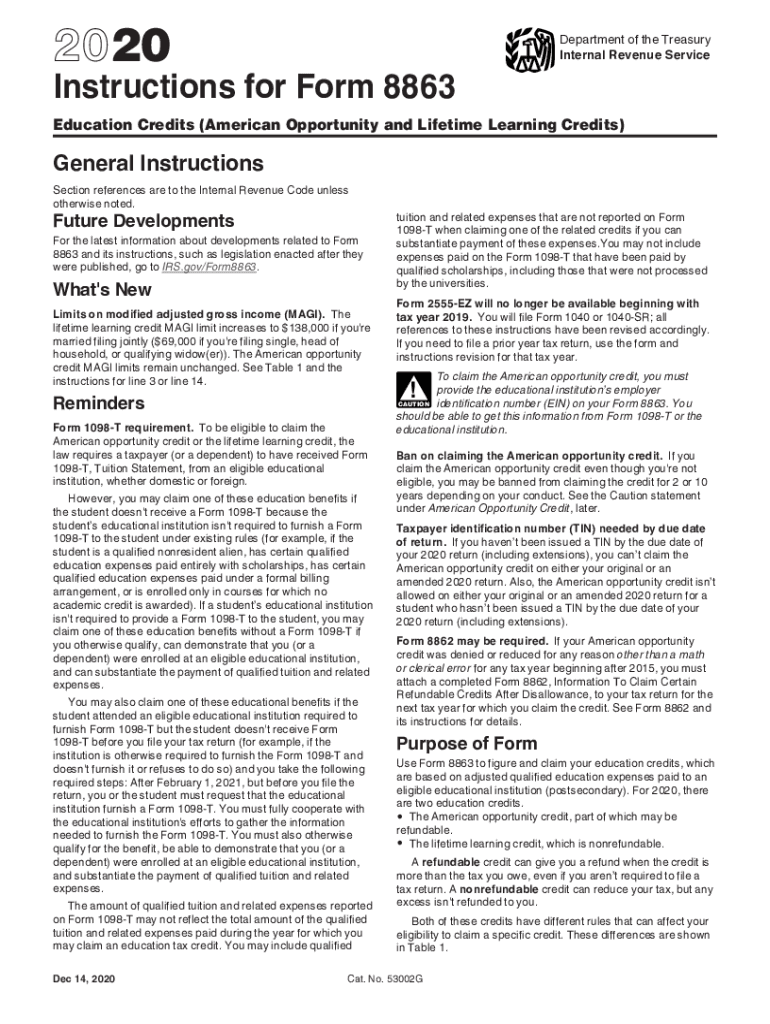

Form 8863 Instructions 2020

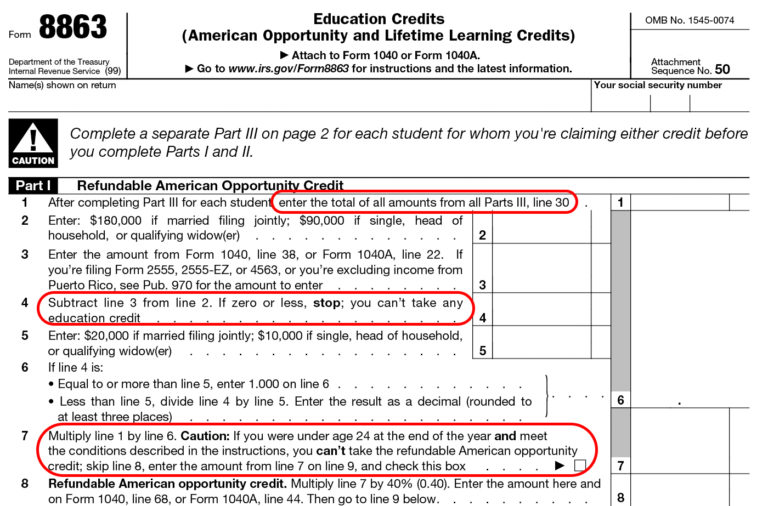

Form 8863 Instructions 2020 - Complete, sign, print and send your tax documents easily with us legal forms. Follow these quick steps to edit the pdf about form 8863, education credits (american. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Enter the amount from form 8863, line 18. Ad register and subscribe now to work on your form 8863 & more fillable forms. Web search irs and state income tax forms to efile or complete, download online and back taxes. Line 7 if you were under age 24 at the end of 2020 and the. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Search by form number, name or organization.

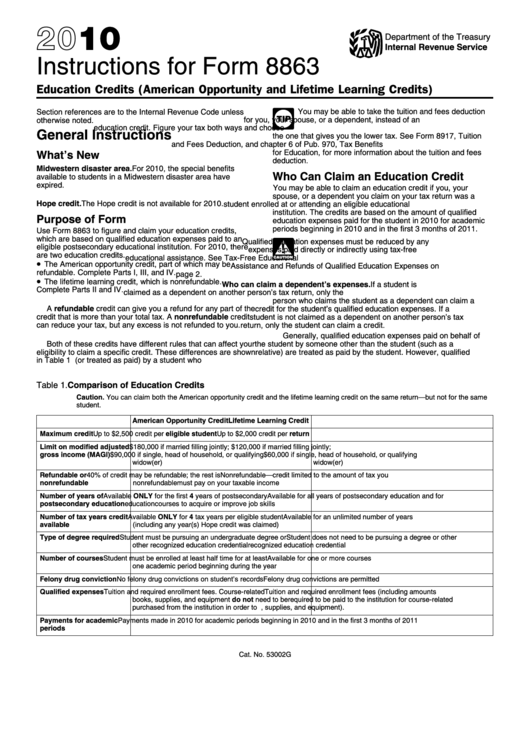

Department of the treasury internal revenue service. Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web with dochub, making changes to your documentation requires just a few simple clicks. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Enter the amount from form 8863, line 18. Search by form number, name or organization. Ad register and subscribe now to work on your form 8863 & more fillable forms. Complete, sign, print and send your tax documents easily with us legal forms.

Line 7 if you were under age 24 at the end of 2020 and the. Download blank or fill out online in pdf format. Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Use the information on the form. Enter the amount from form 8863, line 18. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Ad register and subscribe now to work on your form 8863 & more fillable forms. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Form 8863 typically accompanies your 1040 form, and this.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

Web search irs and state income tax forms to efile or complete, download online and back taxes. Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), on page 6: Web with dochub, making changes to your documentation requires just a few simple clicks. Line 7 if you were under age 24 at the end.

Publication 970, Tax Benefits for Higher Education; Appendices

Search by form number, name or organization. Web see form 8862 and its instructions for details. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Download blank or fill out online in pdf format. Complete, sign, print and send your tax documents easily.

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Use the information on the form. Ad register and subscribe now to work on your form 8863 & more fillable forms. Web see form 8862 and its instructions for details. Complete, sign, print and send your tax documents easily.

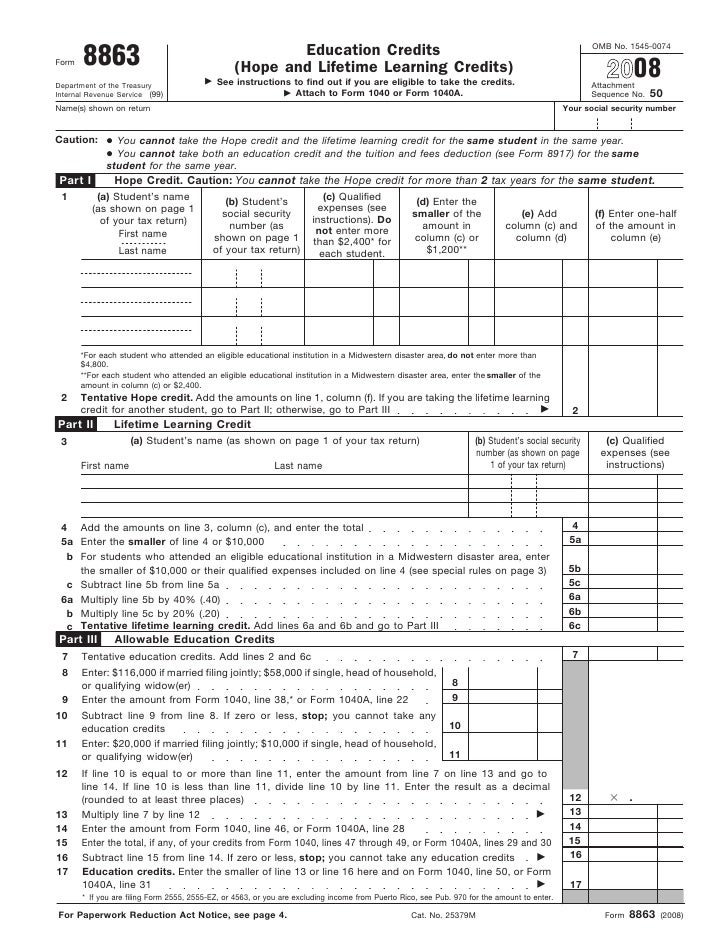

Form 8863Education Credits

Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Ad register and subscribe now to work on your form 8863 & more fillable forms. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Use form 8863 to.

Tax Time!

Complete, sign, print and send your tax documents easily with us legal forms. Web see form 8862 and its instructions for details. Web editable irs instruction 8863 2020. Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Web see form 8862 and its instructions for details.

Credit Limit Worksheet A Fill Online, Printable, Fillable, Blank

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Search by form number, name or organization. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Enter the.

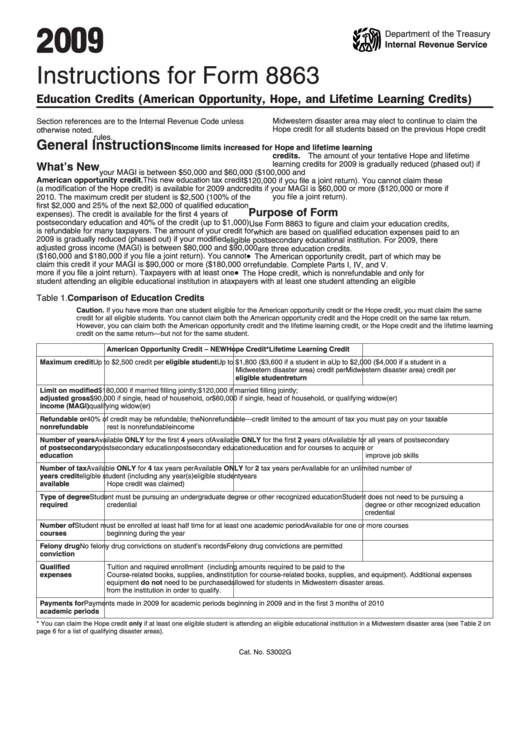

Instructions For Form 8863 Education Credits (American Opportunity

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Purpose of form use form 8863 to figure and claim your.

Instructions For Form 8863 Education Credits (American Opportunity

Web with dochub, making changes to your documentation requires just a few simple clicks. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Download blank or fill out online in pdf format. Web use form 8863 to figure and claim your education credits, which.

Fill Free fillable Form 8863 Education Credits PDF form

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational. Download blank or fill out online in pdf format. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web use form.

Form 8863 Instructions Information On The Education 1040 Form Printable

Enter the amount from form 8863, line 18. Form 8863 typically accompanies your 1040 form, and this. Web see form 8862 and its instructions for details. Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Search by form number, name or organization.

Web See Form 8862 And Its Instructions For Details.

Purpose of form use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. Ad register and subscribe now to work on your form 8863 & more fillable forms. Follow these quick steps to edit the pdf about form 8863, education credits (american. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational.

Department Of The Treasury Internal Revenue Service.

Complete, sign, print and send your tax documents easily with us legal forms. Line 7 if you were under age 24 at the end of 2020 and the. Download blank or fill out online in pdf format. Web search irs and state income tax forms to efile or complete, download online and back taxes.

Web Per Irs Instructions For Form 8863 Education Credits (American Opportunity And Lifetime Learning Credits), On Page 6:

Enter the amount from form 8863, line 18. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Use The Information On The Form.

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Form 8863 typically accompanies your 1040 form, and this. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Search by form number, name or organization.