Form 5695 Instructions

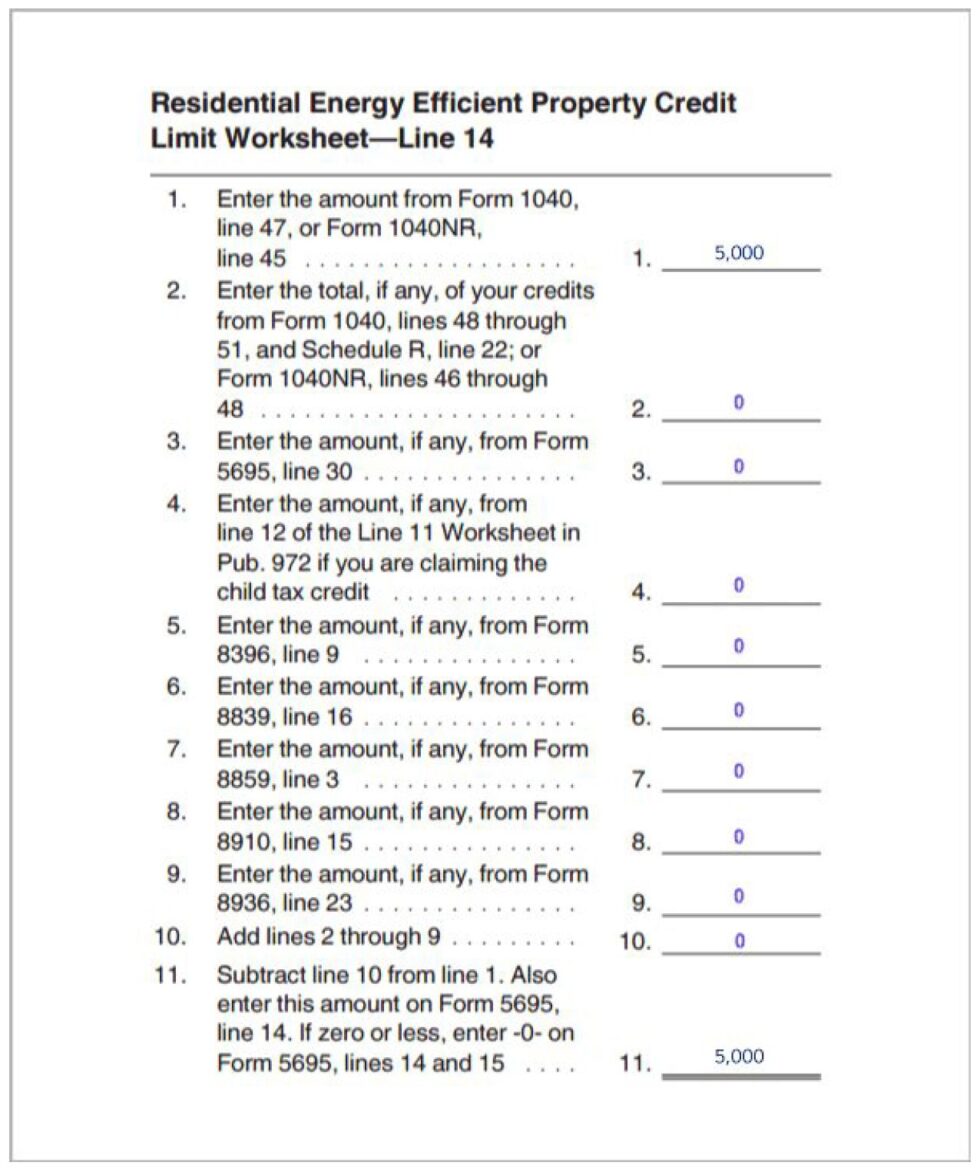

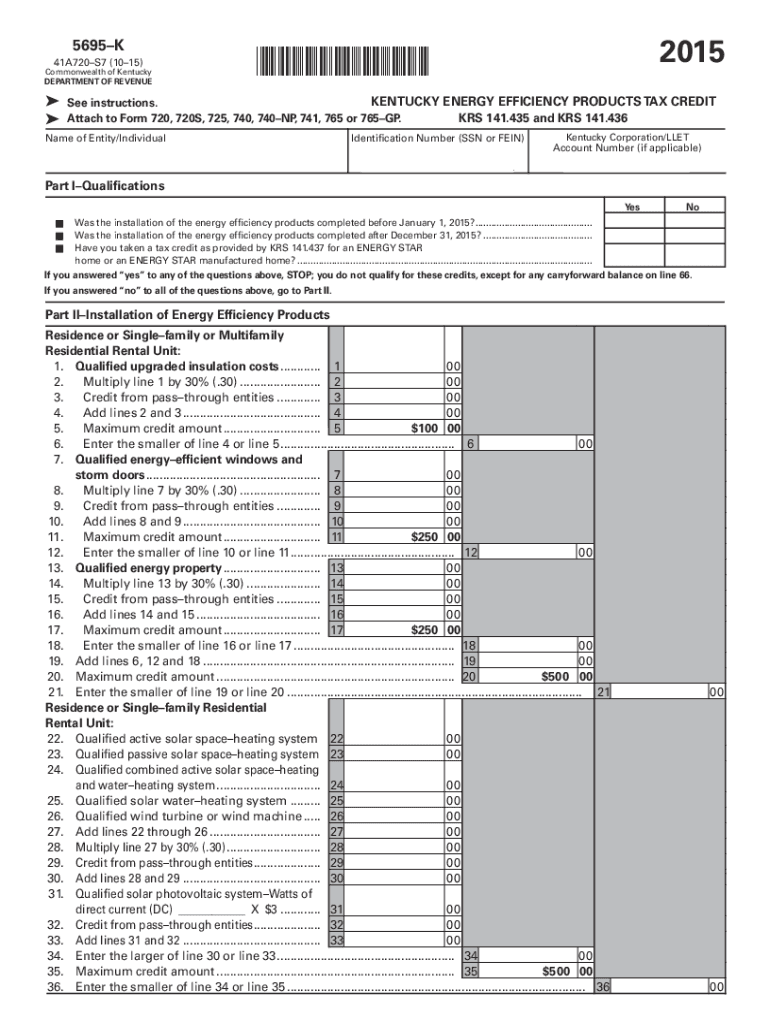

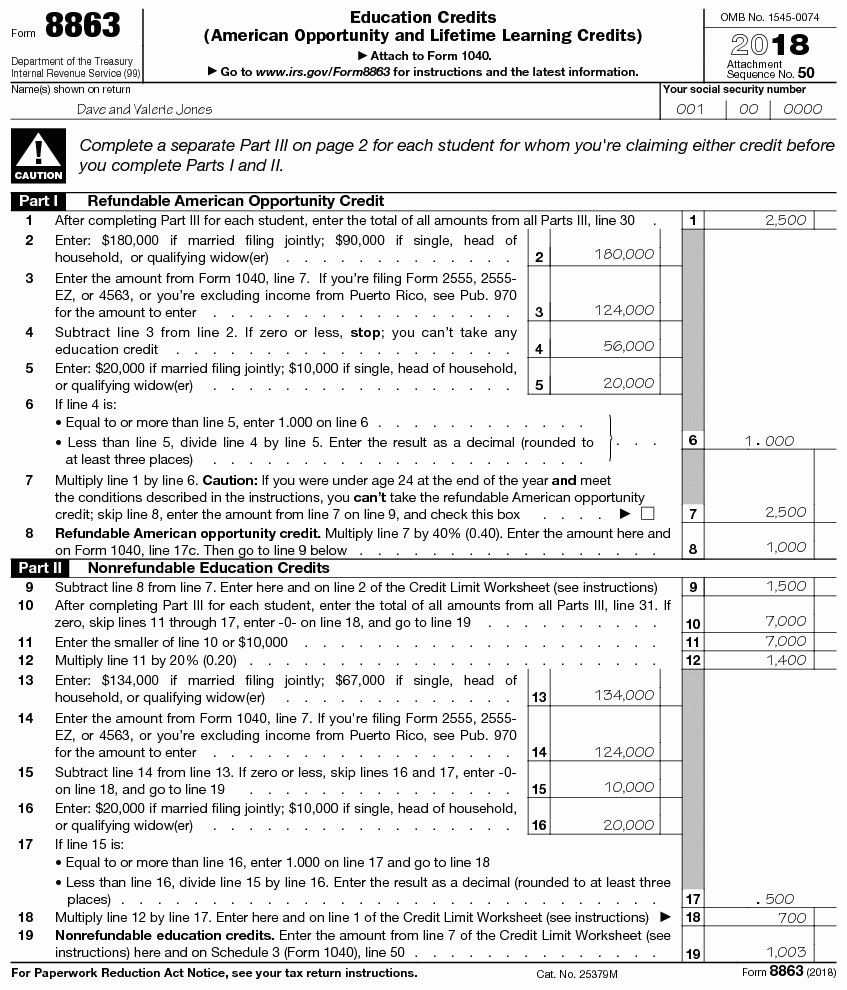

Form 5695 Instructions - For instructions and the latest information. The credit is worth a maximum of $500 for qualified improvements made in 2021. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps. Web use form 5695 to figure and take your residential energy credits. The residential energy credits are: The energy efficient home improvement credit. The residential clean energy credit, and. The nonbusiness energy property credit. Web per irs instructions for form 5695, page 1: The residential clean energy credit, and;

Use form 5695 to figure and take your residential energy credits. The instructions give taxpayers additional information regarding eligibility for the credit. The residential energy credits are: Web use form 5695 to figure and take your residential energy credits. Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The energy efficient home improvement credit. Claiming the itc is easy. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying expenditures. Web instructions for filling out irs form 5695 for 2020.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Use form 5695 to figure and take your residential energy credits. Web the residential energy credits are: The residential energy credits are: The instructions give taxpayers additional information regarding eligibility for the credit. Claiming the itc is easy. It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion(s) are relevant to your home improvement project. The nonbusiness energy property credit. For instructions and the latest information. Department of the treasury internal revenue service.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

The energy efficient home improvement credit. Claiming the itc is easy. For instructions and the latest information. Also use form 5695 to take any residential energy efficient property credit carryforward from 2013 or to carry the unused portion of the credit to 2015. It’s divided into two parts based on the two different tax incentive programs, but you only need.

Instructions for filling out IRS Form 5695 Everlight Solar

The residential energy credits are: Also use form 5695 to take any residential energy efficient property credit carryforward from 2013 or to carry the unused portion of the credit to 2015. The section 25c credit is claimed on form 5695. The instructions give taxpayers additional information regarding eligibility for the credit. Web information about form 5695, residential energy credits, including.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. To claim the credit, you must complete and. Web form 5695 instructions. The section 25c credit is claimed on form 5695. The residential clean energy credit, and;

Form 5695 Instructions Fill Out and Sign Printable PDF Template signNow

The residential energy credits are: Web the residential energy credits are: Web instructions for filling out irs form 5695 for 2020. Web form 5695 instructions. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The energy efficient home improvement credit. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. Also use form 5695 to take any residential energy efficient property credit carryforward from 2013 or to carry the unused portion of the credit to 2015. Web instructions for.

Form 5695 Instructions Information On Form 5695 —

Web form 5695 instructions. To claim the credit, you must complete and. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Web instructions for filling out irs form 5695 for 2020. The residential energy credits are:

2020 Form 5695 Instructions Fill Out and Sign Printable PDF Template

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The residential energy credits are: The instructions give taxpayers additional information regarding eligibility for the credit. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy.

Business Line Of Credit Stated 2022 Cuanmologi

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps. The energy efficient home improvement credit. The credit is worth a maximum of $500 for qualified improvements made in 2021. Web instructions for filling out irs form 5695 for 2020. Web federal tax form 5695 is used to calculate your residential energy credit,.

Tax Form 5695 by AscendWorks Issuu

Web use form 5695 to figure and take your residential energy credits. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps. Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web instructions.

Form Instructions Is Available For How To File 5695 2018 —

Claiming the itc is easy. Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The section 25c credit is claimed on form 5695. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up.

Also Use Form 5695 To Take Any Residential Energy Efficient Property Credit Carryforward From 2013 Or To Carry The Unused Portion Of The Credit To 2015.

The residential energy credits are: Web the residential energy credits are: The instructions give taxpayers additional information regarding eligibility for the credit. The credit is worth a maximum of $500 for qualified improvements made in 2021.

Web Form 5695 Instructions.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The energy efficient home improvement credit. Web use form 5695 to figure and take your residential energy credits.

It’s Divided Into Two Parts Based On The Two Different Tax Incentive Programs, But You Only Need To Complete Whichever Portion(S) Are Relevant To Your Home Improvement Project.

The energy efficient home improvement credit. Web per irs instructions for form 5695, page 1: The residential energy credits are: Web instructions for filling out irs form 5695 for 2020.

The Residential Clean Energy Credit, And.

Department of the treasury internal revenue service. Residential energy property credit (section 25d) through 2019, taxpayers could claim a section 25d credit worth up to 30% of qualifying expenditures. The section 25c credit is claimed on form 5695. Use form 5695 to figure and take your residential energy credits.