Form 8979 Instructions

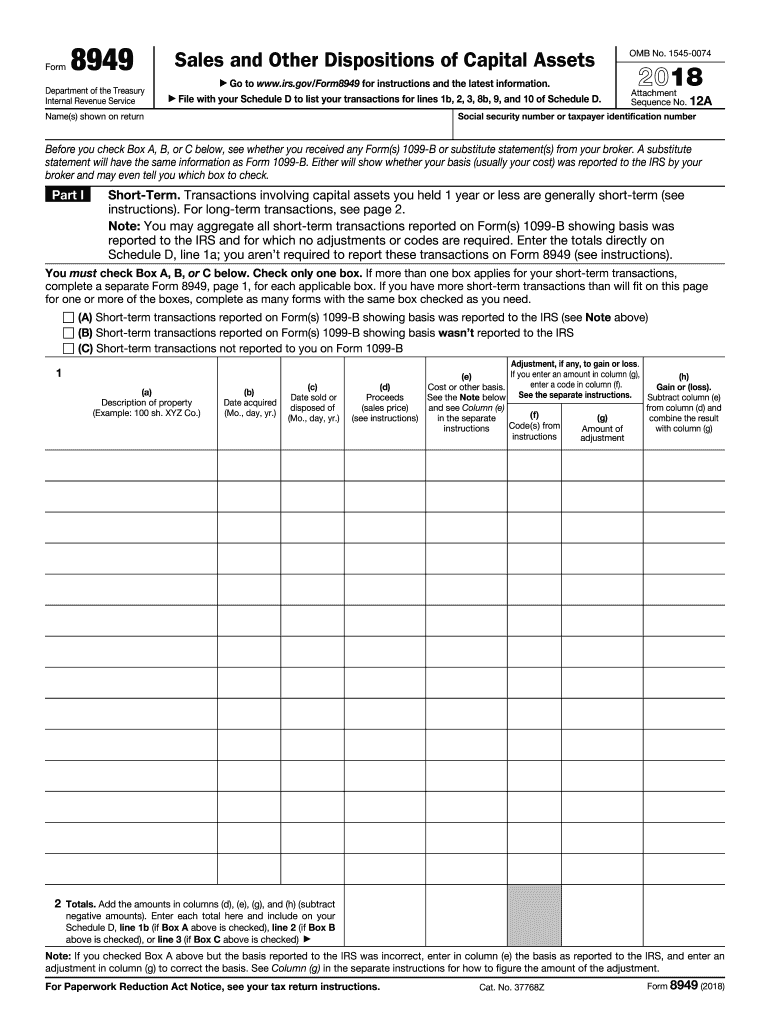

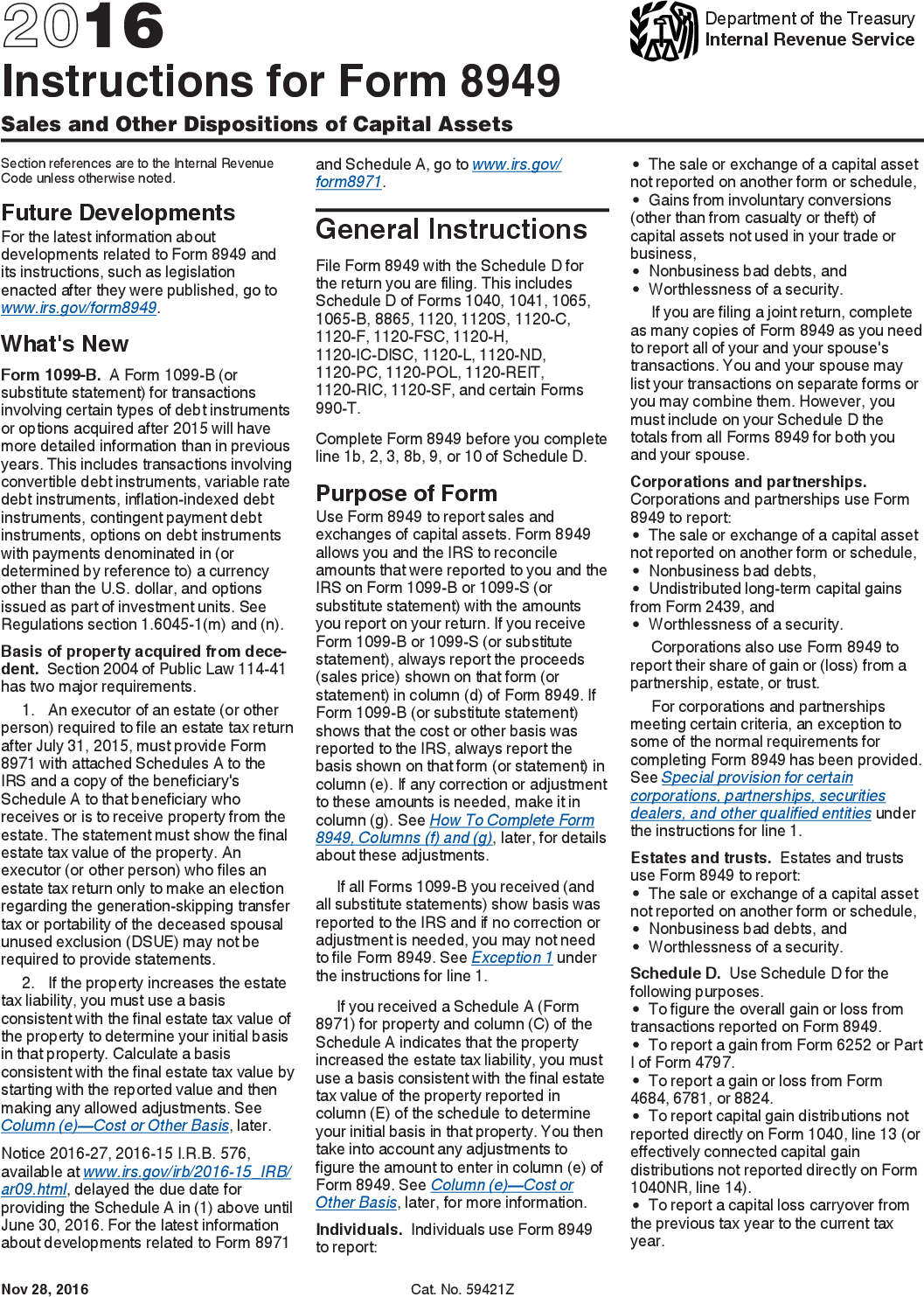

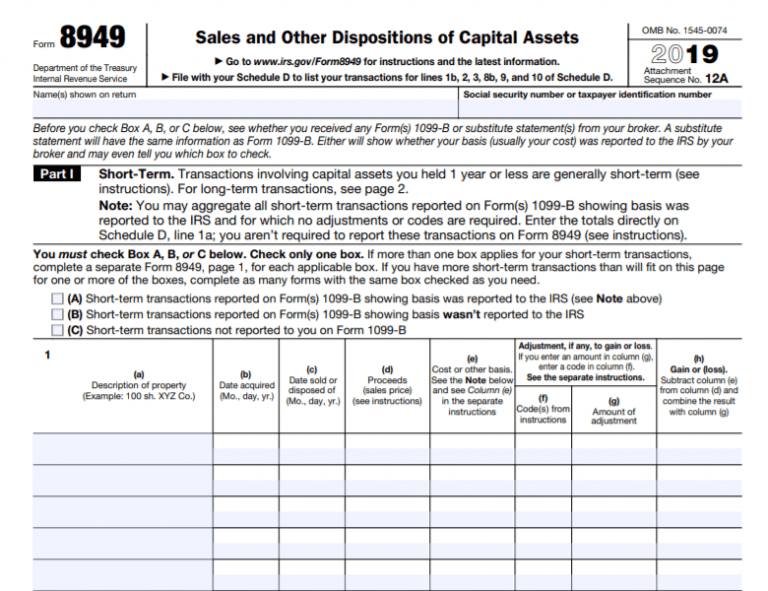

Form 8979 Instructions - Web general instructions file form 8949 with the schedule d for the return you are filing. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. These changes will be included in the next revision. Use this form 8879 (rev. For the main home sale exclusion, the code is h. Sign part iv, section a. Filers should rely on this update when filing form 8979. If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with the form. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Web information about all forms, instructions, and pubs is at irs.gov/forms.

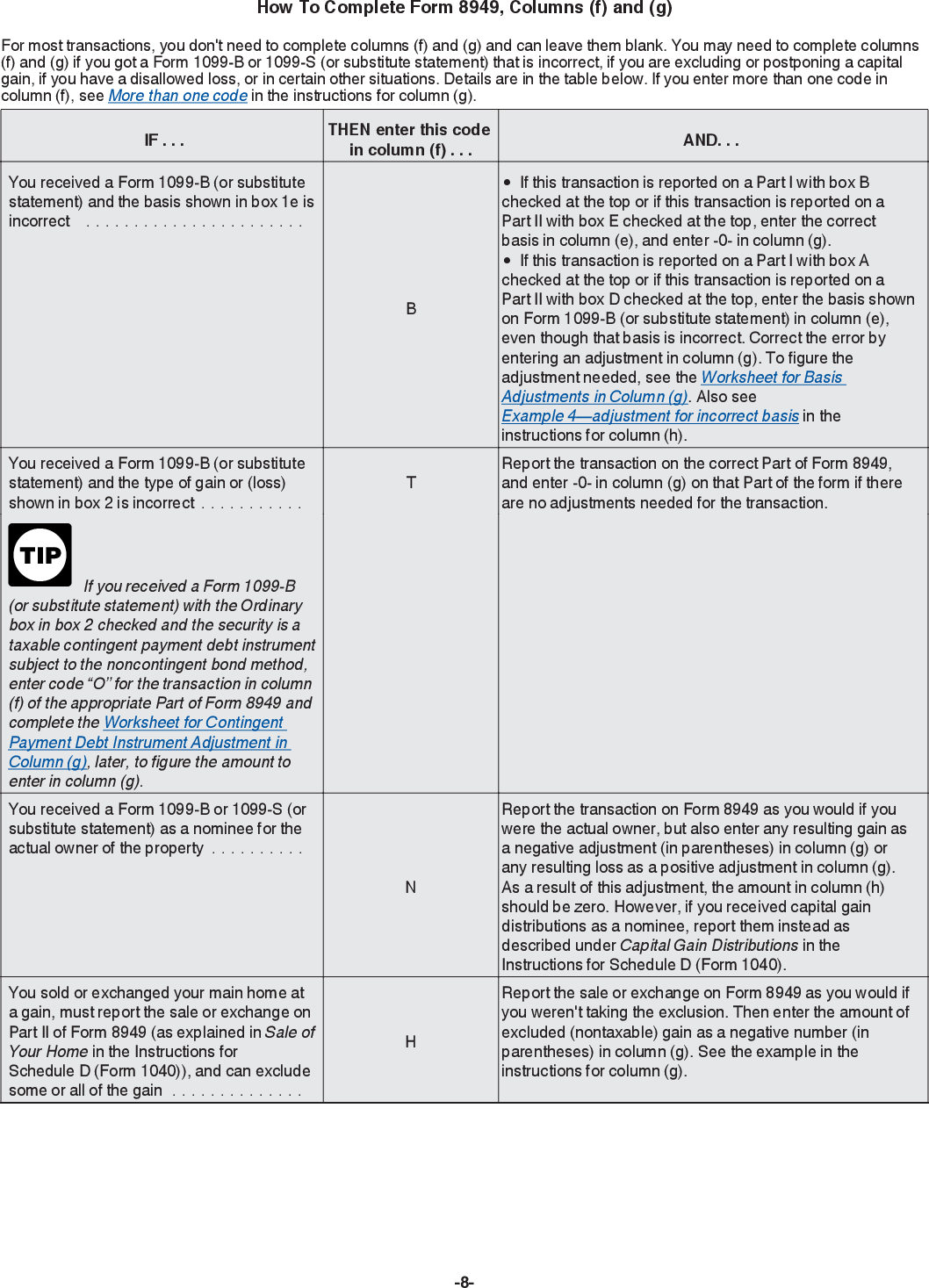

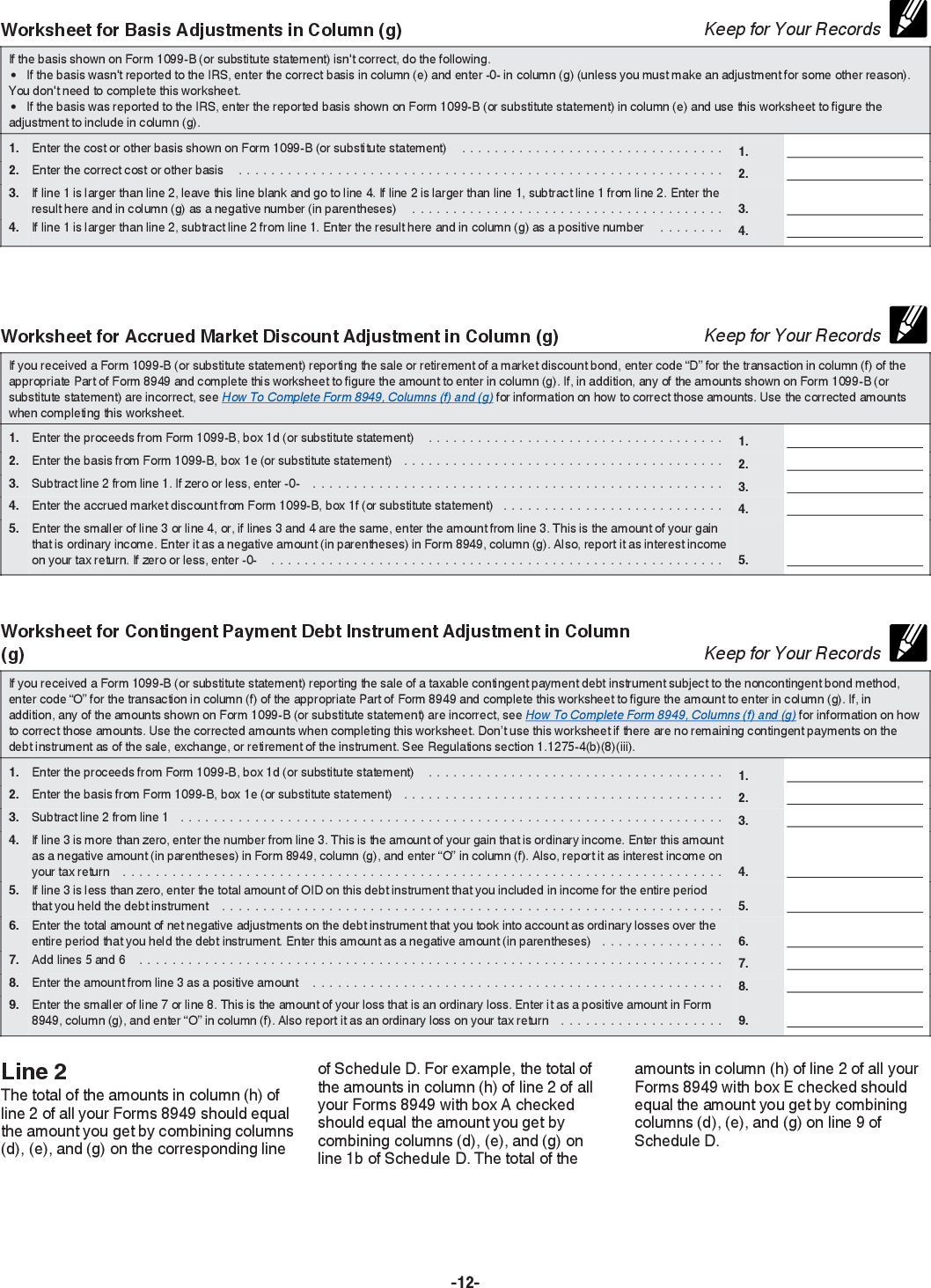

Then enter the amount of excluded (nontaxable) gain as a negative number. Use this form 8879 (rev. Web form 8949 is used to list all capital gain and loss transactions. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. These changes will be included in the next revision. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web use form 8949 to report sales and exchanges of capital assets. Web information about all forms, instructions, and pubs is at irs.gov/forms. You will need to enter it as two.

These changes will be included in the next revision. Web to make a change, submit a form 8979 authorizing the change. Then enter the amount of excluded (nontaxable) gain as a negative number. For example, the form 1040 page is. Sign part iv, section a. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Almost every form and publication also has its own page on irs.gov. Use this form 8879 (rev. You will need to enter it as two. If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with the form.

Form 8949 Fill Out and Sign Printable PDF Template signNow

Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Web preparing schedule d and 8949. Web information about all forms, instructions, and pubs is at irs.gov/forms. For example, the form 1040 page is. For the main home sale exclusion, the code is h.

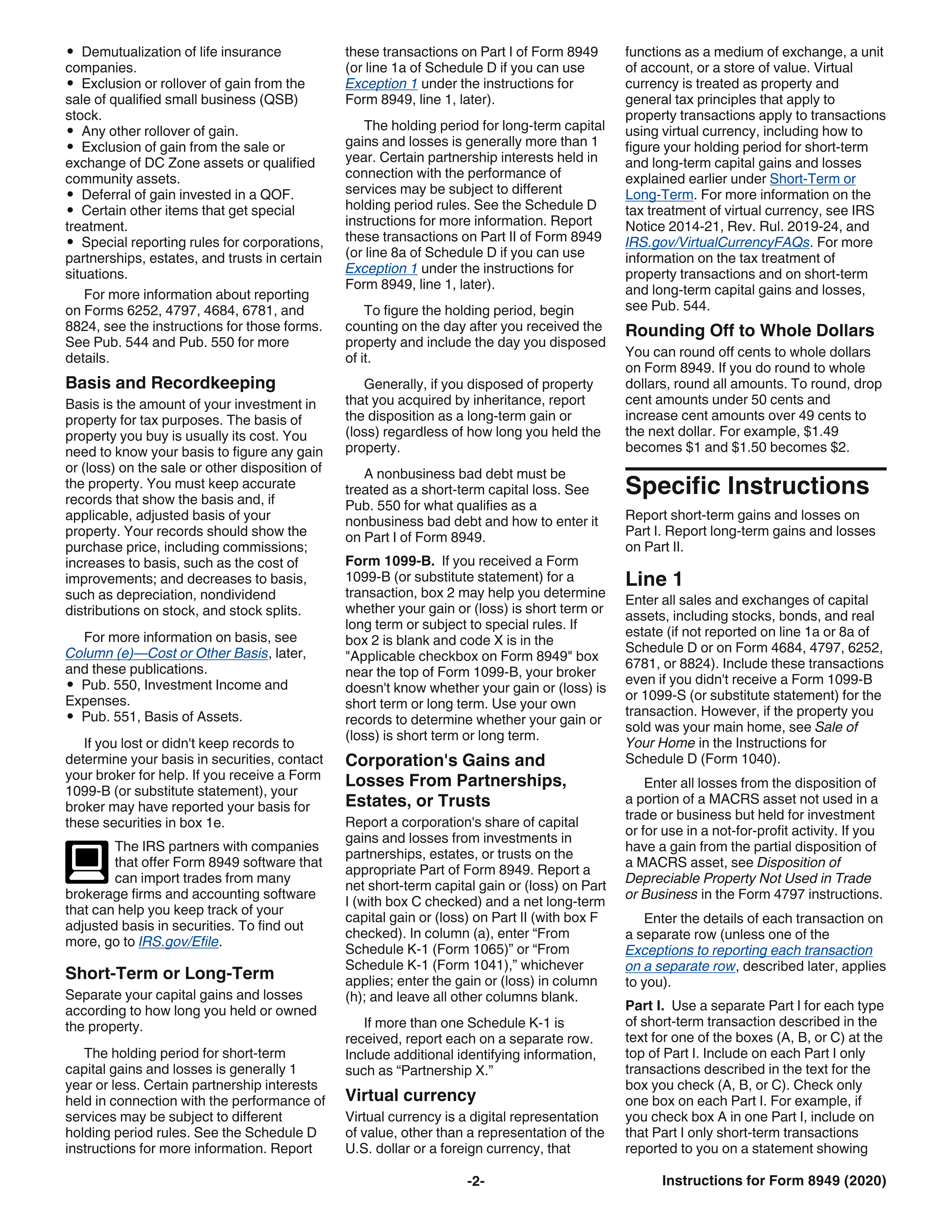

IRS Form 8949 instructions.

If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with the form. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Use this form 8879 (rev. Web use form 8949 to report sales and exchanges of capital assets. Form 8949.

Online generation of Schedule D and Form 8949 for 10.00

Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Sign part iv, section a. Use this form 8879 (rev. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949.

IRS Form 8949 instructions.

Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Web in the instructions for irs form 8949, it lists out a.

irs form 8949 instructions 2022 Fill Online, Printable, Fillable

Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Form 8949 allows you and the irs to reconcile amounts that were reported.

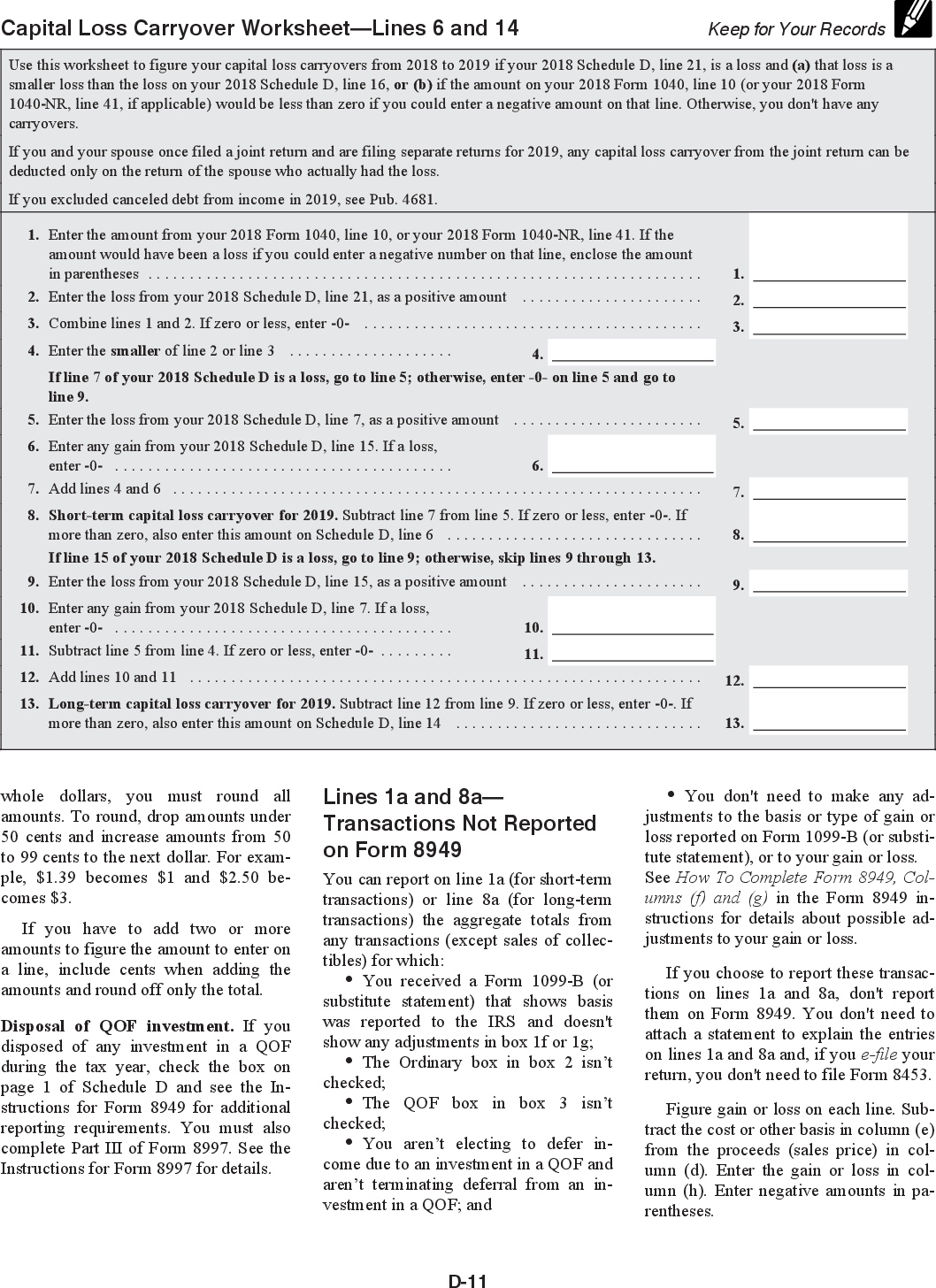

IRS Schedule D instructions.

Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. Filers should rely on this update when filing form 8979. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web in the instructions for irs form 8949,.

In the following Form 8949 example,the highlighted section below shows

For example, the form 1040 page is. Web to make a change, submit a form 8979 authorizing the change. These changes will be included in the next revision. Web this update supplements the instructions for form 8979. Almost every form and publication also has its own page on irs.gov.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Web form 8949 is used to list all capital gain and loss transactions. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. These changes will.

Online generation of Schedule D and Form 8949 for 10.00

Web general instructions file form 8949 with the schedule d for the return you are filing. Web this update supplements the instructions for form 8979. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Web designating an individual partnership representative. Web report the sale.

Online generation of Schedule D and Form 8949 for 10.00

Web to make a change, submit a form 8979 authorizing the change. For the main home sale exclusion, the code is h. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web general instructions file form 8949 with the schedule d for the return you are filing. You.

Web Preparing Schedule D And 8949.

Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. For example, the form 1040 page is. You will need to enter it as two. Web designating an individual partnership representative.

Web Form 8979 Is Used To Revoke A Partnership Representative Or Designated Individual, Resign As A Partnership Representative Or Designated Individual, Or Designate A Partnership.

Filers should rely on this update when filing form 8979. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Sign part iv, section a.

Then Enter The Amount Of Excluded (Nontaxable) Gain As A Negative Number.

If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with the form. Almost every form and publication also has its own page on irs.gov. For the main home sale exclusion, the code is h. Web general instructions file form 8949 with the schedule d for the return you are filing.

Web Form 8979 Is Used To Revoke A Partnership Representative Or Designated Individual, Resign As A Partnership Representative Or Designated Individual, Or Designate A Partnership.

Web use form 8949 to report sales and exchanges of capital assets. Web to make a change, submit a form 8979 authorizing the change. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Complete part ii, section a and part iii, section b.