annual Return of

On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. Web paper forms for filing. Requesting a waiver of the electronic filing requirements: Who is eligible to participate in the irs penalty relief program? For information on filing a request for a hardship.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web paper forms for filing. Who is eligible to participate in the irs penalty relief program? Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. (1) the.

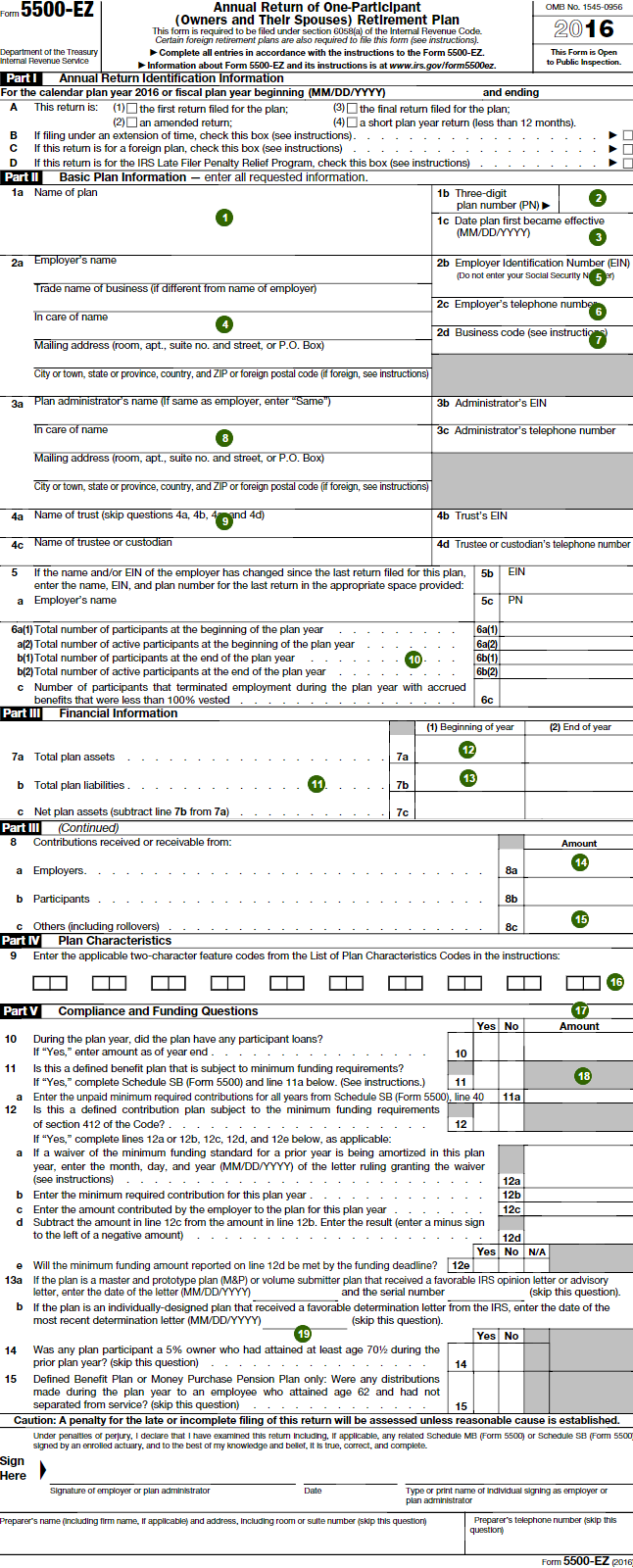

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process. (1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Department of labor’s.

Form 5500 EZ Annual Return of One Participant Pension Retirement Plan

(1) the first return filed for the plan (3) the final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Web paper forms for filing. What is the irs penalty relief program? Requesting a waiver of the electronic filing requirements: Or use approved software, if available.

Web Paper Forms For Filing.

Department of labor’s employee benefits security administration, the irs, and the pension benefit guaranty corp. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Requesting a waiver of the electronic filing requirements: Who is eligible to participate in the irs penalty relief program?

(1) The First Return Filed For The Plan (3) The Final Return Filed For The Plan (2) An Amended Return (4) A Short Plan Year Return (Less Than 12 Months)

Or use approved software, if available. What is the irs penalty relief program? On december 8, 2022 dol, irs, and pbgc released informational copies of the 2022 form 5500 series and announced upcoming changes to the efast2 website authentication process.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)