Form 8960 Line 4B

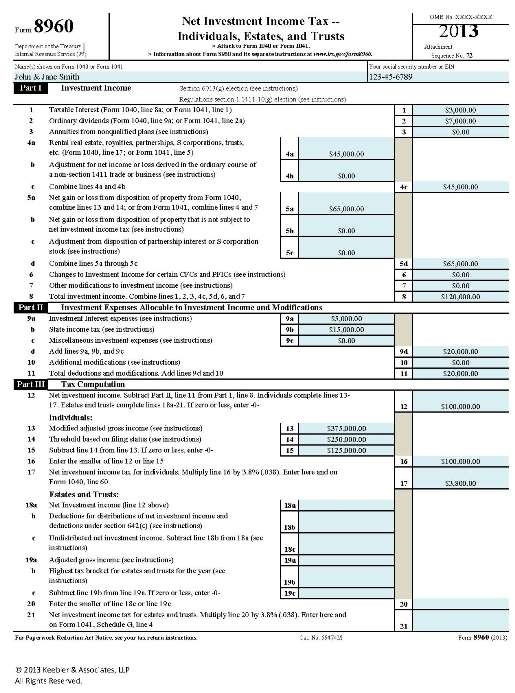

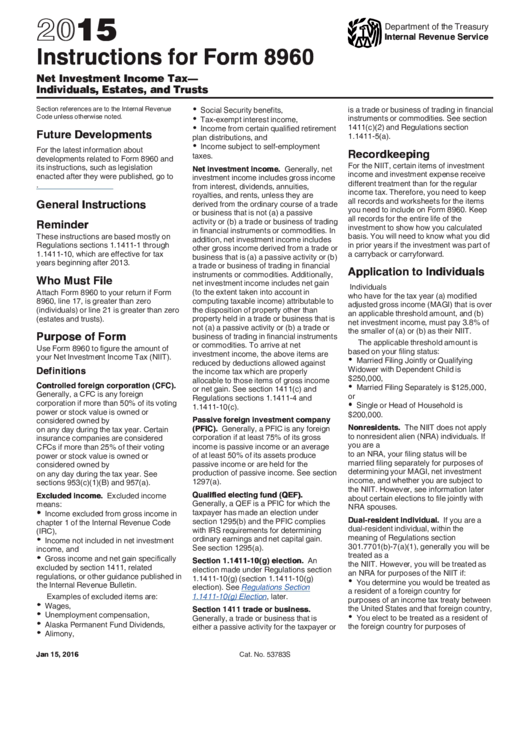

Form 8960 Line 4B - Web use form 8960 to figure the amount of your net investment income tax (niit). Web beginning with drake14, screens c, e, f, and 4835 have an option for carrying information to form 8960. Web the entry for line 4b is used to adjust the amount automatically pulled to form 8960, line 4a. Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Purpose of form use form 8960 to figure the. Web individuals who have for the tax year (a) magi that’s over an applicable threshold amount, and (b) net investment income, must pay 3.8% of the smaller of (a) or (b) as their niit. Web answer form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Definitions controlled foreign corporation (cfc). Generally, a cfc is any foreign corporation if more. The video below explains how net investment income from passthrough entities is.

Web answer form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. On line 4b, enter the net amount (positive or negative) for the following items. Generally, a cfc is any foreign corporation if more. Web individuals who have for the tax year (a) magi that’s over an applicable threshold amount, and (b) net investment income, must pay 3.8% of the smaller of (a) or (b) as their niit. Web beginning with drake14, screens c, e, f, and 4835 have an option for carrying information to form 8960. If the income from one of these forms should flow to the 8960, check the. Definitions controlled foreign corporation (cfc). Purpose of form use form 8960 to figure the. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web form 1041, line 5;

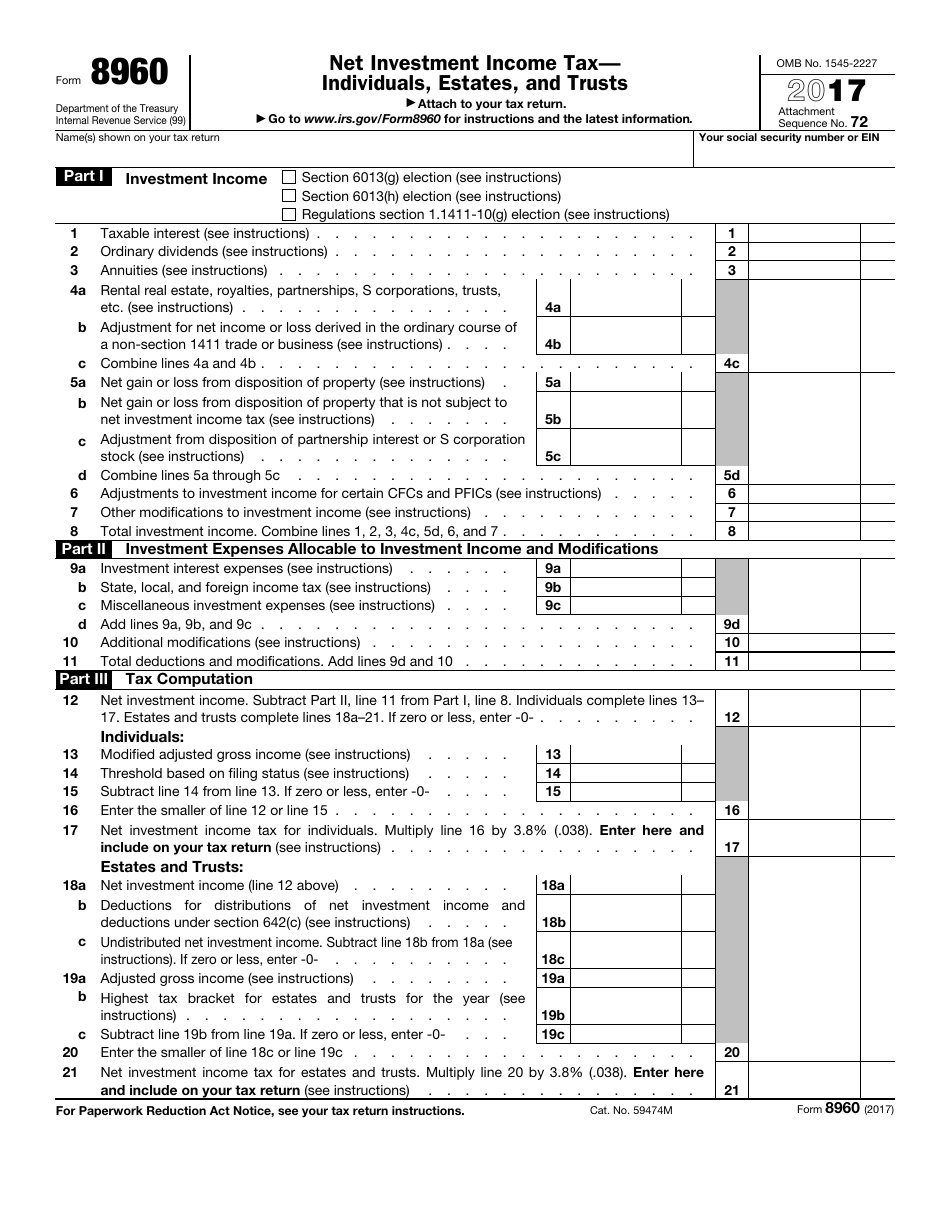

Web answer form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. On line 4b, enter the net amount (positive or negative) for the following items. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Web the entry for line 4b is used to adjust the amount automatically pulled to form 8960, line 4a. The video below explains how net investment income from passthrough entities is. Purpose of form use form 8960 to figure the. Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Web use form 8960 to figure the amount of your net investment income tax (niit). Web individuals who have for the tax year (a) magi that’s over an applicable threshold amount, and (b) net investment income, must pay 3.8% of the smaller of (a) or (b) as their niit. Web form 1041, line 5;

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

On line 4b, enter the net amount (positive or negative) for the following items. Generally, a cfc is any foreign corporation if more. Web form 1041, line 5; Definitions controlled foreign corporation (cfc). If the income from one of these forms should flow to the 8960, check the.

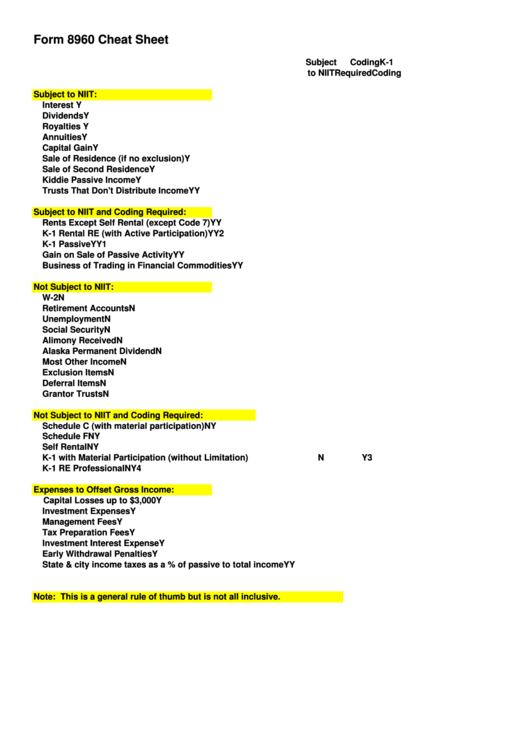

Form 8960 Cheat Sheet printable pdf download

Purpose of form use form 8960 to figure the. Definitions controlled foreign corporation (cfc). Web how do i change the amount flowing to form 8960, line 4b in a 1040 using worksheet view? Web use form 8960 to figure the amount of your net investment income tax (niit). Web answer form 8960 line 4a reports the amounts from form 1040.

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

Web beginning with drake14, screens c, e, f, and 4835 have an option for carrying information to form 8960. If the income from one of these forms should flow to the 8960, check the. Web answer form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Definitions controlled foreign corporation (cfc). Web form 8960 line 4a.

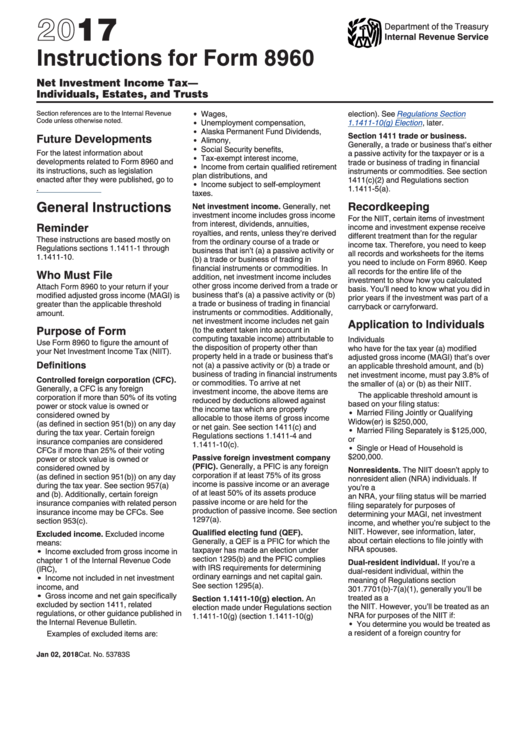

Instructions For Form 8960 (2015) printable pdf download

On line 4b, enter the net amount (positive or negative) for the following items. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Purpose of form use form 8960 to figure the. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals,.

Form 8960 Obamacare Tax implications for US Taxpayers in Canada

Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. The video below explains how net investment income from passthrough entities is. Generally, a cfc is any foreign corporation if more. Web use form 8960.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Web how do i change the amount flowing to form 8960, line 4b in a 1040 using worksheet view? Web use form.

Energy Transfer Partners K 1 2019 Image Transfer and Photos

Web the entry for line 4b is used to adjust the amount automatically pulled to form 8960, line 4a. On line 4b, enter the net amount (positive or negative) for the following items. Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Web form 8960 line 4a reports the amounts from form 1040, schedule 1,.

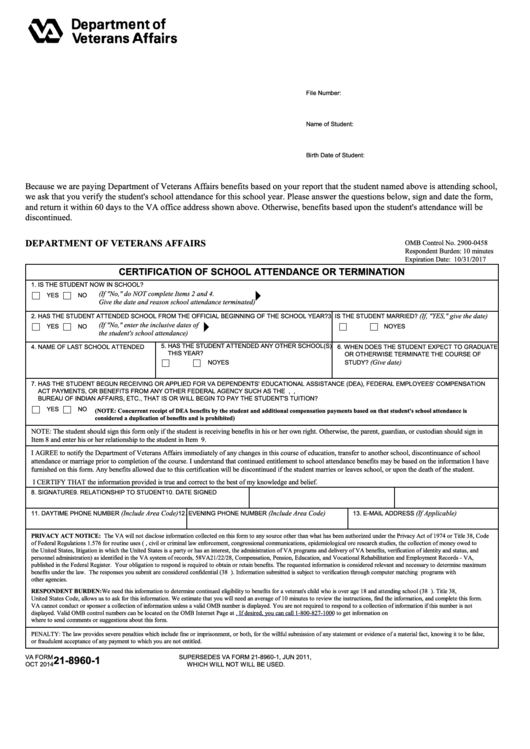

Fillable Va Form 2189601 Certification Of School Attendance Or

Web beginning with drake14, screens c, e, f, and 4835 have an option for carrying information to form 8960. Generally, a cfc is any foreign corporation if more. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web form 8960 department of the treasury internal revenue service (99).

Instructions For Form 8960 Net Investment Tax Individuals

Purpose of form use form 8960 to figure the. Web how do i change the amount flowing to form 8960, line 4b in a 1040 using worksheet view? Web form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Web use form 8960 to figure the amount of your net investment income tax (niit). Web answer.

What is Form 8960 Net Investment Tax TurboTax Tax Tips & Videos

The video below explains how net investment income from passthrough entities is. Definitions controlled foreign corporation (cfc). Purpose of form use form 8960 to figure the. Web form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Web use form 8960 to figure the amount of your net investment income tax (niit).

Web Beginning With Drake14, Screens C, E, F, And 4835 Have An Option For Carrying Information To Form 8960.

On line 4b, enter the net amount (positive or negative) for the following items. Web how do i change the amount flowing to form 8960, line 4b in a 1040 using worksheet view? Web individuals who have for the tax year (a) magi that’s over an applicable threshold amount, and (b) net investment income, must pay 3.8% of the smaller of (a) or (b) as their niit. Definitions controlled foreign corporation (cfc).

If The Income From One Of These Forms Should Flow To The 8960, Check The.

The video below explains how net investment income from passthrough entities is. Web the entry for line 4b is used to adjust the amount automatically pulled to form 8960, line 4a. Web answer form 8960 line 4a reports the amounts from form 1040 line 17. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount.

Web Form 1041, Line 5;

Web use form 8960 to figure the amount of your net investment income tax (niit). Web form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Web answer form 8960 line 4a reports the amounts from form 1040, schedule 1, line 17. Generally, a cfc is any foreign corporation if more.

Purpose Of Form Use Form 8960 To Figure The.

Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return.

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)