Form 568 2023

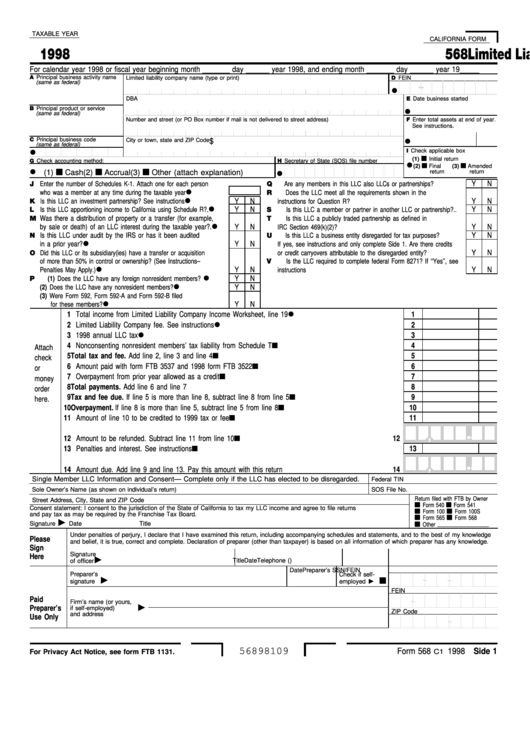

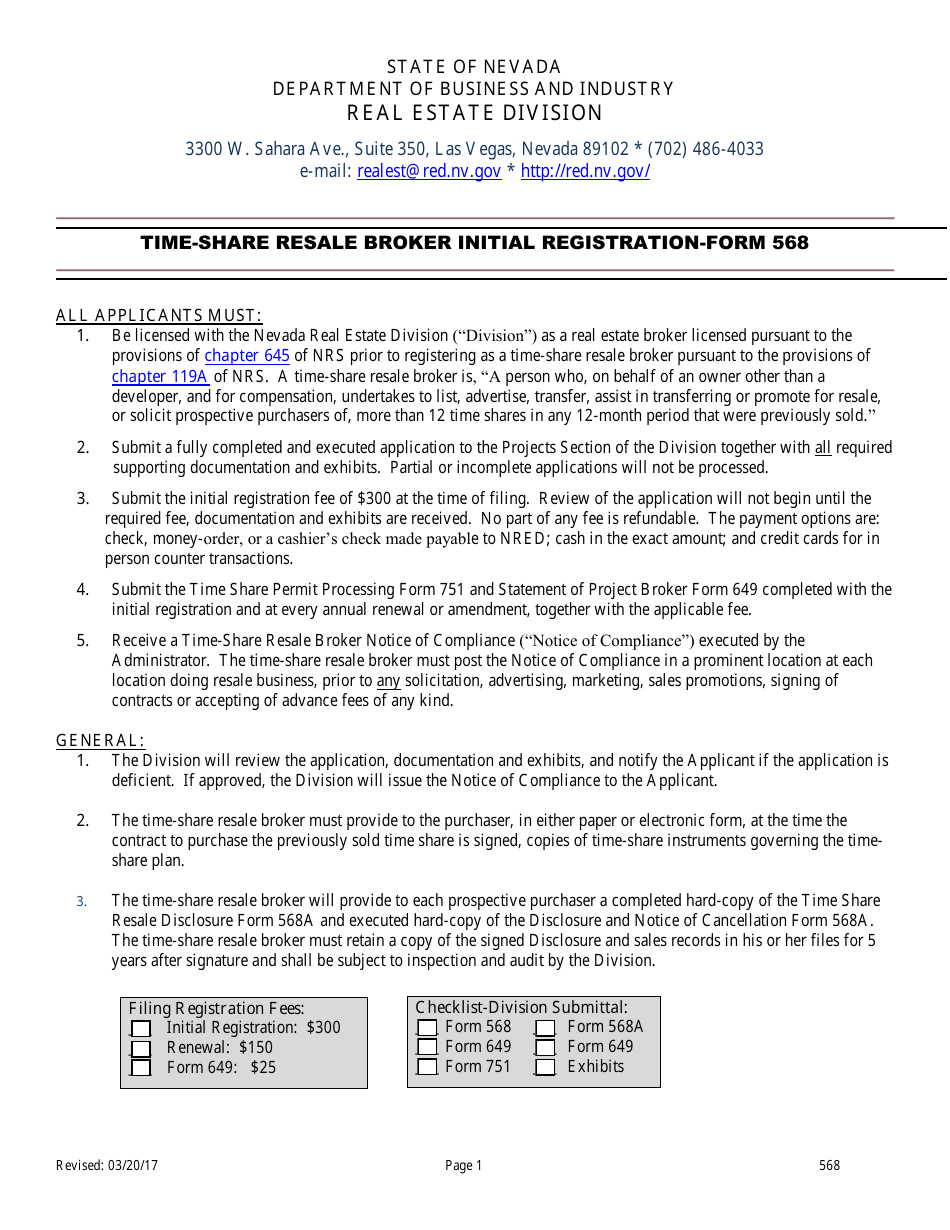

Form 568 2023 - 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Printing and scanning is no longer the best way to manage documents. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. This tax form is basically treated as an income return for llcs in california. Web final invention statement form number hhs 568 description the final invention statement is one of three reports required as part of the closeout process for. Web handy tips for filling out form ca 568 instructions online. All california llcs must file form 568 [ 3 ]. Web how do i know if i should file california form 568, llc return of income for this year? Solved • by turbotax • 300 • updated january 13, 2023 form 568 accounts.

View our emergency tax relief page. Show sources > about the corporate income tax the irs and most states require. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web handy tips for filling out form ca 568 instructions online. 16, 2023, to file and pay taxes. This card can only be. Web more about the california form 568. 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Web ca form 568 due dates 2023 california state form 568 for limited liability companies. It contains 0 bedroom and 2.

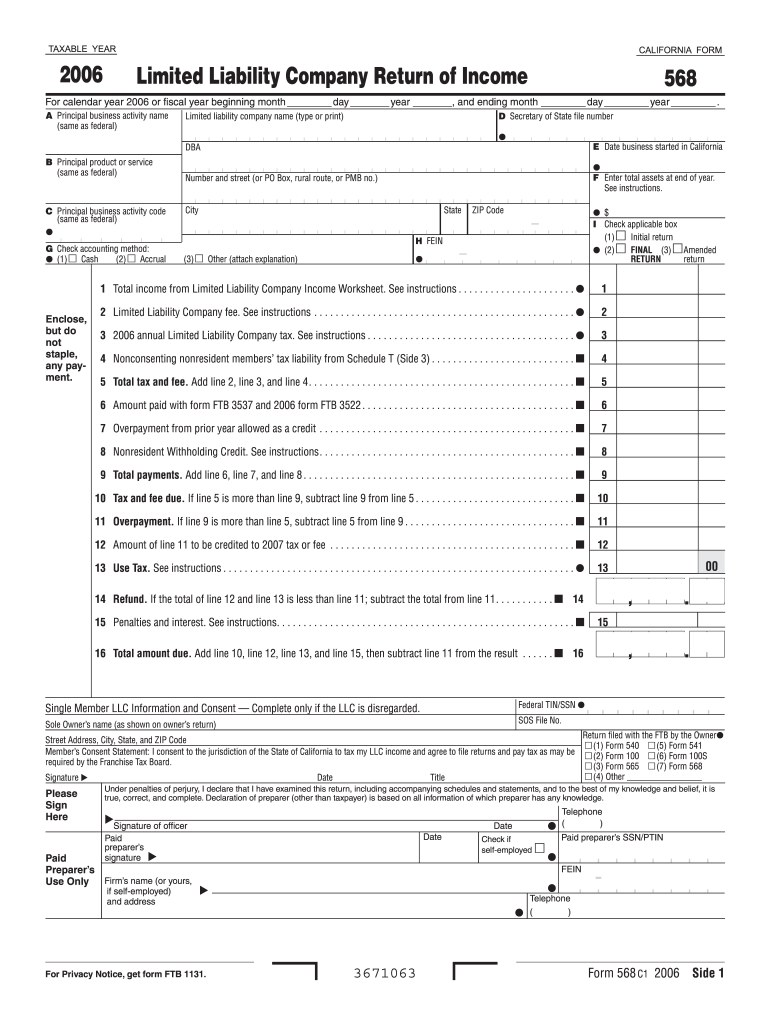

Web final invention statement form number hhs 568 description the final invention statement is one of three reports required as part of the closeout process for. Submit this waiver prior to, or up to 15 days after filing the tax return. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use schedule. Web how do i know if i should file california form 568, llc return of income for this year? 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Get everything done in minutes. Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability company return of income, side 1, line 2, limited liability company fee. 3537 (llc), payment for automatic extension. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. This form is for income earned in tax year 2022,.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

3537 (llc), payment for automatic extension. View our emergency tax relief page. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use schedule. This card can only be. Go digital and save time with signnow, the best.

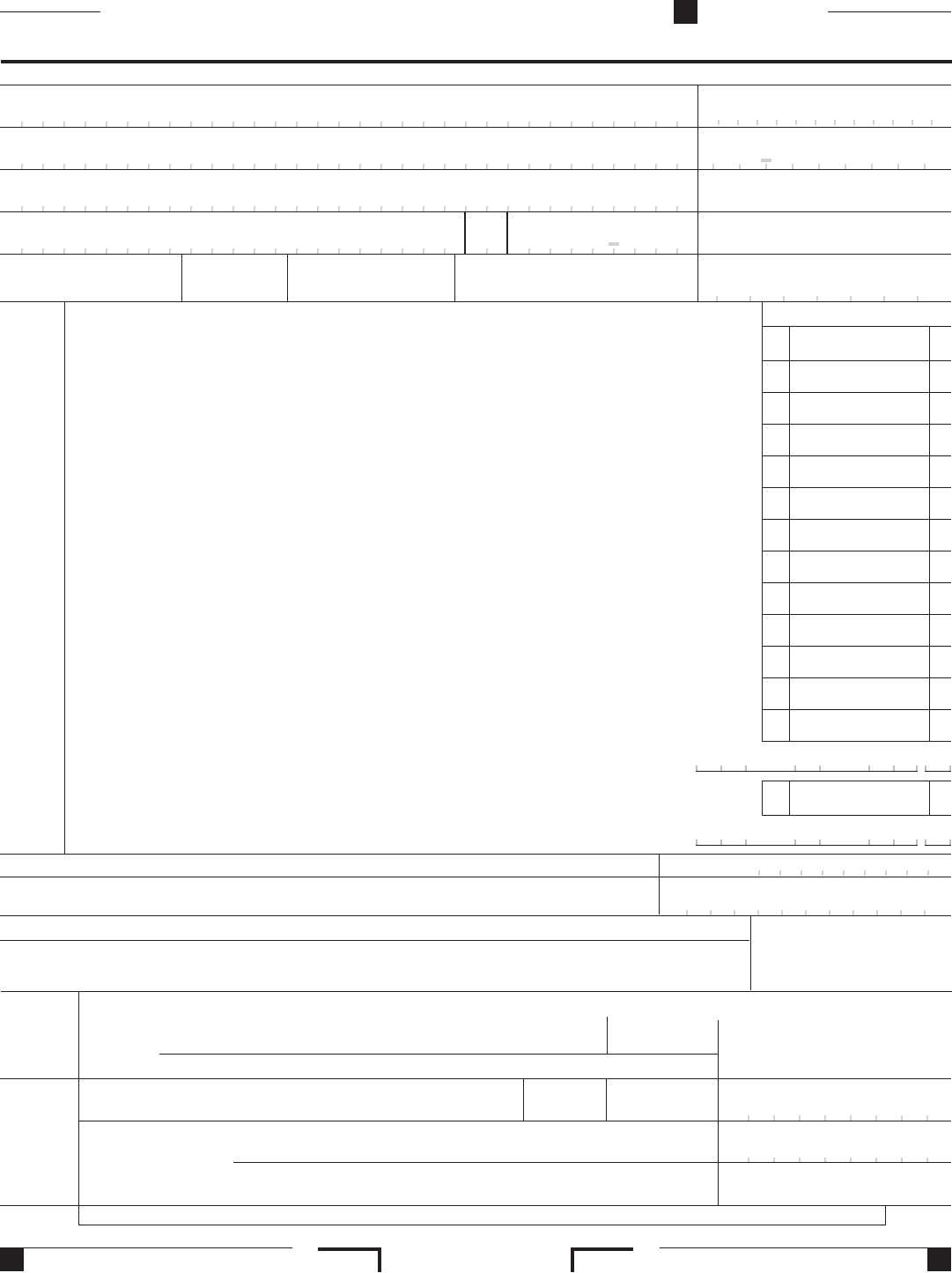

Fillable Form 568 Limited Liability Company Return Of 1998

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web taxes and fees limited liability companies are automatically assessed an $800 tax. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability.

Form 568 Limited Liability Company Return of Fill Out and Sign

Submit this waiver prior to, or up to 15 days after filing the tax return. This tax form is basically treated as an income return for llcs in california. 3537 (llc), payment for automatic extension. Show sources > about the corporate income tax the irs and most states require. Web this waiver request applies to returns filed in 2023, for.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: This amount needs to be prepaid and filed with form 3522. This form is for income earned in tax year 2022,. This card can only be. Show sources > about the corporate income tax the irs and most states require.

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

Submit this waiver prior to, or up to 15 days after filing the tax return. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. Web taxes and fees limited liability companies are automatically assessed an $800 tax. This tax form is basically treated as an income return for llcs in california. What is the california llc.

Instructions For Form 568 Limited Liability Company Return Of

Printing and scanning is no longer the best way to manage documents. View our emergency tax relief page. Web 568 2022 limited liability company tax booklet this booklet contains: This form is for income earned in tax year 2022,. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

View our emergency tax relief page. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. Web form 568 is due on march 31st following the end of the tax year. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. 3537 (llc), payment for automatic.

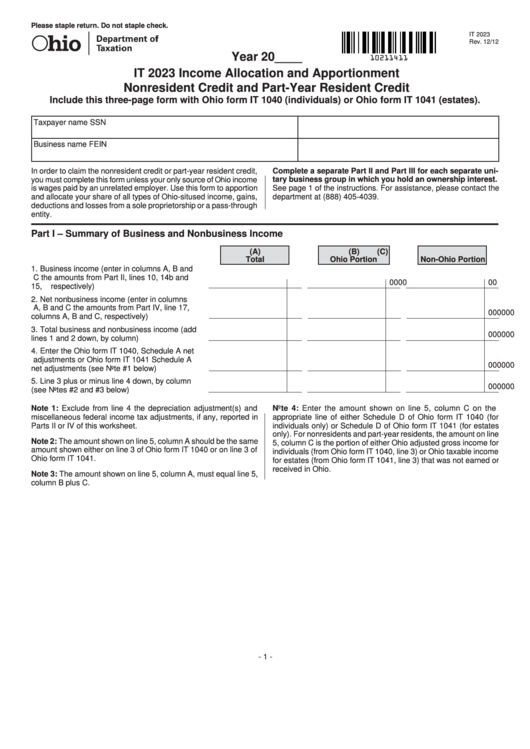

Fillable Form It 2023 Allocation And Apportionment Nonresident

View our emergency tax relief page. For example, the 2023 tax needs. 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Get everything done in minutes. Web ca form 568 due dates 2023 california state form 568 for limited liability companies.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web what is form 568? 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Go digital and save time with signnow, the best. 3537 (llc), payment for automatic extension. Web form 568 is a california tax return form, and its typical due date is march 15 or.

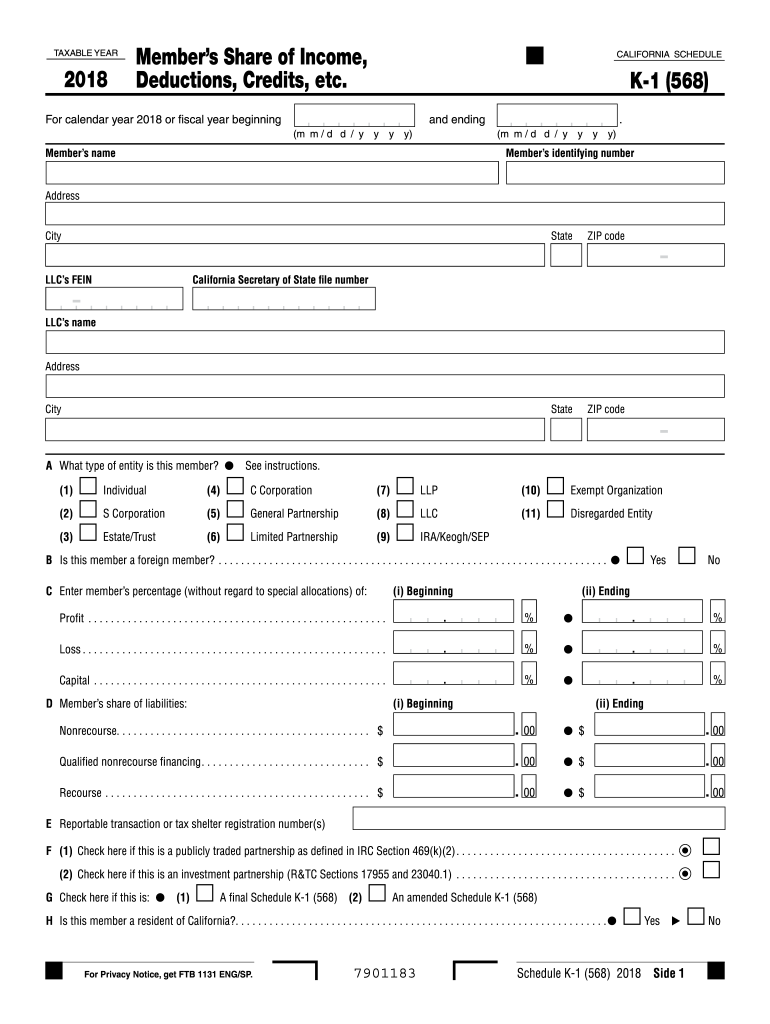

California k 1 instructions Fill out & sign online DocHub

Solved • by turbotax • 300 • updated january 13, 2023 form 568 accounts. Form 568, limited liability company return of income ftb. Web this waiver request applies to returns filed in 2023, for tax years beginning on or after january 1, 2020. Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability.

Web This Waiver Request Applies To Returns Filed In 2023, For Tax Years Beginning On Or After January 1, 2020.

Printing and scanning is no longer the best way to manage documents. Web ca form 568 due dates 2023 california state form 568 for limited liability companies. Llcs classified as a disregarded entity or. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

540 Form (Pdf) | 540 Booklet (Instructions Included) 540 2Ez Form (Pdf) |.

9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web form 568 is due on march 31st following the end of the tax year. This tax form is basically treated as an income return for llcs in california.

View Our Emergency Tax Relief Page.

This amount needs to be prepaid and filed with form 3522. Web 568 2022 limited liability company tax booklet this booklet contains: For example, the 2023 tax needs. The california llc tax due date is when llcs in california are required to have their tax returns filed.

Web Since The Limited Liability Company Is Doing Business In Both Nevada And California, It Must File A California Form 568, Limited Liability Company Return Of Income And Use Schedule.

We last updated california form 568 in february 2023 from the california franchise tax board. Web we last updated california form 568 from the franchise tax board in february 2023. Submit this waiver prior to, or up to 15 days after filing the tax return. Get everything done in minutes.