Form 8606 Backdoor Roth

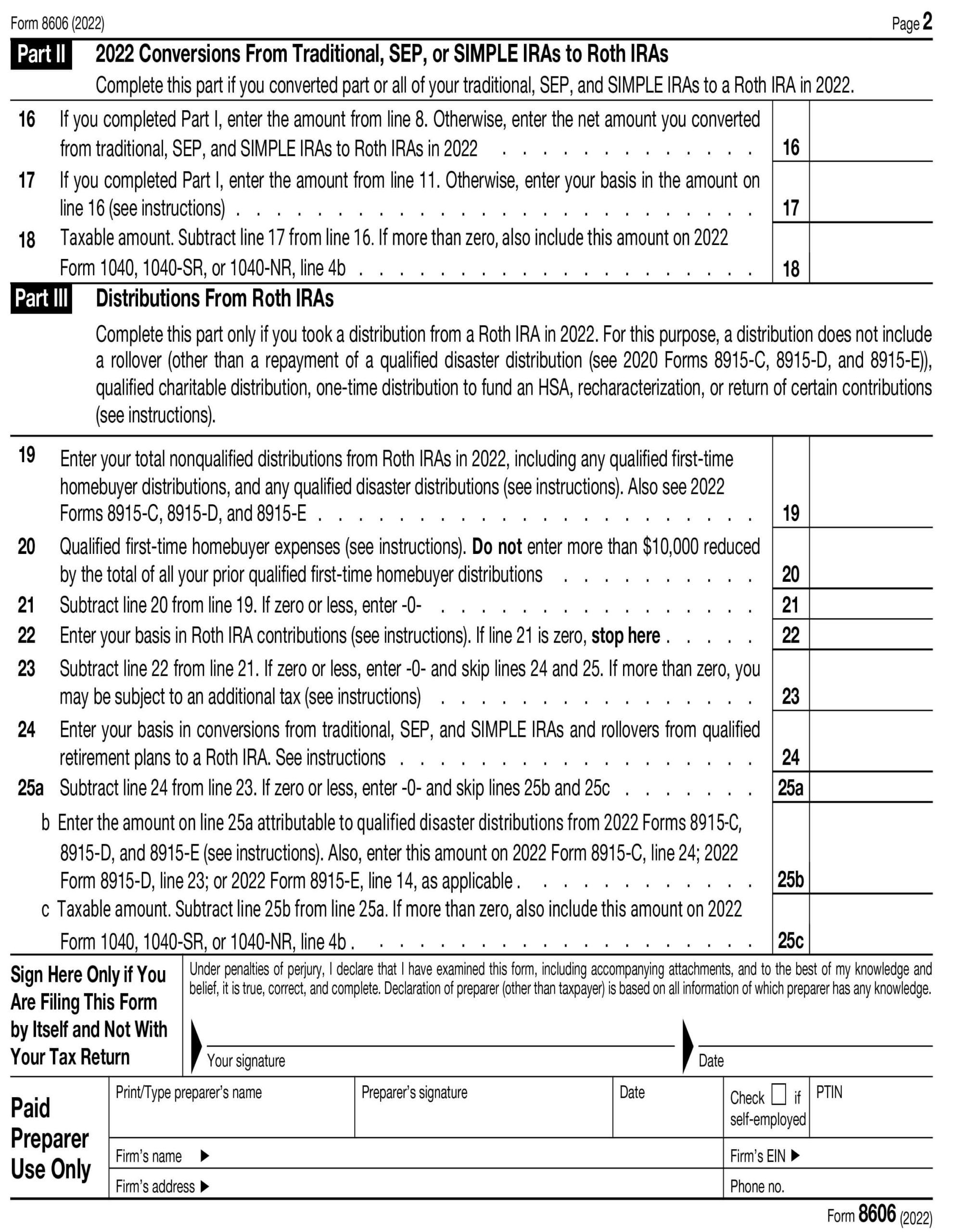

Form 8606 Backdoor Roth - 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Made a 2018 $5.5k ira contribution in early 2019. Nondeductible contributions you made to traditional iras. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web use form 8606 to report: Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty. Web the increase or decrease in basis is reported using irs form 8606. Form 8606 is used to report several financial transactions but the. This is the same word, but has a slightly.

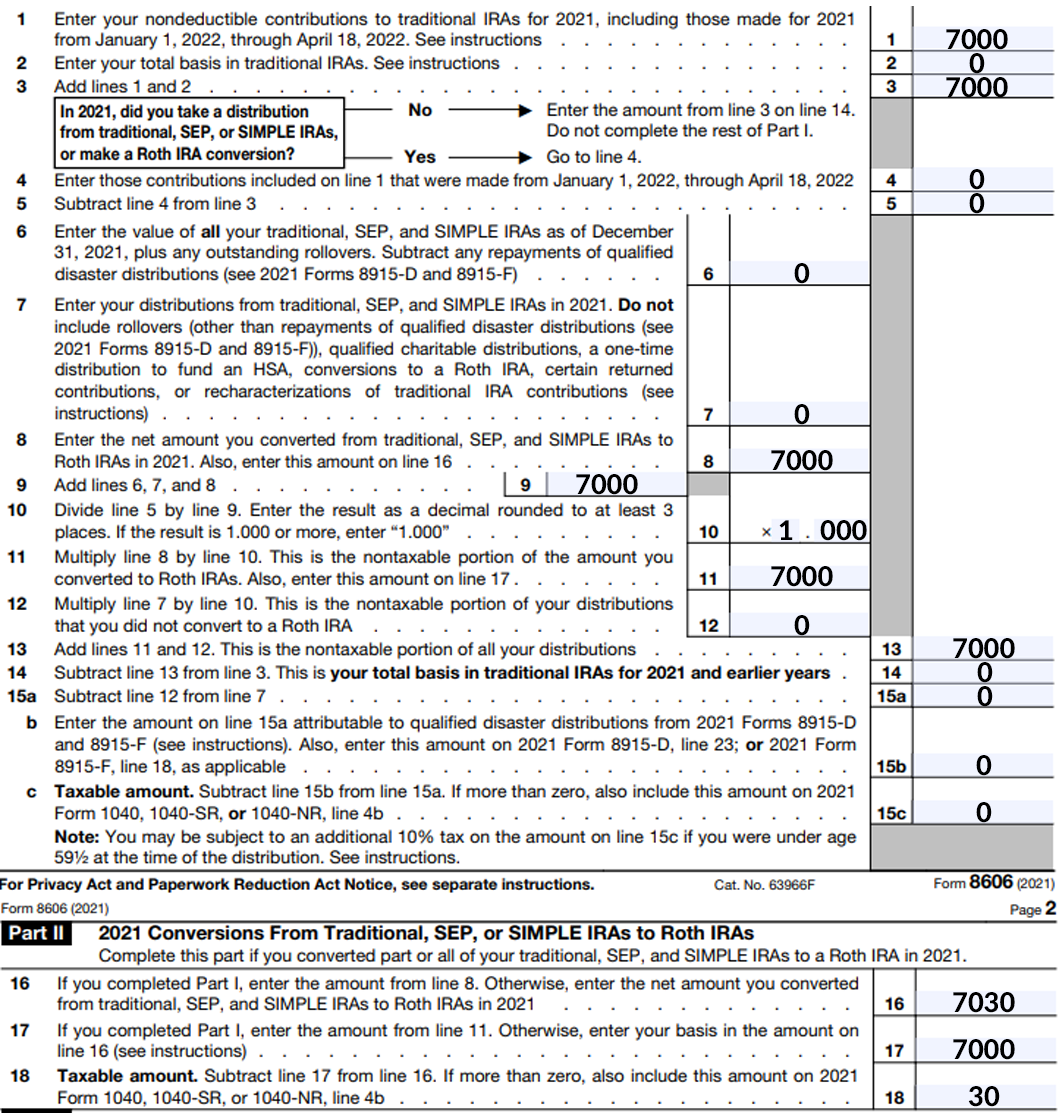

Web use form 8606 to report: Made a 2018 $5.5k ira contribution in early 2019. This is the same word, but has a slightly. Web the main reasons for filing form 8606 include the following: Nondeductible contributions you made to traditional iras; Distributions from traditional, sep, or simple iras, if you have ever made. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web timeline of contributions to backdoor roth ira. In some cases, you can transfer.

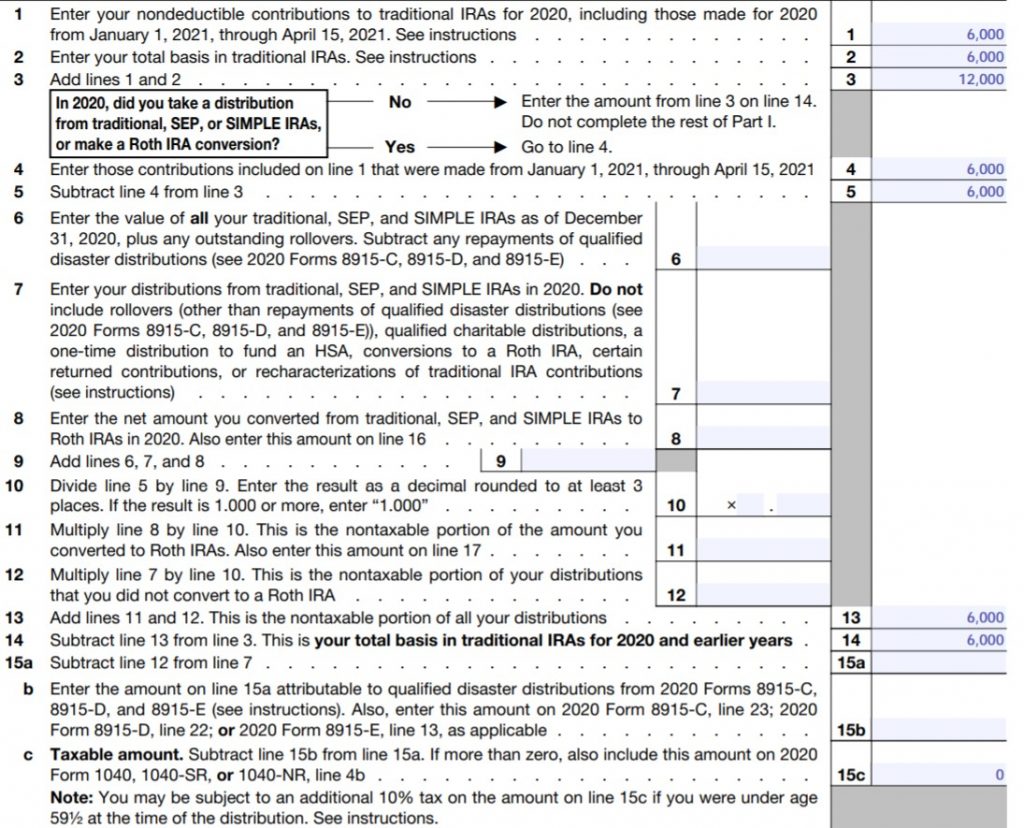

Web the main reasons for filing form 8606 include the following: Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web use form 8606 to report: Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Did a roth conversions of that contribution in early 2019. Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. Web use form 8606 to report: Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty. Web the increase or decrease in basis is reported using irs form 8606. I contributed $6000 after tax money to traditional ira in.

Backdoor IRA Gillingham CPA

2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Made a 2018 $5.5k ira contribution in early 2019. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. This is.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. This is the same word, but has a slightly. Web use form 8606 to report: I contributed $6000 after tax money to traditional ira in. Form 8606 is used to report several financial transactions but the.

Make Backdoor Roth Easy On Your Tax Return

Made a 2018 $5.5k ira contribution in early 2019. Web form 8606 (2022) page. Did a roth conversions of that contribution in early 2019. Web use form 8606 to report: Web timeline of contributions to backdoor roth ira.

The Backdoor Roth IRA and December 31st The FI Tax Guy

Distributions from traditional, sep, or simple iras, if you have ever made. Nondeductible contributions you made to traditional iras; Form 8606 is used to report several financial transactions but the. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. This is the same.

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

Web the increase or decrease in basis is reported using irs form 8606. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. In some cases, you can transfer. This is the same word, but has a slightly. Web for purposes of form 8606, a traditional ira.

Fixing Backdoor Roth IRAs The FI Tax Guy

Form 8606 is used to report several financial transactions but the. In some cases, you can transfer. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Contributing to a nondeductible traditional ira; Web the main reasons for filing form 8606 include the following: Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web use form 8606 to report: Made a 2018 $5.5k ira contribution in early 2019.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Nondeductible contributions you made to traditional iras. Web form 8606 (2022) page. This is the same word, but has a slightly. Web use form 8606 to report: Made a 2018 $5.5k ira contribution in early 2019.

Make Backdoor Roth Easy On Your Tax Return

Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Web the main reasons for filing form 8606 include the following:.

SplitYear Backdoor Roth IRAs The FI Tax Guy

Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. Web ( if you're required to file.

Web Form 8606 Is A Crucial Irs Document That Taxpayers Must Be Familiar With, Particularly Those Who Are Interested In Executing A Backdoor Roth Ira Conversion.

Did a roth conversions of that contribution in early 2019. Web timeline of contributions to backdoor roth ira. Web form 8606 (2022) page. Web use form 8606 to report:

Web ( If You're Required To File Form 8606 To Report A Nondeductible Contribution To A Traditional Ira, But Don’t Do So, You’ll Be Subject To A $50 Penalty.

This is the same word, but has a slightly. Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. Nondeductible contributions you made to traditional iras; Web the main reasons for filing form 8606 include the following:

Web If You Have Ever Tried A Backdoor Roth Conversion Yourself And Don’t Know What Form 8606 Is, That Is A Problem.

Distributions from traditional, sep, or simple iras, if you have ever made. I contributed $6000 after tax money to traditional ira in. Nondeductible contributions you made to traditional iras. Contributing to a nondeductible traditional ira;

Distributions From Traditional, Sep, Or Simple Iras, If You Have A Basis In These Iras;.

Form 8606 is used to report several financial transactions but the. Made a 2018 $5.5k ira contribution in early 2019. Web the increase or decrease in basis is reported using irs form 8606. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion.