Form 593 Pdf

Form 593 Pdf - Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Sign it in a few clicks draw your signature, type it,. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. I will complete form 593 for the principal portion of each installment payment. Typically this is a real estate escrow person (reep). If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. Web form will vary depending on individual circumstances. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee.

Web form 593, real estate withholding statement, of the principal portion of each installment payment. Real estate withholding is a prepayment of income (or franchise) tax due. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Recordkeeping 6 hr., 13 min. The estimated average time is: If this is an installment sale payment after escrow. Download this form print this form more about the. I will complete form 593 for the principal portion of each installment payment.

Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Citizensand residentsgoing abroad get forms and other informationfaster and easier. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Enter the names of a petitioner, respondent, and another. Real estate withholding is a prepayment of income (or franchise) tax due. Typically this is a real estate escrow person (reep). Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web as of january 1, 2020, california real estate withholding changed.

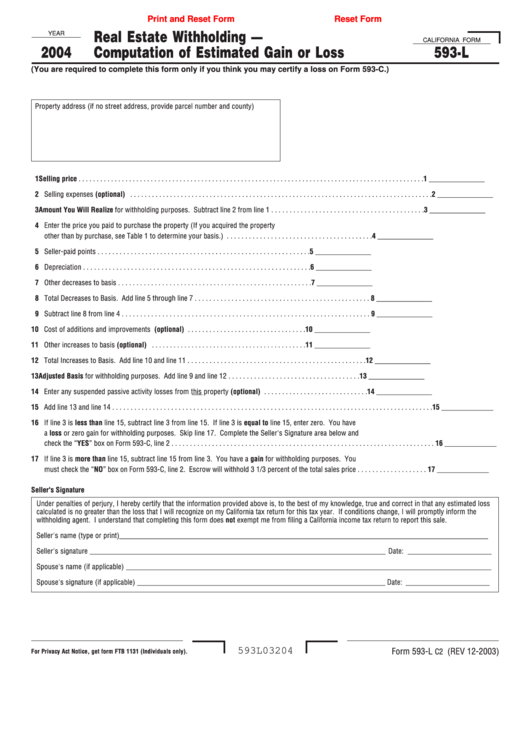

Fillable California Form 593L Real Estate Withholding Computation

Recordkeeping 6 hr., 13 min. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Enter the names of a petitioner, respondent, and another. Web as of january 1, 2020, california real estate withholding changed. Web california real estate withholding.

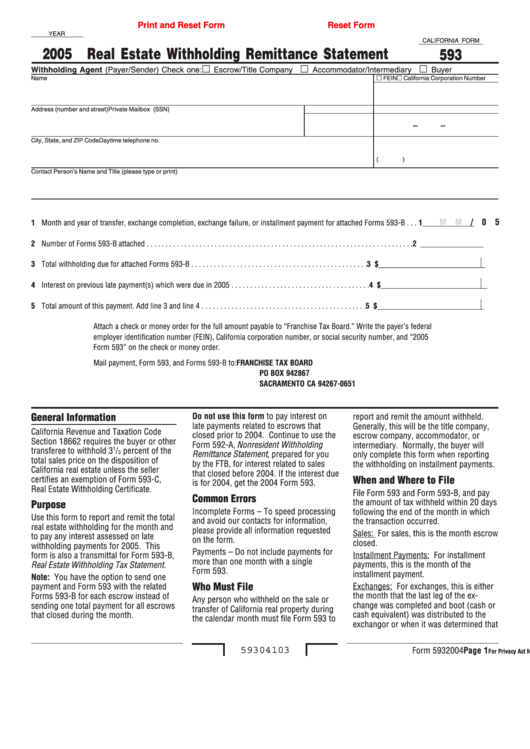

Fillable Form 593 Real Estate Withholding Remittance Statement 2005

The estimated average time is: Typically this is a real estate escrow person (reep). Web as of january 1, 2020, california real estate withholding changed. Citizensand residentsgoing abroad get forms and other informationfaster and easier. If this is an installment sale payment after escrow.

Form 5695 2021 2022 IRS Forms TaxUni

_________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web form will vary depending on individual circumstances. Typically this is a real estate escrow person (reep). Enter the names of a petitioner, respondent, and another. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate.

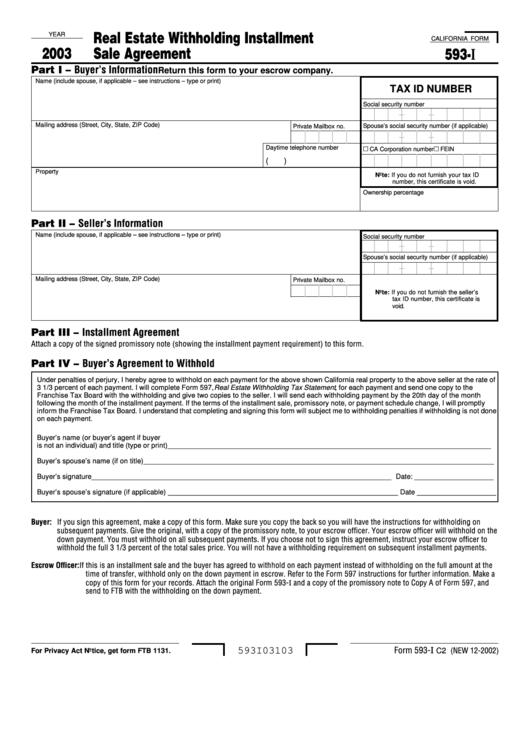

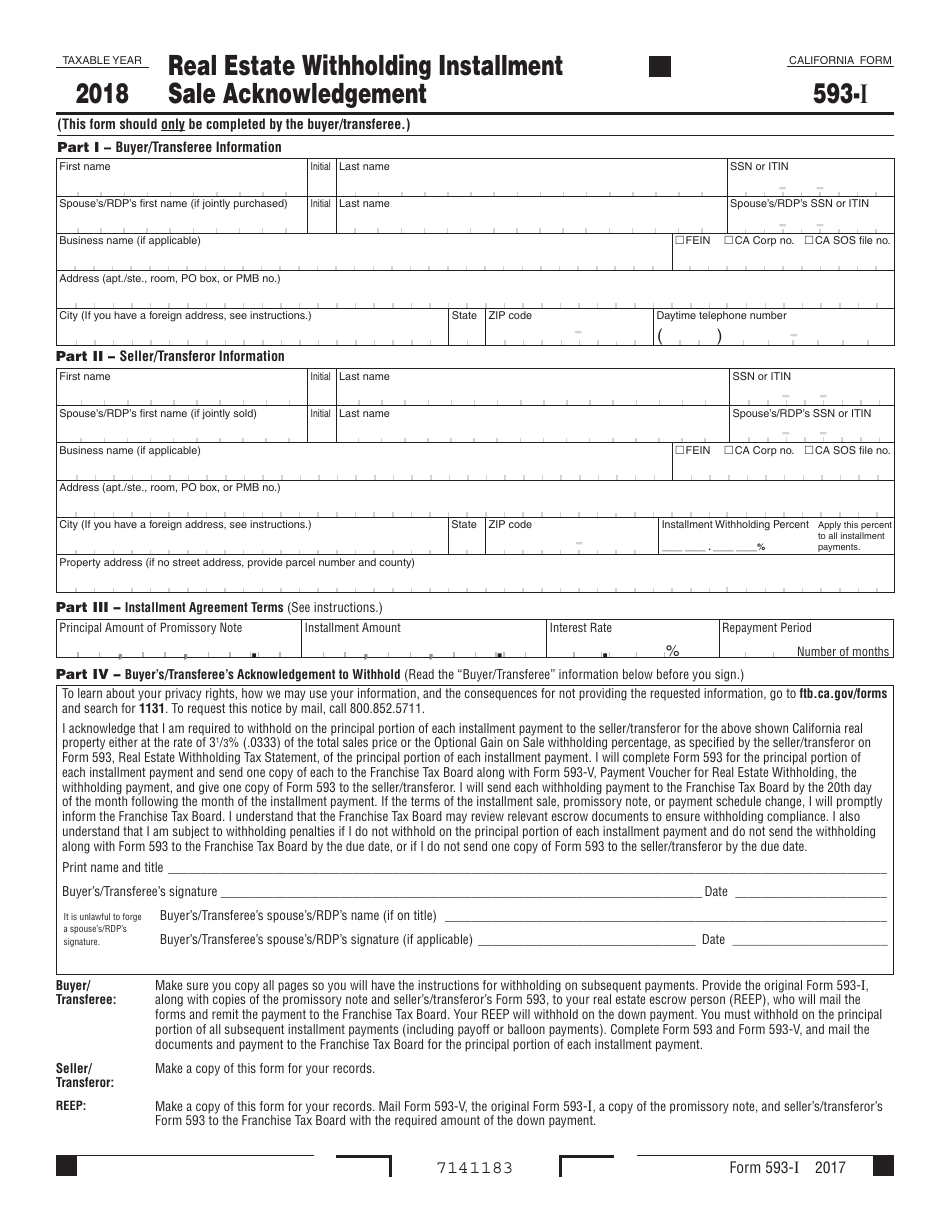

Form 593I Real Estate Withholding Installment Sale Agreement

Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Recordkeeping 6 hr., 13 min. I will complete form 593 for the principal portion of each installment payment. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,..

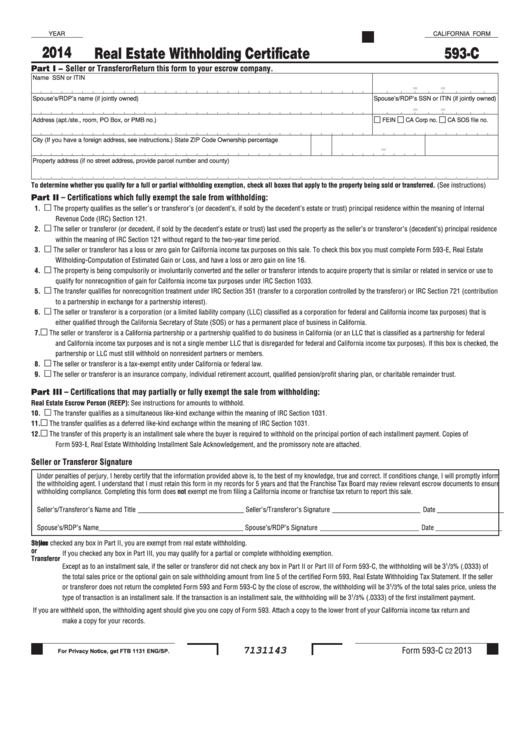

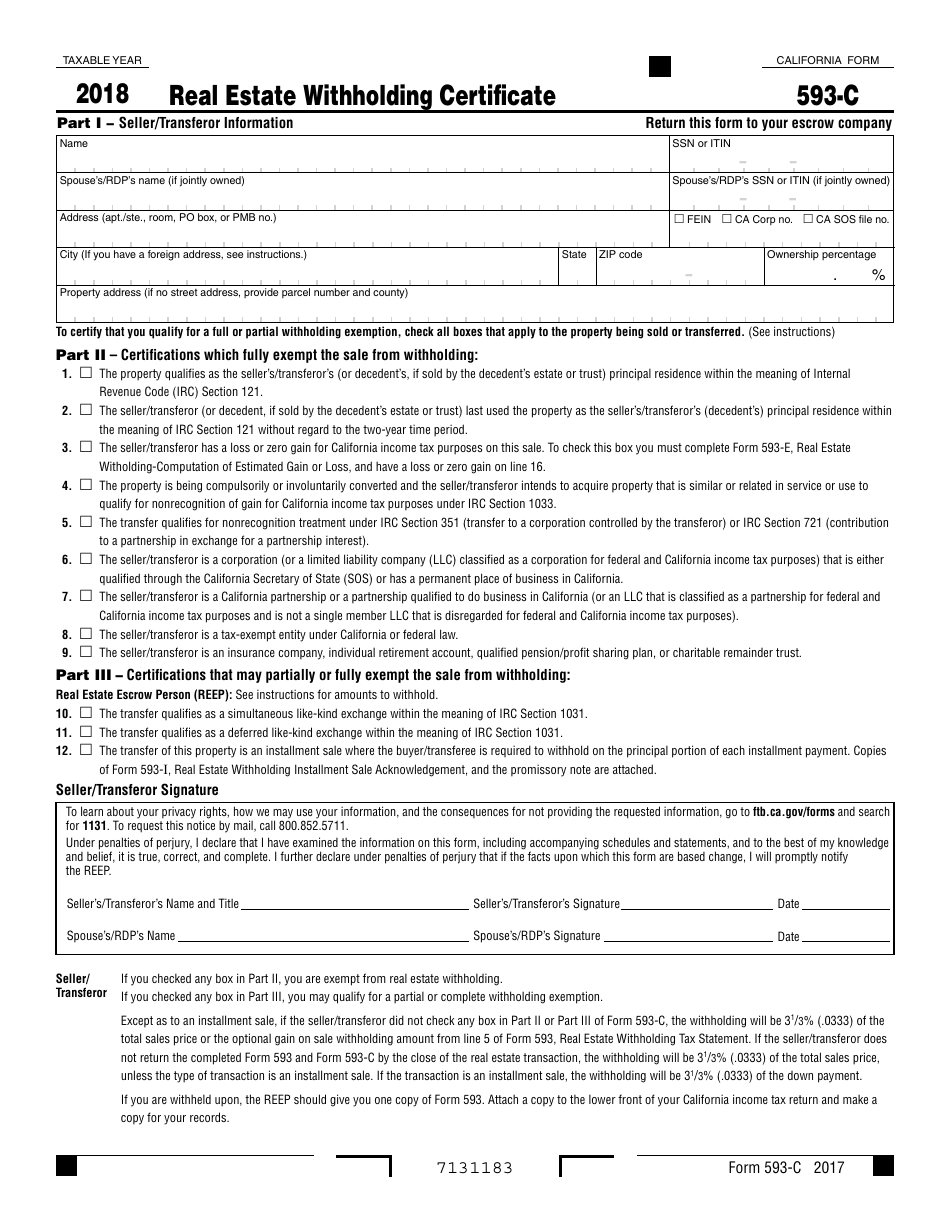

Fillable California Form 593C Real Estate Withholding Certificate

I will complete form 593 for the principal portion of each installment payment. Web as of january 1, 2020, california real estate withholding changed. Learning about the law or the form 2 hr., 59 min. Citizensand residentsgoing abroad get forms and other informationfaster and easier. Real estate withholding is a prepayment of income (or franchise) tax due.

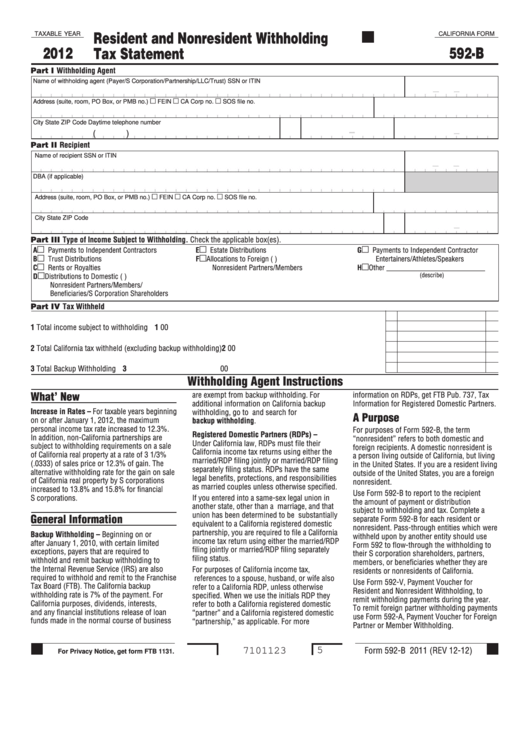

Fillable Form 592B Resident And Nonresident Withholding Tax

Web form will vary depending on individual circumstances. Web form 593, real estate withholding statement, of the principal portion of each installment payment. Enter the names of a petitioner, respondent, and another. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Web 593 escrow or exchange no.

Form 593c Download Fillable PDF or Fill Online Real Estate Withholding

Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2019, installment payments made in 2019, or exchanges. Enter the names of a petitioner, respondent, and another. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Edit your.

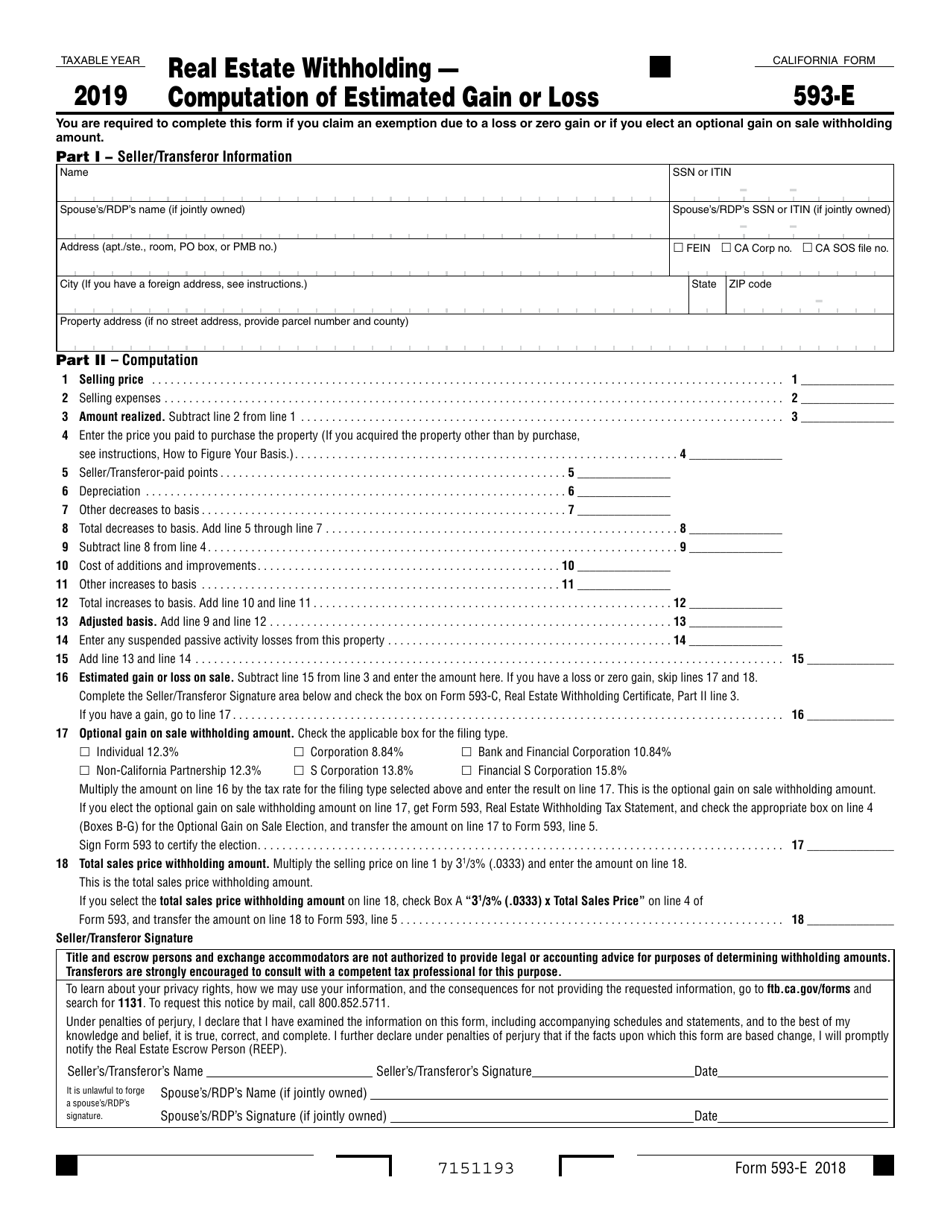

Form 593E Download Fillable PDF or Fill Online Real Estate Withholding

Enter the names of a petitioner, respondent, and another. Typically this is a real estate escrow person (reep). Download this form print this form more about the. Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor.

Form 593I Download Printable PDF or Fill Online Real Estate

Enter the names of a petitioner, respondent, and another. Web as of january 1, 2020, california real estate withholding changed. Web 593 escrow or exchange no. Sign it in a few clicks draw your signature, type it,. Web form 593, real estate withholding statement, of the principal portion of each installment payment.

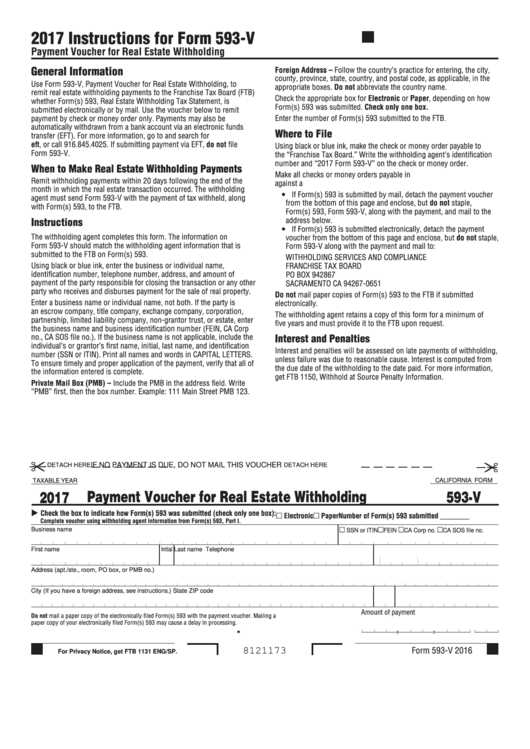

Fillable Form 593V Payment Voucher For Real Estate Withholding

Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web 593 escrow or exchange no. Real estate withholding is a prepayment of income (or franchise) tax due. If this is an installment.

Enter The Names Of A Petitioner, Respondent, And Another.

The estimated average time is: Real estate withholding is a prepayment of income (or franchise) tax due. Download this form print this form more about the. Web 593 escrow or exchange no.

_________________________ Part I Remitter Information • Reep • Qualified Intermediary Buyer/Transferee.

Typically this is a real estate escrow person (reep). Web payment and do not send the withholding along with form 593 to the ftb by the due date, or if i do not send one copy of form 593 to the seller/transferor by the due date. Sign it in a few clicks draw your signature, type it,. I will complete form 593 for the principal portion of each installment payment.

Edit Your Calif Form593 E Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web as of january 1, 2020, california real estate withholding changed. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Citizensand residentsgoing abroad get forms and other informationfaster and easier.

Learning About The Law Or The Form 2 Hr., 59 Min.

Web california real property must file form 593 to report the amount withheld. If this is an installment sale payment after escrow. Web california real estate withholding. Web form will vary depending on individual circumstances.