Form 5884-A Instructions

Form 5884-A Instructions - Web provisions of the taxpayer certainty and disaster tax relief act of 2020 necessitated an updated version. The current year employee retention credit consists of the following 3 credits. Qualified wages do not include the following. General instructions purpose of form use. Credits for affected disaster area employers (for employers affected by hurricane. Employers file form 5884 to. These credits typically include employee retention credits for eligible. However, this form and its. February 2018) department of the treasury internal revenue service. Draft instructions include designated disaster zone and codes.

Credits for affected disaster area employers (for employers affected by hurricane. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. These credits typically include employee retention credits for eligible. Draft instructions include designated disaster zone and codes. Qualified wages do not include the following. The current year employee retention credit consists of the following 3 credits. February 2018) department of the treasury internal revenue service. Employers file form 5884 to. Web provisions of the taxpayer certainty and disaster tax relief act of 2020 necessitated an updated version. General instructions purpose of form use.

Web provisions of the taxpayer certainty and disaster tax relief act of 2020 necessitated an updated version. Qualified wages do not include the following. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. General instructions purpose of form use. Employers file form 5884 to. February 2018) department of the treasury internal revenue service. The current year employee retention credit consists of the following 3 credits. Credits for affected disaster area employers (for employers affected by hurricane. Draft instructions include designated disaster zone and codes. These credits typically include employee retention credits for eligible.

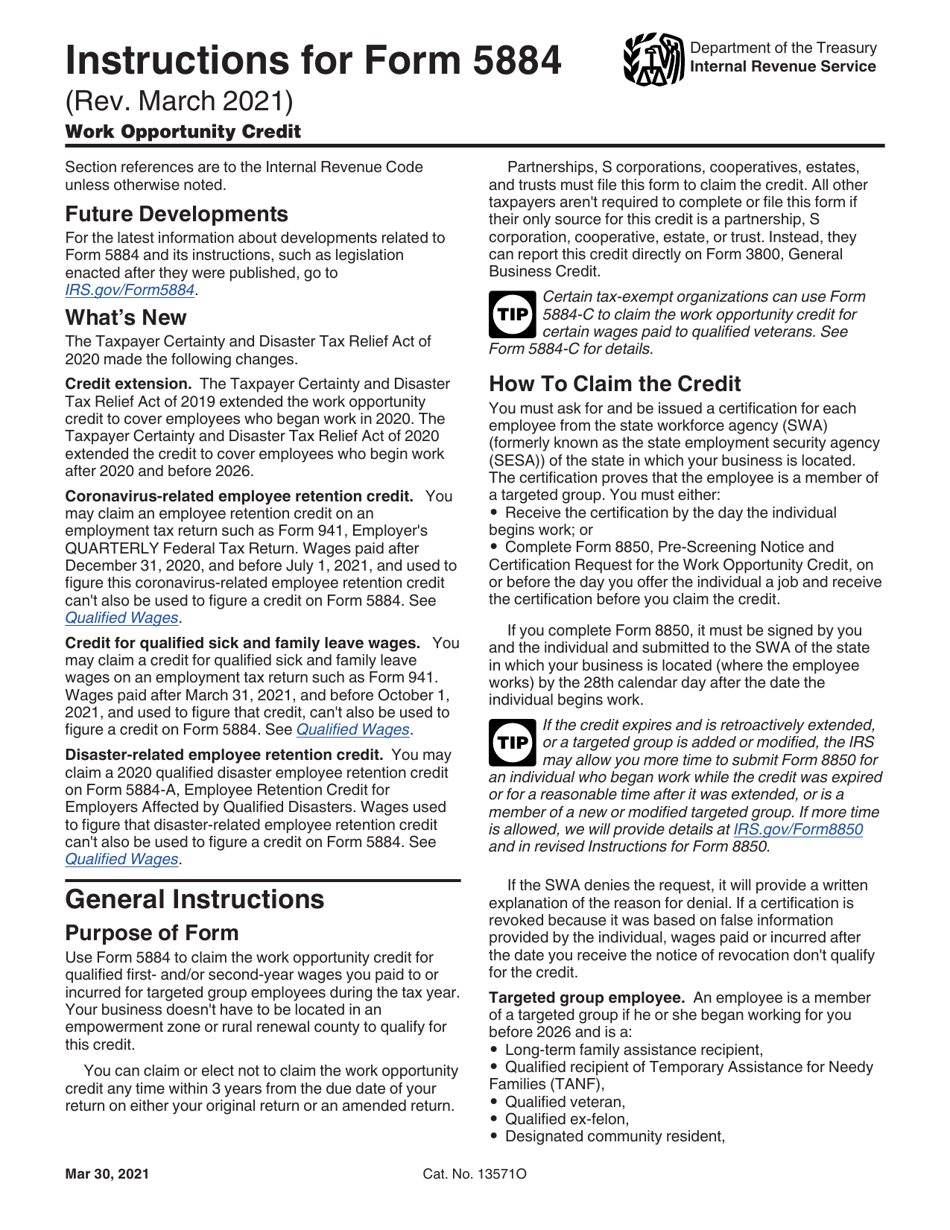

Download Instructions for IRS Form 5884 Work Opportunity Credit PDF

February 2018) department of the treasury internal revenue service. Employers file form 5884 to. These credits typically include employee retention credits for eligible. Qualified wages do not include the following. The current year employee retention credit consists of the following 3 credits.

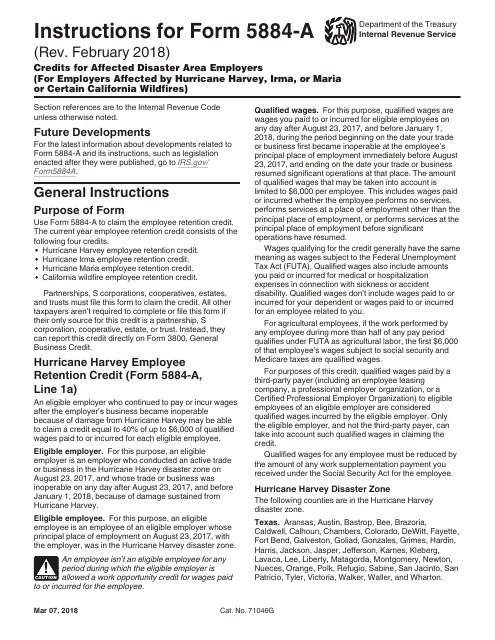

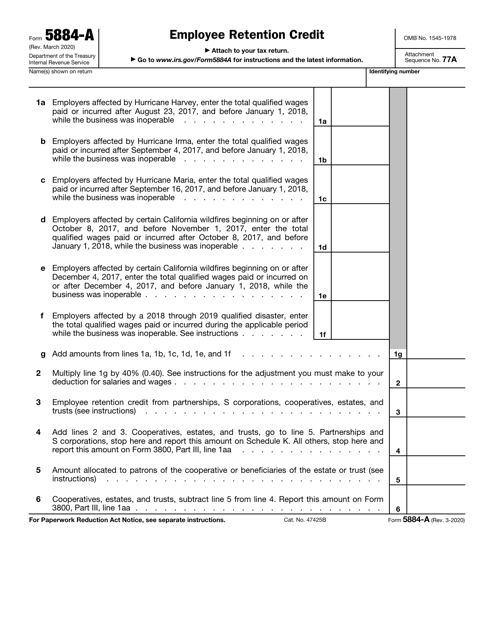

Download Instructions for IRS Form 5884A Employee Retention Credit PDF

Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Employers file form 5884 to. February 2018) department of the treasury internal revenue service. General instructions purpose of form use. However, this form and its.

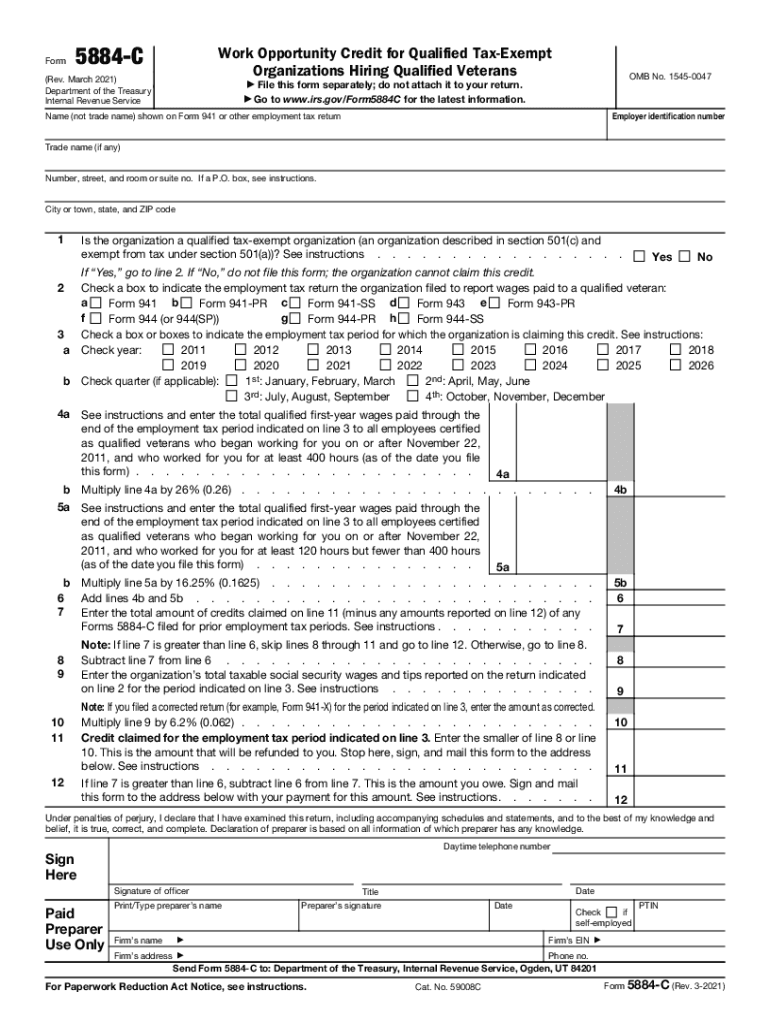

Irs Work Opportunity Credit Form Fill Out and Sign Printable PDF

Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. General instructions purpose of form use. Credits for affected disaster area employers (for employers affected by hurricane. Qualified wages do not include the following. The current year employee retention credit consists of the following 3 credits.

U.S. TREAS Form treasirs58842000

February 2018) department of the treasury internal revenue service. Draft instructions include designated disaster zone and codes. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Credits for affected disaster area employers (for employers affected by hurricane. Qualified wages do not include the following.

Download Instructions for IRS Form 5884A Credits for Affected Disaster

However, this form and its. The current year employee retention credit consists of the following 3 credits. Employers file form 5884 to. Draft instructions include designated disaster zone and codes. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file.

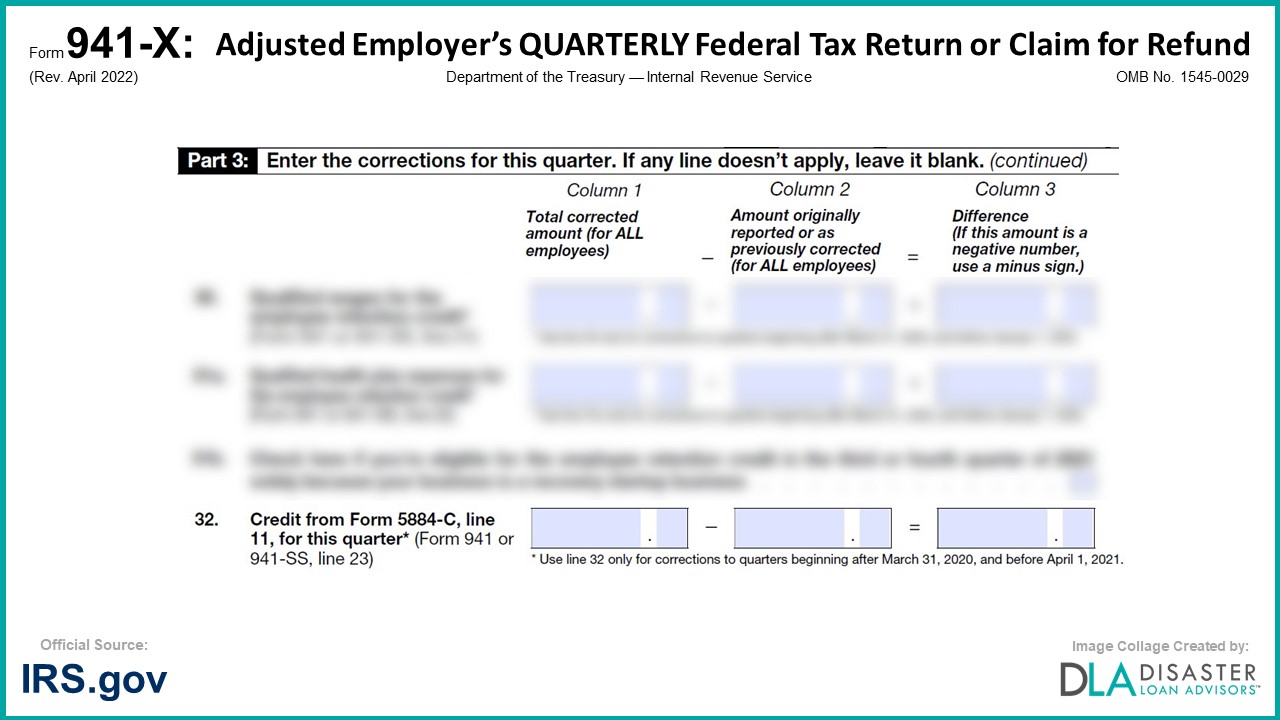

941X 32. Credit From Form 5884‐C, Line 11, for This Quarter, Form

Credits for affected disaster area employers (for employers affected by hurricane. Employers file form 5884 to. However, this form and its. The current year employee retention credit consists of the following 3 credits. Draft instructions include designated disaster zone and codes.

IRS Form 5884A Download Fillable PDF or Fill Online Employee Retention

However, this form and its. Draft instructions include designated disaster zone and codes. These credits typically include employee retention credits for eligible. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Credits for affected disaster area employers (for employers affected by hurricane.

Fill Free fillable F5884b Accessible Form 5884B (Rev. December 2010

Credits for affected disaster area employers (for employers affected by hurricane. These credits typically include employee retention credits for eligible. Qualified wages do not include the following. However, this form and its. Employers file form 5884 to.

Form 5884 Work Opportunity Credit (2014) Free Download

The current year employee retention credit consists of the following 3 credits. However, this form and its. General instructions purpose of form use. Employers file form 5884 to. Credits for affected disaster area employers (for employers affected by hurricane.

Download Instructions for IRS Form 5884A Employee Retention Credit for

These credits typically include employee retention credits for eligible. Draft instructions include designated disaster zone and codes. February 2018) department of the treasury internal revenue service. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. However, this form and its.

Employers File Form 5884 To.

Web provisions of the taxpayer certainty and disaster tax relief act of 2020 necessitated an updated version. However, this form and its. Credits for affected disaster area employers (for employers affected by hurricane. The current year employee retention credit consists of the following 3 credits.

February 2018) Department Of The Treasury Internal Revenue Service.

General instructions purpose of form use. Qualified wages do not include the following. Draft instructions include designated disaster zone and codes. These credits typically include employee retention credits for eligible.