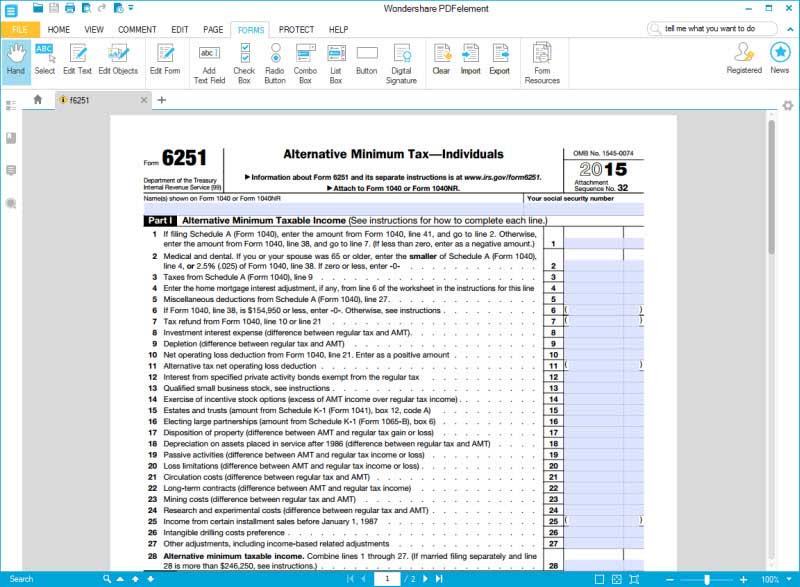

Form 6251 Instructions

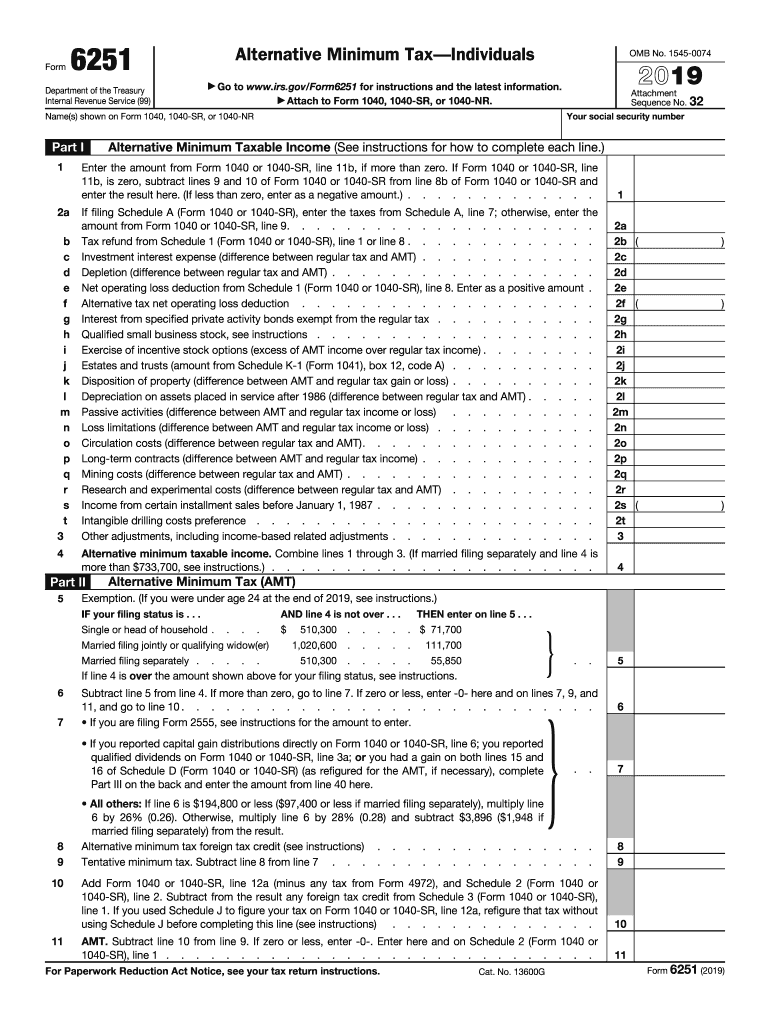

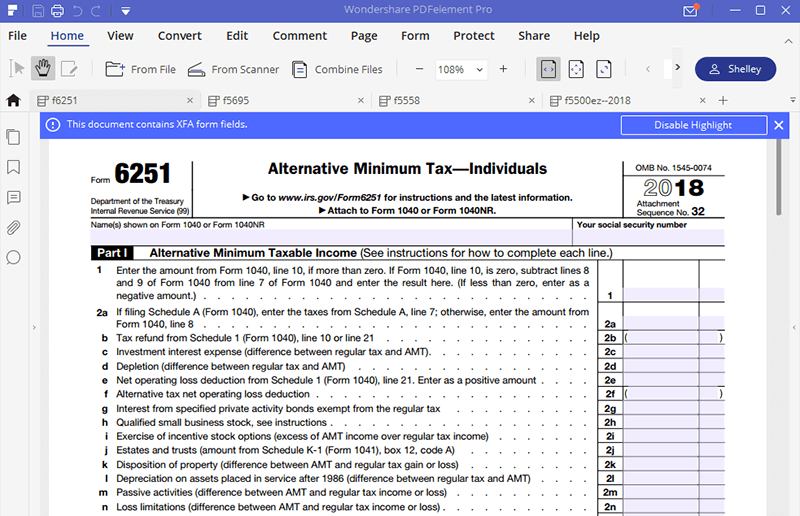

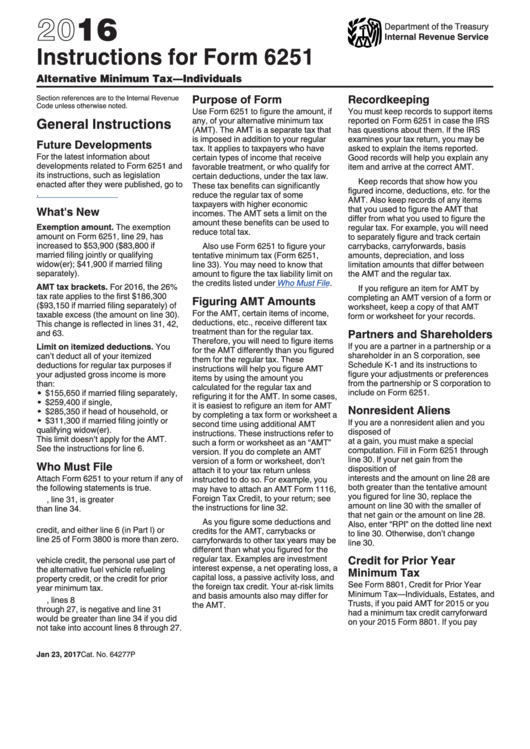

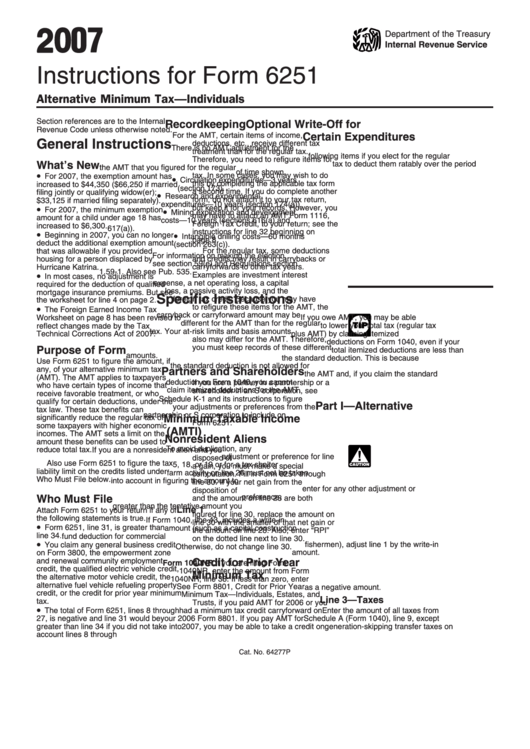

Form 6251 Instructions - If you are filing form 2555, see instructions for the amount to enter. Form 6251 is used by individuals to figure alternative minimum tax. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. $59,050 if married filing separately). Use this form to figure the amount, if any, of your alternative minimum tax (amt). For instructions and the latest information. Use the clues to complete the pertinent fields. Include your individual details and contact information.

Form 6251 is used by individuals to figure alternative minimum tax. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; Use this form to figure the amount, if any, of your alternative minimum tax (amt). If you are filing form 2555, see instructions for the amount to enter. How tax planning can help you avoid amt and lower your total tax bill. Web how to fill out a form 6251 instructions? Include your individual details and contact information. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. On the website hosting the form, click on start now and pass for the editor. The amt was designed to ensure that the wealthy pay their fair share of taxes. Use this form to figure the amount, if any, of your alternative minimum tax (amt). Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Include your individual details and contact information. For instructions and the latest information. How tax planning can help you avoid amt and lower your total tax bill. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability.

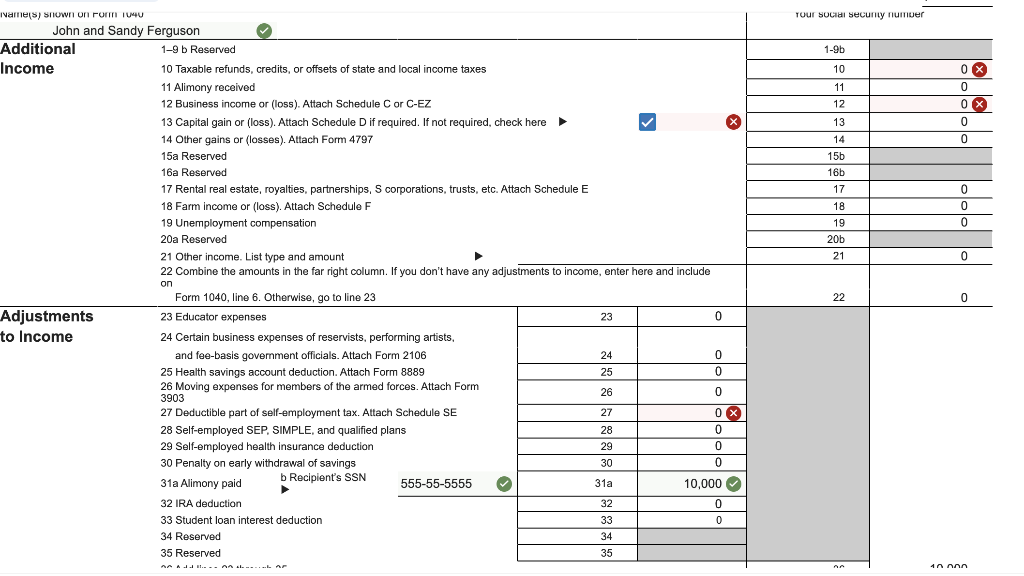

Instructions for How to Fill in IRS Form 6251

On the website hosting the form, click on start now and pass for the editor. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Make certain you enter correct details and numbers in appropriate fields. Web form 6251 is used.

Form 6251 Fill and Sign Printable Template Online US Legal Forms

Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. Department of the treasury internal revenue service. The amt was designed to ensure that the wealthy pay their fair share of taxes. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines.

Tax Form 6251 Fill Out and Sign Printable PDF Template signNow

Use this form to figure the amount, if any, of your alternative minimum tax (amt). $59,050 if married filing separately). Make certain you enter correct details and numbers in appropriate fields. Web how to fill out a form 6251 instructions? Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Include your individual details and contact information. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. It adds back various tax breaks you might have claimed.

Worksheet to See if You Should Fill in Form 6251 Line 41

The amt was designed to ensure that the wealthy pay their fair share of taxes. On the website hosting the form, click on start now and pass for the editor. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. Form 6251 is used by individuals to figure alternative.

for How to Fill in IRS Form 6251

The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax. The amt applies to taxpayers who have certain.

for How to Fill in IRS Form 6251

Form 6251 is used by individuals to figure alternative minimum tax. Use the clues to complete the pertinent fields. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; How tax planning can help you avoid amt and lower your total tax bill. Make certain you enter correct details.

Instructions For Form 6251 2016 printable pdf download

Include your individual details and contact information. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Although reducing your.

Instructions For Form 6251 Alternative Minimum Tax Individuals

Include your individual details and contact information. How tax planning can help you avoid amt and lower your total tax bill. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Make certain you enter correct details and numbers in appropriate fields. It adds back various tax breaks you might.

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. If you are filing form 2555, see instructions for the amount to enter. Form 6251 is used by individuals to figure alternative minimum tax. Although reducing your taxable income to zero is perfectly legal, the.

It Adds Back Various Tax Breaks You Might Have Claimed On Your Form 1040 Tax Return, Then Determines Your Taxes Owed.

The amt was designed to ensure that the wealthy pay their fair share of taxes. The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). For instructions and the latest information.

Include Your Individual Details And Contact Information.

Web how to fill out a form 6251 instructions? The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Make certain you enter correct details and numbers in appropriate fields. How tax planning can help you avoid amt and lower your total tax bill.

Web Form 6251, “Alternative Minimum Tax—Individuals,” Is A Tax Form That Calculates Whether You’re Liable For Paying The Alternative Minimum Tax And If So, How Much You Should Pay.

On the website hosting the form, click on start now and pass for the editor. If you are filing form 2555, see instructions for the amount to enter. Department of the treasury internal revenue service. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share.

Web Today, Over 50 Years Later, There Exists A Lot Of Confusion Over Amt, And How To Minimize Tax Liability.

Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax. $59,050 if married filing separately). Form 6251 is used by individuals to figure alternative minimum tax.