Form 8829 Schedule C

Form 8829 Schedule C - Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. Any gain derived from the business use of your home, minus. When the online turbotax se system. Complete, edit or print tax forms instantly. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. General instructions purpose of form use. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022.

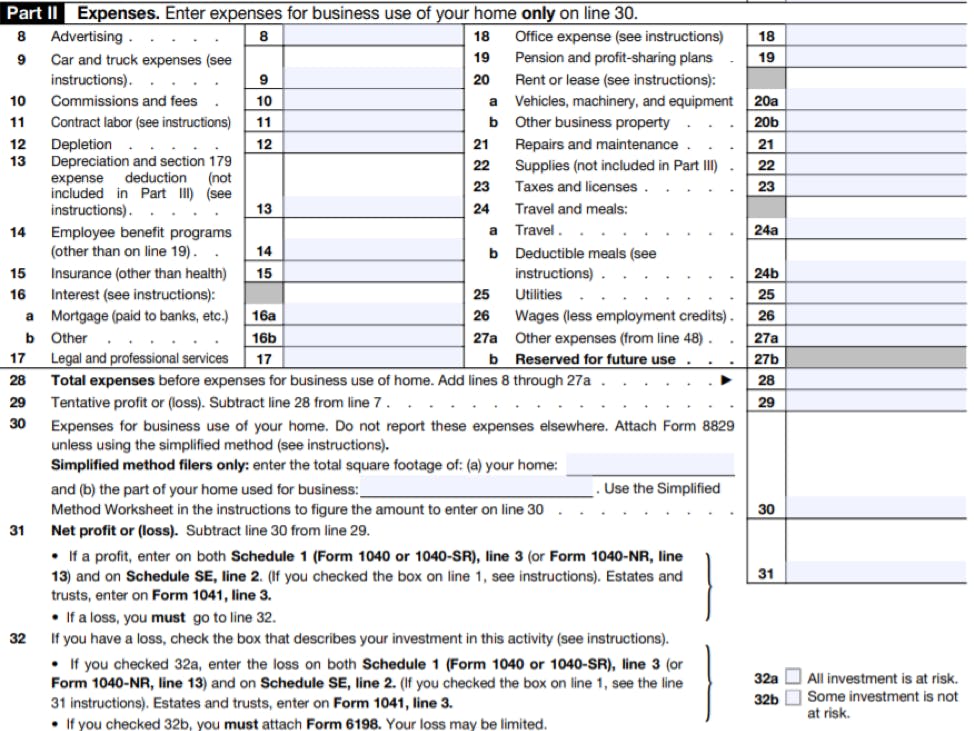

Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. There are two ways to claim. Any gain derived from the business use of your home, minus. Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Form 8829 is produced only when directed to a schedule c using the for drop list at the. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. I can't get line c for the simplified office space calculation for form 8829 to accept a number higher than 111. Web schedule c, line 30 schedule f, line 32 form 2106, line 4 e.pg2 as upe (unreimbursed partnership expenses), line 28 in the example above, schedule c displays the.

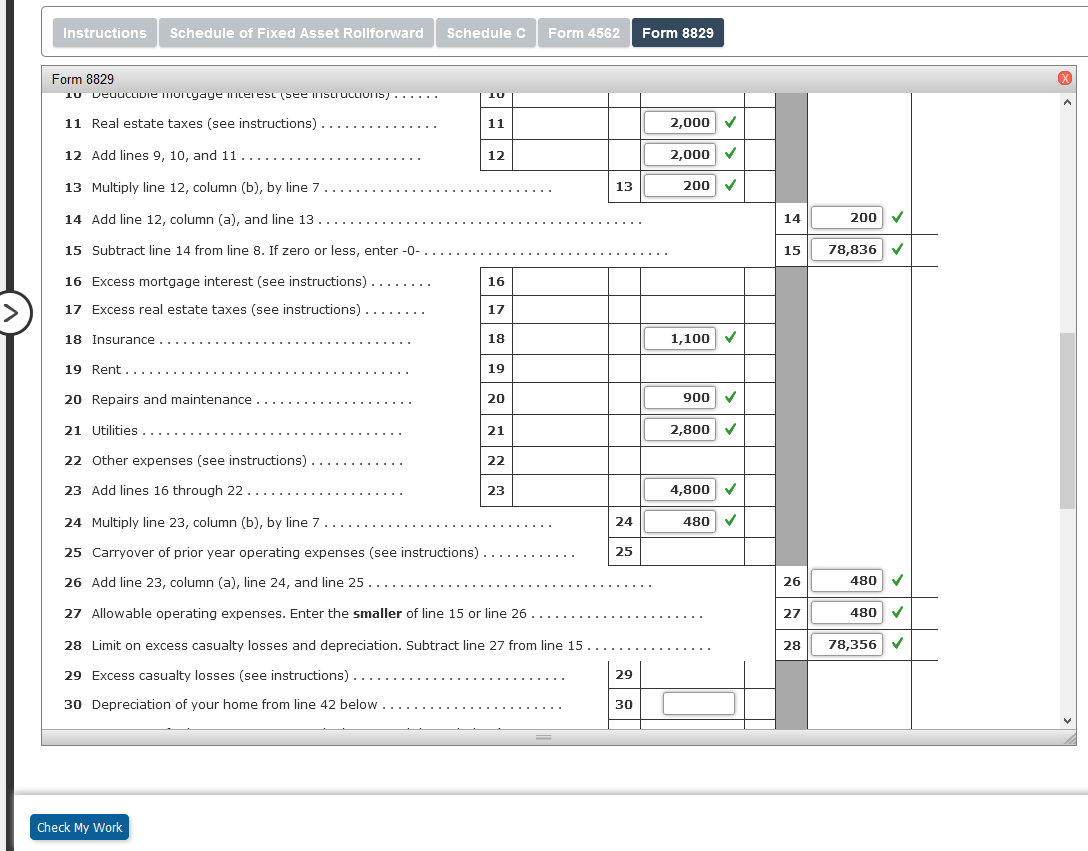

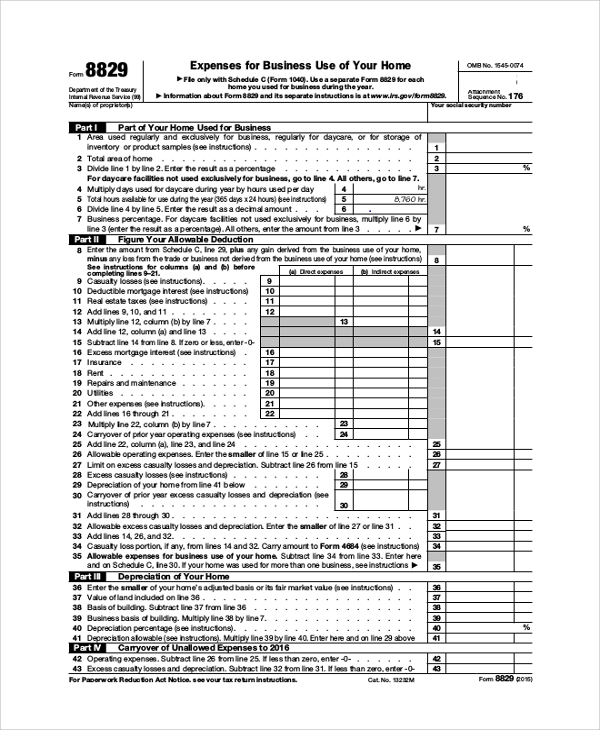

Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Form 8829 is produced only when directed to a schedule c using the for drop list at the. An activity qualifies as a business. Web form8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Web if your business qualifies for the home office deduction, you’ll file form 8829 with your schedule c, profit or loss from business. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. There are two ways to claim. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. June 5, 2022 9:05 pm. Any loss from the trade or business not derived from the business use.

Working for Yourself? What to Know about IRS Schedule C Credit Karma

Ad complete irs tax forms online or print government tax documents. An activity qualifies as a business. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Form 8829 is produced only when directed to a schedule c using the for drop list at the. Web use schedule c (form 1040).

Solved Required Complete Trish's Schedule C, Form 8829, and

Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). When the online turbotax se system. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form.

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Web form8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton.

Solved Required Complete Trish's Schedule C, Form 8829, and

See the instructions for lines 25 and 31. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web form8829 department of the treasury internal revenue.

Schedule C Profit or Loss From Business Definition

Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name. There are two ways to claim. If no separate business name, leave.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Ad complete irs tax forms online or print government tax documents. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web form 8829, expenses for business use of home, is a tax form you fill out to claim.

Tax Write Off Guide for Home Office Deductions & Expenses

Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. June 5, 2022 9:05 pm. Web unallowed expenses from a prior year form 8829 that.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. Web use screen 8829 to report expenses associated with an office in the.

The New York Times > Business > Image > Form 8829

Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Web if your business qualifies for the home office deduction, you’ll file form 8829 with your schedule c, profit or loss from business. General instructions purpose of form use. Any loss from the trade or business not derived from the business use.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

June 5, 2022 9:05 pm. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form.

An Activity Qualifies As A Business.

Web enter the amount from schedule c, line 29, plus. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c.

Any Loss From The Trade Or Business Not Derived From The Business Use.

Ad complete irs tax forms online or print government tax documents. If no separate business name, leave blank. When the online turbotax se system. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

There Are Two Ways To Claim.

See the instructions for lines 25 and 31. June 5, 2022 9:05 pm. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Form 8829 is produced only when directed to a schedule c using the for drop list at the.

Web Use Screen 8829 To Report Expenses Associated With An Office In The Taxpayer's Main Home.

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web form8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Any gain derived from the business use of your home, minus.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)